Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 12, 2025

SHARE

Is De-Dollarization a Real Threat or Just Talk? What Traders Need to Know

The world has started trading oil in a different currency! Do you know where the winds of change are blowing? De-dollarization is real! It is a move to reduce dependence on the US dollar in trade and finance. This trend is driven by BRICS initiatives, growing CNY adoption, and sanctions backlash. Want to learn how this impacts you as a trader?

In this article, you will learn why the US dollar has remained dominant for so long and what’s fueling the de-dollarization debate in 2025. Also, we will explain how this shift impacts stocks, futures, and crypto markets. Lastly, you will understand how to track these changes in real time using leading market analysis tools like our platform, Bookmap. So, do you want to identify market risks and opportunities precisely? Read till the end to position yourself strategically!

What Is De-Dollarization, and Why Does It Matter?

De-dollarization refers to reduced dependence on the US dollar for:

- International trade,

- Finance, and

- Reserves.

Historically, the US dollar has held the position of the reserve currency status, which means it is the most widely used currency in global trade and central bank reserves. However, currently, there are growing concerns over:

- US economic policies,

- Sanctions, and

- Geopolitical tensions.

These factors have pushed many nations to explore alternatives.

For example,

- BRICS countries (Brazil, Russia, India, China, and South Africa) have been actively discussing the possibility of creating a BRICS currency.

- This currency will be used to trade within their bloc (bypassing the dollar).

Why De-Dollarization Matters for Traders?

Please note that de-dollarization is not just a political or economic shift! It has direct implications for financial markets. Let’s see how it impacts you as a trader:

| Increased FX Market Volatility | Developing a New Way to Price Commodities | Reallocation of Global Capital |

|

|

|

What Can be the Trading Implications Across Asset Classes?

