20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

December 25, 2024

SHARE

Exploring Momentum Trading Strategies: A Comprehensive Guide

You’ve probably heard the saying, “The trend is your friend,” countless

times. It’s not just a cliché; it’s a guiding principle in the ever-changing

world of financial trading. Most successful traders understand the

importance of recognizing and riding trends.

However, in the fast-paced trading landscape, what’s in demand today might

not be tomorrow. Momentum trading, as a financial strategy, can bring big

profits but also comes with its own set of challenges. In this article,

we’ll show you how to identify trends and momentum, verify them using

advanced tools, and pinpoint the right moments to enter and exit trades for

maximum profits. So, keep reading to learn more about momentum trading.

The Fundamentals of Momentum Strategies

“This time it’s different” – This well-known quote from Sir John Templeton

serves as a reminder for traders not to blindly chase trends. While “going

with the flow” can align you with significant market movements, it’s

essential to exercise caution. Let’s delve deeper into the fundamental

principles.

What is Momentum in Trading?

Momentum in trading refers to the rate and swiftness at which asset prices

move in financial markets. It is a measure of the strength and persistence

of price trends in financial markets. The basic idea behind recognizing

momentum is that:

-

Assets that have been performing well are likely to continue to

perform well. -

Assets that have been performing poorly are likely to continue in

that direction.

How Traders Practice Momentum Trading

In momentum trading, traders buy and sell assets following a particular

trend. See the table to understand their actions:

|

Type of Trend |

Assumption |

Aim |

Market Action |

|

Uptrend |

Assets that have shown strong recent price performance |

To earn profit from the continuation of upward trends.

|

It involves purchasing assets that are clearly moving |

|

Downtrend |

Assets with a history of poor performance will continue |

To earn profit from the continuation of the downward |

It’s advisable to sell assets that are on a downward |

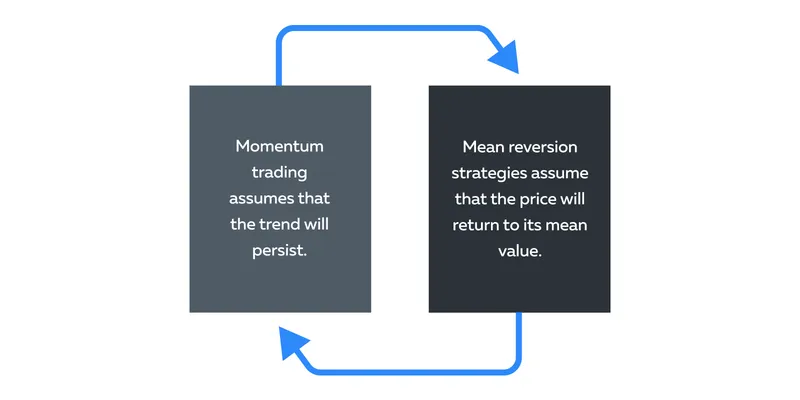

How Momentum Trading Contrasts from Mean Reversion

Momentum trading is often contrasted with mean reversion strategies. Mean

reversion strategies assume that if an asset’s price has moved too far from

its historical average, it will eventually return to that average. This

contrasts with momentum strategies, which expect trends to persist.

The Science Behind the Trend

The success of momentum trading can be attributed to several factors.

Understand closely the science behind the trend in momentum trading:

Trader Psychology

In the context of momentum trading, the two most common ideas in a

trader’s psychology

are:

|

Buy High and Sell Higher |

FOMO (Fear of Missing Out) |

|

|

External Catalysts:

-

Industry News and Global Events:

-

Momentum in trading can be triggered by external factors such as

major

industry news and global events

. -

Positive news or events related to a particular sector or asset

class can drive increased buying interest. -

For example, if a pharmaceutical company announces a

breakthrough in drug development, the stock of that company may

experience a surge in momentum as investors pile in.

-

-

Earnings Reports:

-

Earnings reports, especially for publicly traded companies, have

a significant impact on momentum. -

Positive earnings results attract more buyers, driving the price

higher. -

Conversely, poor earnings lead to negative momentum as investors

sell off their holdings.

