Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

Interviews

October 6, 2024

SHARE

From a Successful Career in Tech to Trading Full-Time With Bookmap: A Silicon Valley Trader’s Catalyst After Combining His Workflow Into a Single Tool

This article is based on an interview with Claudio, conducted by Owain Higham

Can you tell me a bit about yourself? Are you a professional trader?

I am a full-time trader, yes. There is a very specific definition of what a ‘professional trader’ is in the United States, so I’m always careful how I talk about that. But I am a full-time trader, yes, if that’s what you look at as a professional trader.

So you’re located in the US right now. Are you from the US, or did you move there?

I am originally Brazilian. I am almost 40 years old, and I moved out of Brazil when I was around 18.

I built a career in software engineering, moving around between Europe, the Middle East, and Africa doing software development projects, especially with mobile carriers, leading those projects. Then I came to the United States about 10 years ago. When you work with tech, eventually you just land in Silicon Valley, right? And that’s how I ended up here.

Is tech still booming there like in the past, or are things different now?

Right now it’s a bit different. Obviously Covid happened, but the market, the economy, and the companies repositioned themselves with what the next wave is, what the next technology is.

My personal opinion is that there is a lot more fear in the market related to those tech companies, because I see recruitments left and right the whole time, there’s no stopping it.

It’s definitely different. There is a lot of push and pull about working or not working in an office anymore, but it’s still the center. There are new tech centers being built in the United States around Miami and Austin, Texas, which are becoming the new Silicon Valleys. I don’t think they will ever replace it, but they are becoming the Silicon Valley 2 and 3 of the United States.

What took you from a successful career in tech to trading?

Obviously success is dependent on a bunch of different personal parameters, but I definitely had a very successful career in tech. I did really amazing projects that helped a lot of people across the world in terms of payments and healthcare. But all in all, to give me the freedom of time to do what I care to do in my life right now, working in tech would not allow me to do it. Obviously you can make it work—and don’t get me wrong—I love what I’ve built, I love the opportunities I was given. But I really wanna do something else, which is build a dog sanctuary. I wanna rescue as many dogs as I want, I wanna have a big, farm-sized space and be able to economically support all that, because it’s expensive. It’s not just bringing in all of the dogs, I have to take over the veterinary bills, the medication, the surgery. All of that takes a lot of money. I just took one of my dogs to the vet yesterday for a routine checkup and it was $700. For one dog. So it does take a lot of money, and I wanna do this the right way.

There is also the component that technology moves, but it doesn’t move that much. There are cycles that take so many years, and I’m a person that likes to be constantly moving, learning and doing new things. That’s pretty much why I ended up moving so much across different countries and moving across different projects, to get myself to do something different. Because you know, there is only so much you can do with developing web applications, there is only so much you can do developing back end applications, right? You just get stuck.

I have been a long-term investor for twenty-plus years now. It is something that is very embedded into Brazilian culture; trying to save money, having retirement accounts. Obviously it is a country with a lot of economic problems that makes it difficult for people to save money. But you know, I started working in tech, I was really young, and then obviously I started making money at a very early stage, and I was able to start doing that. So the concept of investing, of saving money was always there. Obviously there were ups and downs.

Then around 2019 I started day trading, so about a year before the pandemic hit. It’s the classic story; you look at the candles, you look at the charts and it’s like, “Oh, this is so easy. I’m just gonna buy here, sell here.” And then, “Oh, hindsight.” So great. 2020 came and everything was just so easy, because it was just buying, and everything was just going. I was like, “I’m the best trader in the world.” You know, all the classic things, man. I was still working in tech, but spending more trading because I was working from home, and things were doable. And because I am in the California time zone, and I was trading in the New York time zone, I had all this time before my actual work time in California. So I had about three, four hours trading before I had to give any time to my actual work. 2020 came to a close, my project ended, and I’m like: “I’m going full-time.” Then the market turned around early 2021. I entered a drawdown and then I was like, “Oh, I don’t know as much as I thought I knew about trading.” Classic stories. How many times have you heard this!