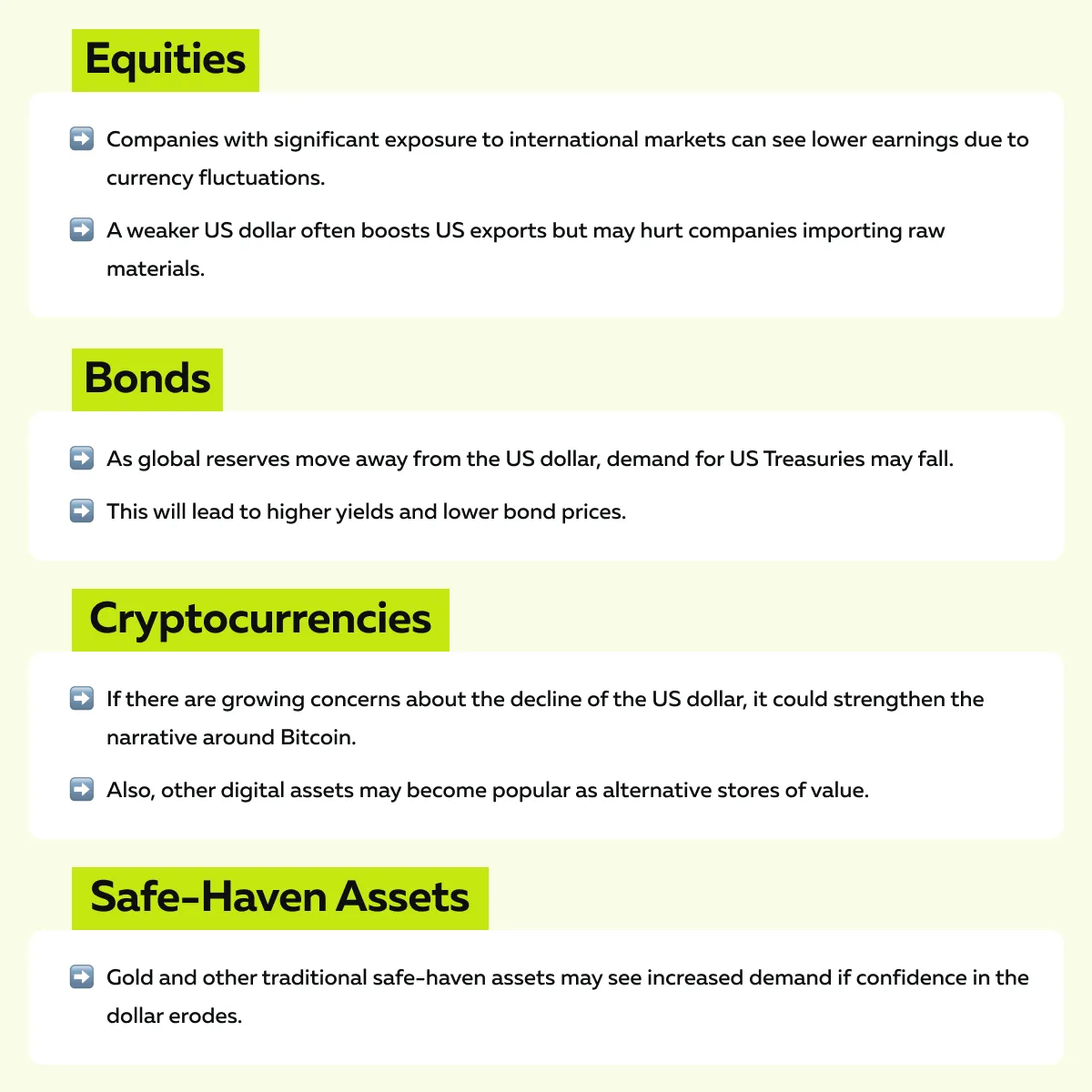

De-dollarization can affect multiple asset classes, creating opportunities and risks for traders. Let’s see how through the graphic below:

Why the US Dollar Has Been the Dominant Global Currency?

The US dollar (USD) has been the world’s dominant global currency for decades. This dominance is not accidental! It is driven by several critical factors that make the US dollar the preferred choice for trade, investment, and reserves worldwide.

Let’s check them out:

1. USD-Denominated Global Trade

A large portion of global trade is conducted in US dollars, especially for commodities such as:

- Oil,

- Natural gas, and

- Metals.

Since the 1970s, oil-exporting countries have agreed to price and settle oil transactions in USD (a system known as the petrodollar system). As a result, countries trading in energy and raw materials must use US dollars, which creates a constant demand for them.

2. Trust in the Federal Reserve and the US Treasury

The Federal Reserve and the US Treasury are considered highly credible and stable institutions. Check out the graphic below to learn about their unique roles:

This trust encourages global investors to hold and transact in US dollars (even during uncertain times). As a result, when economic uncertainty rises, investors and central banks prefer holding dollars as safe-haven assets because of the perceived stability of US institutions.

3. Deep and Liquid US Treasury Markets

The US Treasury market is one of the world’s most liquid and deep financial markets. US Treasury bonds can be easily bought or sold in large volumes without significantly impacting prices. That’s why they are preferred by:

- Foreign governments,

- Central banks, and

- Institutional investors.

Since US Treasury securities are denominated in USD, global investors naturally accumulate and hold dollars to participate in these markets. Strong liquidity further strengthens the dollar’s reserve currency status.

4. Global Debt Denominated in USD

A significant portion of global debt (particularly debt issued by emerging market countries and corporations) is denominated in US dollars. When countries or companies borrow in dollars, they must make interest and principal payments in USD, which sustains a strong demand for the dollar.

Also, demand for the dollar spikes in times of global financial stress because borrowers rush to obtain dollars to meet their debt obligations. Such situations make the US dollar a safe-haven asset during market turbulence.

For example,

- During past global financial crises (such as the 2008 financial meltdown or the COVID-19 pandemic), the dollar’s demand surged as investors sought safety.

Track volatility is driven by macroeconomic shifts using Bookmap’s advanced heatmap and volume tracking tools.

What’s Fueling the De-Dollarization Debate in 2025?

The global conversation around de-dollarization has gained momentum in 2025. Nowadays, more and more countries are exploring alternatives to reduce their reliance on the US dollar.

Let’s check out some common factors driving this shift:

- BRICS Countries Are Moving Towards a Common Currency

BRICS nations have been discussing the creation of a BRICS currency to facilitate trade among member nations. Here, the primary goals are to:

- Establish a common medium of exchange,

- Bypass the US dollar, and

- Reduce dependence on Western financial systems.

