Ready to see the market clearly?

Sign up now and make smarter trades today

Interviews

December 8, 2024

SHARE

Investment Banker Turned Mindset Coach: Trading Words of Wisdom From Christoph Wahlen of PRO Coaching

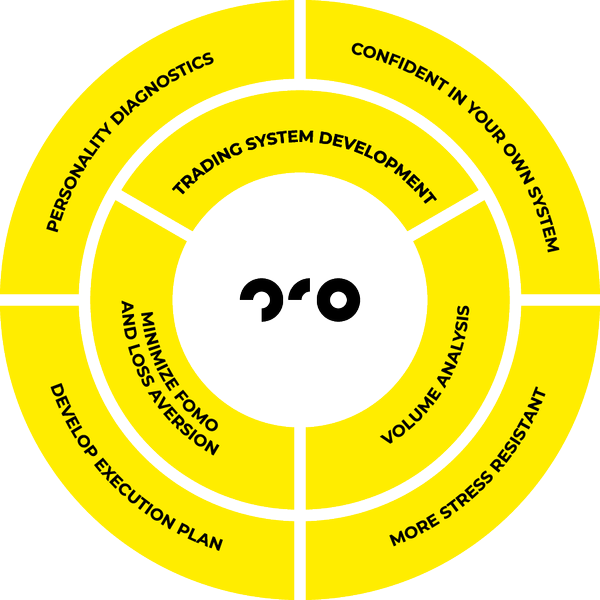

“A good trader is a trader that knows both the market and himself,” says Christoph Wahlen. He has been using his unique SECOR test to measure and match personality with a trading style, as well as helping his clients develop their own style.

This article is based on a conversation with Christoph Wahlen. Conducted and edited by Owain Higham.

You used to work in an investment bank, is that right?

Well, that was a long time ago. That was before I studied and did my MBA, but yes, I worked in a European investment bank, that’s right. That was an interesting place to work in. Back in the day, it was way different. It was very early to use excel and plot charts out of excel, so you see how long ago that is! Yes, we did have some Bloomberg terminals for the traders, but we didn’t have Rithmic or dxFeed for retail traders. Nobody had the experience of professional data for a reasonable price.

So that’s where I started, then I went to IT where I met some people who brought me to Bookmap. They brought me to MBO data, market structure, and all the things you can plot on a subchart.

So what do you do now?

I’m a trader myself—I mostly trade stocks and futures, some crypto—and I’m a trading educator. I’m actually a mindset coach who probably knows more about trading than 90 to 95 percent of the usual trading coaches. Most of them copy me. For instance, 3 German coaches adopted Bookmap after I put it on my website.

It’s my intention to bring my ‘trader mindset’ test, which is called the SECOR test, to the broader English market. It’s currently only available in German, but it’s specially designed for all traders. It looks at personality factors relevant for traders, and nobody else in the world has that.

I use it for my sales funnel, which is actually a waste, because it’s a treasure, honestly. Not many people use it. You have to take trading really seriously to value this thing, it is not designed for get-rich-quick people. But for me, in German, it works. It is really scientific and state of the art.

What’s the biggest technological change you’ve seen since those days in investment banking?

I have some people that I coach that have some money, and when I say ‘some money’, I mean below 100 million euros. It’s not like 5 billion, but it’s a lot. Even those “small” investors, if they know what trading is all about, they know that Bookmap is the new way of looking at things.

This new perspective was brought to me by Bookmap, giving me another technical view into the markets. The major point of Bookmap for me and my clients is seeing what drives the market, the clues provided by Bookmap and the subchart addons that allow you to build your new trading system around that information. That is what changed. Even my guys in investment banking, the guys from the trading floor, yes they used Bloomberg terminals, but to be very honest, I have no idea if they really used deep level data like MBO. It was 30 years ago, so I have my doubts they used it, and that it even existed at that time.

I assume you must be very confident in your ability to explain mindset concepts. How did you get started with it?

If you put my CV next to Tony Robbins’, they would probably match by 95%. We had the same teachers. I was more on the professional side, and he was more into teaching. We learned about things like endurance, but he was more focused on end-users. I have more people that work in business and want to work in another business, a business which is highly competitive, where you have to leap out of your comfort zone.