So I had this drawdown and I put myself back into consulting. I was like, “Trading is my thing, I just need to catch my breath, get out of this drawdown, and then define the next phase.” I got some consulting work, money flowing in, and it freed my mind. Then I was like, “OK, back into trading.”

I had another breakthrough in the last quarter of 2021, and that continued going. That was my second breakthrough, and right now I’m having what is my third breakthrough as a trader, which is all Bookmap.

Img 1: One of Claudio’s dogs enjoying a walk in sunny California.

What is it that changed, what makes you think you are in your third phase?

I am a Mac user primarily, and I am a product builder. Because I build products for users as well, I always look at software from that perspective. I’m also very lenient, because I’m in the shoes of product managers and engineers and so on. There are those products that make so much difference for you that you overlook everything else that is wrong with it, because the value that it brings is so much higher than all the other little problems you have with it. That was my relationship with Bookmap from day zero.

The third breakthrough that is happening now is this: I’ve always been a Mac user, and I had a Mac Intel. Now I have the M1 Mac. The way I operate is that I have so many different monitors with the Bookmaps detached. I was trading options, looking at the futures of the S&P 500 and the Nasdaq, as well as all the tickers; AMD, Apple, Nvidia, and this and that. One on each monitor. The way I operate, the way my mind operates, is I’m trying to reverse-engineer what the algos are doing across all the different books, so it gives me the confidence to say it’s time for something; for a reversal, for more selling or whatever I’m looking for.

So I’m trying to connect all of these points together. My charts were in TradingView, and my execution was on WeBull for the options. So this whole time I had 3 different platforms operating, and I’m changing context the whole time. I wasn’t trading futures, but I always looked at futures. Futures for me was an expected path, just because I was already trading SPY and QQQ options of the ES and NQ puts. It was just a matter of time, but so many other things were happening in my life, and it wasn’t time to dive into something new.

Michael, your product manager, asked me if I trade using the charting features. I was like, “No, because I don’t trust the stability of the tool”. I wanted it to be static. I know the dark zones are coming in, but I’m looking at my charts on TradingView and I’m executing my trades on WeBull. Then a few weeks later he asked one of the engineers to send me the M1 beta version, and a whole new world exploded for me.

If you pull back to what I said in the beginning, I am a Mac user. It was never in my mind a possibility of switching back to Windows to run Bookmap. I was gonna live with Bookmap, but I was not gonna go back to Windows. It was just not going to happen. So it was always this balance of what actually pings me more. When that happened, it was something magical. At that moment, it was like, okay, this is very stable. Now I zoom in, zoom out, and everything just works and is instantaneous. Then I started drawing lines, my boxes and all the drawings. Then I started getting confident and I started doing paper trading on futures. Then I was like, “Let me connect with my actual futures broker Tradovate.”

Then suddenly everything just started evolving so fast. I’ve been trying to take it all in, everything that is happening within me at this point. Two weeks ago, in that single week, I made more money than I made all last year. All of it! Last week I had my biggest day ever. It was insane.

So what is all of this? Obviously it’s a combination of experience, putting in the work and whatever. I have probably over 1,000 hours of experience with Bookmap; of replaying and just dissecting things. But I think one of the core things was that I’m finally locked to one single platform where I’m doing everything. I am looking at the order flow coming in, I am doing my charting, and I’m actually executing: I am moving my stops, I am moving my orders. I’m not switching back and forth from so many monitors, not trying to look for the right options strike or to the other broker’s platform to switch futures. I am just locked into what I am seeing, and I think there is a beauty of having your mind so clear of noise and other things that let you just completely let you get in the ‘flow’, of the zone of what is happening with that price action, and you are just executing. It became much more chill to trade. It just feels so much more at peace, instead of juggling all these different numbers. Instead I’m just locked into one thing. And it’s beautiful.

So if I understand correctly, even though you obviously have skills as a trader, this recent unprecedented success is thanks to a change in your trading setup, because you’re more focused?

Because I am more focused. I am not juggling between tools and brokers, I am just here. I don’t even have my TradingView charts open anymore, it’s all Bookmap.

What’s your style of trading?