The China-Russia and China-Brazil Trade

China and Russia have already bypassed the US dollar. They are now settling energy and commodity trades in their local currencies (yuan and ruble). Similarly, Brazil and China have agreed to use their respective currencies for bilateral trade.

2. Sanctions Backlash Are Forcing Countries to Develop Alternatives to SWIFT

The US recently sanctioned countries like Russia and Iran, excluding them from SWIFT. SWIFT transactions are usually settled in USD. Let’s see how both these countries are responding:

| Russia’s Response | Iran’s Response |

|

|

China’s Interference

Besides SPFS, China’s CIPS (Cross-Border Interbank Payment System) is emerging as an alternative to SWIFT. It is now offering countries a way to settle transactions in Chinese yuan.

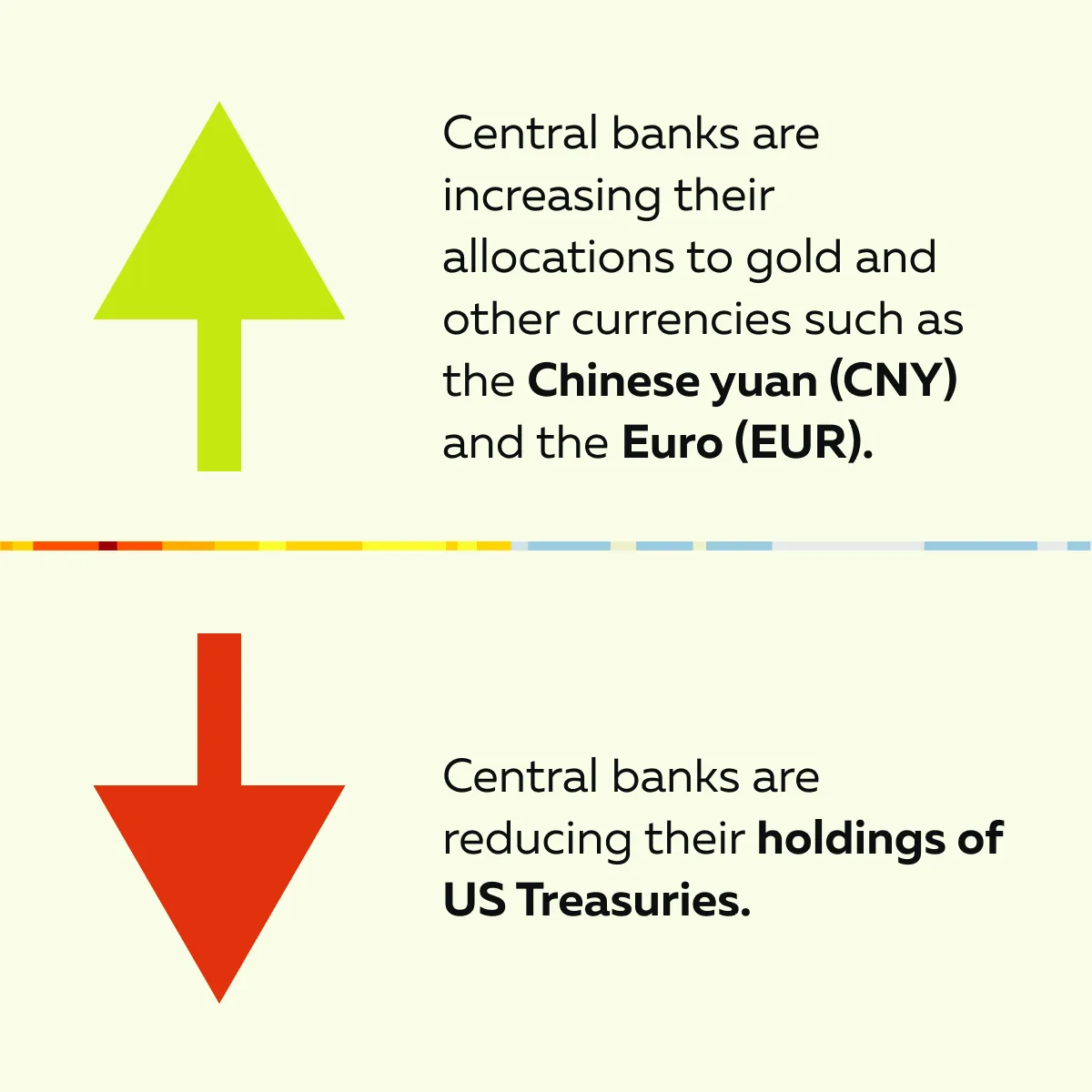

3. Central Banks are Now Shifting to Gold and Other Currencies

Many central banks have started diversifying their reserves. Let’s see how:

