Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

October 26, 2024

SHARE

How Bookmap Order Flow Provides Stock Traders With An Edge?

Most trading platforms have well-known candlestick charts. On their basis, traders make technical analysis using indicators, drawing tools, looking for candlestick patterns and price formations. But despite their popularity, the candlestick chart shows OHLC prices. This limits the vision and understanding of the causes of price movement.

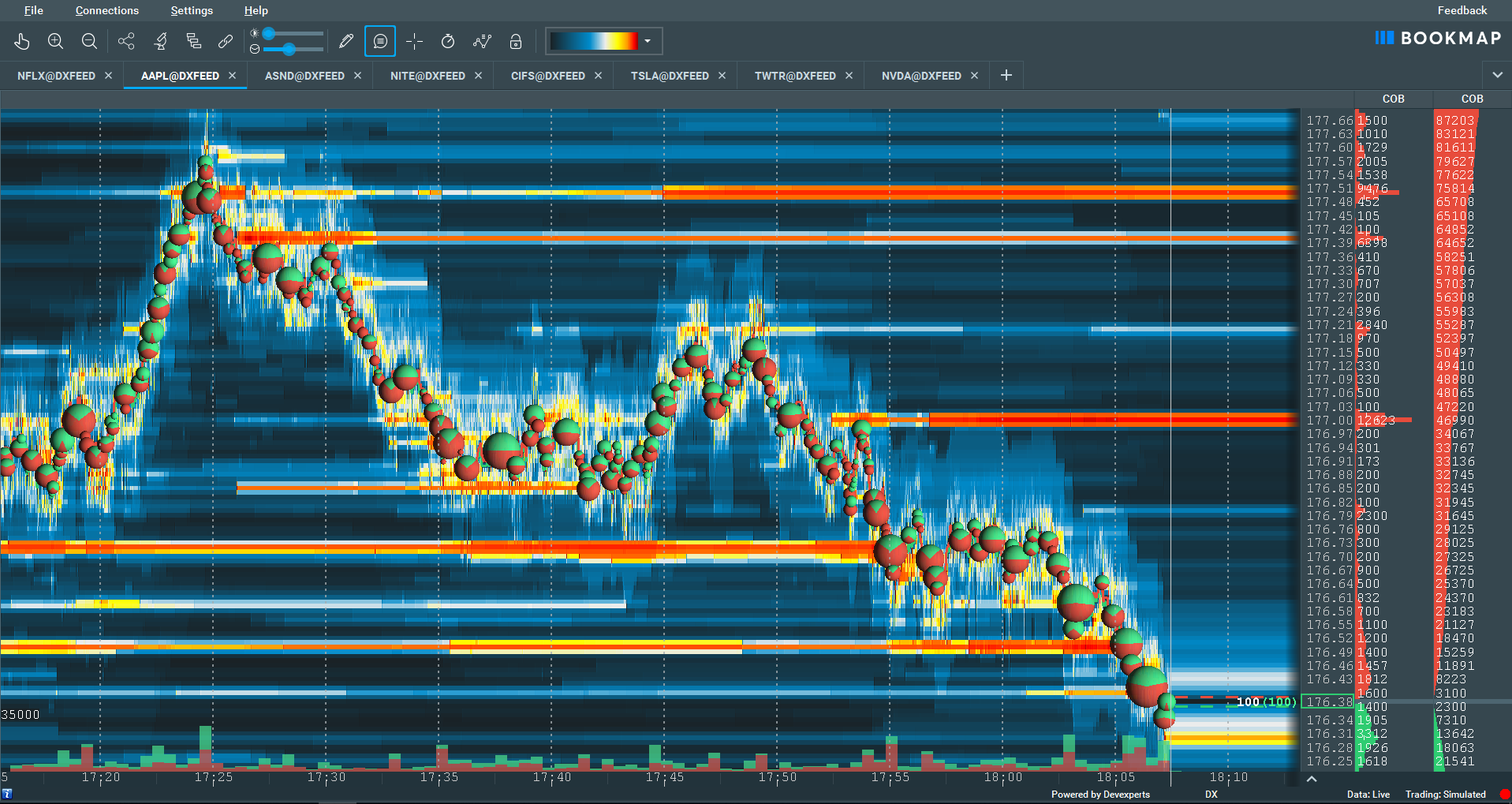

Bookmap platform, in collaboration with the dxFeed data provider, provides stock traders the visualization of extended market data. Right on the chart traders can enable unfiltered Best Bid/Ask lines, Volume Dots, an evolution of current and historical Limit Order Book as a heatmap, and much more.

