20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

February 8, 2024

SHARE

Heatmap in Trading: How To Learn What Market Depth Is Hiding

The heatmap is a way to determine where liquidity is in the market and how liquidity-providers are behaving. In other words, it helps traders to determine where the actual orders in the market are being made.

In this article, we explain what the Bookmap heatmap does and why it is useful to traders.

-

Price charts: is there a better method?

-

What is the heatmap?

-

Profitable trading with the heatmap

-

Market data visualization in the era of HFT and AI

Are you looking for a quick overview of the Bookmap heatmap in action? Watch this short video.

Watch a video summary of this article (with added examples).

Price charts: Is there a better method?

Since equity and futures markets first developed, most traders have relied upon price charts to understand the behavior and psychology of other traders and institutions. In the early days of trading, these price charts were made up of lines or bars. Since the late 1980s, they have been made up of “candles” that show an open, close, high, and low for the given time-period.

These types of charts are a tried-and-true method for understanding the market. They are certainly better than relying on gut feeling to make trades. But these methods were also developed during a time when computers were much less powerful than they are today and when many sources of market information were not available. This means there may be better ways of understanding the market today than have been available so far.

For example, before the 1980s, there was no publicly available information about limit orders. If you were a soybean trader before the 1980s, there was no way for you to know if a sell order for 1,000 contracts of soybeans had been made at $16 per bushel. Today, this information is available. And since the price is ultimately determined by these types of orders, it is possible to develop a charting method that provides this information.

This is what the heatmap does. It provides a better method of charting financial assets – better because it charts the actual determinants of price, the orders themselves, instead of their consequence.

What Is The Heatmap and Heat Map Stocks?

The heatmap is a visual representation of the limit orders put into the order book. On the right side of the vertical timeline is the current order book. On the left side of the vertical timeline is the position of the order book in the past. This information is recorded as a color-coded map – offering a great way to analyze heat map stocks, futures, etc.

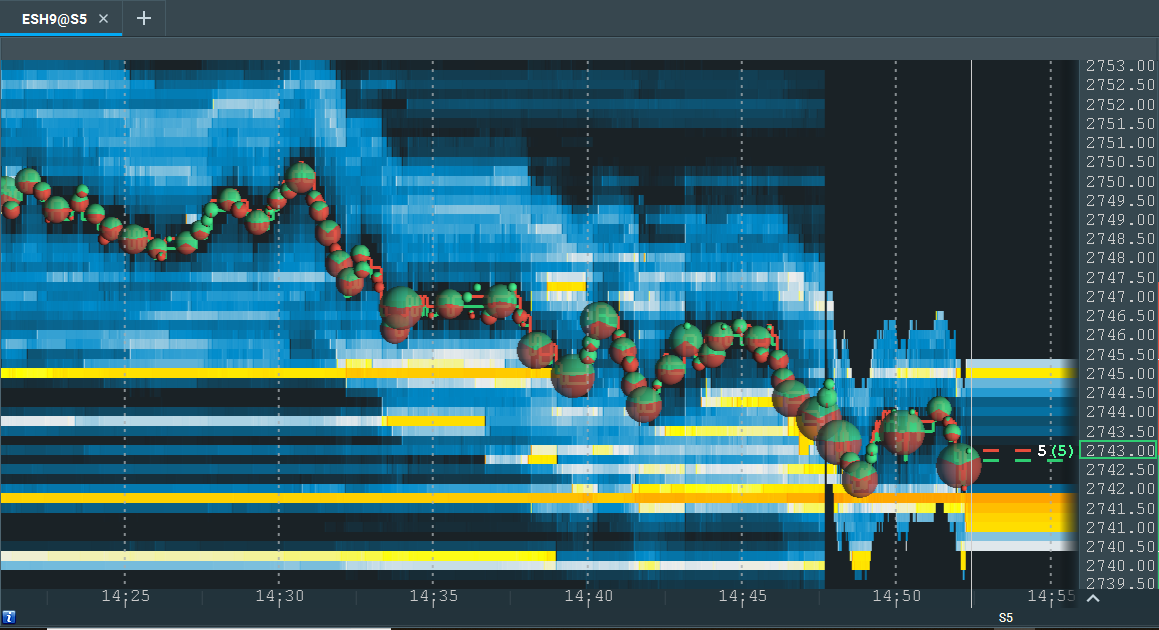

In this image, a large number of limit buy orders can be seen at 2741.50 (orange line). The red, dotted line is the “best ask” (lowest price limit sell order). The green, dotted line is the “best bid” (highest price limit buy order). When the best bid and ask first began to hit the area of high liquidity at 2741, they rose.

They are now testing the area again, and support can be seen at this level. There is also a large number of limit sell orders at 2745, as represented by the yellow line at that level. This implies that if the best bid and ask rise to 2745, resistance can be expected.