I’ve always been a day trader. I was scalping when I was doing options where my average position time was between 5 to 10 minutes prior to this transition when I got the M1 version of Bookmap. Now my average trade time is over an hour, because I have so much more confidence on holding, on believing in what I’m seeing. My mind is just so much less paranoid, I guess.

Right now I am on the day trading spectrum. Scalping and day trading is kind of the same thing, but the definition is on the holding periods. I never called myself a trend trader, I’ve always been a scalper, trying to catch reversals. But now I am riding the entire trend, I am adding to the winner. This is something that is happening now because I’ve reached a whole different level of comfortability with my trading that I’ve never experienced before.

I’m an overthinker. This helps me a lot, but as a trader it also screws you a lot. Obviously the order flow is the biggest component of it all, but I think in this bigger context, it’s all because of consolidating into a single tool.

You’re still looking at the same thing, but it’s more like your mindset has changed. Your psychology is more clear, so you’re more confident. Has it slightly changed your style of trading?

Yeah, a lot of my strategies are still the same, a lot of my entry signals are still the same, but in the past I was also looking to capture a much smaller piece of that move because of comfortability. Having to manage different things, having to match different things, looking here, looking there—trying to match everything in my head. The more you’re trying to process, the worse the decisions you make.

I was already a profitable trader, I was already a consistent trader. As any trader with ups and downs, with cycles and what not, I had already found my groove. But this took me to a whole other dimension. So much so that my mentors came and were like, “OK, let’s really dissect what is happening with you”.

I’m still really taking it all in. It feels really surreal. You always want big success, but it’s always odd when it happens. It’s like, is this real? Am I dreaming?

You’ve said Bookmap is now your only tool, but how does it fit into the rest of your workflow on a typical day?

Let me take you back to how I started and then we’ll get into that. My first breakthrough as a trader was when I finally understood the concept of supply and demand trading. I was doing my zones, putting on all my boxes, practicing and backtesting every day. Then at the end of the day I would look at that like, “Oh yeah, that worked.” Then I remembered—because I follow JTrader on YouTube—this guy always talks about Bookmap. I thought that maybe I could look to see if my zones are actually there, if what I am drawing on my candlesticks charts is reflecting on the actual order book. You can’t do that at the end of the day on other tools, so that’s how I got Bookmap.

At first, Bookmap was not for me to use during live trading, but just to use at the end of the day and see what I drew on my candlestick charts really happened. That really took me to a greater level of confidence in trading, because I could trust that my zones were there. As traders, we are always looking for something that can give you a hundred percent trust. It’s impossible, but you’re always looking, right? ‘Cos you really want it. That’s how it started, really. I was using Bookmap to backtest my own strategies at the end of the day. I would go through all of the data and see that they were really putting all this supply there, all the demand there, and that gave me the confidence to really trust my candlesticks. Then slowly, I started using Bookmap during the day, but it was really just static on monitors so I could see what the algos were doing, what the bigger zones were. But I was still trading off my candlestick charts.

Then I started using it a lot to educate people on chart patterns. Like an ascending triangle, for example: I am showing people—and myself—this is the chart pattern coming into the supply. That’s what the ascending triangle is, it’s coming into the supply, and I’m showing that here is the supply, really. It becomes so much easier for people to assimilate the actual chart patterns. So I think there is a beauty of education with Bookmap, because you can really see why the pattern really happens, and that gives you more confidence in trusting why things happen.

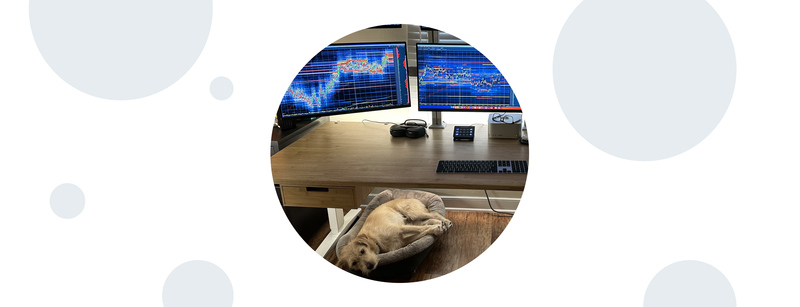

I have 6 monitors here, I have like a whole spaceship. Bookmap was always static, but now, after the M1 version, that’s where I started using it for things like drawing.