Candlestick chart does not show the most important trading information

Using these features traders will see:

- full market transparency and actions of all traders

- at what levels large orders are concentrated

- how changes in liquidity affect the future price movements

- how large traders set traps and how to avoid them

General view of Bookmap platform

What Is an Order Flow Chart and Why It Matters

An order flow chart shows the real-time interaction between liquidity, limit orders, and executed trades. Traders use it to read order flow patterns, understand shifts in buying and selling pressure, and identify where liquidity is forming or disappearing. Unlike traditional charts, an order flow chart highlights the cause of price movement rather than only the outcome.

Heatmap is the key element of Bookmap

Most platforms that provide an Order Flow analysis show market activity in the form of Footprint chart. This allows you to see the actual execution and the number of aggressive buyers and sellers. But this type of chart does not show the levels of limit orders accumulation and the place of liquidity formation.

Order Flow Analysis Visualizations Explained

Order flow analysis visualizations, such as heatmaps and volume-based markers, help traders interpret market behavior with far greater clarity. These visual tools reveal whether liquidity is adding, pulling, or holding firm at key levels. They also highlight how executed volume interacts with resting orders, allowing traders to anticipate potential continuation or reversal zones.

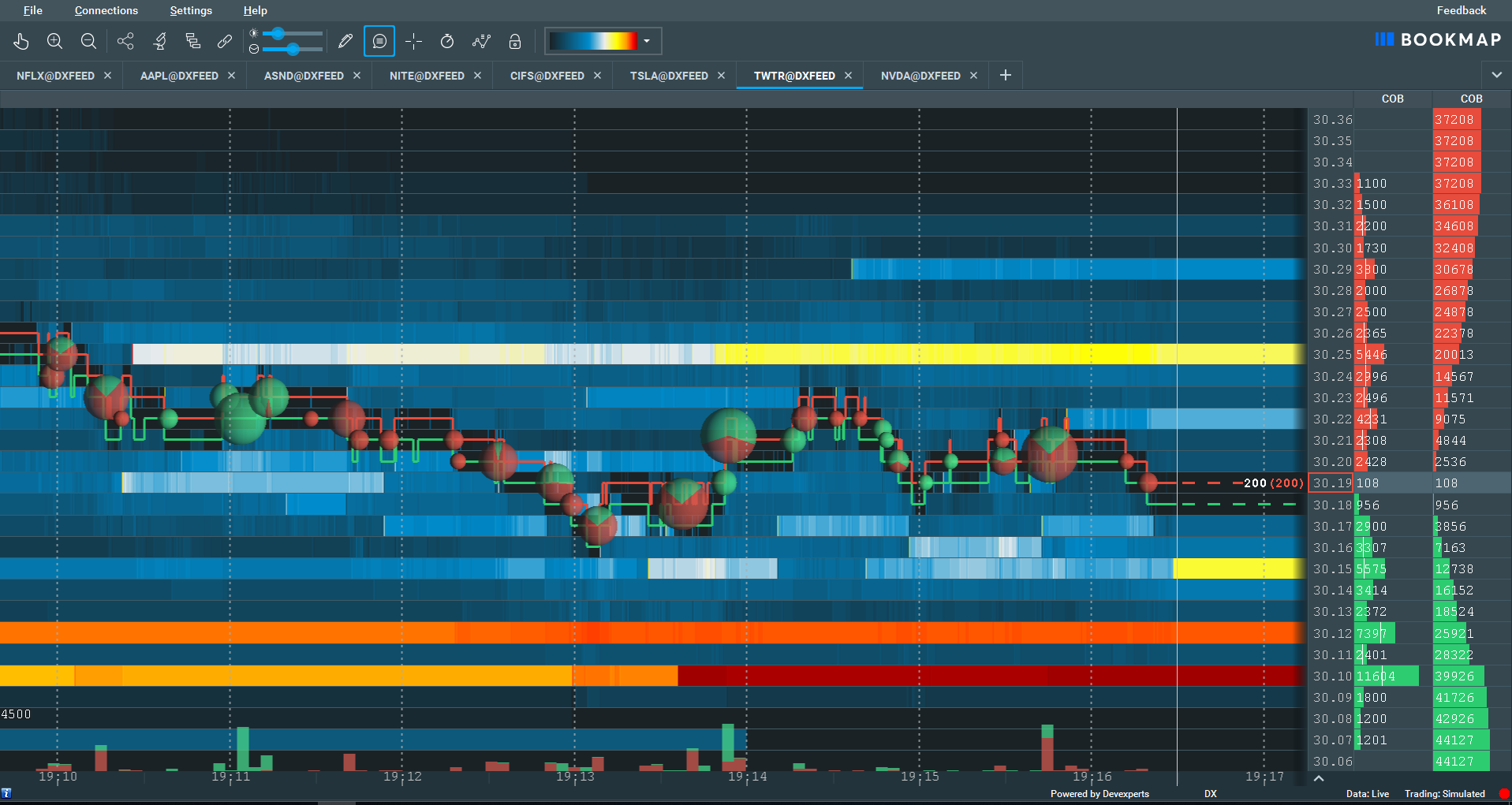

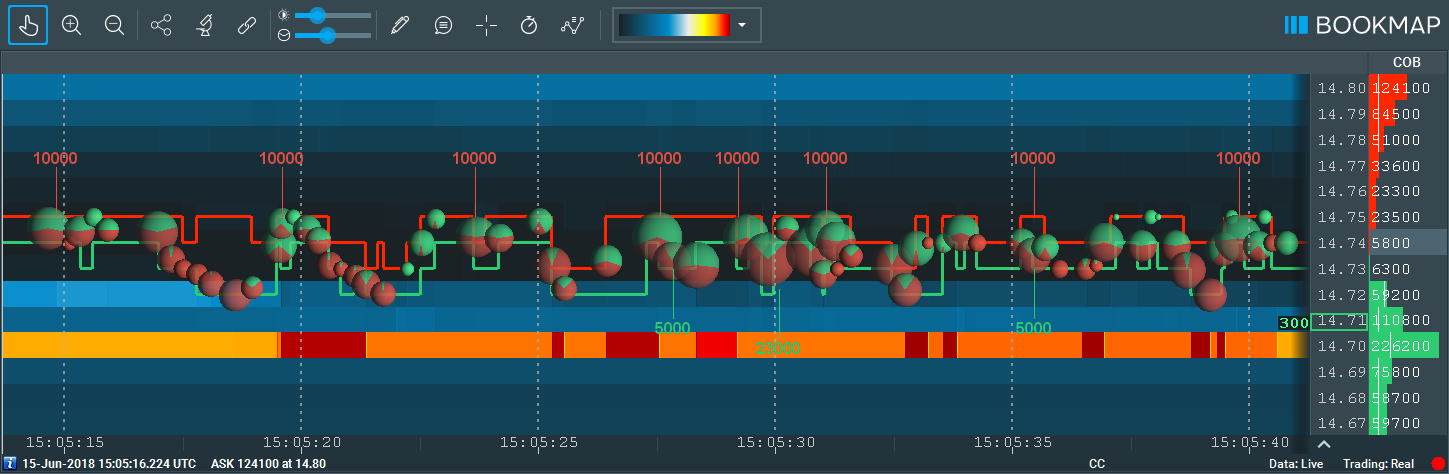

With Bookmap, any change in the order book — placement, change, cancellation, or execution — is displayed on the chart as Heatmap view. The more limit orders placed on a certain level, the brighter the level displayed on the map. Thus, the trader sees the full picture of the market, the current mood and the intention of other participants in the trading process.

