Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

December 25, 2024

SHARE

Making Sense of Support and Resistance: How Price Barriers Impact Trading Decisions

You live in Japan and don’t know Japanese. If you are not open to learning

Japanese, will you be able to set up a profitable business? Trading isn’t

just about buying low and selling high; it’s about understanding the

language of the market.

Through this article, you will understand how support and resistance levels

act as your biggest allies and let you talk with the market. Both these

levels are psychological and technical, defining where the market may pause,

reverse, or surge.

We’ll also guide you on how to act against overreliance and how advanced

tools like Bookmap, uncover the secrets of market liquidity, volume, and

real-time order flow. Let’s get started.

The Basics of Support and Resistance

Support and resistance levels are associated with supply and demand

dynamics. Both of them play a crucial role in determining price movements.

See the table below:

|

Level |

Meaning |

Correlation with Demand |

Visualizing with Tools |

|

Support |

Support is a price level at which an asset tends to stop |

Support levels indicate a strong demand for the asset. |

Market analysis tools like Bookmap have features such

These visually represent support levels by using colors |

|

Resistance |

Resistance is a price level at which an asset tends to

|

Resistance levels indicate a strong supply of the asset. |

Similar to support, using Bookmap, you can visualize |

How These Levels Help Traders

The interaction between support and resistance levels is critical for

traders. Here’s how they are commonly used:

-

Buy at Support:

-

Traders buy assets when they approach support levels

-

They believe that demand will push the price higher from that

point.

-

-

Sell at Resistance:

-

Traders sell assets at resistance levels.

-

They believe the price to reverse due to the supply in that

area.

-

What is Support?

As mentioned earlier, support refers to a specific price level on a stock,

commodity, or any financial asset chart where a downtrend is expected to

pause or even reverse due to a concentration of demand.

You can think of support as a safety net or floor.

-

Think of a tightrope walker walking on a high wire between two

buildings. -

They know that if they slip, there’s a safety net or a floor a few

feet below to catch them. -

This net or floor represents a level of support in the financial

markets. -

It’s the point at which the asset’s price tends to stop falling,

just like the safety net stops the tightrope walker from falling too

far.

Let’s understand through a hypothetical example.

Company X is currently trading at $50 per share. Over the past few months,

the stock has been in a downtrend. However, at the $40 price level, it has

consistently shown signs of support. Every time the price nears $40, it

either bounces back up or at least slows down its descent. This $40 price

level can be considered a support level.

Why do buyers jump in at certain levels, creating support?

The psychology behind the support is driven by several factors, such as:

-

Perceived Value:

-

When the price of an asset drops to a certain level, buyers

believe it’s a good deal. -

They perceive the asset as undervalued, and this perception

encourages them to buy.

-

-

Emotional Reactions:

-

Investors’ emotions play a significant role.

-

When an asset’s price falls and approaches a support level:

-

Fear of missing out (FOMO) or the desire to avoid losses

drives more buyers to enter the market. -

This surge in demand leads to creating a support level.

-

-

-

Stop-Loss Orders:

-

Many traders place stop-loss orders just below key support

levels. -

When these orders are triggered, they can lead to a surge in

buying as traders try to limit their losses.

-

What is Resistance?

Resistance represents a specific price level on a stock, commodity, or any

financial asset chart where a trend, typically an uptrend, can pause or

reverse due to an abundance of selling activity.

Think of Resistance as a Ceiling or Barrier:

-

Resistance can be thought of as a price level that acts like a

ceiling or barrier, preventing the asset’s price from rising

further. -

Just as the ceiling in a room stops you from moving upward,

resistance is a point on a price chart where the price struggles to

break through.

Let’s understand through a hypothetical example.

Company Y is trading at $60 per share. Over the past few months, the stock

has been in an uptrend. However, at the $70 price level, it consistently

shows signs of resistance. Whenever the price approaches $70, it tends to

slow down or even reverse. This $70 price level is a resistance level.

Why do sellers jump in at certain levels, creating resistance?

The formation of resistance is influenced by

emotions and market psychology

, including:

-

Fear of Missing Out (FOMO):

-

When the price of an asset approaches a resistance level,

traders fear missing out on potential gains. -

Additionally, they also believe that the price has reached an

overbought state. -

This perception leads to hesitation and selling at this

perceived “peak.”