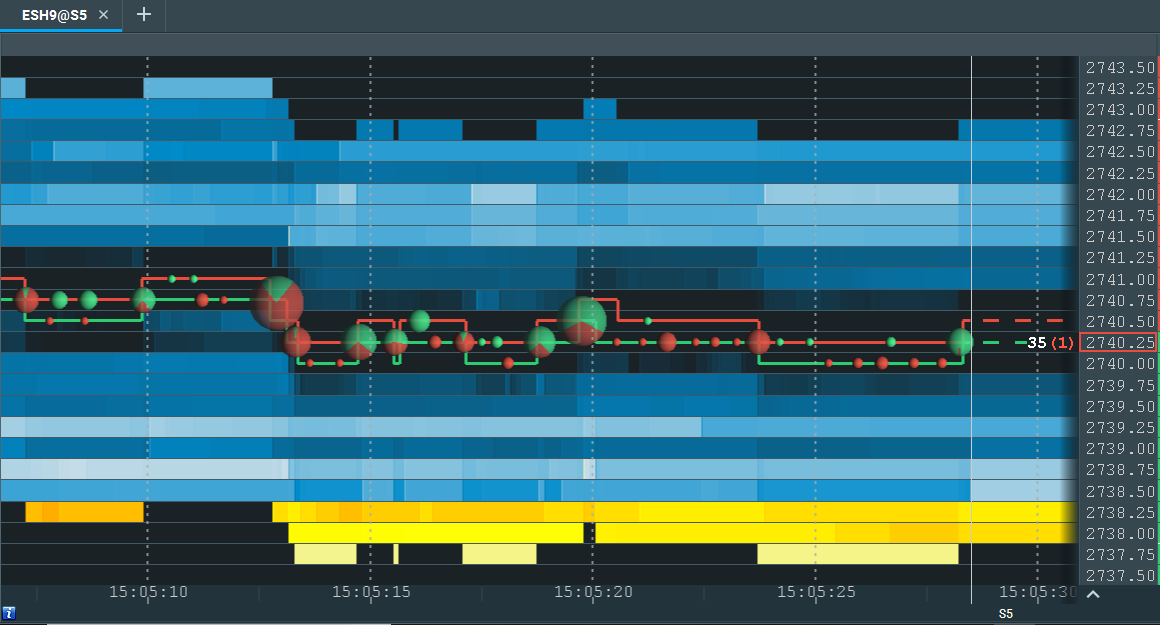

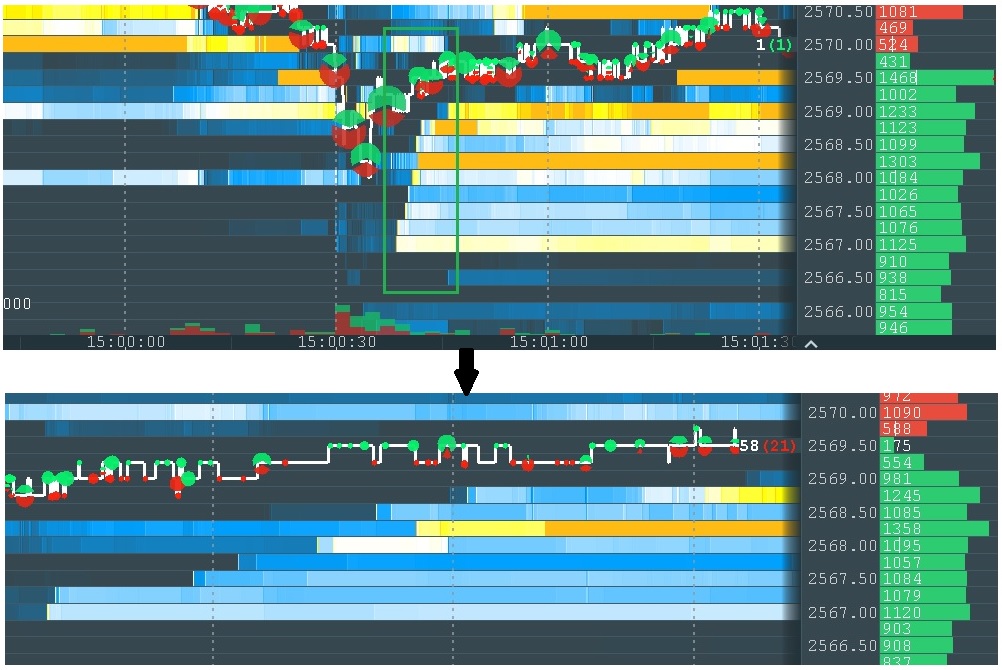

In Bookmap, there is no limitation on zoom. Traders can analyze the market on different time frames up to nanoseconds (although in practice it’s not necessary). Here is an example of a higher resolution view:

This provides a close-up shot of the best ask (red line) and best bid (green line). The price of the most recent transaction is indicated with a rectangle on the right side of the screen. In this case, the most recent transaction was a market sell order for $2740.25. This transaction occurred at the best bid (the highest price limit buy order).

The bubbles shown indicate the volume of market orders. A green bubble means there were significantly more market buys than market sells. A red bubble means the opposite (significantly more market sells than market buys). A bubble that is partially red or green indicates that the ratio between market sells and buys was more balanced.