Brighter heatmap fields symbolize a large number of shares in the order book

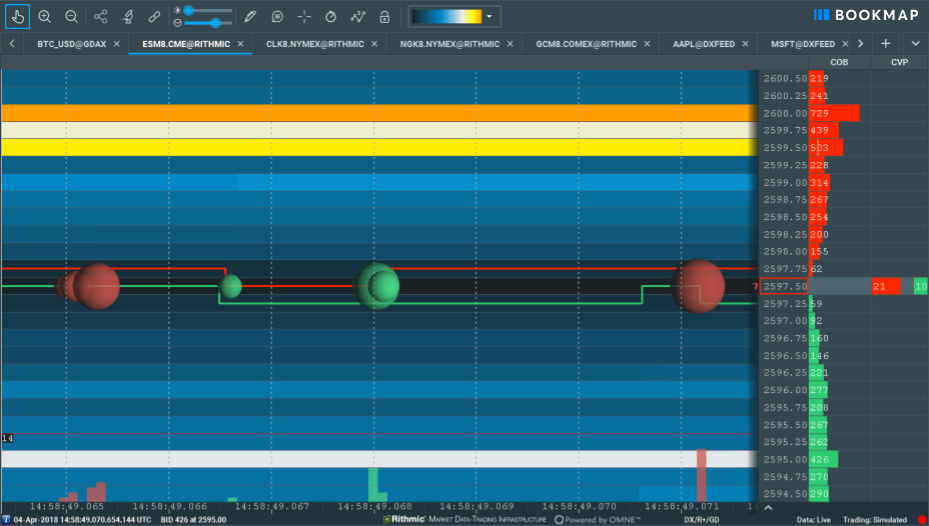

In addition to basic market data, Bookmap provides traders a full Order Depth in real-time. Chart scaling to nanoseconds allows you to see the sequence and exact time of order execution. By default Bookmap chart updates at a rate of 40 frames-per-second, displaying the market in real-time with a CPU consumption of 1-3% per chart. This has become possible thanks to advancements in video-card GPU technology.

Best Bid and Offer lines represent the highest buyers and the lowest sellers price. This helps to see how the spread changed over time and under what market actions.

Seeing how the market liquidity is changing gives you a huge advantage. If you add executed trades to the chart, you will see how the price reacted to the liquidity levels. Volume Bubbles shows the volume of executed trades in a specific period. Its size depends on the number of executed contracts. The division of the circle into the red and green sections indicates how much of the total amount refers to buy or sell aggressive trades. Thus, traders receive important information about who controlled the market situation. Increasing the chart to millisecond allows you to see how orders were executed.

Volume Bubbles represent the executed trades at a specific point

How Order Flow Charts Compare to Footprint Charts

A footprint chart shows executed volume inside each price bar, while an order flow chart displays both executed volume and the evolving depth of the order book. Traders analyzing futures often combine a footprint chart with an order flow chart for cumulative delta, but Bookmap simplifies this by visualizing depth, liquidity shifts, and trade aggression in one view.

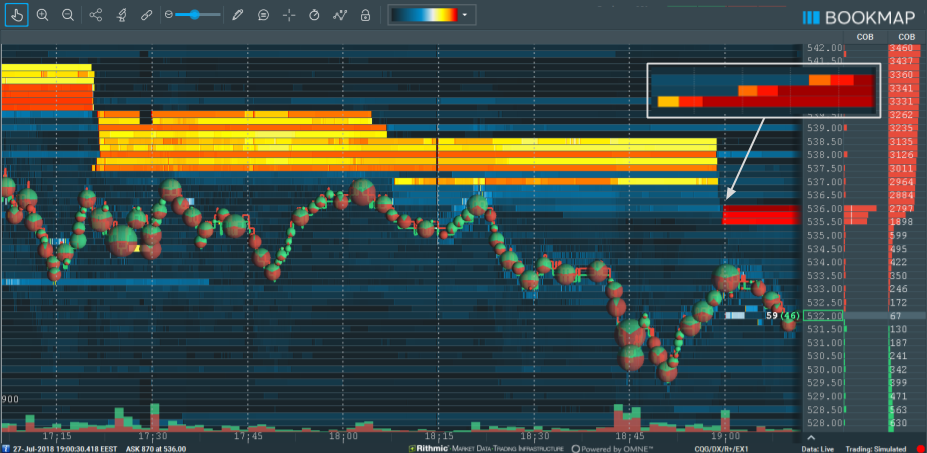

It’s not a secret that large order size on the stock market has a significant effect on price. Therefore, to minimize this effect, large traders use different trading algorithms and special order types like Iceberg order. Using such orders, a market maker or large trader can divide the full order size into parts, and hides the real volume from other participants. With the help of the Iceberg Detector functional, all hidden orders are visible on the chart. Such orders are shown on the chart, as numbers near Best Bid & Offer lines.

Bookmap uncovers Iceberg orders and displays them on a chart

In the example below, you can see how a large trader sets significant amounts of buy orders near the best ask price, causing the price to move up. You can see how the trader placed orders of different sizes, at different prices, and various time, to be undetected by other algorithmic traders. But this activity is easily spotted with a single glance at Bookmap chart.