-

-

Profit-Taking:

-

Investors who bought the asset at lower prices may decide to

take profits when the price nears a resistance level. -

This selling activity can act as a barrier to further price

increases.

-

-

Technical Analysis:

-

Many traders and algorithms use technical analysis to identify

resistance levels on price charts. -

When these levels are reached, it can trigger automated selling

or profit-taking actions.

-

Identifying Support and Resistance Levels

Identifying support and resistance levels is crucial. Historical price

levels help in determining these key levels. Let’s dive in further.

How to Use Historical Price Levels For Identification

Historical analysis is a three-step process. See the table below::

|

Steps |

Explanation |

|

Select a Time Frame |

Start by examining 6-month or 1-year historical price |

|

Observe Price Halts |

As you review the chart, pay close attention to price

These levels are characterized by multiple price touches

|

|

Strength in Frequency |

|

Psychological Levels

Psychological levels

play a significant role in trading and investing due to the human tendency

to gravitate towards whole numbers and round figures. These levels often act

as key points of interest in the financial markets. Let’s delve into their

significance.

Why are Round Figures Significant?

-

People are naturally drawn to round numbers because they are easy to

remember and provide a clear reference point. -

At round figures, more traders buy, sell, or take other actions.

-

Round numbers have a strong emotional impact on traders. For

example, a stock crossing $100 may trigger excitement, while failing

to break $100 may induce fear or hesitation.

Let’s understand this significance practically using examples of various

assets:

-

Bitcoin at $10,000:

-

Bitcoin’s price at $10,000 has been a significant psychological

level. -

Bitcoin has often faced strong resistance when nearing this

level. -

Traders and investors pay close attention to Bitcoin’s

performance of around $10,000 due to the emotional impact of

reaching a five-figure price. -

When Bitcoin finally broke through $10,000, it triggered

substantial buying interest, leading to further price

appreciation.

-

-

Stocks at $100:

-

In the stock market, $100 is a psychological milestone.

-

A stock approaching $100 may attract significant attention from

traders and investors. -

If the stock fails to break above $100, it can lead to

profit-taking or selling pressure.

-

-

Gold at $1,000:

-

When gold prices approach $1,000, traders closely monitor its

behavior. -

Breaking above $1,000 often leads to increased interest in gold

investments.

-

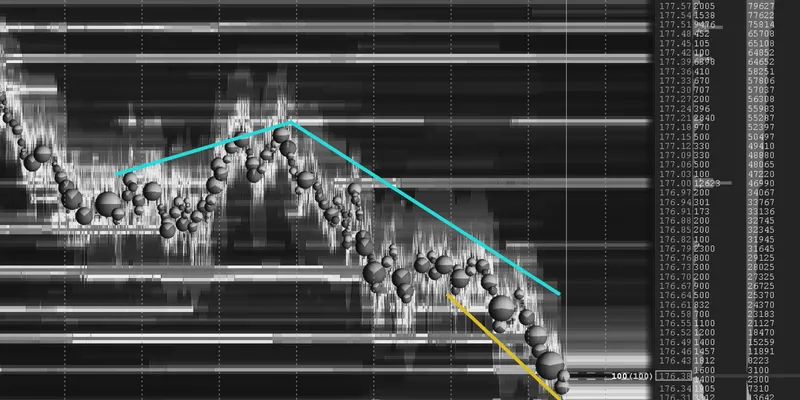

Trendlines and Moving Averages

Most traders use trendlines to identify trend direction and potential

reversal points. Whereas, moving averages are adaptable indicators that help

filter out price noise and identify trends. Let’s start by learning how to

make a trendline.

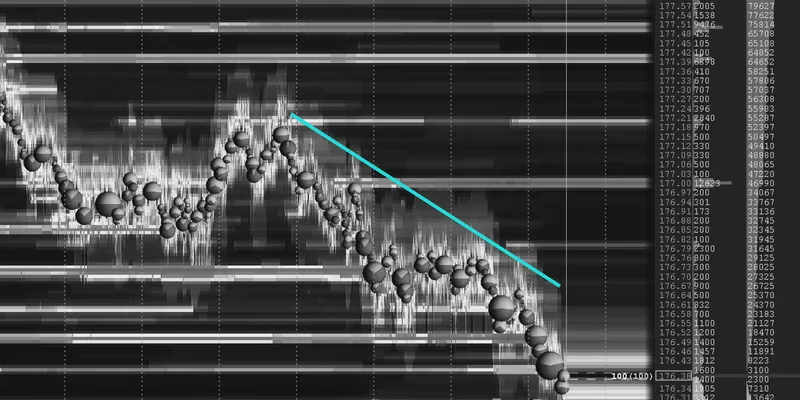

How To Draw Trendlines

Learn easily by reading this step-by-step guide:

Step 1: Identify the Trend:

-

Start by identifying the trend you want to analyze.