Profitable Trading With The Heatmap

The heatmap is not a trading “system,” nor an indicator. It doesn’t tell you when to buy or sell. It simply provides accurate information about what market participants are doing. To the extent that inaccurate information leads to bad trades, Bookmap’s heatmap can allow you to eliminate this problem. This can lead to a more profitable trading business.

However, the heatmap does not interpret market data for you. In our educational materials, we provide theories as to what order book information “means” in one context or another. But ultimately, you must decide how to trade based on the information Bookmap gives you.

A good analogy for trading with Bookmap is real-time multiplayer games. If you play online poker, for example, you can choose to pay attention to other players’ behavior. You can pay attention to whether a player bets or folds in this or that circumstance. You may still misinterpret why the player is betting or folding, but at least you have more information than you would if you only paid attention to your own cards. The heatmap displays true and non-aggregated market depth data with a precision of up to the pixel resolution of your monitor. This allows you to see what the other players are doing. This should be better than not being able to see their actions.

Market Data Visualization in The Era of HFT and AI

High-frequency trading computers can execute round-trip trades within milliseconds. Artificial intelligence algorithms can detect patterns in vast amounts of market data. As human day traders, we do not want to compete against any of these powers.

So, what is the area in which a chart trader can still get a competitive advantage over machines? The answer is visualization. A quick proof of it is the existence of Captchas:

The reason captchas are being used is because of the human ability to spot complex patterns better than computer programs.

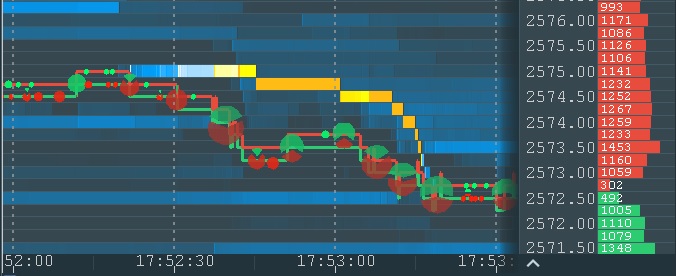

We can also observe a similar “proof” using Bookmap itself. Take a look at the image below. We can determine that it was generated by a single trader with a single glance, and we can see how it affects the price. Those who are familiar with computer science and machine learning understand how challenging it would be to detect this with a computer program in real time.

The typical “stairs” pattern

The pattern itself consists of just several order replacements, but this small snapshot of the chart contains many thousands of market data events. This is a noise that such a program must filter out. In addition, the program must deal with the noise generated by this trader himself in a form of different time intervals and order size during order modifications.

Large traders are usually more influential on the market than small traders. On one hand, they can use their weight to move the market in the desired direction. On the other hand, they have the challenge to execute or manage large orders due to liquidity constraints. Because of this, they try to keep their activity undetected – to mask the fact that this activity belongs to a single trader.

One of the techniques they use to obscure their activity is to split large orders into smaller orders and place them one by one. To make it even more difficult for other robots, they add “noise” in a form of non-equal sizes of smaller orders and non-equal time periods between them. This is an effective method against other robots, but the human eye can spot it with a glance, as shown below.

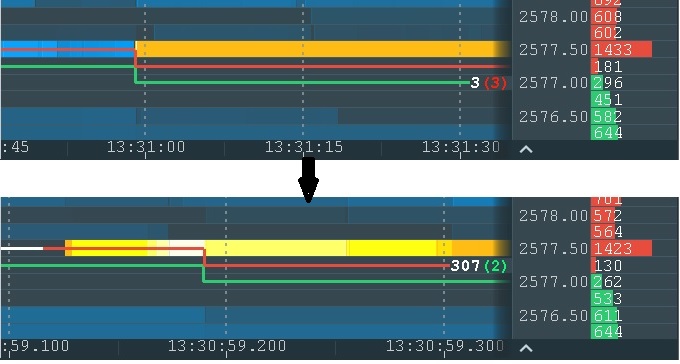

Notice the different time scale of the two charts

Here is another example which is even more complicated for computer vision but still easy for human sight:

This is unlikely to be a spontaneously created pattern by multiple traders

This is how the heatmap can be used in trading. By visualizing liquidity, the heatmap allows a trader to get the same information the robo-trading algorithms have access to, but with the added advantage of human sight and human understanding. Like any other tool in trading, this doesn’t guarantee success. But it does offer an excellent means of gaining an edge over other traders who do not have it.

FAQ

What is a trading heatmap?

A trading heatmap is a visual tool that displays where large buy and sell limit orders are placed in the market. It helps traders identify areas of support and resistance based on real-time liquidity data.

How does the Bookmap heatmap work?

The Bookmap heatmap visualizes market depth over time by showing real-time and historical limit orders in a color-coded format. Bright areas represent high liquidity, helping traders spot key price levels and market intent.

How is a heatmap better than a traditional candlestick chart?

Unlike candlestick charts, the heatmap shows the underlying liquidity that drives price movements, giving traders insight into true support and resistance levels instead of relying solely on past prices.

Can I use Bookmap’s heatmap for both stocks and futures trading?

Yes, Bookmap’s heatmap supports multiple asset classes, allowing traders to visualize and analyze liquidity for both stocks and futures markets in real time.