What are Fat Tails in Trading?

Some people subscribe to the efficient market theory, and while it is true that the markets are very competitive, large price movements happen far more often than such theories would allow if true.

Trading is all about price, and price fluctuations can sometimes be extreme. Such price moves across specific timeframes are known as fat tails, which can lead to excessively large profits or losses, depending on how such risk is managed.

If you want to learn more about fat tails, how to protect yourself against them, and even how to profit from them, then read on!

Table Of Contents

- Definition of Fat Tail

- What are Fat-tailed Distributions?

- The Impact of Fat tails in Trading

- Managing Fat Tail Risk

- Profiting from Fat Tails

- Wrapping up

Definition of Fat Tail

If you were to take the daily closing price of an instrument across a single year and sort them not by date, but by return (starting by the largest loss, all the way up until the largest gain) and plot it on a bar chart, then you would have returns distribution.

Most of the chart would be bunched up in the middle, since most days don’t see the market moving up or down by much. Fat tails are those few days of the year where the market crashes or explodes upwards. They are known as fat tails, because they are on the extreme ends of the distribution, and look like tails when a line is plotted across the entire distribution.

What are Fat Tailed Distributions?

Financial Market Returns

A return is simply the profit or loss over a certain period of time, often represented in percentage terms.

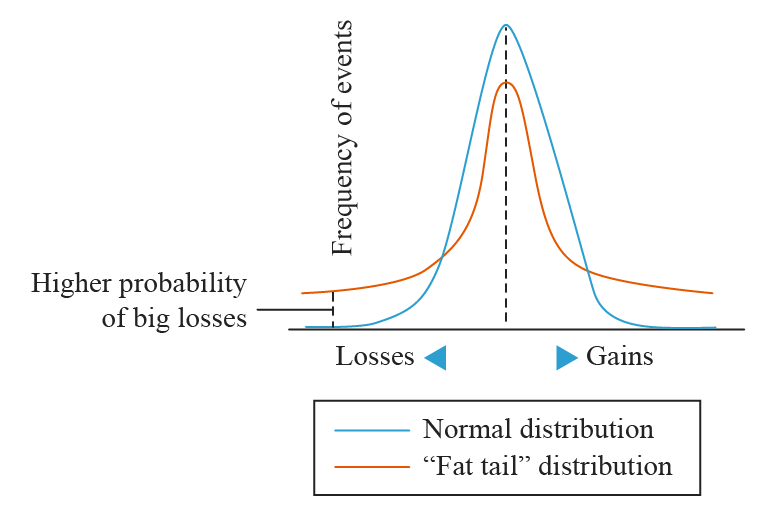

Academics such as economists usually build their models with the assumption that financial market returns are normally distributed, meaning returns tend to remain symmetrical around the mean. However, there is plenty of statistical evidence that shows markets experience extreme events more often than the normal distribution assumes.

Tail Risk

Tail risk can be defined as the risk (or potential return) associated with the financial asset being traded. Tail risk is the probability that price will make an extreme deviation from the mean price.

Tail risk is graphically represented at the edges of the distribution curve. Trail risks are by definition unpredictable, whether the result of “known unknowns” or “unknown unknowns”. It is possible to get the probability of a fat tail occurring based on historical returns, but fat tails can sometimes be even “fatter” than what was witnessed in history before, so traders should remain cautious of such calculations.

The Impact Of Fat Tails In Trading

Most trading strategies are developed based on experience or perhaps data sets (for the quantitative traders out there), both of which rely on historical data.

Since fat tails encompass the distant, but not impossible probability of extreme events occurring, fat tails skew risk metrics and are arguably largely unquantifiable.

Effects On Risk Calculations

There are various risk calculations for estimating how much risk the portfolio or trade is subject to. Such calculations can be very exact, but the existence of fat tails in financial market returns means that the metric may be misleading. Since the probability of extreme events is somewhat based on unknown factors, it can be difficult to calculate.

Traders should remain cautious of relying too heavily on their risk metrics and becoming complacent. For instance, metrics like the Sharpe ratio use the standard deviation as a proxy for risk, which assumes a normal distribution.

There are various ways to deal with this, some more complicated than others. But one of the easiest ways is to simply use a rule of thumb, and add a little bit of extra on top of the risk metrics to cover for unknown data. For example, if you are using the Average True Range of the asset to calculate the distance away from your entry price to place your stop, you might want to use a number closer to 2 or 3 times the ATR output.

Managing Fat Tail Risk

Even though fat tail risk is difficult or perhaps even impossible to calculate, it can still be lessened by taking appropriate measures. Here are two ideas for curtailing fat tails.

Use Stop Losses

Stop losses are orders placed to purchase or sell a security when it reaches a designated price. Since your position sizing should be based on the distance of your stop from your entry price, and your stop loss should be placed in an area that invalidates your trade signal if price touches, then exiting a losing trade with a stop loss can help you cut off the ends of those fat tails.

However, it is worth remembering that since stop losses are triggered as market orders, their price is not guaranteed and can sometimes result in slippage. This is usually not a huge problem and results in only a few points lost in most cases, however during a genuine fat tail event, prices could gap significantly. It is worth bearing this in mind when calculating position sizing, perhaps trading at a slightly smaller size for cover for such an event.

You can read more about stop losses in our Complete Guide to Stops.

Buy Options

When implied volatility is low relative to historical levels, options can be cheap for the buyers. Options buyers can obtain puts or calls, which give the holder the right (but not the obligation) to sell (for puts) or buy (for calls) the underlying at a specific price and date in the future. This is ideal, because the trader only has to outlay a small amount of the underlying and can’t lose more than that, whereas the upside potential is theoretically unlimited.

Options can be used as protection (e.g. buying puts when holding a long position, or buying calls when in a short position), or as outright speculative transactions.

Profiting from Fat Tails

As mentioned many times throughout this post, the fat tailed nature of market results can mean extreme losses or extreme profits, depending on the structure of the trader and how risk was managed. Therefore, traders can try to capture the positive side of fat tails to profit from them.

Other than options as mentioned before, the other method is to follow the trend.

Use Trend-Following Strategies

Trend following strategies simply trade in the direction of price, buying higher highs and selling lower lows. Such strategies are often based on breakouts or moving averages.

In combination with the use of strict stop losses, trend following strategies essentially cut off the left-side tail of a strategy’s returns by exposing itself to the tails on both sides of the assets distribution with the aid of long and short positions. This, combined with letting winners run, means trend following strategies can capture and profit from fat tails.

Wrapping Up

Fat tails can be both a curse and blessing. But since they are something that every trader has to live with, they should be taken into account.

With the right approach, the risk can be mitigated. With the right trade structure (and a bit of luck), they can even be profited from.

Bookmap comes with an array of order flow tools and indicators that some traders use to try to catch fat tails. Try out today for free. Click here to get started.

Twitter

Twitter

Facebook

Facebook