Most central banks (especially in emerging markets) have significantly increased their gold reserves to hedge against potential currency volatility. Also, they are shifting towards:

- Chinese yuan (CNY)

and

- Euro (EUR).

This shift is being implemented by expanding their reserves and including a higher proportion of CNY and EUR. As a trader, you must note that such diversification reduces the demand for US Treasuries. Also, it weakens the dollar’s reserve currency status over time.

4. Bilateral Trade Agreements Are Now Being Done in Local Currencies

Several countries are now entering bilateral agreements in local currencies. These agreements bypass the US dollar entirely. Let’s see some major examples:

| India-UAE Agreement | Russia-India Trade |

|

|

Signs the Dollar May Be Losing Influence—Or Not

The US dollar is a dying legacy! Some say it will no longer be the world’s dominant reserve currency. There are signs of:

- Growing interest in alternatives like the Chinese yuan (CNY)

and

- Developing the upcoming BRICS currency.

But, still, the dollar remains deeply entrenched in the global financial system. And experts say it is too resilient to die!

Let’s have a closer look at both perspectives:

Indicators of Weakening USD Role

The following developments suggest that the role of the US dollar in global trade and finance may be weakening:

1. Reduction in USD Share of Global Foreign Exchange Reserves

Over the past two decades, the share of US dollars in global foreign exchange reserves has steadily declined. According to the International Monetary Fund (IMF), the dollar accounted for around 71% of global reserves in 2000, but by 2025, that figure had fallen to approximately 59%.

Why It Matters?

A declining share of reserves suggests that central banks are reducing their dependency on the US dollar. They are diversifying into other:

- Currencies,

- Gold, and

- Alternative assets.

2. Rising Gold Reserves in Emerging Markets

Central banks in countries like China, India, and Russia have been increasing their gold reserves. They are doing so to hedge against potential volatility in the US dollar.

Why It Matters?

Gold is considered a safe-haven asset. Most use it as a hedge against:

- Inflation,

and

- Currency risk.

By accumulating gold, countries are signaling reduced confidence in the long-term stability of the US dollar.