-

It can be:

-

An uptrend (ascending)

-

A downtrend (descending), or

-

A sideways trend (horizontal).

-

Step 2: Select Reference Points:

|

Type of Trend |

Reference Points |

|

For an uptrend |

Look for a series of higher lows and higher highs. |

|

For a downtrend |

Look for a sequence of lower highs and lower lows. |

|

For a sideways trend |

Observe whether the price moves within a range without a |

Step 3: Draw the Trendline:

-

Use a straight line or a trendline tool on your charting software to

connect the points. -

The points to connect will depend upon the type of trend you are

observing. -

See the table below:

|

Type of Trend |

Points to Connect |

|

Uptrend |

Connect the low points |

|

Downtrend |

Connect the high points |

|

Sideways Trend |

Connect the price peaks and troughs |

Step 4: Validate the Trendline:

-

Ensure that the trendline touches multiple price points.

-

The more times the price respects the trendline without significant

breaches, the stronger the trendline.

How to Calculate Moving Averages

Moving averages are calculated by adding the closing prices of an asset over

a specific number of periods (e.g., days or hours) and then dividing by the

number of periods.

For example, a simple moving average (SMA) over 50 days is calculated by

summing the closing prices of the last 50 days and dividing by 50.

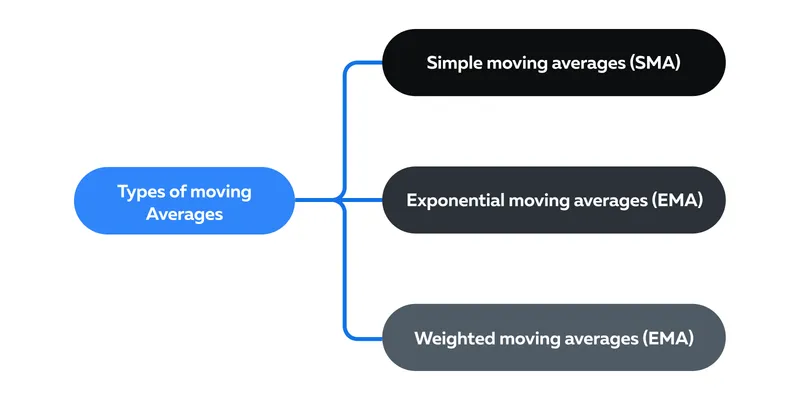

What are the Different Types of Moving Averages?

Are Moving Averages Adaptable to Price Changes?

Moving averages adapt to price changes by continuously recalculating the

average as new prices are added and old prices are dropped from the

calculation window. This adaptability helps traders identify changes in

trend direction.

For example:

|

Event |

Indication |

|

Short-term moving average (e.g., 50-day) crosses above a |

A potential uptrend |

|

Short-term moving average (e.g., 50-day) crosses below a |

A potential downtrend |

Trading Strategies Using Support and Resistance

Using support and resistance levels in trading strategies can be a powerful

tool for traders and investors. Let’s study the popular bounce and break

strategy.

The Bounce and Break Strategy

The Bounce and Break Strategy identifies:

-

Potential “bounces” off support

-

Potential “breaks” through resistance

Let’s break this down with a simple scenario:

Suppose Mr. A is analyzing the price of Stock XYZ, which has been on a

steady uptrend. He notices that the price is approaching a well-established

support level of $50. Here’s what Mr. A did before making a trading

decision:

a) Historical Observation

-

Mr. A reviewed the past price behavior of Stock XYZ and saw that it

had touched the $50 support level several times before. -

Each time it touched this level, it bounced back up.

