Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 5, 2024

SHARE

Investing in Tomorrow: A Guide to Emerging Market Opportunities

Ever wondered how value investing works? It’s about putting your money in

fast-growing economies that offer good opportunities. In this article, we’ll

check out some up-and-coming markets that could be a goldmine for investors.

We’ll understand why they’re attractive to investors and the factors that

influence their growth.

Also, we will uncover the histories of key financial hubs, such as Brazil’s

B3, India’s National Stock Exchange, and the evolving markets of China.

Finally, we’ll guide you through a step-by-step approach to entering

emerging markets. Let’s get started.

What are Emerging Markets?

Emerging markets refer to economies that:

-

Are in the process of rapid industrialization and

-

Experience higher-than-average growth rates

Let’s see some common classification criteria:

-

GDP Growth:

-

Emerging markets typically exhibit a higher rate of economic

growth compared to developed countries. -

This growth is often fueled by industrialization, urbanization,

and technological advancements.

-

-

Market Accessibility:

-

Foreign investors can access and participate in these markets

with ease. -

Emerging markets often have fewer restrictions and barriers to

entry than more mature economies.

-

-

Economic Development:

-

While not as advanced as developed nations, emerging markets

show signs of progress in:-

Infrastructure

-

Education, and

-

Overall economic diversification

-

-

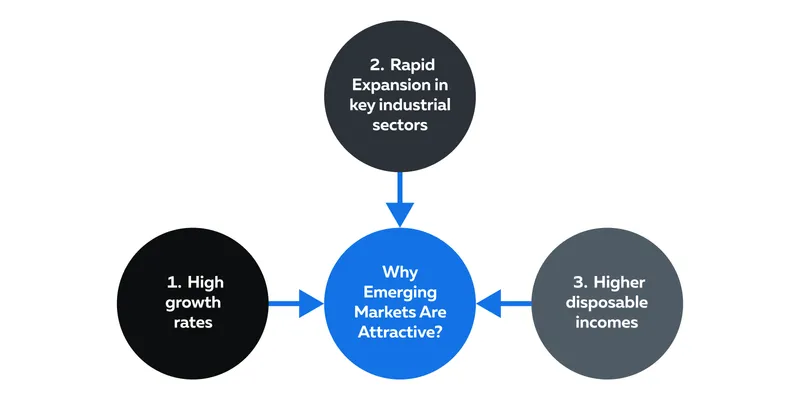

Why are Emerging Markets Considered Attractive Investment Destinations?

Emerging markets have historically demonstrated robust growth rates and

present attractive opportunities for investors seeking high returns. This

growth is fueled by factors such as:

-

A youthful demographic

-

Increased productivity, and

-

Capital investment.

Furthermore, investors are drawn to emerging markets due to the presence of

industries and rapid expansion in sectors like technology, renewable energy,

and healthcare. The emerging markets also witness the rise of the middle

class. As disposable incomes increase, consumer demand rises, creating

opportunities for businesses to thrive. This demographic shift contributes

to sustained economic growth.

Which Factors Influence Emerging Markets?

Emerging markets can be influenced by both micro and macro-economic factors.

Understand them through the table below:

|

Macroeconomic Factors |

Microeconomic Factors |

|

Political Changes

|

Infrastructure Development

|

|

Foreign Investment Policies

|

Regulatory Environment

|

|

Commodity Prices

|

Labor Market Conditions

|

Exploring The 3 Key Emerging Markets

Currently, investors recognize Brazil, India, and China as key financial

hubs and emerging markets. Let’s explore their sectoral growth trends, the

opportunities, and the challenges that define these dynamic economies.

The B3 – Brazil’s Beacon for Investors

The Backdrop – History & Role

-

B3, formerly known as BM&FBOVESPA, is Brazil’s main stock

exchange and financial market. -

Its history dates back to 2008 when two of Brazil’s major exchanges

merged:-

The São Paulo Stock Exchange (Bovespa) and

-

The Brazilian Mercantile and Futures Exchange (BM&F) in

2008.