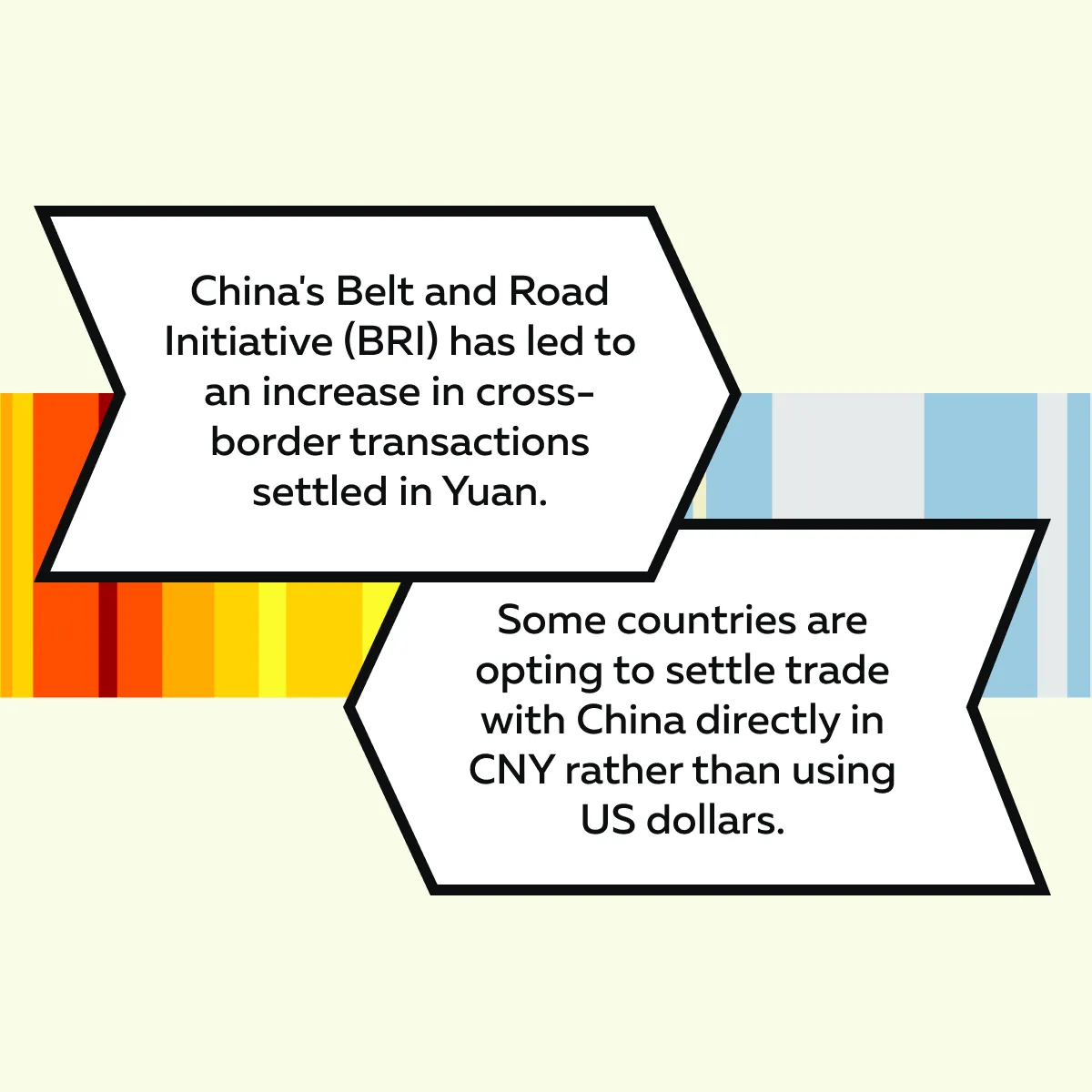

3. Increased Use of CNY in Cross-Border Transactions

The Chinese yuan (CNY) is becoming more prominent in international trade (particularly in Asia and Africa). Let’s see how:

Why It Matters?

As more countries accept the yuan for trade, their dependence on the US dollar decreases, adding momentum to the de-dollarization trend.

4. Saudi Arabia Exploring Yuan for Oil Trades

Saudi Arabia is a key player in the global oil market. It has reportedly explored the possibility of settling oil trades in the Chinese yuan.

Be aware that oil has historically been priced and traded in US dollars (the petrodollar system). If this shift happens, it could be a significant blow to the dollar’s dominance in global trade.

Why It Matters?

If Saudi Arabia and other major oil producers start accepting yuan or other currencies for oil, the demand for US dollars in energy markets could decline sharply.

Counterpoints: Why the USD Isn’t Going Anywhere (Yet)

Despite growing concerns, several factors suggest that the US dollar’s position as the global reserve currency remains secure (at least for now):

1. USD Still Dominates approximately 59% of FOREX Reserves

The US dollar’s share in global reserves has fallen. But it still accounts for about 59% of total reserves (far exceeding any other currency). The euro (EUR) holds around 20%, while the Chinese yuan (CNY) accounts for less than 3%.

As long as the majority of the world’s “foreign exchange reserves” remain in dollars, the USD will continue to dominate global finance.

2. Trust in US Legal and Banking Systems

The US legal system and banking infrastructure offer unmatched stability and transparency. It has:

- Consistent legal frameworks,

- Protection of property rights, and

- Rules to facilitate dispute resolution.

As a result, this system is trusted worldwide by investors, corporations, and governments. Even countries exploring alternatives recognize that no other system offers the same level of reliability as the US legal and financial environment.

3. No Real Competitor Has USD’s Liquidity and Convertibility

No other currency can match the scale and depth of US Treasury markets (where trillions of dollars change hands daily). Even if alternative currencies like the BRICS currency or the yuan gain traction, they do not yet have the infrastructure or liquidity to challenge the dollar’s dominance.