Img 2: Claudio’s other dog resting beside Bookmap charts!

You’ve mentioned that you are now experiencing much better performance and also have longer holding periods for trades. Is this a case of holding trades for longer being more profitable in your strategy, or is it just a case of having the confidence to stay in positions for longer that results in fewer mistakes and thus losses?

I think it’s a bit of both. The benefits of keeping your mind super focused obviously adds comfortability and lets you continue on the same train of thoughts, so you’re never looking to the side and then getting distracted, or getting another thought that breaks into the reasoning for the trade.

I think one of the things that always happened to me was always finding a reason to exit, even if the original reason to exit was not there. What I’m saying is, there were obviously common things that people will obviously no longer do, but in my case it only came after my workflow started simplifying. As my workflow simplified, I started finding less reasons to get me out of the trade, and just stayed in the same original theory that I had.

You also mentioned Brazilian investing culture. I’m curious how much impact you think culture really has on an individual trader?

Where you’re born will obviously have an effect on your perception of money; on how you save money, how you invest money. If you are struggling for money, it is obviously very hard for you to save money to make investments.

I cannot speak for other countries. However, because of the economic situation of Brazil, there has always been a culture in mainstream media to teach people economic tips on how to save money and how to stretch your money, because these are all things where you have those issues. I lived and did a lot of work in Africa, and this is something that I saw there too. There is a culture of trying to help the least fortunate by giving them tips on how to at least move up the ladder of society a little bit.

In Brazil you have these private retirement plans, and you have the mainstream media constantly telling people that you have to save money, that you have to think about your future. It’s not you pitching you how to invest, it’s just reminding you that you have to put money aside to save. The most important thing in Brazil is that they are constantly teaching you how to budget, how to separate the money for the bills.

In my case, I got interested in what is behind where my money goes when I put my money into passive investment funds, which companies they are buying. But I wasn’t an active investor, I was depositing money into funds. Now I understand what passive investments are.

There is a famous story of two commodity traders in the 80s that had a bet on whether or not you could teach new traders to trade profitably. A big conclusion of the so-called “Turtle Traders” was that risk management is more important than where you buy and sell. Do you think the idea that risk management trumps trading strategy is valid; that you could theoretically buy and sell randomly, but as long as you cut losers and let winners run, you can still be profitable?

It is absolutely true. The most important thing for me that really changed my trading was when I finally understood what risk management really is. It’s very personal, there is no cookie cutter recipe for everyone. It’s really based on the types of strategies, the level of comfort, your understanding of the tools, and obviously market dynamics and so on.

There are always moments of drawdowns, moments where you think you got the key, and then the market goes and changes the lock. What got me out of the drawdown mentally was knowing that I could control my losses. Even if I was a bit disconnected from the market or, you know, something had changed that day, being able to control the losses always kept my mind from going to a darker place, keeping me in the game. I know how to trade, it’s just there is something else going on that I have to fix.

It’s easy to get lucky and make a lot of money, but it takes ability to actually keep that money. I’m just another one of those that learned the hard way. Risk management is still the king. It doesn’t matter how many strategies you have, it doesn’t matter how many tools you have, it doesn’t matter how good your computer is—if you don’t know when the trade is wrong, when you have to cut it—you’re gone, there is no account. If you don’t have an account, you cannot trade.

Do you have a hard rule for dealing with drawdowns, such as stopping trading after a sequence of successive losses?

I have a core rule: If I make what I call a “cardinal sin”, I have to immediately stop trading. So revenge trading, averaging down into a losing position, all those things you cannot do. If I catch myself doing those, then it’s immediately off. It doesn’t matter how good the day is, it doesn’t matter. I have to keep myself accountable, because I’m the only one watching myself. I’m alone in this room. I mean, I have the dogs, but… [He chuckles].

If I get into the second consecutive loss, I already have to take a step back and reevaluate. It can happen, right? Maybe this entry was two minutes too early, let’s do it again. If it goes against me again, then I have to take a step back, even if the setup is there. Because for me it can unlock the chase of the trade. It unlocks that emotion.