Obviously it always starts with a crisis, in terms of giving too much and receiving too little. To be very honest, I was not in touch with myself, I was just repeating things, and the crisis got started. That journey is still on. I mean, you do know trading systems and you do know what to do, but at that time, I couldn’t stick to it, I couldn’t stick to my own plan. Or I couldn’t see the picture clearly. Let’s say it’s a downward trend and you always look for the way up, even if technically or fundamentally it’s going down, it has to go down—not ‘buy the dip’, but ‘sell the rally’. The point is, I didn’t see things clearly, and trading like that can cost you a lot of money.

Or I traded the wrong instrument. This was before CFDs (Contract for Differences). The instruments were totally unfair. You buy securities from them, but you are not trading the actual market. It was horrifying, even when I won. Let’s say you came from 7,800 on the DAX, making a long trade with a target at 8,000. On every other data platform on this day the DAX reached 8,002, but they still say, “No, you missed 8,000”, because they raised the spread from say, 50 euro cents, to 5 euros, and you didn’t hit your target.

The wrong instruments, the wrong mindset, the wrong data, not the right picture, borrowing a lot of money. Then I tried footprint charts, but that is just market orders, which wasn’t enough. Then I met my old friend from IBM and he said, “Okay, you have to look into the heatmap and you have to look into Bookmap”.

So that’s where it all came from, it was crisis-based. You need endurance to keep on going. You fail, then you get back up, you fail, then you get back up.

One of my majors in my MBA was not finance but marketing, and in marketing you come from consumer behavior, and before that, attitudes; towards risk, towards conscientiousness, and that kind of thing. So that’s where I came from. What personality factor brings you to buy Hershey’s, to buy Vauxhall, or to go to Barclays instead of any other British bank. So, that idea was developed further and put into an assessment tool, customized for traders.

It is sometimes said that as long as you have an edge, the main thing is that it has to fit your personality. How important is it for your strategy to fit your personality, and how do you know if it fits your personality?

I would say I am the only one that can be the end-to-end solution to it, because on the scientific side, my SECOR test measures personality factors, and on the other side, I can match their personality with a trading style. Or I can help my clients to develop their own trading style. That’s a longer path, but it’s worth it. My idea of mapping strategy with personality was cloned by a lot of trading coaches. Unfortunately, they don’t have the diagnostic tools I have.

Some of my clients who worked with me for a long time entered the World Cup Trading Championships, and 3 people won or got at least fifth place. So it’s working!

Can you give us a sneak peek of what’s in the quiz, an example of the kind of questions?

Sure. In the SECOR test, every letter is a symbol for the factor I am looking for. In SECOR: ‘S’ is for ‘Stress resilience’, E is for ‘Emotional lability’ (changes in mood). The ‘C’ stands for ‘Conscientiousness’, that’s one of the big five.

The ‘O’ is ‘Overconfidence’. There are two factors in overconfidence: one is your ability to estimate your own level of knowledge, and that’s a question like “How tall are The Himalayas?”, or “When was Margaret Thatcher born?”, and you have to give me a range. You have to be 95% sure, not 100% sure. You don’t have to look it up, it won’t help you if you look it up. Just give me a time span where you are pretty sure you are right.

The last letter is an ‘R’, which is ‘Risk’. We test if you are risk averse or love risk. Since this is a scientific test, we won’t just ask if you’re risk averse or love risk—you are never asked directly, you are always asked indirectly.

We also test if you go with the crowd or go your own way. If you do the test, you could say: “My personality is good for being a contrarian.”

Christoph expains that “the term ‘Emotional lability’ is another word for ‘neuroticism’, and is one of two factors I took from the ‘Big 5’ Inventory test, adapting it to SECOR. Two out of six personality factors I used for SECOR are taken from the 5-factor model of personality.”

What would you say the prototype of a good trader is?

The prototype of a good trader is a trader that knows both the market and himself. Not being, statistically speaking, below average and overconfident, where there is a good match between the level you think you are at, and the level others think you are at. You have to know yourself. So a good trader that is becoming more professional and taking good risks is knowing yourself, knowing the market, and having the best trading strategy for your personality type. There are not many in the world that can match that definition.

