Ready to see the market clearly?

Sign up now and make smarter trades today

Education

September 21, 2024

SHARE

Beyond the Numbers: Understanding the Impact of Trading Psychology

Trading isn’t just about crunching numbers or following trends. At its core, it’s about people. And where there are people, emotions and mindset play a big role.

Trading is as much a mental challenge as it is a financial one. Being able to stay calm and focused when the market is wild can make a big difference in results. So, while tools and strategies are crucial, understanding and managing your trading psychology can set you apart from the rest. Thus, understanding and managing one’s trading psychology can be the difference between success and failure.

With that in mind, let’s dive deeper and identify how you can bolster your trading psychology and make better trading decisions.

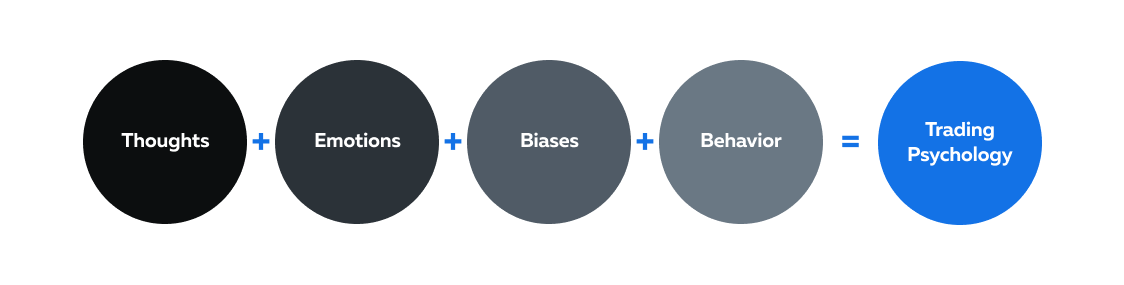

What is Trading Psychology?

Trading psychology is all about understanding the emotional and mental factors that influence a trader’s decisions. It’s not just about charts and numbers; it’s about how a trader’s feelings and thoughts can affect their ability to follow a trading strategy.

Let’s understand how trading psychology comes into play through a fictional market scenario:

Meet Mr. A, a day trader who seems to have an affinity for volatile stocks. One day, he identifies a stock that has experienced a significant upward trend over the past few hours.

He decides to enter a long position (buy) with the expectation that the trend will continue, and he can profit from the upward movement.

Trading Psychology in Action:

|

Which emotion is showcased? |

How does the trader feel psychologically? |

How does it affect trading decisions? |

|

Greed |

As the stock prices continue to rise, Mr. A starts feeling a sense of excitement and he anticipates potential profits. |

Mr. A increases his position size to maximize gains.

|

|

Fear |

Amidst the rising stock price, Mr. A spots a slight dip.

The emotion of fear erupts and makes him worry that the trend might reverse and turn into a loss. |

Mr. A starts feeling anxious about holding onto his position.

With every dip, he decides to offload some of his holdings at a loss. |

From Mr. A’s actions, it’s clear that his emotions clouded his judgment, leading him to make less-than-optimal decisions.

The Relationship Between Discipline and Decision-Making

Most successful traders remain disciplined and stick to their trading plan. This enables them to exit the trade according to their predetermined criteria, even if the stock’s price continues to rise after they exit.

A disciplined approach protects traders from the potential downsides of emotional decisions, such as:

-

holding onto the trade for too long out of greed or

-

panic-selling due to fear

This is how practicing trading discipline plays a key role in executing a level-headed and rational approach:

-

-

Adhering to trading plan:

-

-

A disciplined trader drafts a well-defined trading plan with specific entry and exit criteria.

-

The plan usually states a certain target profit and stop-loss level.

-

Discipline guides them to stick to those levels despite the emotional fluctuations.

-

-

Managing emotions:

-

- Markets can be unpredictable, causing emotional upheavals.