The emotions are always going to be there, you just have to understand what triggers your emotions so you can learn how to use them in your favor or protect yourself against them. If the same trade doesn’t work twice, it unlocks the chase, so it’s better to walk away and come back. There are too many hours of trading a day.

I don’t usually have a max dollar amount a day, because it’s very situational of what I am doing and what the dynamics of the day are, the same way I don’t have a target of profits for the day. I stay around, I look for my setups. Sometimes I have many setups happening ten times a day, sometimes twenty times a day. I try to be mindful of taking the setups. Sometimes it can become overtrading.

If I get into, let’s say, three days of negative PnL at the end of the day, I take a few days off. The market is still going to be here, right? Sometimes you get burnt out with trading, as well. Sometimes you just catch yourself burnt out too late. It could be a consequence of the market, it could be that specific day, the liquidity of the day, whatever the reason is. I believe you just have to stop, take a step back, and then continue. That’s what I do when things are not working.

So after every losing trade you stop and take a breather? Or are you just so aware of your emotions that you can manage your psychology on the go?

There are two things. One: Yes, I am very conscious now, after going through it so many times and feeling so much pain. So many times I was so frustrated with myself, the inability to control myself, of losing more money than I was supposed to. Times where I knew—as it was happening—that I shouldn’t be averaging down, but thinking, “This time it’s gonna work, this time it’s gonna happen”. I’ve been through that so many times, where after it’s all done and you go through that pain that only you can feel, you sit on the floor and you’re like, “What the hell are you doing with your life?”. There comes a point where you just say enough. If I don’t figure this out, I cannot make trading work, and I really want it. I mean, I still want it, to make trading work. [He laughs]. I don’t think there is ever a destination, you’re always just going, because the market is constantly changing, and that’s the thing that I love the most now.

The second thing to discipline is that we all have issues with it. The important thing is, a lot of those things you can only learn with trial by fire, only when you go through it and then you’ll learn how you react. But a lot of times you know how you’ll react, but you don’t know what to do with that. You don’t know how to fix it, for whatever reason.

One of the things that was a catalyst this year for me as well was when I came across a book called the Mental Game of Trading by Jared Tendler. It’s doing the rounds now, and I’m very happy that people are discovering him, because he did such an amazing thing for me. What I did first was, I read the book, then right after that he did a live workshop for several weekends. What this book and the workshop teaches is how to map your emotions during trading, and it gives you a path to understand it and create a workflow to protect you from yourself; to think about your strategies within the context of your emotions, to think about what actually works. It really gives you what to correct, what to map, and then obviously you have to put in all the work. It’s not a recipe book on how to solve your problems, but really a guide to help you get there. That’s one of the issues in general, right? You know things are there, but you don’t know what questions to ask about yourself, and that’s what this book and the workshops did for me. It helped me get to the questions and get to a framework for me to track those emotions and put them into priorities, then figure out what to do with them.

We are told that we have to trade like a robot, that we have to compartmentalize our emotions. There is a little bit of truth to that, but the reality is, you’re never gonna be a robot, because you are acting on emotions all the time. It’s how you understand what causes those emotions and how you progress through each phase of that which determines how successful you are going to be as a trader.

Human emotions are older than language, so there must be something there. There is another book that talks about the power of emotions called Trading from Your Gut by Curtis Faith that argues that professional traders can afford to occasionally listen to their gut feelings, because they have the experience to back it up.

I use the same argument regardless of trading; gut is really a consequence of your subconscious recognizing things that you’ve already experienced before. It’s not a random thing. This is something that I understood in my original line of work of building software for humans. A lot of times I would get into conversations with other engineers and designers that were saying, “My gut tells me this”, and I was like, “No, it is your experience”. And it’s really that—it’s your subconscious telling you something.

Img 3: A smiling Claudio at his workstation.

Do you believe your strategy you are trading now is unique to you, or do you think you could give your rules to someone and they could trade it just as well as you?

