Ready to see the market clearly?

Sign up now and make smarter trades today

Education

February 5, 2025

SHARE

Key Order Flow Strategies: Breakouts, Trends, Trapped Traders, and Stop Runs

Understanding Order Flow and Market Dynamics

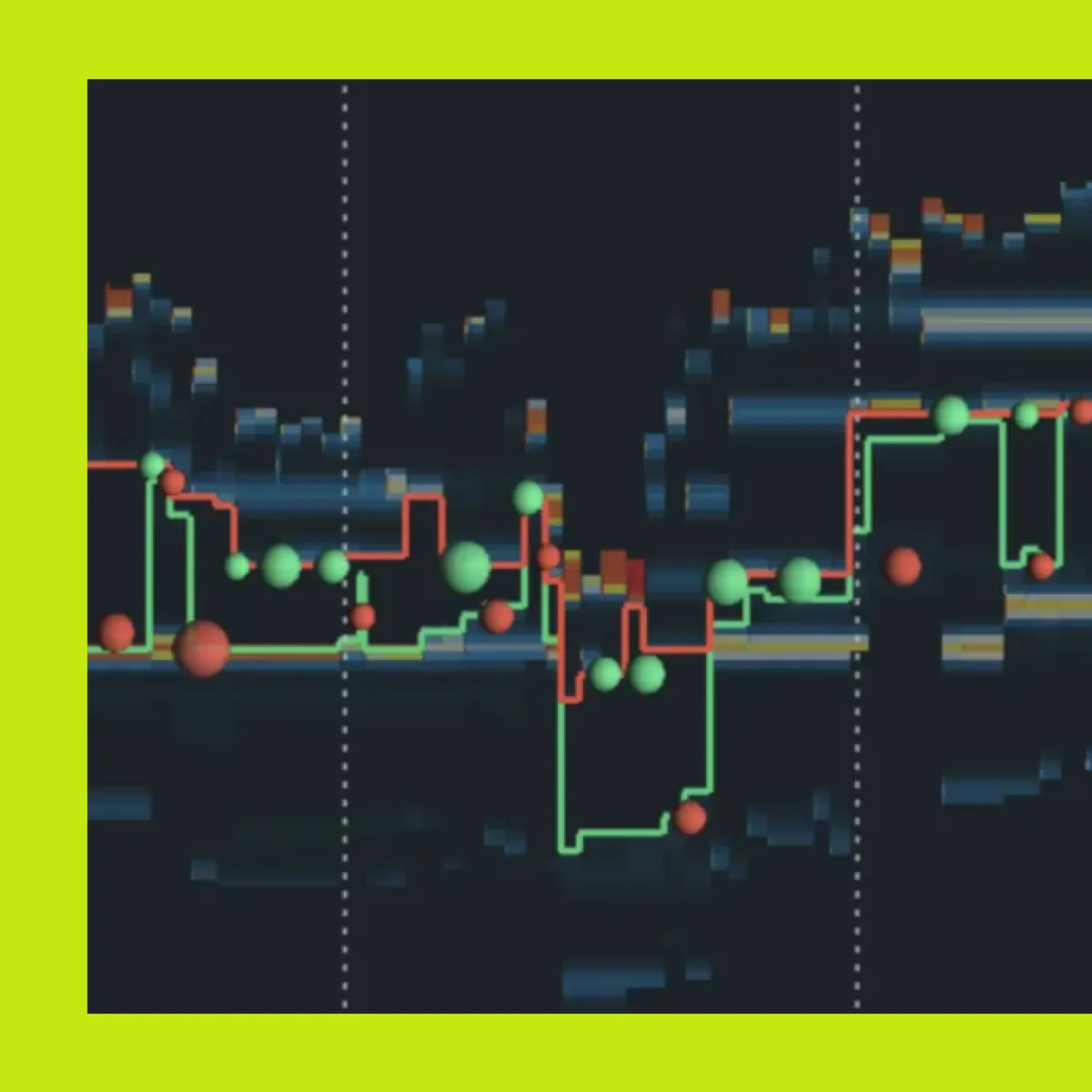

Order flow analysis provides traders with a powerful edge by revealing the underlying dynamics of price movement. By understanding how market participants interact with liquidity, traders can make more informed decisions, anticipate reversals, and improve execution timing. This article explores essential order flow strategies, including price structure, aggressive and passive orders, exhaustion signals, and key trading dynamics such as short squeezes and stop runs.

