December Trading

Deals Are Live!

Save on Global+, data access,

and add-ons.

See All December Deals

Black Friday

Nov 28-Dec 31

31 days : 0 hours

50% OFF Global+ Quarterly

+ 50% OFF Data (3 months)

Cyber Monday

Dec 1 - Dec 31

0 days : 0 hours

60% OFF Global+ Monthly

+ Data (1 month)

Add-on Deals

Dec 1 - Dec 31

0 days : 0 hours

50% OFF

Add-ons

New Year Sale

Dec 26 - Jan 1

25 days : 0 hours

30% OFF Global+ Lifetime

*Data not included

Education

May 12, 2025

SHARE

Is the US Dollar Still a Safe Haven? Why Its Status Is Being Questioned in 2025

Is the mighty US dollar losing its armor? The US dollar’s once unshakable status as the ultimate safe haven is now being challenged in 2025.

Want to learn why? In this article, you will learn why the dollar is showing signs of weakness! You will understand the macroeconomic and political factors causing this change and discuss how investors and traders need to adapt.

Also, you will learn what assets are replacing the dollar as a flight to safety. Finally, we will share practical strategies for monitoring dollar movements using real-time tools, like our avant-garde Bookmap. Read this article till the end! And fine-tune your strategy in a world where the USD’s dominance is no longer guaranteed!

A Safe Haven No More? The Dollar’s Changing Role!

For a long time, the US dollar has been considered a safe haven during periods of:

- Financial crisis,

- Geopolitical tension,

and

- Market uncertainty.

During these events, investors would rush to buy US assets (primarily US Treasuries) because they are considered one of the safest investments globally. This consistent demand for the dollar strengthened its position as the world’s reserve currency. However, this trend is now changing!

Recent Weaknesses in 2025

In 2025, this pattern is no longer as predictable. USD weakness has been observed during recent bouts of market volatility. This shift has confused many investors because, traditionally, uncertainty would lead to a stronger dollar.

So, why is this happening? The table below shows the three most probable reasons for this change:

Use Bookmap to watch the order flow as markets react to changing monetary and geopolitical conditions.

Market Confusion and Mixed Signals

In 2025, investors no longer view the US dollar as a clear-cut safe haven. The market is sending mixed signals. While some still turn to the dollar during crises, others explore alternative assets.

This confusion is mainly because of the risk of the US economic slowdown. There are concerns about:

- Slowing growth,

and

These concerns are making the dollar less attractive. As a result, market participants are more cautious, weakening the USD at times when it would traditionally have surged.

Drivers of Dollar Weakness in 2025

The US dollar is showing signs of sustained weakness in 2025. Check out the graphic below to learn about some common reasons:

Let us understand these factors in detail:

Rising Fiscal Concerns

The United States is running record-high fiscal deficits. This excessive borrowing has led to a sharp increase in the debt-to-GDP ratio. As a result, several investors are now raising fears about the country’s long-term financial stability.

Please note that when debt levels rise too high compared to the size of the economy, investors become hesitant to hold US assets, contributing to USD weakness.

Additionally, there are the following risks:

| Risk of Long-Term Dollar Devaluation | Weakening Demand for US Treasuries |

|

|

Track dollar-driven moves in real time with Bookmap’s liquidity and order flow tools.

Geopolitical Shifts

The US political environment has become increasingly unpredictable after Trump’s second term. Countries that have long depended on the US for trade and security are:

- Rethinking their economic ties,

and

- Exploring alternatives to the US dollar as a safe haven.

Due to this trend, global markets are diversifying, significantly weakening the dollar’s dominance in international trade.

Rise of New Geopolitical Alliances

New alliances like BRICS+ (Brazil, Russia, India, China, South Africa, and new entrants) now trade in local currencies.

Countries like China, Russia, and various Middle Eastern nations actively forge bilateral trade deals in currencies other than the dollar.

Global Alternatives Gaining Traction

Yuan-denominated trade is on the rise! China and Russia have bypassed the dollar and are making trade settlements in yuan. Other countries, including Saudi Arabia, are also exploring the yuan as a preferred currency for oil and commodity trades.

Additionally,

| There is a Growing Preference for the Euro and Gold | The Blockchain-Based Payment Systems Are Emerging |

|

|

What’s Replacing the Dollar as the “Flight to Safety”?

As USD’s weakness continues in 2025, investors are now looking for safer alternatives to protect their wealth. Traditionally, the US dollar was the first choice during times of global uncertainty, but now, other assets and currencies are emerging as better options for stability.

