Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

December 11, 2024

SHARE

Deciphering Market Relationships: The Dynamics of Correlation Trading

Have you ever wondered how the seemingly distinct assets in financial

markets are intricately interconnected, their movements subtly influencing

each other’s prices? This intriguing puzzle lies in the secrets of

correlation trading.

In this article, we will understand how new tools are simplifying the

understanding of these connections, ultimately paving the way for profit in

this ever-evolving landscape of emerging technologies.

Also, we will explore some of the strategies that make correlation trading

even smarter. So, let’s dive in and learn more.

Grasping the Intricacies of Correlation Trading

Correlation trading is a sophisticated strategy revolving around the idea

that the price movements of one asset can influence or predict the price

movements of another. To measure this movement, a statistical measure known

as the correlation coefficient is used.

What are Correlation Coefficients?

-

These coefficients quantify the degree of association between the

two assets. -

These range from -1 to 1.

-

The value of the correlation coefficient indicates the strength and

direction of the correlation.

Refer to the table below and understand the three common types of

correlation coefficients and their indications:

|

Types of Correlation |

Correlation Coefficients |

Indication |

|

Perfect Negative Correlation |

-1 |

When one asset goes up, the other goes down |

|

Perfect Positive Correlation |

1 |

Both assets move in the same direction |

|

No Correlation |

0 |

Signifies no linear relationship between the assets |

The Foundations of Correlation Trading

Correlation trading is commonly used by traders and investors to identify

and capitalize on the interconnectedness of various assets. It is not

limited to any particular market or asset class and includes equities,

commodities, currencies, and more.

The core idea is to identify when the prices of two or more assets move:

-

In tandem or

-

In opposite directions

This identification provides opportunities for profit or risk mitigation.

Dynamic Nature of Correlation Coefficients

It must also be noted that correlations are not static. They can change over

time due to various factors. Geopolitical events, economic news, or policy

changes can dramatically alter the dynamics between different markets.

For example,

-

Let’s consider the impact of geopolitical tensions.

-

In the event of a war or significant political turmoil, assets like

gold and oil may experience sharp price increases due to increased

demand for safe-haven assets or supply disruptions. -

At the same time, stock markets might display vulnerability, with

investors reacting to uncertainty and potential economic fallout. -

These changing correlations can present opportunities for

correlation traders to profit by:-

Going long on gold and

-

Short on equities

-

Note: Successful correlation trading requires a deep understanding of

financial markets and a keen awareness of the global events and factors that

can shape these relationships.

Real-World Correlations in Trading

Let’s explore real-world correlations in trading by examining three classic

scenarios:

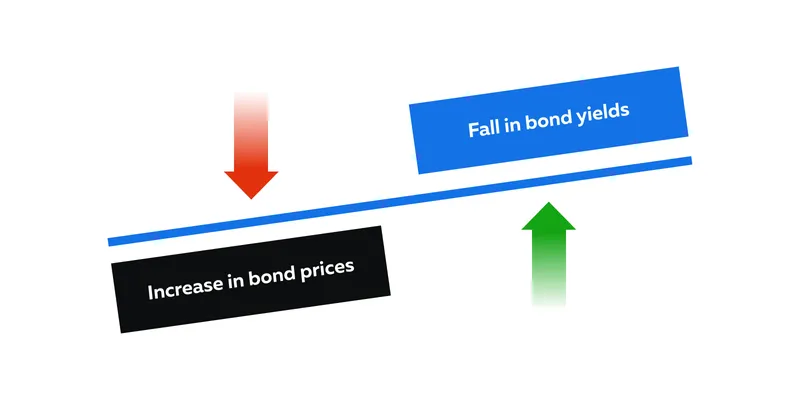

Scenario 1: Bond Prices and Yields

-

The relationship between bond prices and yields is a classic example

of real-world correlations. -

When bond prices rise, bond yields fall, and vice versa.

-

This inverse correlation is because of the concept that bond prices

move in the opposite direction of yields.

Let’s understand through an example.

-

Assume that global economic uncertainty is on the rise.

-

In such a situation, investors often seek safety in government

bonds, which are considered low-risk assets. -

As demand for these bonds increases, their:

-

Prices go up, and

-

Yields go down

-

-

Investors refrain from investing in riskier assets such as equities.

Scenario 2: Gold and Geopolitical Crises/Oil Price Movements:

-

During geopolitical crises or times of increased global uncertainty,

investors often instinctively turn to gold. -

This is because gold is considered as a safe-haven asset.

-

Gold has an inverse correlation with riskier assets like stocks.

-

This is because gold:

-

Is considered a store of value and

-

Acts as a hedge against economic instability.

-

-

As tensions rise, gold prices tend to increase as investors view

gold as a reliable asset to weather the storm.

Scenario 3: Oil Price Movements and Broader Economic Correlations

-

Significant oil price movements also reveal intricate correlations.

-

Oil, being a critical commodity, has wide-reaching impacts on

various sectors of the economy. -

For instance,

-

When oil prices surge, it drives up the costs of production and

transportation. -

This surge impacts a wide range of industries and leads to

negative correlations between oil prices and the performance of

stocks in those sectors.