-

So, he concluded that the $50 level was a robust support for this

stock.

b) Waiting for Confirmation

-

Mr. A wasn’t hasty. He looked for additional signs that supported

the idea of a bounce. -

He paid attention to candlestick patterns, especially those

indicating a potential bullish reversal, and he also checked for

volume confirmation.

c) Making a Trading Decision

-

After conducting his analysis, Mr. A decided to take a long (buy)

position. -

He believed that history might repeat itself, and the price would

bounce off the $50 support level.

This strategy is essentially a straightforward yet effective way for traders

seeking opportunities in the market.

How Important Is Confirmation?

There is a possibility of a false breakout in the Bounce and Break strategy.

Even if a support level has been held multiple times in the past, there is

no guarantee that it will do so in the future. Waiting for confirmation

helps reduce the risk of entering a trade just before a support level

breaks.

Also, it is always advised to rely on multiple confirmation signals before

making a trade. Traders must not solely base their decision on the

historical performance of a support level. The usage of technical analysis,

volume data, and other indicators is paramount.

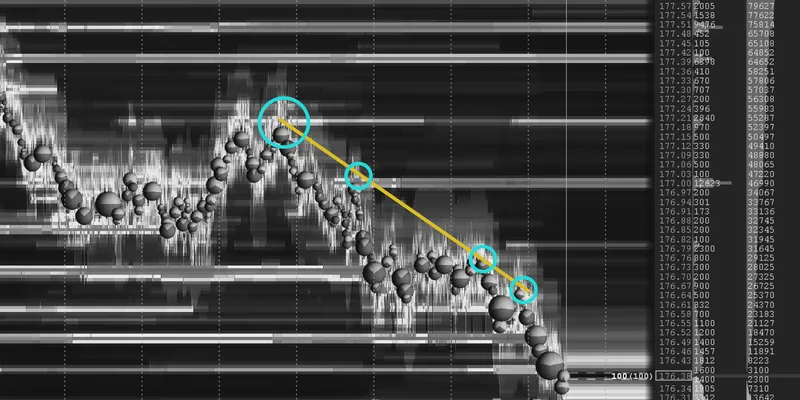

Role Reversal Trades

Role reversal trades represent a price level that was:

-

Previously acting as resistance and

-

Now switches roles to become a support level, or vice versa.

Let’s understand the concept through this hypothetical scenario.

-

Bitcoin is trading below the $15,000 price level for an extended

period. -

This price level is acting as strong resistance.

-

In a recent rally, Bitcoin successfully broke through this

resistance and surged to $20,000. -

Now, Bitcoin has pulled back and is trading at around $15,000.

Why do Role Reversals Happen?

Here are some possible causes:

-

When an asset breaks through a significant resistance level, it

triggers excitement and leads to increased buying interest and

demand. -

After the resistance is broken and the price pulls back to that

level, traders who missed the initial breakout see it as a second

chance. -

Those who sold at the resistance level may experience “seller’s

remorse” when they see the price continuing to rise after the

breakout. Some of these sellers may buy back in at the prior

resistance level, further supporting the idea that it now acts as a

support.

Leverage Bookmap to Enhance S/R Analysis

Bookmap is a platform with advanced visualization features that can provide

traders with a unique perspective on S/R zones and market liquidity. Here’s

how Bookmap enhances S/R analysis:

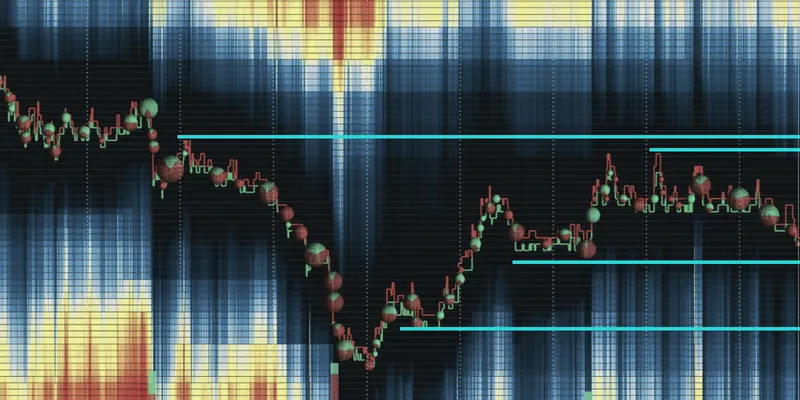

a) Advanced Visualization with Heatmap:

Bookmap’s heatmap provides a real-time view of the order book. It shows the

concentration of buy and sell orders at different price levels.