-

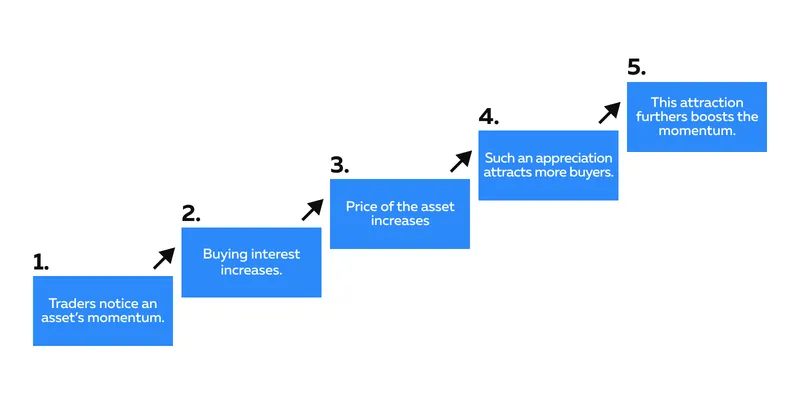

Self-Perpetuation of Momentum:

Momentum can self-perpetuate due to a positive feedback loop. See the events

of this loop:

-

Traders notice an asset’s momentum and start buying into it.

-

This increases demand and pushes the price higher.

-

The price appreciates and attracts even more traders who don’t want

to miss out on potential profits. -

This further boosts the momentum.

-

This loop/cycle continues until:

-

There is a significant shift in sentiment or

-

There are external factors that reverse the trend.

-

Building a Momentum Trading Strategy

Building a successful momentum trading strategy is a two-step process:

-

Step I: Identify assets with strong momentum

-

Step II: Confirm and validate the identified momentum

Let’s understand these steps:

Step I: Identifying Assets with Momentum:

Several market traders use traditional technical indicators to identify

assets with momentum. Two popular indicators for this purpose are:

|

MACD (Moving Average Convergence Divergence) |

RSI (Relative Strength Index) |

|

|

Step II: Confirm the Identified Momentum

High trading volumes are a significant confirmation of momentum. When an

asset experiences a surge in price alongside substantial trading volume, it

suggests that the momentum is more likely to be genuine. Several advanced

market analysis tools, like Bookmap, can be used to confirm momentum.

Let’s see how traders use Bookmap to confirm the momentum:

|

What are the Features/Benefits? |

How Does it Help Traders? |

|

Heatmaps |

|

|

Graphical Representation of Market Data |

|

|

Visualization Tools |

a) Allowing them to observe the progression of the order b) Equipping them with a visual advantage in identifying |

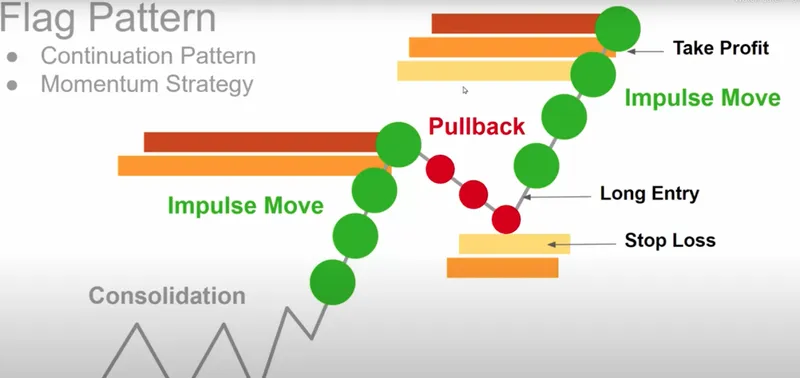

Setting Entry and Exit Points

Breakout trading is a strategy where traders aim to capture price movements

when an asset’s price breaks through a significant level of support or

resistance. This is considered a signal of strong momentum. Breakouts can

occur in various forms, such as:

-

Breakout above a previous high;

-

Breakout below a previous low;

-

Breakout is when an asset moves out of a well-defined chart pattern

like a triangle or a rectangle.

When do traders set an entry point?

Traders enter a breakout trade when the price breaks out of the established

range. This happens:

-

Either by going long (buying) if the breakout is to the upside;

-

Or by going short (selling) if the breakout is to the downside.

When do traders set an exit point?

Breakout traders use price-based exit strategies to capture profits. This

involves:

-

Setting a target price at a certain distance from the breakout point

or -

Using a trailing stop-loss order to lock in profits as the price

continues to move in their favor.