- Discipline helps traders stay calm, making decisions based on facts, not feelings.

-

-

Managing risks:

-

-

Discipline ensures that the trader has already set a stop-loss order at a comfortable level.

-

If the stock’s price starts to move against, the stop-loss order will automatically execute, limiting potential losses and preventing emotions from leading to impulsive decisions.

-

-

Addressing biases and cognitive distortions:

-

-

Traders are susceptible to cognitive biases, including:

-

Confirmation bias: Favoring information that confirms pre-existing beliefs

-

Overconfidence bias: Overestimating one’s abilities

-

-

These biases can lead to inaccurate interpretations of market data and flawed trading decisions.

-

By effectively managing their emotions, diligently adhering to their plans, and consistently practicing trading discipline, traders can successfully evade the influence of cognitive biases.

Therefore, while understanding market dynamics is crucial, mastering one’s emotions and biases through discipline is equally, if not more, important for successful trading.

What Role Do Emotions Play in Trading?

Emotions significantly influence trading decisions. While they can lead to both gains and losses, understanding their potential impact is vital for effective trading. Predominantly, emotions such as fear, greed, and overconfidence influence trading decisions.

This is how these emotions manifest in the market:

|

Emotion |

Description |

Behavioral Impact

|

|

Fear |

Fear often surfaces when traders face potential losses or uncertain market conditions. This apprehension can trigger various reactions. |

|

|

Greed |

Greed is the relentless pursuit of profit, which can result in risky behaviors. |

|

|

Overconfidence |

Overconfidence represents a cognitive bias that forces traders to overestimate their abilities. The traders believe all their predictions would unfailingly prove accurate. |

|

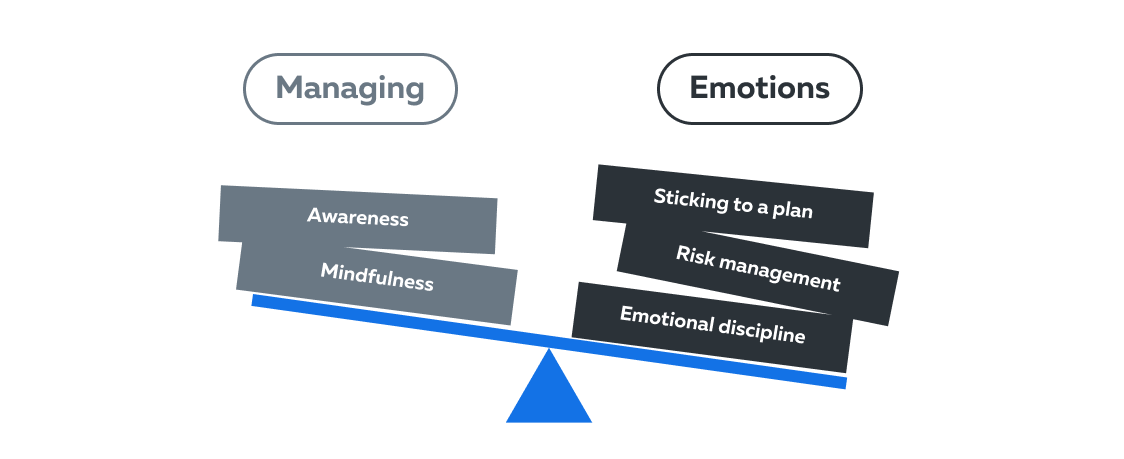

Managing Emotions for Successful Trading

Emotions like fear, greed, and overconfidence significantly influence one’s trading decisions, often leading to suboptimal trading outcomes. Traders who can adeptly manage their emotions are more likely to make rational, well-informed decisions and achieve better results in the long run.

This is how traders can manage their emotions:

-

Awareness: This involves recognizing the influence of emotions on decisions. Traders must honestly acknowledge their emotional state while trading.

-

Mindfulness: The practice of mindfulness aids in maintaining focus on the present moment and refraining from impulsive trading, which stems largely from human emotions.