Let us check them out:

A) Gold and Commodities Act as a Hedge Against Dollar Devaluation

Gold has always been a trusted safe haven during economic uncertainty. With fears of dollar devaluation growing, investors are now increasing their gold holdings.

Please note that gold retains its value even when the dollar weakens. Thus, central banks and institutional investors are allocating more to gold as a reliable hedge against:

- Inflation concerns,

and

- Currency risks.

Copper as an Unexpected Hedge

Interestingly, investors are increasingly viewing copper as a hedge. Due to the rising popularity of renewable energy and electric vehicles (EVs), the demand for copper is expected to remain strong. Thus, investors are now looking at copper as protection against a declining dollar value.

B) Short-Term Government Bonds (Ex-US) Offer Stability in Safe Jurisdictions

Central banks and institutional investors are moving funds into short-term government bonds. They are mainly investing in bonds issued by countries with:

- Lower inflation volatility,

and

- Stronger political stability.

Nations like Switzerland and Singapore have become attractive destinations. These bonds offer safer returns compared to US Treasuries.

Why Short-Term Bonds?

You may be wondering why there is a preference for short-term bonds. These bonds represent less risk than long-term bonds. That is because they are less sensitive to interest rate changes.

In uncertain times, investors prefer these bonds as a safe haven. They provide liquidity and stability without being tied to long-term market volatility.

