December Trading

Deals Are Live!

Save on Global+, data access,

and add-ons.

See All December Deals

Black Friday

Nov 28-Dec 31

9 days : 22 hours

50% OFF Global+ Quarterly

+ 50% OFF Data (3 months)

Cyber Monday

Dec 1 - Dec 31

9 days : 22 hours

60% OFF Global+ Monthly

+ Data (1 month)

Add-on Deals

Dec 1 - Dec 31

9 days : 22 hours

50% OFF

Add-ons

New Year Sale

Dec 26 - Jan 1

3 days : 22 hours

30% OFF Global+ Lifetime

*Data not included

Education

October 15, 2024

SHARE

Market Participant Dynamics Pt 2: Metrics & Strategies for Navigating Price Influence

In contemporary financial markets, the impact of market participants holds

paramount importance. Each order placement, trade execution, and decision

made significantly contributes to the intricate process of price discovery.

So, gaining a strong understanding of the behavior of market participants is

fundamental.

We will delve into the strategies, metrics, and technologies that facilitate

excellence in navigating these dynamic and fiercely competitive markets.

Furthermore, we shall explore the profound influence exerted by market

players on asset prices. Let’s dive in!

Understanding Price Influence: Key Metrics and Tools

Metrics and tools play essential roles in helping market participants

understand and manage the impact of their trading activities on prices.

These instrumental tools serve two primary purposes:

-

Facilitating the formulation of well-informed trading decisions.

-

Mitigating risk within the complex landscape of financial markets.

Now, let us look at these metrics and tools in greater detail:

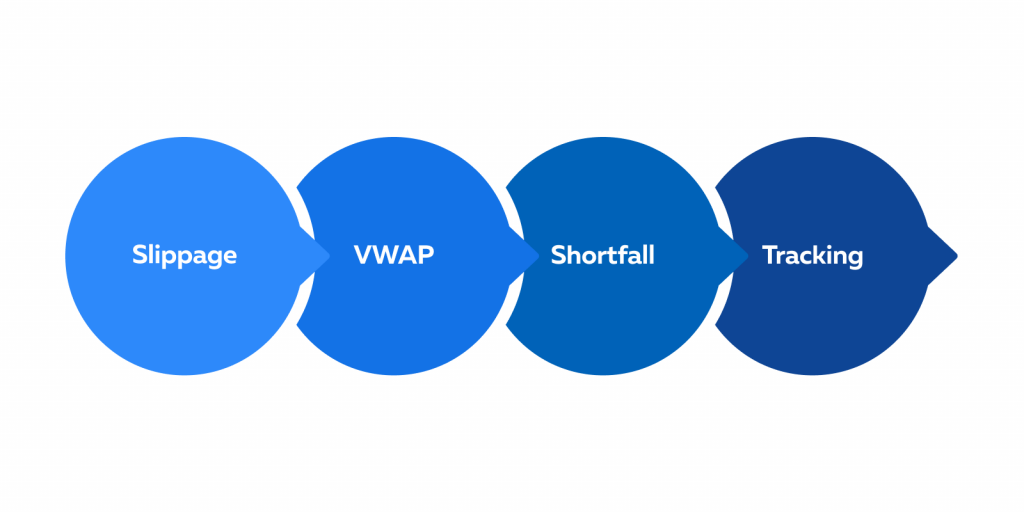

1. Slippage

Definition:

-

Slippage refers to the difference between the expected price of a

trade and the actual price at which the trade is executed. -

It arises when market participants place substantial orders,

particularly during highly volatile market conditions.

Impact:

-

Slippage results in traders obtaining a less favorable price than

initially anticipated. -

This leads to unexpected losses or reduced profits.

Causes:

-

Slippage can be caused by various factors, such as:

-

Market volatility

-

Order size relative to market depth

-

Speed of order execution

-

2. VWAP (Volume Weighted Average Price):

Definition:

-

VWAP serves as a trading benchmark used to assess the quality of a

trader’s execution. -

It helps traders benchmark their trade executions against the

average market price. -

It is primarily used to determine if traders achieved a favorable or

unfavorable outcome.