-

Adherence to a Plan: By following a well-defined trading plan and strategy, the impact of emotions on trading decisions can be minimized.

-

Risk Management: Implementing effective risk management techniques helps mitigate the impact of emotional decisions on overall trading outcomes.

-

Emotional Discipline: Developing emotional discipline involves training oneself to manage fear and greed by maintaining a long-term perspective and adhering to a consistent strategy.

Understanding and managing these emotions is key to navigating the market with clarity and making informed decisions.

Trading Discipline: A Pillar of Trading Psychology

Discipline is often considered one of the foundational pillars of successful trading psychology. It refers to the ability of traders to adhere to their:

-

Trading plans,

-

Tested strategies, and

-

Risk management rules

Maintaining discipline is crucial for several reasons:

-

Consistency:

-

Discipline ensures that traders consistently follow their established strategies and plans.

-

This helps in building a track record of successful trading over time.

-

-

Mitigating Emotions:

-

Emotions can lead to impulsive decisions that deviate from the trading plan.

-

Discipline helps traders avoid emotional reactions and stick to rational decisions.

-

-

Minimizing Impulsive Behavior:

-

Disciplined traders are less likely to fall victim to FOMO (Fear of Missing Out) or other irrational behaviors that can lead to losses.

-

-

Effective Risk Management:

-

Disciplined traders are more likely to adhere to proper risk management techniques.

-

This helps them control the size of their positions and manage potential losses.

-

Methods to Enhance Trading Discipline and Risk Management

Maintaining discipline is crucial for successful trading psychology as it ensures adherence to trading plans and effective risk management. The following methods contribute to disciplined trading:

-

Developing a Comprehensive Trading Plan:

-

A well-defined trading plan outlines:

-

Entry and exit strategies

-

Risk management rules

-

Overall trading goals

-

-

Following such a plan reduces the influence of emotions and ensures a systematic approach.

-

-

Using Stop-Loss and Take-Profit Orders:

-

Placing stop-loss orders helps limit potential losses, and take-profit orders secure profits at predetermined levels.

-

These orders remove the need for traders to make emotional decisions during market fluctuations.

-

-

Continuous Learning and Adaptation:

-

Staying informed about market developments and adapting strategies as needed is essential.

-

A disciplined trader is open to learning and is willing to adjust their approach based on changing conditions.

-

-

Keeping a Trading Journal:

-

Recording trades and the reasoning behind each decision in a trading journal fosters self-awareness and helps traders identify patterns of behavior.

-

This can lead to improvements in decision-making over time.

-

-

Practicing Stress Management Techniques:

-

Trading can be stressful, and stress can impair decision-making.

-

Techniques such as meditation, deep breathing, and regular breaks can help manage stress and keep emotions in check.

-

Disciplined utilization of Trading Tools like Bookmap provides visual representations of market data and helps in enhancing trading accuracy. This results in well-informed decisions based on data rather than emotions.

How Does Disciplined Use of Trading Tools like Bookmap Help?

Bookmap is a market data visualization tool that displays the order book and historical trade data in a visual format. Here’s how employing Bookmap with discipline can improve trading outcomes:

|

Benefits |

Explanation |

|

Informed Decision-Making |

|

|

Pattern Recognition |

|

|

Confirmation of Strategies |

|

|

Adjust Stop-Loss and Take-Profit Levels |

|

In essence, combining discipline with advanced tools like Bookmap equips traders with the robust foundation and insights necessary for consistent success in the volatile world of trading.

Conclusion

In trading, it’s not just about numbers; it’s about understanding our feelings too. Balancing emotions and smart strategies is key to winning in the financial world. Remember, having a solid plan that grows and changes with the market is crucial for success.

Ready to enhance your trading strategy with the right tools? Combine your understanding of trading psychology with the powerful insights provided by Bookmap. Experience the difference today. Sign up for Bookmap here.