Ready to see the market clearly?

Sign up now and make smarter trades today

Education

April 2, 2024

SHARE

Smart Money Moves: Investment Strategies for Young Adults in 2024

The stock market is designed to transfer money from the active to the patient. This statement is attributed to legendary investor Peter Lynch and reflects the importance of smart investment strategies for young adults. In this article, we will cover some key strategies such as starting to invest early, managing debt wisely, and diversifying portfolios. We will also explore the role of technology in modern investing and discover the usage of investment apps, podcasts, and online courses to stay informed.

We will learn about cryptocurrencies, what makes cryptocurrencies so attractive to young investors, and how they can use this emerging asset class to achieve their financial goals. Let’s begin.

Understanding the 2024 Economic Landscape

To make smart investment strategies, young adults must understand the economic landscape. It is usually defined by global economic trends, which are influenced by various factors, such as:

- Ongoing trade negotiations,

- Shifts in major economies, and

- The impact of regulations on market stability.

Let’s understand these key points below:

Ongoing Trade Negotiations

The ongoing trade negotiations and agreements between major economies such as the U.S., China, and the EU have significant impacts on the global markets. For example, the failure to start a new round of multilateral trade negotiations at the WTO conference in Seattle could hinder the progress of global trade liberalization and growth prospects.

The International Monetary Fund (IMF) also considers a successful trade round to be an important step toward:

- Raising global growth prospects and

- Strengthening the international trading system.

Shifts in Major Economies

The U.S., China, and the EU are major players in the global economy. Changes in fiscal policy or regulations in these countries can have a ripple effect on the global markets. For instance, the U.S. and China introduced tariffs in 2018, which curbed trade between the two countries but did not reduce trade overall. Instead, trade was reallocated among other countries.

European Union Regulations

The European Union’s regulations impact market stability. For example, high energy prices stemming from the Russia-Ukraine war squeezed household spending and raised inflation in Europe.

Preferential Trade Agreements

The majority of preferential trade agreements occur between emerging economies. This situation leads to:

- More trade between developing countries (South-South trade) and

- Less trade between developed and developing countries (North-South trade).

How Will the Economic Landscape Unfold in 2024?

Based on forecasted data and research reports, the economic landscape in 2024 is expected to be characterized by slower growth, but less volatility. Additionally,

- The US economy and job growth are expected to slow down. However, this outlook has improved after the Fed said it’s probably done raising interest rates.

- The ongoing Ukraine war is the biggest looming risk. It can escalate and lead to a potentially tenuous energy supply situation.

- The global economy is expected to decelerate in 2024 as the effects of monetary policy will take a broader toll.

- Consumer spending growth is expected to stay positive overall in 2024 but at a lower rate than in 2023.

- Most firms expect their price growth next year to remain above pre-COVID levels.

How do Local Economic Factors Affect Investments?

Several local economic factors such as job market trends, housing market fluctuations, and inflation rates impact investment decisions for young adults. Let’s explore how:

-

- Job Market Trends:

- Unemployment Rates:

- High unemployment rates indicate a challenging job market.

- These rates affect young adults’ ability to secure stable employment.

- Lack of income stability impacts wealth accumulation and the ability to make rational investment decisions.

- Unemployment Rates:

- Housing Market Fluctuations:

- Housing affordability directly impacts young adults’ decisions to rent or buy.

- High housing costs lead to delayed homebuying or increased reliance on rental properties.

- Job Market Trends:

- Inflation Rates:

-

- Inflation erodes the purchasing power of money.

- Central banks adjust interest rates to control inflation.

- Changes in interest rates impact the cost of borrowing for young adults and influence their decisions related to loans and mortgages.

How Are The Current Job Market Conditions?

The current job market is characterized by a low unemployment rate. As of December 2023, the unemployment rate in the United States was 3.7%. This low unemployment rate indicates a tight labor market, which can lead to increased earning potential for workers.

Additionally,

- The job openings and labor turnover summary report showed that job openings increased to 8.8 million in November 2023. This increase reflects a strong demand for labor.

- In terms of emerging career sectors,

- The U.S. Bureau of Labor Statistics projects that total employment is expected to grow by almost 4.7 million from 2022 to 2032.

- The healthcare and social assistance sector is expected to drive the primary growth.

- Due to high demand, careers in the health care and social assistance sector will offer:

- Increased earning and

- Saving capacities.

Starting with the Basics: Building a Strong Financial Foundation

Building a strong financial foundation is crucial for young adults starting their careers or recent graduates. They must prioritize:

- Creating a budget,

- Building an emergency fund,

- Understanding personal cash flow, and

- Managing debt.