-

-

The consolidation created a more comprehensive and efficient

platform for trading financial instruments. -

B3 plays a pivotal role as a financial hub for Latin America,

serving as a key player in regional capital markets. -

It provides a platform for companies to:

-

Raise capital

-

Facilitate trading in various financial instruments, and

-

Contributes significantly to the development of the Brazilian

and regional economies.

-

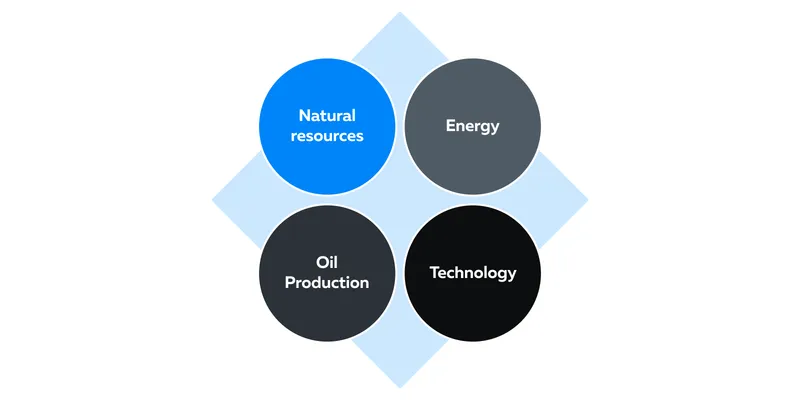

Trading on B3 – Securities & Sectors

B3 accommodates a diverse range of financial instruments, including stocks,

bonds, and derivatives. Notably, it is renowned for listing companies in

sectors like natural resources and energy. Brazilian multinational

corporations in these sectors often find a home on B3, providing investors

with opportunities for portfolio diversification. Let’s see some standout

sectors:

The natural resources and energy sectors are standout performers on B3.

Brazil’s abundant natural resources, coupled with advancements in

technology, make these sectors attractive for investment. The country’s

energy industry, driven by renewable sources and oil production, continues

to show substantial potential.

The Investor Landscape

-

B3 attracts a mix of domestic and international investors.

-

Institutional investors, including pension funds and asset

management firms, are significant participants. -

Global investors also seek exposure to Brazil’s economic growth and

diverse investment opportunities.

The Regulatory Environment and Barriers

The regulatory environment in Brazil has evolved. It now encourages

investment while maintaining market integrity. However, foreign investors

must be aware of taxation policies and foreign exchange controls.

Navigating the National Stock Exchange of India

The Backdrop – History & Role

-

The National Stock Exchange of India (NSE) has played a

transformative role in the Indian financial landscape since its

establishment in 1992. -

It was founded as a response to the need for a modern and

transparent stock exchange. -

NSE introduced electronic trading, replacing the traditional open

outcry system. This revolution helped in:-

Reducing transaction times

-

Minimizing errors

-

Enhancing overall market accessibility.

-

-

The introduction of the Nifty index, comprising 50 of the most

liquid stocks, has become a benchmark for the Indian equity market.

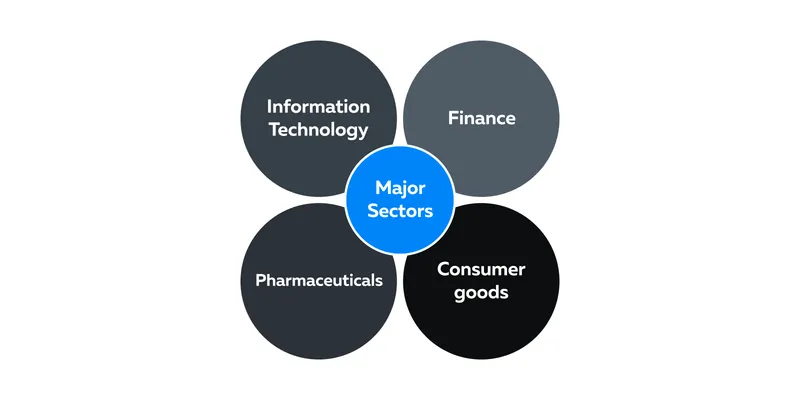

The Index Composition and Major Sectors:

The Nifty 50 index is a key barometer of the Indian equity market and

represents various sectors. See them below:

Product Diversity

-

The NSE offers a wide range of financial products.