Calculation:

It calculates the average price of a security over a specified time, taking

into account the trading volume at each price level. The formula is as

follows:

VWAP= Price x VolumeVolume

Where,

-

“Σ” represents the summation symbol.

-

“Price” refers to the price at which each trade occurred during the

specified period. -

“Volume” represents the trading volume.

Usage:

Traders use VWAP to evaluate whether their trades were executed at prices

better or worse than the prevailing market conditions.

|

What’s the rule? |

What does it suggest? |

|

Trader’s execution price consistently exceeds VWAP |

The trader is performing skillful trading, obtaining |

|

Trader’s execution price consistently falls below VWAP |

The trader is executing inefficiently, obtaining prices |

3. Implementation Shortfall:

Definition:

Implementation shortfall is a metric used to quantify the efficiency of

trades. Traders and portfolio managers use implementation shortfall to

evaluate the success of their trading strategies.

Calculation:

Implementation shortfall is calculated as follows:

Implementation Shortfall=Decision Price-Actual Execution Price

Where,

-

The decision price is the price at which a trader decides to enter

or exit a position.

Usage:

Implementation shortfall can manifest in two forms, each assessing the

quality of trades:

|

1. Positive Implementation Shortfall |

This indicates that the trade was executed favorably. |

|

2. Negative Implementation Shortfall |

This signifies that the trade was not executed favorably |

4. Real-time Tracking:

Definition:

It refers to monitoring the behavior of other market participants. Real-time

monitoring enables traders and investors to make informed decisions and

react quickly to changing market conditions.

Tools:

To monitor real-time market participant behavior, traders use various tools

and technologies. These include:

-

Trading platforms

-

Algorithmic trading systems

-

News feeds and

-

Market data analytics

Understanding these key metrics and employing the right tools for real-time

tracking is essential for navigating the intricate landscape of financial

markets with confidence and precision.

Navigating Participant-Driven Price Movements: Strategies and Tools

Mastering the art of trade execution is paramount. It optimizes trade

execution and mitigates adverse price shifts. To do this, traders need a

deep understanding of:

-

Market dynamics

-

Order book depth

-

Timing

The strategic placement of orders helps traders strike a balance between

achieving their trade objectives and minimizing the impact of their actions

on market prices. Let’s explore this topic more.

Strategic Order Placement

The primary objective of strategic order placement is to achieve optimal

trade execution. This means:

-

Executing trades at favorable prices and

-

Simultaneously mitigating adverse price shifts.

Below are some key techniques for doing strategic order placement:

|

Common Techniques |

The Meaning |

How does it help traders? |

|

Iceberg Orders |

|

|

|

Time-Weighted Average Price (TWAP): |

|

a) distributing trading activity b) reducing the impact of the order on prices.

|

|

Limit Orders |

a) the highest price they are willing to pay (for buy b) the lowest price they are willing to accept (for sell |

|

|

Algorithmic Trading |

|

a) adapting to changing participant behavior. b) optimizing trade execution while minimizing price

|

|

Smart Order Routing |

Smart order routing systems analyze multiple liquidity |

This approach assists traders in: a) accessing the most advantageous prices. b) minimizing the impact of their orders on individual |

|

Staggered Orders |

|

|

Leveraging Algorithms for Order Management

As per most traders, large orders have a substantial impact on asset prices.

This makes leveraging sophisticated algorithms for order management a

strategic necessity. Several key algorithms that play a pivotal role in

achieving this objective are:

|

Algorithms |

Meaning |

Goal |

|

Percentage of Volume (POV) Algorithms |

POV algorithms execute trades as a percentage of the |

|

|

Volume-Weighted Average Price (VWAP) Algorithms |

VWAP algorithms execute orders in line with the volume

|

|

|

Time-Weighted Average Price (TWAP) Algorithms |

|

|

|

Algorithmic Pairs Trading: |

|

|

The Role of Dark Pools in Trading

Dark pools are discreet trading platforms allowing traders to shield

themselves against the immediate price effects caused by sizable market

participants. Let’s understand some of their key characteristics:

-

Private Trading Venues: Dark pools operate as off-exchange, private

trading platforms. -

Relative Obscurity: In comparison to traditional public stock

exchanges, dark pools operate in relative obscurity. -

Confidentiality: Dark pools provide a level of confidentiality; when

traders execute orders within a dark pool, their trades remain

undisclosed on public order books. -

Price Impact Mitigation: They serve to protect traders from

immediate price impacts. -

Block Trading: Dark pools are often employed for block trading,

making them advantageous for institutional investors needing to

execute substantial orders without market disruption.