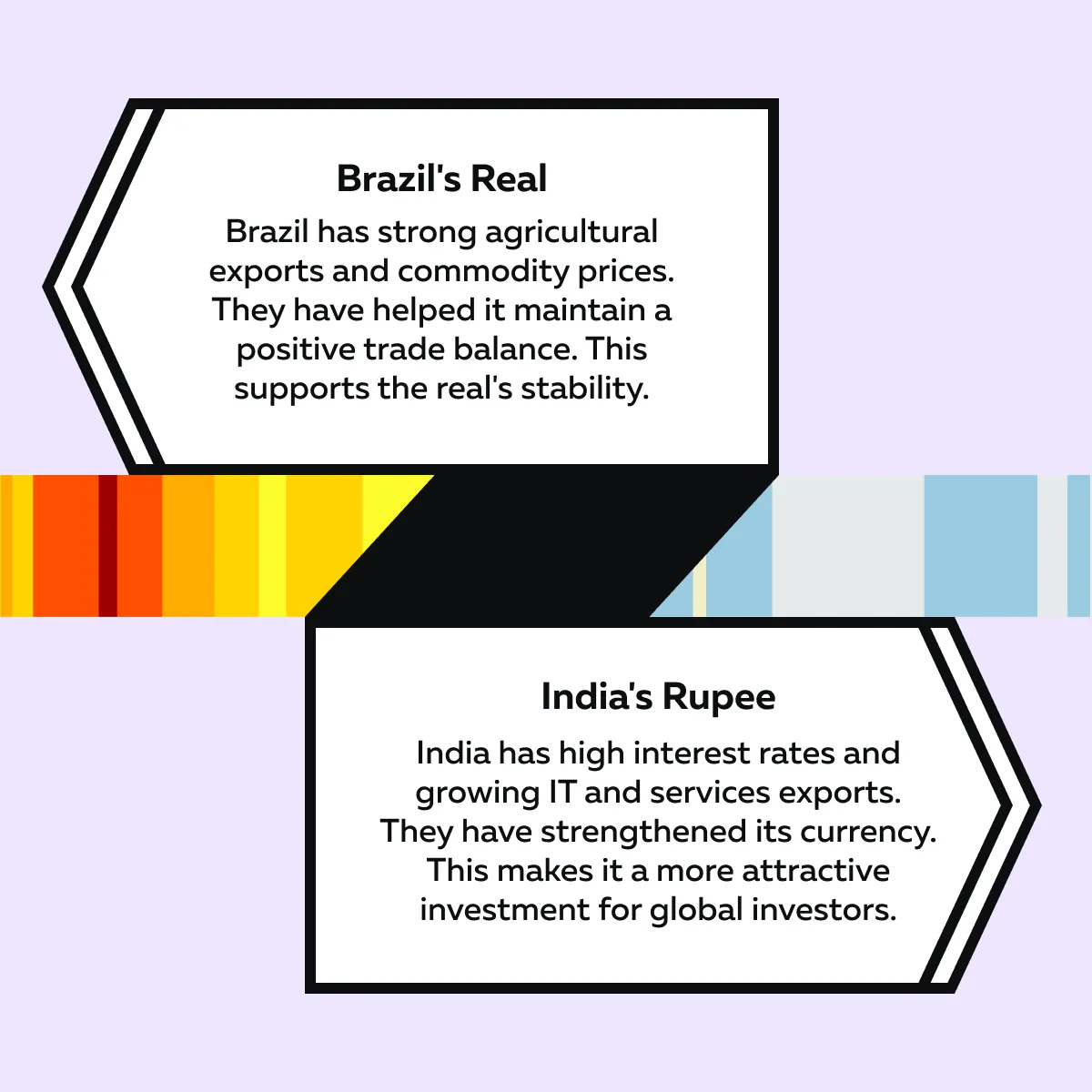

C) Selective Emerging Market (EM) Currencies Showing Resilience

Surprisingly, some emerging market (EM) currencies are performing better than expected. They are offering attractive returns for investors. Nowadays, countries like Brazil and India are benefiting from:

- Strong trade balances,

and

- High interest rates.

These factors support the strength of their local currencies. Let us see how through the graphic below:

Diversification Away from the Dollar

Due to US dollar weakness, investors are now diversifying their portfolios by holding a mix of:

- Safe-haven assets,

- Short-term bonds,

and

- Selective EM currencies.

This strategy lets them reduce exposure to the risks associated with dollar volatility.

Implications for Traders Across Markets

Due to USD weakness in 2025, the US dollar’s safe haven status has been shaken, and volatility is growing. Thus, you must adjust your strategies across different markets as a trader. Let us check out some major implications:

- Unpredictable Movements in USD-JPY and EUR-USD

For FX traders, trading pairs like USD-JPY and EUR-USD are becoming more volatile. This volatility is because the dollar no longer behaves as a predictable safe haven. Due to this, there are no usual flight-to-safety flows to the dollar. Thus, you need to be prepared for sudden spikes or reversals.

Why Volatility Is Higher?

- Uncertainty over US fiscal policy and debt concerns

- Shifts in investor sentiment toward alternative safe-haven currencies (like the yen or euro)

- Increasing adoption of other currencies for international trade

- Reducing the dollar’s dominance

- Impact on Oil, Gold, and Commodities

Commodities like oil and gold are traded in dollars in global markets. When the dollar weakens, it boosts their prices. Let us see how:

- Gold: A falling dollar makes gold more attractive as a hedge against inflation and uncertainty.

- Oil and Energy Commodities: Lower dollar value increases demand from non-dollar markets, leading to higher prices.

Opportunities for Profit

If you accurately predict sustained dollar weakness, you can capitalize on rising commodity prices. This rise occurs mainly during the following:

- Geopolitical tensions,

or

- Inflationary periods.

- Rising Hedging Costs for Foreign Investors

In the equity markets, foreign investors who buy US stocks are now more cautious due to an increase in currency hedging costs.

- Declining Confidence in USD

If confidence in the US dollar erodes further, foreign capital inflows into US equities may decline, leading to:

- The underperformance of US stock indices,

and

- Uncertainty in tech-heavy markets like the Nasdaq.

- Lower Demand from Foreign Buyers

For bond traders, US Treasuries (usually viewed as a safe haven asset) may see weaker demand due to:

- Rising US debt levels,

and

- Geopolitical uncertainties.

Please note that countries like China and Japan (historically major buyers of US debt) are also slowing down their purchases, contributing to a lack of support for Treasury prices.