How to Read Order Flow Patterns in Stocks

Reading order flow patterns involves tracking how liquidity behaves at key levels and how aggressive buyers or sellers interact with that liquidity. For stock traders, recurring patterns include absorption at major levels, liquidity sweeps, spoofing activity, and sudden shifts in depth that precede breakouts or reversals. An order flow chart helps expose these behaviors in real time.

Large Trader placed orders with various size, price and on different time

By using the Imbalance indicators, the trader will at a glance understand who influences the price – buyers or sellers. For instance, if the Order Book Imbalance shows + 50%, this indicates the interest of buyers to raise the price higher. On the other hand, this may indicate the intention of sellers to push price higher to facilitate their short positions.

If the Volume Imbalance value is in the positive zone, it will tell about the overbalance of buy market orders and vice versa.

Trade Data Visualization for Better Market Analysis

Modern trade data visualization tools help traders move beyond static charts by displaying how the order book evolves second by second. This supports traders who rely on volume trading techniques, liquidity tracking, and microstructure-based decision making. Seeing these dynamics in real time helps clarify whether participants are absorbing, initiating, or avoiding trades at specific prices.

All these tools provide stock traders with excellent clues to what the market might be trying to do and how it might react to certain prices. By analyzing the Order Flow, it becomes clear the intentions and expectations of market participants to future price movements.

Connectivity to major US stock exchanges & ECNs provides full market depth data that enable you to stay one step ahead in the highly competitive markets.

Discover more profitable trades with powerful order flow analysis tools. Start using reliable stock market data with Bookmap and dxFeed.

FAQ

How does Bookmap help stock traders compared to traditional candlestick charts?

Unlike candlestick charts that only show OHLC prices, Bookmap provides real-time visibility into liquidity, order flow, and market participant behavior, offering a much clearer view of why prices move.

What is the role of the Heatmap in Bookmap?

The Heatmap visualizes the placement, movement, and cancellation of limit orders over time. Brighter areas represent higher liquidity, helping traders spot support, resistance, and hidden market activity.

How does Bookmap detect hidden orders like Icebergs?

Bookmap’s Iceberg Detector reveals hidden large orders near the best bid and ask, displaying them directly on the chart so traders can identify institutional activity that would otherwise be invisible.

What is the advantage of using Imbalance indicators in Bookmap?

Imbalance indicators show which side — buyers or sellers — has greater control of the market, helping traders anticipate price direction based on real-time shifts in order flow and liquidity.

What is an order flow chart?

An order flow chart is a visual display of real-time liquidity, depth, and executed trades. It helps traders understand why prices move by revealing the underlying behavior of buyers and sellers.

How do you read order flow patterns?

To read order flow patterns, traders watch how liquidity changes at key levels and how executed trades interact with that liquidity. This highlights activity such as absorption, exhaustion, spoofing, or aggressive buying and selling.

What are the best order flow indicators to watch?

Common order flow indicators include liquidity heatmaps, volume bubbles, bid and ask updates, and imbalance metrics. Together, these tools show which side of the market is in control.

Can Bookmap be used as an order flow chart for futures trading?

Yes. Although the article focuses on stocks, Bookmap is widely used as an order flow chart for futures trading, offering real-time depth, liquidity tracking, and cumulative volume tools for futures markets.

What is the benefit of using cumulative delta with order flow?

Cumulative delta helps traders understand whether aggressive buyers or sellers dominate over time. When combined with order flow visualizations, it offers deeper insight into the intent behind price movement.

Are you looking for software, or to learn what an order flow chart is?

Order flow charts can refer either to the concept itself or to specific software platforms that visualize liquidity and executed trades. If you’re trying to understand the method, the article covers the fundamentals. If you’re looking for software, Bookmap provides a real-time order flow chart tailored for stocks, futures, and crypto.

Which market are you analyzing — stocks, futures, or crypto?

Order flow charts work across all major markets, but the behavior of liquidity and execution varies. Stock traders often focus on depth changes and hidden orders, futures traders look at imbalances and absorption, and crypto traders pay close attention to volatility and liquidity gaps. Bookmap supports all three.

Are you looking for a specific order flow indicator or a complete chart type?

Some traders only need a single tool, like cumulative delta or an imbalance indicator. Others want a complete order flow chart that shows depth, liquidity shifts, and executed trades in one view. Bookmap combines all key order flow indicators into a unified chart for easier interpretation.