He has a good match between his personality and his trading style. I think it’s very professional to find out what your personality type is, then we can develop a strategy around your personality type. Yes, we could make you more resilient. We could find a balance between being too risky or overly risk averse to get you towards the mean. But still, if you have a tendency for a specific type of trading, it might be better for one trader to be a contrarian, and another trader to be more of a trend follower.

I used to think that people that are hungry for risk would make better traders, but now I realize it’s not that simple.

Yes, it’s not that simple.

What tips do you give to people who want to improve their trading? Do you recommend journaling, for example?

Journaling is a good idea, definitely. It is a good start for a journey.

What should you be journaling about, your emotions or your trades?

Your emotions on your trades. [He laughs]. Then you could see, for example, that you should not trade if you are too emotional in both directions. That being, not to be on cocaine, thinking: “I can do anything”, and not to be depressed saying, “I wanna kill myself”. If you are at either side of these extremities—don’t do it.

Even if you are a big player with 100 million and deep pockets, you can’t compete with the guys that have 10 billion or more. Even if you’re big with deep pockets, you can’t match with the other guys, so you’re just a pike, you’re not a whale. You cannot move the market, and even if you could for one second, they will still eat you up. So go with the flow, not against it.

I have a few clients, who I would say are wealthy clients, or at least people in upper management who want to trade, and want to do it professionally. It’s not like the 18 to 25-year-old male that wants to buy a Lamborghini, that wants to get rich quick. It’s more about people that want to know what they have to work on, in terms of mindset and data. They want a plan they can stick to.

Even if you’re rich and work as, let’s say, a big lawyer or consultant making thousands a day, you still cannot move the market. So be humble. Let’s say you’re working in a company with a thousand or so people and you are used to getting your way—it’s not the same in the market, you’re not getting your way in the market. That’s why I say know yourself and know the market as it is, as it is, as it is! Maybe you can manipulate a thousand people in your own company, but you cannot manipulate the market.

Christoph Wahlen’s coaching website: https://pro-coaching.de/

What kind of personality should be consuming as much as analysis and talking to as many traders as possible, versus ignoring all the information and just listening to themselves? Some traders—if they hear somebody going the other way—they just dump their trade. But other traders actually need that information and they use it as a signal.

Yeah, that’s a good question. Thank you for that question. There is no easy answer to that. [He pauses to think]. The problem is, if you hear 100 people, you get 100 different opinions. The people I work with, they usually stop listening to all the noise. My idea of a top trader with an ideal personality is one which can rely on himself.

It also depends on the timeframe you are trading.

Would they still consume the information just to know what the market is doing, or would they ignore everything?

I would still do it, but at more of a distance, so that you’re detached. If another trader is saying something, you can think: “Probably he is saying that because of his trading style.” Is it the truth? If I was working with a client, I would bring them to be more detached and to see if the situation right now fits their trading style. Being detached is key.

You have to be more self-aware. You have to know yourself. If you are not able to evaluate the situation yourself, the trade is already against you. Then risk management is everything. Know yourself, and know the market. That is, know your craft. It could be tennis as well, right? Play the things you know you can play well, know when it’s good to invest, and be able to stay out of the market when you don’t have an edge.

I will tell you one thing; if you don’t work on yourself, you will repeat your failures all over again, either until you resolve your personal issues, or you go bankrupt.

Most traders go through cycles, patterns of behavior. How can you better know that the pattern is happening?

[He pauses to think.] Yeah, if you don’t wanna invest in coaching, then the prerequisite to that is journaling. Something I really ask my clients to do is journaling. When do you tilt? When you get into a bad cycle? What’s your trigger? Then we have to work on that particular trigger. It is hard to work on your blind spot yourself, I might add.

Traders are known for overestimating their abilities. What about in terms of the markets, do you think traders tend to overestimate how big of a move is going to happen, or do they underestimate how big the risk of an outsized move is?

[He pauses to think.] I would say the first, they tend to overestimate. They also overestimate their knowledge. So I do think you have to have that experience that comes from 10,000 hours of screen time. And you have to watch the correlated markets too—it’s not just your product or your equity, it’s about the correlated stuff as well, and where they are in terms of context. 10,000 hours of screen time, and context, context, context.

It’s not about money. The money comes second. It’s about knowing yourself and knowing how the market works. It’s a funny thing, but money is windfall profit. Excel in yourself, then the money comes as a windfall. I know, because that’s one of the oddest things I have to work on with my clients.