Recognizing Price Structure and Market Trends

Identifying Market Trends

Price structure plays a fundamental role in order flow analysis. A market characterized by lower highs and lower lows signals a downtrend, whereas higher highs and higher lows indicate an uptrend. These structural patterns help traders anticipate potential breakout points and reversals.

Example: If price is forming a series of lower highs while aggressive sellers persist, traders can look for confirmation of a continued downtrend. Conversely, a break above the last lower high with strong buying pressure may indicate a trend reversal.

Understanding Aggressive vs. Passive Orders

The Difference Between Aggressive and Passive Orders

The interaction between aggressive and passive orders determines price movement:

- Aggressive orders (market orders): Move price quickly by consuming available liquidity.

- Passive orders (limit orders): Provide liquidity at key levels and can act as support or resistance.

By analyzing the relationship between these order types, traders can assess which side is dominating the market and whether a breakout is likely to succeed or fail.

Spotting Key Order Flow Signals

- Absorption: Large passive orders holding against aggressive order flow indicate a potential reversal.

- Initiative Buying/Selling: Heavy market orders aggressively lifting the offer or hitting the bid signal strong momentum.

Identifying Exhaustion and Market Reversals

How to Spot Exhaustion

Exhaustion occurs when buying or selling pressure weakens, signaling a potential reversal or consolidation. A key exhaustion signal is the presence of large aggressive orders followed by a lack of follow-through.

Example: A strong push higher with large green dots (aggressive buying) that fails to continue indicates buying exhaustion, increasing the probability of a pullback.

Confirmation Signals for Reversals

- Lack of Follow-Through: Price stalls despite large market orders.

- Shift in Liquidity: Passive orders start to stack on the opposite side.

- Stop Runs Without Continuation: Sudden liquidity grabs that fail to progress further.

Determining Market Control: Buyers vs. Sellers

How to Identify Control Shifts

Traders can gauge who controls the market by monitoring shifts in aggressive activity and liquidity changes.

- Buyers in control: Higher lows with strong bids and aggressive buying.

- Sellers in control: Lower highs with strong asks and persistent aggressive selling.

If buyers continually absorb selling pressure and push price higher, the uptrend is intact. Conversely, if price struggles to break resistance and large sell orders emerge, sellers are taking control.

Practical Example

If price is moving higher but large passive sell orders are absorbed without follow-through, it suggests buyers may be losing control.

Spotting Short Squeezes and Stop Runs

The Mechanics of Short Squeezes

A short squeeze occurs when trapped sellers are forced to buy back their positions, accelerating price movement upward.

Identifying a Stop Run

A stop run happens when the market moves through known stop-loss levels, triggering forced liquidations and liquidity grabs.

Example: If price suddenly surges past resistance with aggressive buying and a spike in executed stop orders, a short squeeze is in progress. Conversely, a sharp drop into a support zone with stop-loss triggers followed by immediate buying can indicate a stop run before reversal.

Trading Styles Utilizing Order Flow Analysis

Scalping

- Quick trades based on order flow shifts and liquidity changes.

Momentum Trading

- Entering trades in the direction of aggressive order flow dominance.

Reversal Trading

- Identifying exhaustion points and taking positions against weak momentum.

By leveraging Bookmap’s visualization tools, traders can identify real-time market behavior and refine their strategy accordingly.

Watch Order Flow in Action

To see these strategies applied in real-time, check out our latest educational session here.

Next Steps

Deepen your order flow knowledge with these resources:

- Explore the Learning Center for advanced order flow strategies.

- Join our Discord community to engage with fellow traders.

- Sign up for a live session to learn from market professionals.

Mastering order flow analysis enables traders to gain a deeper understanding of market mechanics and make smarter trading decisions. Keep refining your skills and stay ahead of the markets!