Tools to Understand Market Influence

Having the right tools to understand and respond to market influence is

paramount. These tools empower traders with insights and capabilities. This

helps them make informed decisions and stay ahead in today’s fast-paced

trading environment. Let’s explore some common tools.

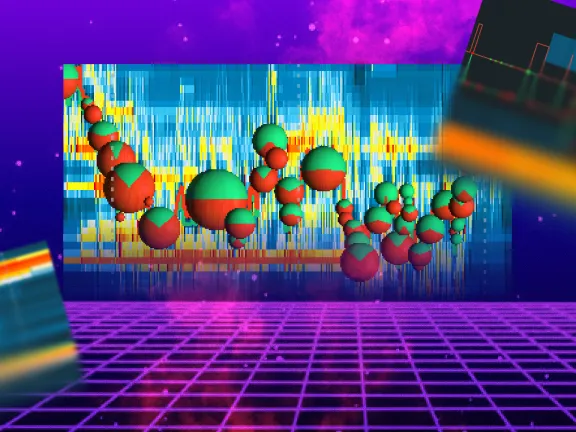

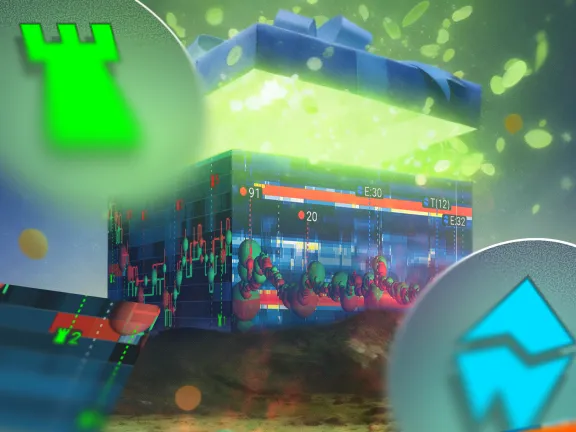

Harnessing the Precision of Real-time Data

Real-time data platforms, exemplified by tools like Bookmap, provide traders

with immediate and granular insights into market participant actions. They

equip them with the capability to anticipate and respond proactively to

potential price shifts. These tools display a continuous stream of live

market data, which includes:

-

Price movements

-

Order book depth

-

Trade volumes, and

-

Actions of other market participants.

How Does It Help?

The stream of live market data allows traders to:

-

spot trends

-

detect anomalies, and

-

understand the forces influencing price movements in real time.

For instance,

A trader using a tool like Bookmap can visualize the order book with

remarkable clarity through its heatmap feature.

-

This visualization provides a dynamic and color-coded representation

of order book liquidity. -

It highlights the key areas where buy and sell orders are

concentrated.

This helps traders to:

-

identify potential support and resistance levels

-

gauge market sentiment, and

-

time the entry or exit positions.

Visual Tools for In-depth Market Analysis

It is widely believed that information is not just power; it’s the

foundation of informed decision-making.

Specialized visualization tools, like Bookmap, offer innovative heatmaps.

This enables traders to see a granular view of the order book and helps in:

-

Conducting an in-depth market analysis

-

Revealing key areas of liquidity and potential price inflection

points

The Importance of Heatmaps

In recent times, heatmaps have emerged as a game-changing visualization tool

for traders. They take raw market data, such as bid and ask orders, and

transform it into a visually intuitive representation. Here’s how heatmaps

help traders:

|

What do heatmaps offer? |

How does it work? |

How does it help traders? |

|

Granular Order Book Insight |

|

Through color coding, traders identify specific price |

|

Immediate Visual Cues |

|

Traders can instantly recognize areas of concentration |

|

Dynamic Visualization |

Heatmaps are dynamic and get updated in real time. |

Traders can observe how the order book evolves as new |

|

Pattern Recognition |

Heatmaps display all the emerging trends and patterns. |

Traders can notice recurring behaviors, such as |

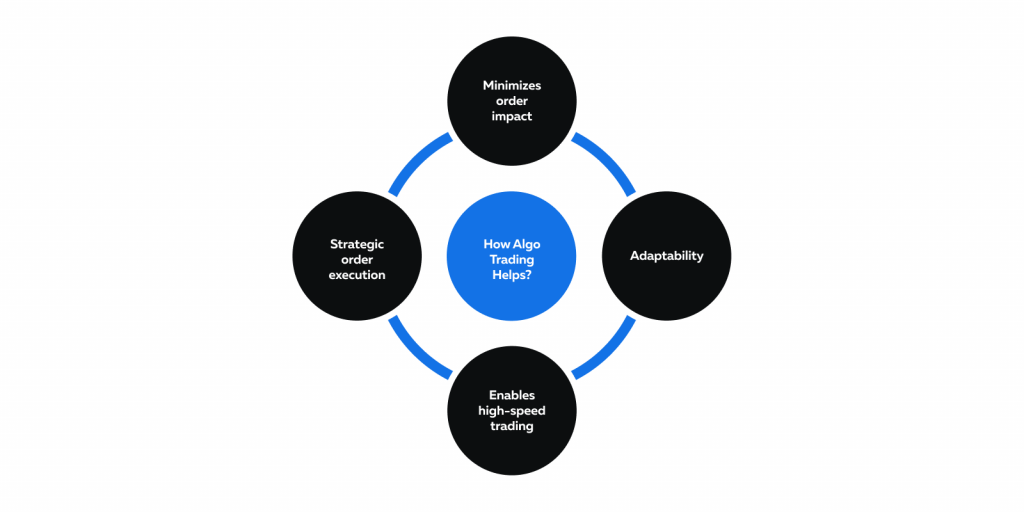

The Rise of Algorithmic Strategies

The algorithmic strategies can strategically disperse and manage orders.

This ultimately minimizes the immediate price influence of large trades and

ensures smoother and more efficient market interactions. Let’s understand

how it helps traders:

-

Strategic Order Execution:

-

Algorithmic strategies analyze a multitude of factors, such as:

-

Market conditions

-

Historical data, and

-

Real-time information

-

-

It creates an optimal execution plan and executes orders

strategically.

-

-

Minimizing Market Impact:

-

When traders execute sizable orders all at once, they can

disrupt market equilibrium. -

Algorithms fragment these orders into smaller and more

manageable portions that are spread out over time and across

various venues.

-

-

Adaptability:

-

Algorithmic strategies are highly adaptable.

-

They automate the execution process and allow traders to execute

large orders efficiently.

-

-

Enables High-speed Trading:

-

Speed is of the essence in algorithmic trading.

-

These strategies can execute orders in milliseconds.

-

This helps in:

-

Capitalizing on fleeting market opportunities and,

-

Reacting to changing conditions faster than human traders

can.

-

-

Conclusion

In the ever-evolving world of trading, recognizing the profound influence of

market participants is paramount. Metrics such as slippage, VWAP, and

Implementation Shortfall serve as vital tools for traders, enabling them to

precisely execute trades and assess their efficiency. Equally essential are

the techniques and strategies that empower traders to adeptly maneuver in

participant-influenced market conditions.

In this context, the importance of leveraging modern tools cannot be

overstated. Real-time data platforms and visualization aids, exemplified by

tools like Bookmap with their heatmaps, offer traders a competitive edge.

These tools provide invaluable insights for adapting to and predicting

market shifts with precision.

A comprehensive understanding, combined with the right tools, equips traders

to excel in a market where participant behavior significantly shapes price

dynamics. Those who master these aspects position themselves for success in

a world where knowledge, strategy, and precision are the keys to thriving.

Ready to elevate your trading with cutting-edge tools and insights? Join our

community today and unlock a world of advanced trading knowledge.

Sign Up Now!