How do traders use the heatmap to quickly identify potential S/R zones?

-

The heatmap’s color coding helps traders visualize liquidity.

-

This makes it easier to spot areas with strong S/R potential.

b) Using Volume Dots:

Bookmap’s Volume Dots display real-time trading activity. These dots

indicate when trades occur and the volume associated with each trade.

Let’s understand with an example.

-

Mr. X is analyzing Bitcoin’s price.

-

The price approached a support level of $40,000.

-

He noticed a cluster of large buy Volume Dots appearing just above

$40,000. -

This signals strong buying interest, reinforcing the strength of the

support level.

Conversely, a cluster of large sell Volume Dots near a resistance level

would suggest strong selling interest.

c) Historical Liquidity Analysis:

Bookmap also allows traders to review historical liquidity data. By

observing the heatmap over time, traders can identify areas where high

liquidity has persisted. These areas often correspond to strong S/R zones

that are respected by the market.

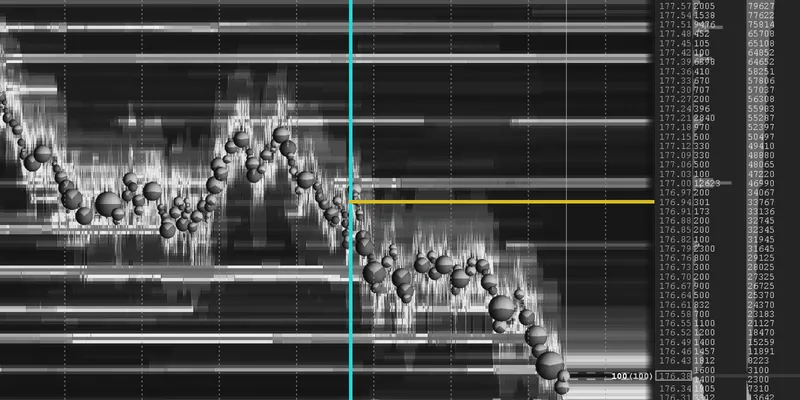

d) Real-Time Order Flow Changes:

Bookmap displays real-time order flow changes. Traders can easily see:

-

When large orders enter the market or

-

When a previously strong S/R level experiences a sudden shift in

liquidity.

Common Mistakes and How to Avoid Them

Traders must understand the common mistakes and learn how to avoid them.

Here are the two most common mistakes that most traders make:

Mistake 1: Over-reliance on Support and Resistance

Let’s understand through a scenario.

-

A trader identifies a robust support level at $50 for a stock.

They’re so confident in this support level that they place a

substantial buy order, expecting a bounce. -

However, the market sentiment changes due to unforeseen news, and

the stock breaks below $50, leading to a significant loss for the

trader.

How to Avoid It

-

Don’t treat Support and Resistance (S/R) levels as absolute or

guaranteed, especially in volatile markets or when unforeseen events

occur. -

Always use other technical indicators and confirmations. Don’t rely

solely on S/R levels. -

Always use stop-loss orders to manage risk.

Mistake 2: Ignoring Volume

Let’s understand through a scenario.

-

A trader observes a cryptocurrency approaching a resistance level at

$10,000. -

The price appears to break above this resistance, and the trader

enters a long position. -

However, they fail to notice that the break occurred with very low

trading volume. -

The price quickly reverses, and the trader experiences losses.

How to Avoid It

-

Always pay attention to trading volume when analyzing S/R breaks.

-

Combine volume analysis with other technical indicators to confirm

S/R breaks.

Conclusion

Support and Resistance (S/R) levels can certainly help you understand the

language of the market. Be it your business venture in Japan, or your trades

in the market, you can enjoy both only after making informed decisions.

S/R levels provide critical insights into market dynamics and help traders

identify potential reversal points. Advanced market analysis tools, like

Bookmap, enhance S/R analysis through heatmaps, volume dots, display of

real-time order flow changes, and more.

Ready to experience the power of advanced visualization in identifying

Support and Resistance zones? Dive deeper and gain an edge in your trading

decisions with Bookmap.

Sign up now

and elevate your trading strategy.