Page 1 of 1

Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Sat Oct 26, 2019 1:24 am

by berenis

Hello,

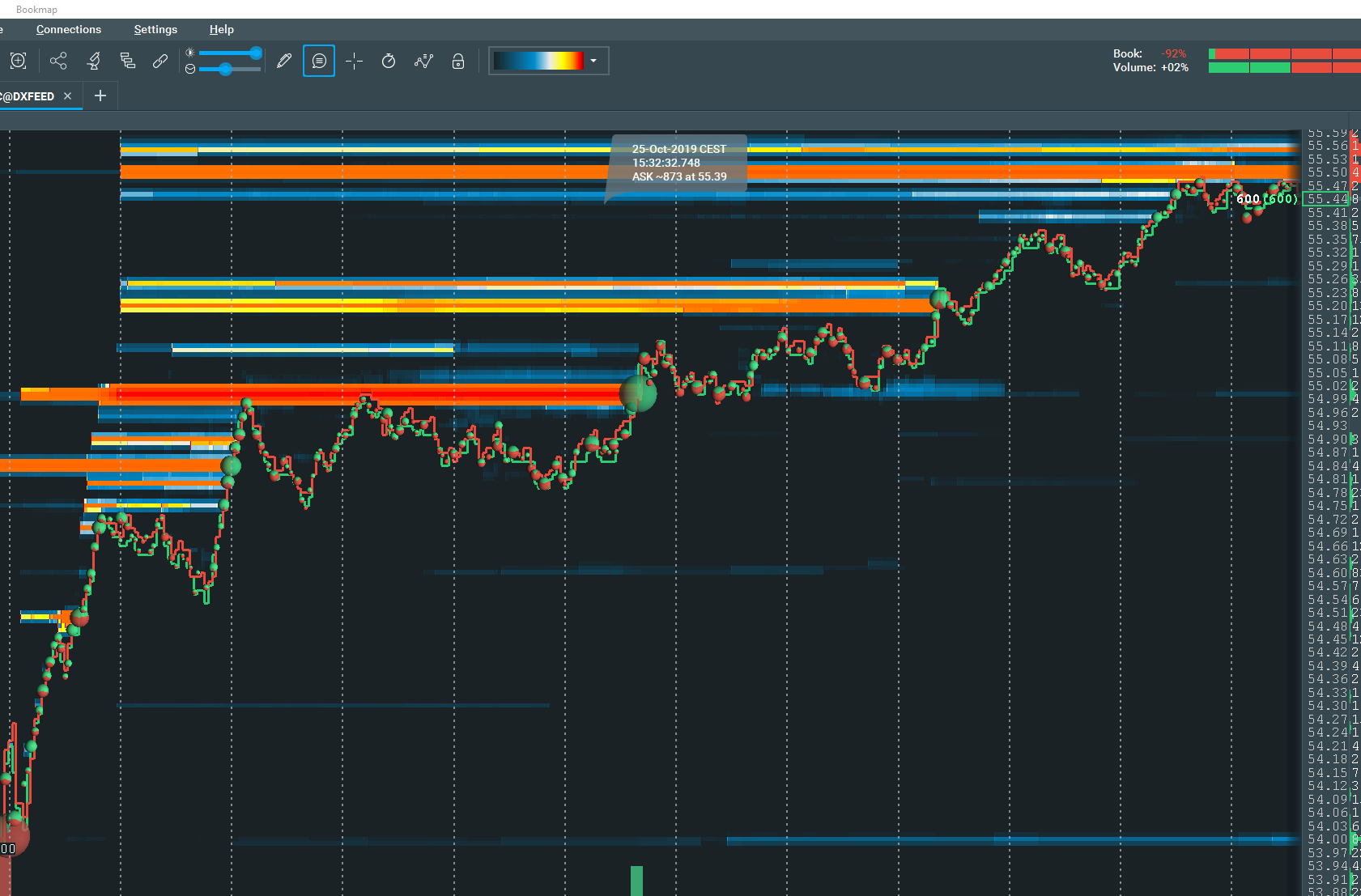

here is what the first minutes of INTC (intel) chart looked like (see image below=.

VERY imbalanced book with 92% ask orders, tons of limit order overhead acting like resistance, yet almost no bid order to support the price.

Yet the price went straight up.

Seing those orders ahead I would have never went long, especially after a large gap up, yet it was the thing to do and price ate most of those levels.

This is counter intuitive, could someone explain the phonomenon, and why price went in the direction with the most limit orders (resistance)? With little bid orders I would have expected the price to fall like a rock.

- bookmap.PNG (223.51 KiB) Viewed 12455 times

Re: Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Wed Oct 30, 2019 7:51 pm

by fibdax

the difficulty is right there. Understand when they take away without getting into the book. It's counter-intuitive but buyers don't have patience to be executed. Area 54.99 kept the prices for a while but then they were executed and went on .... it sounds easy but it's not at all easy.

Re: Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Sat Nov 02, 2019 6:18 pm

by mpxtreme

Resting "liquidity" does not mean resistance or support...it's just orders.

It's only "counter intuitive" because you lack education...inform yourself.

If it was that easy...price ladder/orderbook/Dom traders would be rich in short time.

Re: Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Tue Nov 05, 2019 10:43 pm

by Bruce

Hi berenis,

Here's an older video but i think you'll still find the content helpful and answer your question.

https://youtu.be/0H1PxLaXuhs

You may also consider attending the Advanced daily Bookmap webinars at 11am ET. We cover this type of phenomena all the time.

regards,

Bruce

Re: Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Tue Nov 05, 2019 10:52 pm

by berenis

Hi Bruce,

i wish I could see the video, but it is a private one. Can you please make it public.

Re: Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Fri Dec 27, 2019 3:42 am

by ingyukoh

Why imbalanced orderbook in ask side attracts up volume?

Two possibilities:

1. uninformed up volume takers

2. serious informed up volume takers :

Added Trade Vol=measure up volume change/unit time @ ask

Added Liquidity Vol=compare against liquidity change /unit time at the imbalanced order book @ask

Strength of Added Trade Vol against Added Liquidity Vol(crossing of these two lines in time) can

be good signal for serious up volume taker in spite of imbalanced order book in ask side

Re: Why does very imbalanced order book ask side attracts price instead of rejecting?

Posted: Fri Dec 27, 2019 12:47 pm

by fibdax

ingyukoh wrote: ↑Fri Dec 27, 2019 3:42 am

Why imbalanced orderbook in ask side attracts up volume?

Two possibilities:

1. uninformed up volume takers

2. serious informed up volume takers :

Added Trade Vol=measure up volume change/unit time @ ask

Added Liquidity Vol=compare against liquidity change /unit time at the imbalanced order book @ask

Strength of Added Trade Vol against Added Liquidity Vol(crossing of these two lines in time) can

be good signal for serious up volume taker in spite of imbalanced order book in ask side

Indeed an excellent theory, bookmap could not be translated into an indicator?thanks