4. Emerging Currencies Face Capital Controls and Trust Deficits

Currencies like the Chinese yuan (CNY) face challenges such as:

- Capital controls,

and

- Lack of trust beyond their regional influence.

Nowadays, China is actively working to internationalize the yuan. However, global investors remain wary due to strict government controls and a lack of full convertibility.

What De-Dollarization Means for Traders in Stocks, Futures, and Crypto?

If de-dollarization becomes a reality, you must understand how this shift impacts different asset classes (stocks, futures, and cryptocurrencies). Be aware that moving away from the US dollar introduces both risks and opportunities for active traders. Let’s see what you can expect across key markets:

- The Impact of a Weaker Dollar on Stocks

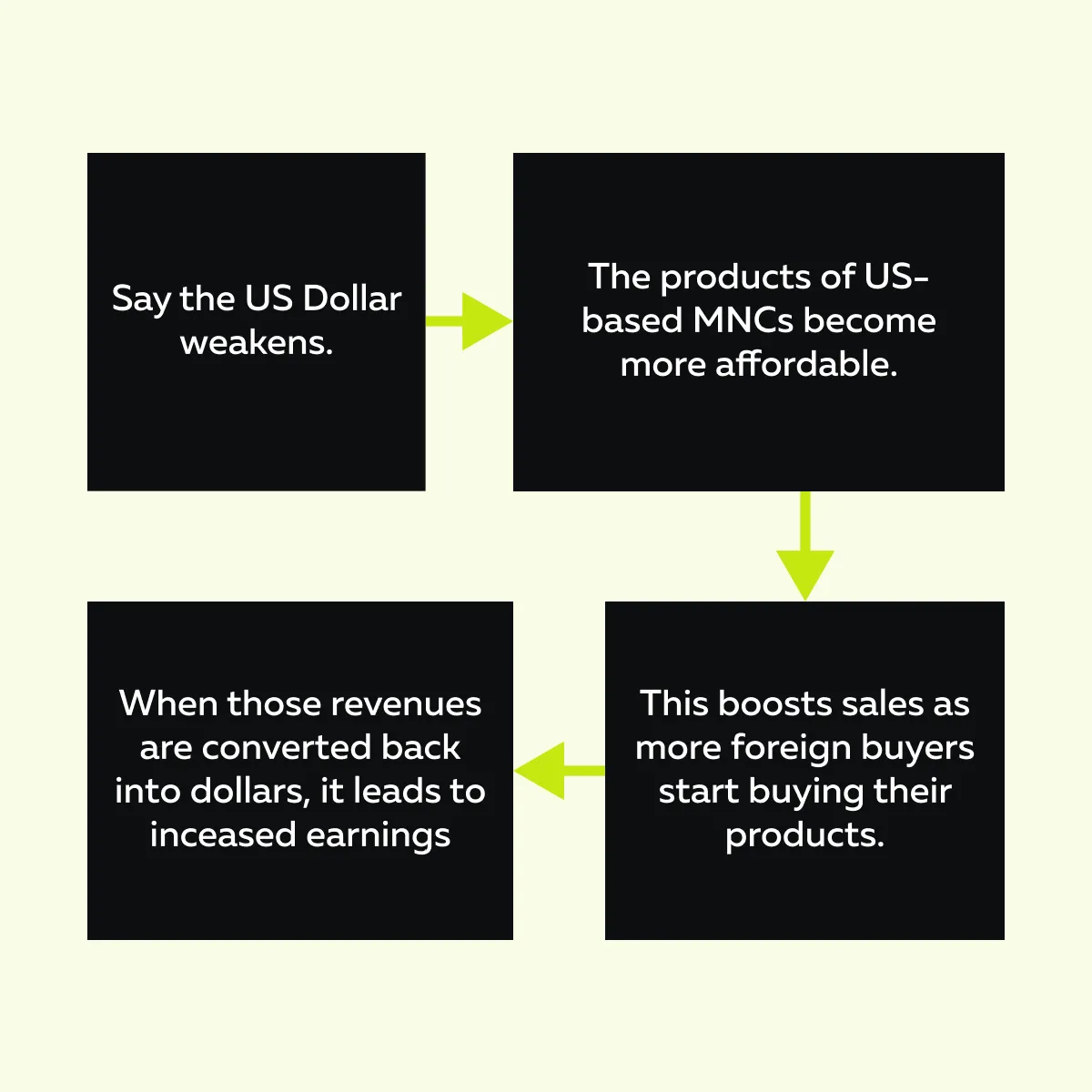

When the US dollar declines, it often benefits US-based multinational companies (MNCs) that generate a significant portion of their revenue from overseas markets. Let’s see how through the graphic below:

Notably, this leads to higher earnings for companies in sectors like:

- Technology,

- Pharmaceuticals, and

- Consumer goods.

That’s because they rely heavily on global markets. However, on the negative side, de-dollarization could lead to capital outflows from emerging markets. If investors start seeking safer alternatives, it can even cause stock market volatility in those regions.

- The Commodity Prices May Become More Volatile

Commodities like gold and oil are traditionally priced in US dollars. If the dollar weakens due to de-dollarization, these commodities may be repriced in other currencies. Let’s understand in detail:

| Gold | Oil |

|

|

- The Growing Role of Crypto in a De-Dollarized World

Please note that Bitcoin (BTC) and stablecoins (USDT and USDC) are increasingly viewed as neutral assets. That’s because in a de-dollarized world, they can:

- Facilitate trade,

and

- Act as stores of value.

Also, de-dollarization advocates often support decentralized solutions, as these reduce dependency on any single nation’s currency. Let’s learn how:

| Bitcoin as a Reserve Asset | Stablecoins for Trade |

|

|

- Increased Volatility in Dollar-Correlated Assets

De-dollarization increases the volatility in dollar-correlated assets (particularly during major global announcements or policy shifts). Let’s learn how:

| FX Markets | Commodities | Cryptos |

| After de-dollarization-related headlines, currency pairs like USD/CNY, EUR/USD, and USD/JPY may experience sharper moves. | Sudden price swings in oil, gold, and agricultural products may occur. | Bitcoin and other digital assets could see volume surges in response to geopolitical or macroeconomic developments. |

As a trader, you should be prepared for unexpected volatility in dollar-sensitive assets during global policy announcements.

How to Track the Narrative in Real-Time?

To stay ahead of de-dollarization developments, you can use our advanced market analysis tool, Bookmap. It allows active traders to:

- Monitor real-time market movements,

and

- Assess how news impacts different asset classes.

Let’s gain more clarity and see how you can use Bookmap to gain a competitive advantage:

1. Liquidity Monitoring

As a Bookmap user, you can track liquidity changes in key assets like:

- Gold,

- Oil, and

- Bitcoin.

Suppose you observe sudden pullbacks or large buy walls in these markets on Bookmap. This data indicates how institutional participants are reacting to de-dollarization headlines.

2. Volume Surges Around Macro News

Trading volumes often surge during global events such as:

- BRICS meetings,

or

- Federal Reserve statements.

You can easily monitor these volume spikes on Bookmap, which lets you identify moments when markets react to significant policy shifts.

3. Order Flow Reactions to Geopolitical Headlines

You can track order flow data on Bookmap. These features reveal how institutional players respond to geopolitical developments tied to de-dollarization.

Ideally, you should watch for aggressive buying or selling (in gold, oil, or Bitcoin futures) after major announcements, which gives you insights into market sentiment.

Conclusion

De-dollarization is not an immediate threat. But it is real. You can think of it as a slow and continuous shift that can change the global economic power. Currently, the US dollar remains dominant in international trade and reserves. However, there are growing efforts by BRICS nations and other countries to diversify their currency holdings, signaling a gradual realignment. For you as a trader, this means increased volatility in stocks, futures, and crypto (particularly around major policy changes and geopolitical developments).

To stay ahead, you should closely monitor macro news, capital flows, and order flow to identify emerging trends using our real-time analysis tool, Bookmap. It can also help you spot liquidity shifts, volume surges, and institutional reactions, letting you capitalize on these macro stories before their full impact is reflected in asset prices. Stay ahead of shifting macro trends with Bookmap’s real-time market insights and order flow tools.