-

In addition to equities, the exchange provides a platform for:

-

Trading derivatives, including futures and options

-

Debt securities, including government bonds and corporate bonds

-

Key Macroeconomic Drivers

The NSE has been influenced by India’s rapid digitalization. Increased

internet penetration and the growth of online trading platforms have

democratized market access, attracting a broader investor base.

Additionally,

-

Stricter compliance standards and governance norms have contributed

to increased investor confidence and transparency. -

There is a growing focus on sectors such as technology, consumer

goods, and healthcare to meet the evolving demands of the Indian

consumer.

Investing in China’s Evolving Markets

The Backdrop – History and Role

China’s remarkable economic ascent has significantly altered global

investment patterns. The country’s rapid industrialization, infrastructure

development, and technological advancements have positioned it as a major

player in the global economy. China’s growth has attracted international

investors seeking opportunities in one of the world’s largest and most

dynamically evolving markets.

The Regulatory Framework and Market Access Initiatives

China has taken steps to open its capital markets to foreign investors with

initiatives like Stock Connect. This program allows international investors to trade shares listed on the

Shanghai and Shenzhen stock exchanges. Also, the Chinese government has

implemented reforms to enhance market transparency and protect investor

rights.

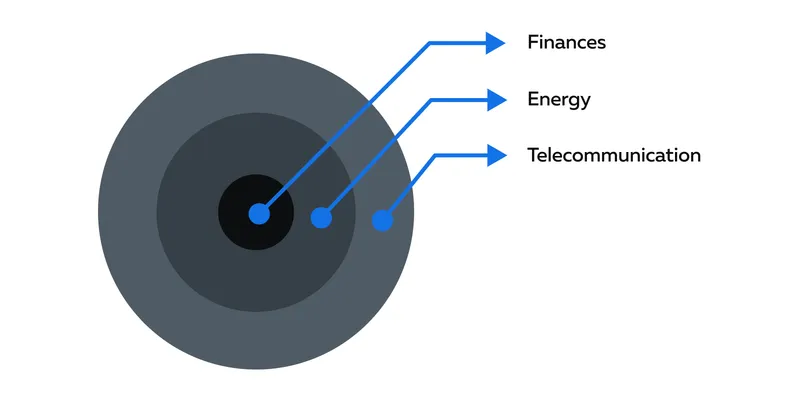

Role of State-Owned Enterprises (SOEs) and Sectoral Growth Trends

State-owned enterprises play a significant role in China’s stock markets,

particularly in strategic sectors like:

Understanding the influence and performance of these entities is essential

for investors, as government policies can impact their operations and market

dynamics.

Further, it must be noted that China’s stock markets reflect the country’s

economic priorities. Sectors such as technology, e-commerce, renewable

energy, and healthcare have experienced rapid growth. Investors keen on

China’s evolving markets often focus on these sectors.

Impact of International Tensions on Market Performance

Let’s explore some of the major impacts and strategies to handle them

through the table below:

|

What are some major impacts? |

What is the meaning? |

How can global investors protect themselves? |

|

Geopolitical Considerations |

Trade disputes and geopolitical events cause market |

|

|

Sensitivity to International Factors |

China’s markets are highly sensitive to international |

|

Risks and Rewards in Emerging Markets

Emerging markets present a paradoxical landscape for investors. These

financial hubs offer substantial opportunities alongside inherent risks.

Let’s understand some common risks:

-

Emerging markets are susceptible to currency fluctuations. The

exchange rate volatility impacts the returns of foreign investors,

as changes in currency values can either:-

Amplify gains or

-

Exacerbate losses

-

-

Governance challenges, including corruption, inconsistent regulatory

frameworks, and political instability, are prevalent in some

emerging markets. -

Emerging markets exhibit thinner trading volumes and less developed

financial markets can create liquidity risks.