Trailing Stop-Loss Orders:

Trailing stop-loss orders allow traders to capitalize on strong trends and

safeguard their profits. Here’s how they work and why they are essential:

-

If the price moves in the desired direction, the trailing stop

follows, maintaining a set distance from the current price. -

If the price reverses by a specified amount, the trailing stop

triggers a market order to exit the position.

How are trailing stop-loss orders used in momentum trading?

Trailing stop-loss orders are particularly useful in momentum trading. They

allow traders to ride strong trends while protecting their profits. The

trailing stop continually adjusts as the price continues to move in the

desired direction. This adjustment ensures that the trader locks in gains if

the price suddenly reverses.

The Concept of Profit Targets:

-

Profit targets are predetermined price levels at which traders aim

to exit a position to secure profits. -

Setting profit targets in advance can help traders exit a position

at optimal points and avoid getting greedy or overly emotional. -

Profit targets are often based on technical analysis, such as:

-

Key support or resistance levels

-

Fibonacci retracement levels, or

-

Previous price highs or lows.

-

How are Profit Targets used in Momentum Trading?

When traders identify a strong momentum move, they set profit targets at

levels where they anticipate the trend may encounter resistance or start to

slow down. This ensures that they take profits while the momentum is still

in their favor.

Challenges and Considerations in Momentum Trading

Momentum trading faces several challenges such as late entries, false

breakouts, and other risks. This makes risk management a critical aspect of

momentum trading. See the table below to understand the major challenges:

|

Dangers of Late Entries |

False Breakouts |

|

|

How Can Traders Overcome Challenges?

To protect their capital, momentum traders should use the following risk

management tools:

-

Setting Maximum Loss Thresholds:

-

These thresholds, often defined as stop-loss orders, represent

the point at which traders are willing to exit a trade to limit

their losses. -

It’s crucial for traders to:

-

Determine their maximum acceptable loss for each trade and

-

Set stop-loss orders accordingly

-

-

By doing so, they can control the potential downside risk.

-

-

Position Sizing:

-

Traders should determine the size of each position based on:

-

Their risk tolerance and

-

The acceptable distance to their stop-loss level.

-

-

This determination ensures that a single losing trade does not

disproportionately impact their overall capital.

-

-

Using Technical Indicators and Analysis:

-

Technical indicators and analysis tools, such as support and

resistance levels, can aid in minimizing the risks associated

with late entries and false breakouts. -

By utilizing these tools, traders can make more informed

decisions and;-

Reduce the chances of entering a trade too late or

-

Getting caught in a false breakout.

-

-

Adapting to Market Shifts

Momentum trading is dynamic. To stay nimble and responsive to shifts in the

market, traders should:

-

Recognize that what’s popular today may not be tomorrow’s trend.

-

Be aware that the market is constantly evolving, and even the most

robust momentum can eventually wane or reverse. -

Stay updated with market news and developments. Being informed

enables traders to anticipate shifts in momentum and act

accordingly. -

Regularly track the performance of the assets they are trading.

-

Use technical analysis tools, watchlists, and real-time data to

identify changes in price trends and momentum.

By adhering to these practices, traders can better adapt to the

ever-changing nature of the market and make more informed decisions.

Periodic Strategy Reviews:

Traders should periodically review and analyze past performance to identify

what has worked well and what hasn’t. Additionally, traders must:

-

Modify risk management parameters, which encompass:

-

Adjusting stop-loss levels

-

Tweaking position sizes

-

Refining profit targets

-

Be open to diversifying their trading strategies and considering

other trading styles, such as mean reversion or value investing, to

navigate different market phases.

Conclusion

Momentum trading relies on the continuation of strong asset trends that

offer significant profit potential. However, it carries inherent risks,

including late entries and false breakouts. This makes utilizing technical

indicators, risk management tools, and staying updated with market

developments vital.

The usage of market analysis tools like Bookmap aids traders in visualizing

the market and performing a constant vigil. Indeed, momentum trading offers

substantial rewards, but it’s not without challenges. Traders must equip

themselves with knowledge and tools to maximize their chances of success.

Momentum trading is just one facet of the vast world of trading strategies.

To ensure its success, thorough backtesting is essential. Dive deeper into

the process with our guide on

“How

Do You Backtest a Trading Strategy?“. Equip yourself with knowledge to

refine and validate your approach for better trading outcomes.