-

Enhancing Correlation Insights Through Visualization

In modern trading, visualization tools provide traders with an immediate and

intuitive understanding of market dynamics. They allow traders to identify

changes in real-time and respond swiftly. Let’s understand how visualization

enhances correlation insights.

Traditional Correlations vs Visual Tools

Traditional methods of assessing correlations, such as using numerical data

like correlation coefficients, have long been used as an analysis tool in

trading.

However, these approaches have limitations:

-

Difficult Interpretation:

-

Correlation coefficients provide a quantitative measure of the

relationship between two assets. -

A correlation of -1 to 1 indicates the strength and direction of

the relationship. -

However, this numerical data alone can be challenging to

interpret swiftly. -

This challenge gets amplified especially when dealing with

multiple assets or rapidly changing market conditions.

-

-

Lack of Intuition

-

Correlation coefficients lack visual representation.

-

Traders often need to mentally process these numbers, which can

be time-consuming and error-prone in the heat of trading.

-

-

Inefficiency in Multivariable Analysis:

-

When dealing with multiple assets or complex portfolio

strategies, calculating and interpreting individual correlation

coefficients for each pair of assets can be a cumbersome and

time-intensive process.

-

Real-Time Adaptation Through Visual Cues

In fast-paced trading, market correlations experience abrupt changes. These

changes can increase during news breakouts, economic data releases, or

policy announcements. This is where visualization tools come to the rescue.

Transformative Power of Visualization:

Visualization tools like correlation matrices and scatter plots offer a more

immediate and intuitive grasp of market dynamics. They enable traders to:

-

Identify rapid changes by representing correlations in real time,

-

React swiftly through dynamic color changes or markers.

The Merits of Multi-Asset Visualization

Multi-asset visualization tools allow traders to view and compare

correlations among multiple assets at the same time. Visualizing multiple

assets in a unified display reduces the risk of overlooking important

correlations.

Traders face major difficulties when they monitor correlations among

multiple assets simultaneously. Traditional methods make this a cumbersome

task, but synchronized visualization tools can make it straightforward and

accurate.

Innovations in Visualizing Correlation Data

Traditional analysis has several limitations. This is where visualization

comes into the picture. Let’s understand its growing prominence in detail.

Overlay Insights and Comparative Analysis

Overlays in visualization tools allow for the direct comparison of datasets.

It enables traders to visualize multiple assets or datasets:

-

Side by side or

-

Superimposed on one another.

Merits of Side-by-Side vs. Overlaid Viewing:

-

Side by Side Viewing:

-

Viewing assets side by side provides a clear, unobstructed

comparison. -

Traders can easily identify:

-

Trends

-

Divergences, or

-

Convergences

-

-

-

Overlaid Viewing:

-

Overlaying assets can be beneficial when traders want to spot

immediate co-movements. -

It is particularly useful in intraday trading where

minute-by-minute movements are essential. -

For instance, in high-frequency trading, overlaying order book

data can help traders identify potential arbitrage opportunities

by visualizing bid-ask spreads and trade execution prices

simultaneously.

-

Heatmaps for Portfolio Optimization

Heatmaps provide a visual representation of asset relationships using color

coding. In the context of correlation analysis:

-

A heatmap displays the strength and direction of correlations

between various assets. -

Each cell in the heatmap corresponds to a pair of assets.

-

The color intensity of the cell indicates the correlation strength.

For example, a deep green cell may represent a strong positive correlation,

while a dark red cell indicates a strong negative correlation.

Using Heatmaps for Portfolio Optimization:

Traders can employ Heatmaps for identifying portfolio imbalances. By quickly

glancing at the heatmap, they can identify the following:

|

Assets with strong positive correlations |

These assets indicate potential concentration risk. |

|

Assets with strong negative correlations |

These assets indicate diversification opportunities. |

Time’s Role: The Importance of Time-Lapse Analysis

Correlations are not static; they change over different timeframes. Hourly,

daily, monthly, or even intraday correlations can exhibit distinct patterns.

Time-lapse analysis enables traders to make more informed decisions by

adapting to the changing nature of correlations over various timeframes.

Let’s see some common benefits:

Benefits of Time-lapse Analysis

|

Time Frame |

Benefits |

|

Intraday Analysis |

Tacking correlations on an hourly or minute-by-minute

|

|

Daily Analysis |

Daily correlations can:

|

|

Monthly Analysis |

Monthly correlations offer a macroeconomic perspective. |

Conclusion

Correlation trading is an old-school analysis technique. It is based on the

concept that movement in the price of one asset affects the other. However,

in the current fast-paced world of trading, it is marred with several

limitations. These traditional methods lack an intuitive visual

representation and prove inefficient when dealing with multiple assets.

This led to the development of visualization techniques that have

revolutionized correlation analysis. Among these innovative techniques,

heatmaps stand out with their color-coded depiction of correlation strength.

These tools have brought about a revolution in portfolio optimization,

offering traders a dynamic and visually intuitive means to navigate the

intricate web of asset relationships in today’s complex financial markets.

Are you ready to take your correlation trading to the next level? Dive

deeper and harness the power of cutting-edge visualization with

Bookmap’s Correlation Tracker Indicator

. Discover the tools that seasoned traders are using to make informed

decisions in dynamic markets.