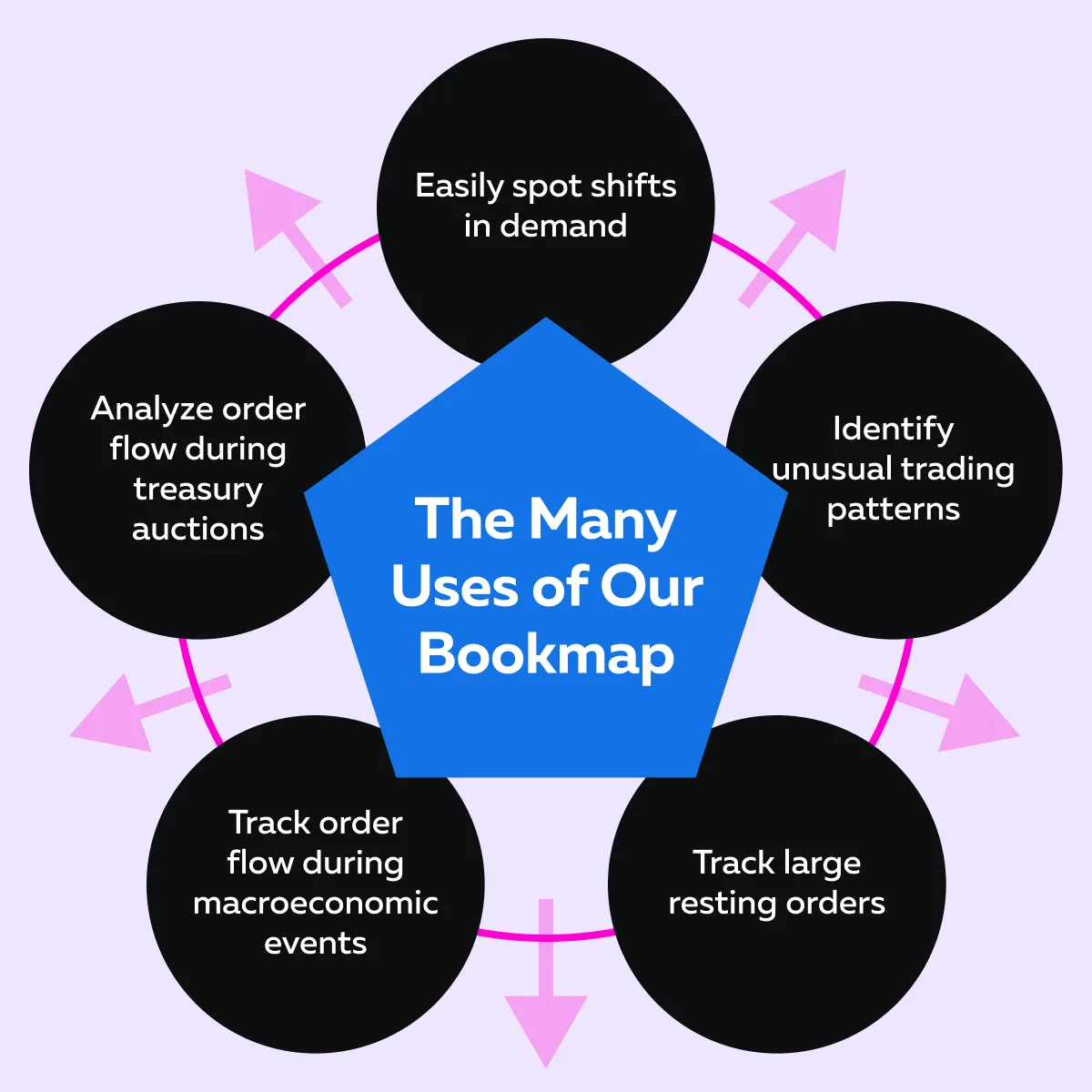

You Can Spot Order Flow Anomalies to Manage These Implications

As a trader, you can use our modern real-time market analysis tool, Bookmap. Let us learn how you can gain a competitive advantage using Bookmap:

How to Track Dollar Shifts in Real-Time?

The status of the US dollar as a safe haven is gradually changing. Thus, you need to monitor dollar movements in real time. Let us learn how you can do so:

| Ways to Track USD Changes in Real-time | Explanation |

| Monitor FX Pairs with Depth-of-Market and Heatmap Tools |

|

| Watch Gold Clues |

|

| Oil Strengthening |

|

| Combine Macro-economic Events with Live Order Flow |

with

|

Conclusion

The reputation of the US dollar as an untouchable safe haven is being challenged in 2025. The dollar’s weakness is attributed to rising US debt and political uncertainty. Additionally, there is a growing reliance on alternative currencies and an increasing demand for gold.

Even central banks have begun diversifying their reserves by including currencies such as the CNY and the Euro, along with other alternative stores of wealth. All these factors are contributing to a decline in the dollar’s dominance.

For you as an investor or trader, this shift means you can no longer assume that the dollar will provide stability during crises. Thus, it’s essential to reassess your trading strategies and closely monitor real-time market developments to stay ahead.

One way to do this is by using our real-time market analysis tool, Bookmap. This tool offers unique features like heatmaps, depth-of-market indicators, and order flow analysis. Using these features, you can better spot emerging trends! See how currency shifts impact equity and futures markets live with Bookmap.