[He pauses]. Both, in a way. I think every strategy is very unique. I was arguing that with a few other experienced traders and they were like, “Give me a list of your most successful strategies”, and I said, “I can give you that, but that doesn’t mean it’s gonna be successful for you.” There are all these different variables in place of market context, the things that I’ve seen, the speed of the tapes that I’ve experienced, my own risk management; like how far I am willing to go, from stop losses to profit targets. Because trading is you constantly receiving all that information and making new decisions. I mean, you have to obey your plan, but you also have to protect your capital if the conditions change.

I do pitch a lot of what I’ve learned and what I’ve built, and I have mixed experience with both people understanding and people not understanding. I think it is fine, it is a matter of people having different speeds of learning, and different moments where that happens. But one thing I’m gonna do by the end of the month is take two of my close friends that have never traded ever, and I’m gonna teach them to trade in the way I trade today with Bookmap. Without any external noise of candlesticks, of market news, of macroeconomics. We just want to look at this information, at this pattern, and trade it with Bookmap. And that’s gonna be all.

Where I am today is obviously a consequence of experience, but I also think that where I am today is the easiest trading I’ve ever done, in terms of workflow and the parameters I’m looking at and so on. We tend to go into complicated paths and look through so many things until we get to what works for us and how we make things simple. In my head, this is very simple. Maybe it isn’t for other people. But that’s what I’m trying to do at the end of this month.

Is this something they’ve asked you to do, or is it your decision?

No, no. It’s my decision. They know about it, I’ve already talked with them. The only reason why it’s the end of this month is because I’m waiting for one of them to come back from vacation.

That’s exactly like the commodity trader’s bet that I mentioned before. It’s the modern version!

So it is, yeah! [He laughs]. Although I’m not doing a bet, I’m more curious.

I’m curious too. How long are you going to give them before you give up? If they are not profitable after 6 months, would you just say there is no hope?

I honestly don’t know. I hope it happens a lot faster than that. I think as traders we are given so much information and we don’t really know what to accept, what to trust, what actually works.

I wanna try the way I am doing now and see what happens. Maybe it fails, maybe it doesn’t work. I don’t have a set timeline. They are my neighbors, so it’s going to be something that’s done every single day, it’s gonna be very intensive.

Are you worried about the potential effects on your performance during this, or do you think it will actually be good for you to teach?

It’s always good, that’s always been the way I’ve learned the most. It really forces you to think through things in a different way, to simplify your own way of thinking, because you have to express things. It won’t affect my trading. I am mostly on the New York trading time, so for me it’s 6:30am Pacific to 1pm, so I still have the rest of the day and night.

Is there anything else you want to share regarding risk management?

One of the things that came with experience was the certainty that comes with knowing there are thousands of other trades waiting for you. You don’t have to keep pursuing this one and lose your mental capital on trying to make this one work. If it doesn’t work, if I feel my heart accelerating, if I have sweaty palms or whatever, for me it’s the wrong trade. I immediately close it. It doesn’t matter if it’s still going, for me it’s always better to regret not being in a trade than regret being in a trade. I would rather watch from the sidelines than be in the trade and lose money with it. If you think about it, most of these things that you do are related to FOMO, like, “Oh, I have to make this trade work. Second try, I have to make it work”. No, you don’t! There are thousands of other trades every day, multiple times a day. Maybe there isn’t that day anymore—there is the next day. The market is always there.

Of course it’s also dependent on whether you’re scalping, if you’re holding onto positions longer, are you looking for the right entry, all of this is connected. But again, I think it’s also—depending on the strategy—very much connected with FOMO. You have to make it work, or you have to be right. And sometimes it’s like, “You know what? Leave it behind.” Why am I gonna be spending mental capital on this when there will be hundreds of other trades waiting for me that might even be better setups, as well? Sometimes you just have to preserve your mental capital so you can be ready for the next one.

From what I’m hearing, you’re very mindful of your emotions, and you’re not greedy.

I am not now. [He laughs]. Not now.

Because of all the pain you experienced, right?

Because of all the pain, man. All the pain. [He smiles].

Sometimes I feel like trading is a spiritual endeavor. It’s not even about money anymore, it’s just about learning about your own emotions.

It really is. I tell my friends: “You really wanna know about yourself? Go trading.” You’re gonna be confronted with everything.