Ready to see the market clearly?

Sign up now and make smarter trades today

Education

February 16, 2024

SHARE

How to Trade the News

Over time, a developing news event can lead to sustained upward or downward trends in financial markets. During the 2008-09 global credit crisis, stock markets experienced a 50% drop over a period of just over 6 months, one of the sharpest drops in stock market history.

Even purely technical traders know the power of news, since they often avoid trading around certain events in anticipation of volatility. For a trader that really wants to open that world of untapped volatility, they need to learn how to trade the news.

Table of contents:

Why is News Important in Trading?

List of High Quality News Sources

Why is News Important in Trading?

Many market participants use the news to navigate their portfolio, some exclusively (such as fundamental traders). Since financial conditions heavily influence markets, it is important to become familiar with the different types of financial news.

It’s not just earnings reports or central bank statements that can impact market prices. Natural disasters, geopolitical instability, or rapid changes in the price of other correlated assets can all have an impact on the asset you are trading. That is why it is essential to keep up with the latest financial news in finance in order to assess trading conditions.

Types of Financial News

In general, there are two kinds of news: breaking or scheduled.

A scheduled news release includes things like statements from the Federal Reserve or Non-Farm Payrolls, which both occur once a month.

Breaking news can be something as simple as a CEO or government official making a comment about interest rates, or it can be more a more unpredictable event (sometimes called a ‘Black Swan’) such as a terrorist attack or a company filing for bankruptcy. Since breaking news usually has fewer sources by definition, extreme events sometimes turn out to be just rumors. But even rumors can have a large impact on markets, such as when it was reported Obama was injured in an explosion in the White House, causing the market to fall sharply until it was discovered the Tweet was fake.

Earnings Reports

How much money a public company is making or losing is an integral part ebb and flow of the stock market. If trading individual stocks, a trading plan should be in place before earnings reports, since the price of an individual stock can soar or plummet within minutes after releasing numbers that impress or disappoint.

For example, you might have a significant short position in a stock, and when its results exceed expectations, it skyrockets 40%. If you have a long-term trading time horizon, you may be able to weather such a move. But if not, you should always respect your stop loss.

Announcements by central banks and interest rates

The Federal Reserve is often dubbed “the Central Bank of The World”, and changes to its monetary policy can impact global markets—from the credit markets to foreign exchange.

The Federal Open Market Committee of the Federal Reserve changed the federal funds rate target in February 1994. To ensure the markets were effectively apprised of this crucial policy decision, the FOMC made it public. The practice of forward guidance has since been adopted by other central banks around the world, making such announcements highly watched events.

Laws and regulations

Despite the widely held belief that cryptocurrencies operate beyond the scope of national legislation, its price, volume of transactions, and user base all respond to news regarding regulatory changes. Depending on what category of regulation the news relates to, the impact varies: broad bans on cryptocurrencies or updates to taxation rules for cryptocurrencies have the most significant impact.

New technology is often at the forefront of changes in the law, but regulations can affect all industries. For example, environmental policies can impact long-standing and huge industries such as the oil industry.

Economic calendar

Market-moving events such as monetary policy decisions or economic data are known ahead of time and highlighted based on importance on most economic calendars.

Since such events are scheduled months in advance, the real impact of the market comes down to the finer details of the release, such as the whether or not the data missed exceptions, or the hawkish or dovish tone of a central bank chair.

Some newer traders can’t wrap their heads around how markets can sometimes fall on good news and rise on bad news. But this is simply due to expectations and market positioning around events, where traders sometimes take profits after buying into expected good news. This is where the old adage “buy the rumor, sell the fact” comes from.

Breaking news

Breaking news can be anything from rising geopolitical tensions to Elon Musk’s latest Tweet, the shared characteristic being the information is new to market participants.

Since breaking news is to varying degrees unexpected, it can lead to large and violent price fluctuations and market players try to digest the importance of these latest instalments—or lack thereof. Often, breaking news can lead to knee-jerk price reactions that correct with time.

List of High Quality News Sources

The quality of the news sources can be just as important as speed. Here are some of the best sources.

Economic calendars

Economy calendars list upcoming events by time and date, with color-coding to indicate the expected importance of the event. Traders can also go back and look at previous releases and see related data and news article.

Here are a list of some of the best economic calendars:

Traditional Outlets

The big names usually don’t have breaking news unless you pay big bucks, but they can be a good place to read general stories, market analysis, and gauge overall sentiment.

Here are the biggest and most trusted traditional outlets:

In the age of the internet, sometimes news can be spread via untraditional sources quicker than traditional. But even the big names have Twitter handles, often posting stories there before on their main websites, making Twitter a sort of news bulletin source, perfect for day traders.

Here are a few of the best Twitter accounts for live news:

https://twitter.com/Stocktwits

https://twitter.com/WSJmarkets

APIs

News scraping APIs scour text all over the internet looking for keywords. If you are a little tech-savvy, a news API might be an effective way to gather your trading insights.

The Order Flow of News

Some traders avoid news events due to the increased volatility, whereas others activity seek out events and exclusively trade the news. Either way, most technical and order flow traders believe that all fundamentals will be “baked” into the price and its behaviors.

Looking at the order flow on the heatmap during an event can lead to extra insights.

Fig 1: UK CPI affects the GBP futures contract, the liquidity pulling and a lack of transaction occuring just before the release, and then large buyers entering and triggered a stop run after the release.

If a data point is released as expected and leads to buying or selling absorption, it can be a potential entry signal.

The volume bubbles will also show the activity of aggressive market participants, informing you if traders want to buy or sell after learning about the data.

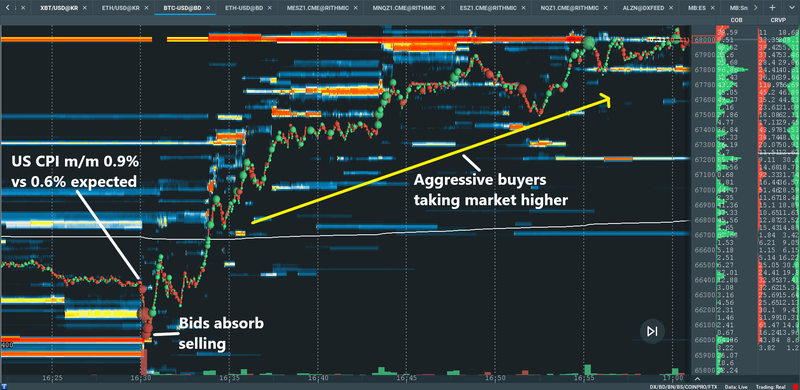

Fig 2: BTCUSD reacts to US inflation data, dropping hard into some bids which absorb the aggressive sellers, then leading to aggressive buyers taking the market higher.

Conclusion

Whether breaking news or a scheduled event, the impact will always be visible in the order book. Bookmap’s heatmap will show you exactly how those behaved coming into, during, and after a news event.

You can try it out for free today. Click here to get started.