How to Approach Risks with Risk Management Tactics

Let’s understand some of the best tactics below:

-

Perform Due Diligence:

-

The investors must perform a thorough due diligence. This

includes a comprehensive assessment of the following:-

Regulatory environment

-

Political stability, and

-

The financial health of companies.

-

-

-

Practice Diversification:

-

The investors should spread investments across different:

-

Asset classes

-

Industries

-

Geographic regions

-

-

-

Employ Hedging Strategies:

-

Investors should implement hedging strategies to manage currency

risk. -

Instruments like currency futures or options can be used to

offset potential losses arising from adverse exchange rate

movements.

-

A Cautionary Note

Despite the allure of high returns in emerging markets, it’s vital to

recognize the flip side. Economic downturns, political instability, or

global shocks can have severe repercussions on these markets. Investors

should brace themselves for the possibility of significant losses and have

contingency plans in place.

How to Approach Emerging Market Investments

To minimize losses and formulate the best trading strategies, the investors

must be aware of how to approach emerging market investments. Let’s

understand through a step-by-step approach:

Step 1: Do Thorough Research:

Country Analysis: Begin with an in-depth analysis of the target country’s

economic, political, and regulatory environment. Evaluate the following

factors:

-

GDP growth

-

Inflation rates, and

-

Political stability

Sector Analysis: Identify sectors showing growth potential and consider:

-

Demographics

-

Technological advancements, and

-

Evolving consumer behavior.

Step 2: Perform Risk Assessment:

-

Political and Regulatory Assessment:

-

Assess the political stability and regulatory framework.

-

Evaluate the potential impact of government policies on your

investments.

-

-

Currency and Exchange Rate Risks:

-

Understand the currency dynamics and potential risks associated

with exchange rate fluctuations.

-

Step 3: Due Diligence on Investments:

Company Analysis:

-

Conduct thorough due diligence on specific companies or assets.

-

The investors must scrutinize:

-

Financial health

-

Governance practices

-

Competitive positioning

-

Legal and Regulatory Compliance:

-

Ensure investments comply with local regulations.

-

Understand legal obligations and potential risks associated with

regulatory changes.

Step 4: Select Investment Vehicles and Market Analysis Tools

ETFs and Mutual Funds:

-

Prefer utilizing exchange-traded funds (ETFs) and mutual funds.

-

These investment assets provide exposure to a basket of assets in

the target market. -

Through this selection, investors can manage risk via

diversification.

Bookmap and Other Analytical Tools:

-

Use advanced market analysis tools like Bookmap for real-time market

data and analysis. -

Such tools aid in understanding market liquidity and identifying

potential entry and exit points.

Step 5: Manage Risk:

Implement Hedging Strategies: Mitigate potential losses due to adverse

market movements by implementing hedging strategies, such as currency

hedging.

Continuous Monitoring:

-

Stay informed about:

-

Macroeconomic trends

-

Geopolitical developments, and

-

Changes in the regulatory landscape.

-

-

Always adjust your strategy based on evolving market conditions.

Conclusion

Emerging markets are an attractive destination for global investors. These

financial hubs present valuable opportunities for diversifying investment

portfolios and offer the potential for high returns.

Yet, caution is paramount, given inherent risks such as currency

fluctuations, thin trading volumes, and governance concerns. To navigate

these waters successfully, investors should adopt a long-term perspective,

embrace diversification, and engage in vigilant, ongoing monitoring.

Also, the usage of modern market analysis tools like Bookmap can help in

real-time visualization of market data that offers a competitive edge.

Looking to bring clarity to the complex landscape of emerging markets? With

Bookmap’s advanced visualization tools, gain unprecedented insights into the

global markets and harness the growth potential of Brazil, India, and China.

Sign up now and explore a world of opportunities.