Let’s understand how you can create a budget:

| Steps | Explanation |

| Assess Income | Identify all sources of income, including:

|

| List Expenses | Categorize expenses into:

|

| Set Financial Goals | Define short-term and long-term financial goals. For example, saving for a trip or building an emergency fund. |

| Allocate Budget | Firstly, allocate funds for necessities. Then, focus on discretionary spending based on priorities and goals. |

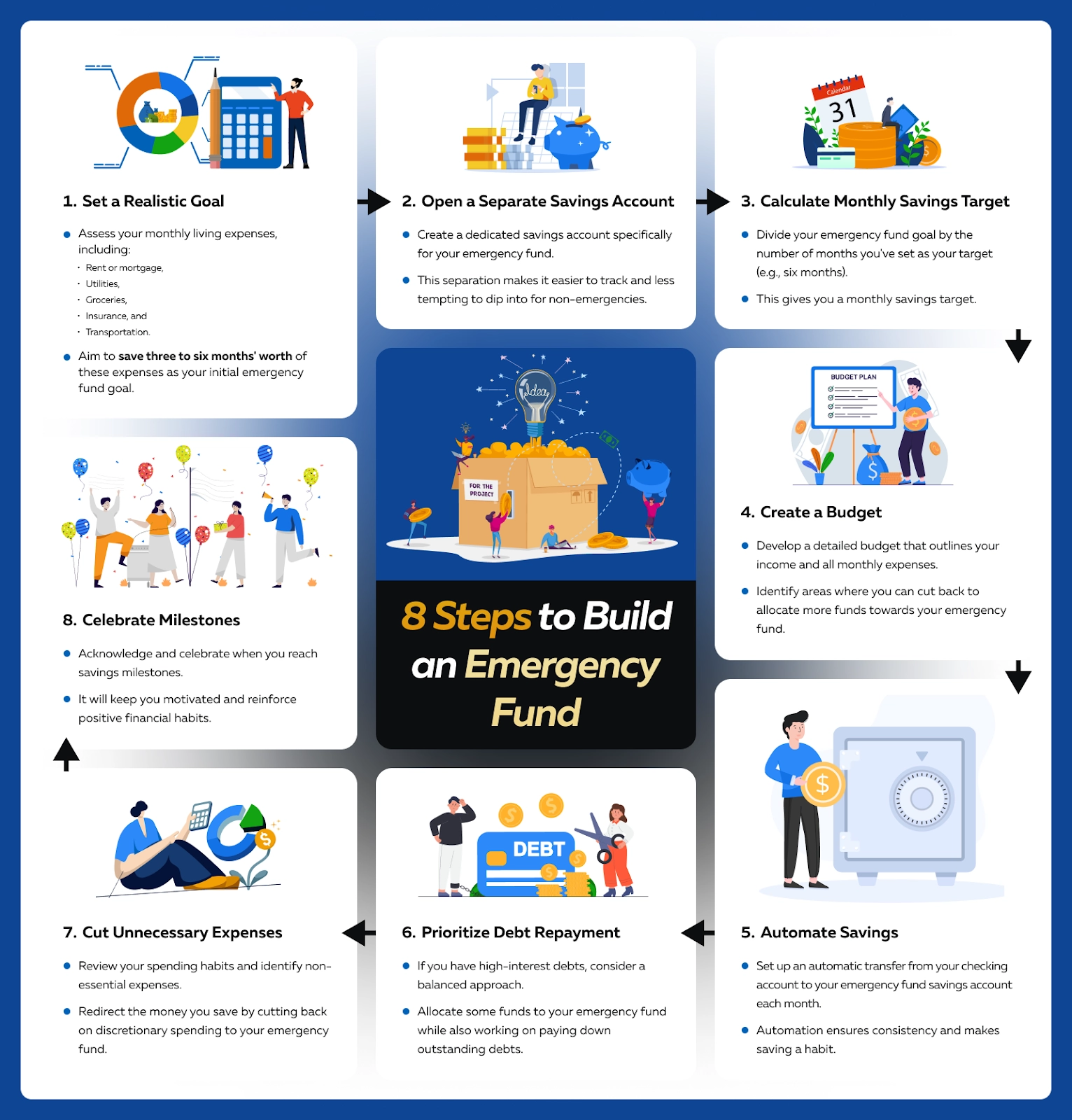

How to Build an Emergency Fund

Building an emergency fund offers several significant benefits. It provides a financial safety net and offers peace of mind in times of unexpected expenses or emergencies. Knowing you have funds set aside can alleviate stress during challenging situations. Here’s how you can build an emergency fund:

How Does Debt Management Help?

Effective debt management plays a crucial role in achieving financial well-being and stability and alleviating financial stress. Knowing that you have a plan in place to address your debts:

- Provides peace of mind and

- Improves your overall well-being.

Additionally, timely payments and responsible debt management contribute to a positive credit history.

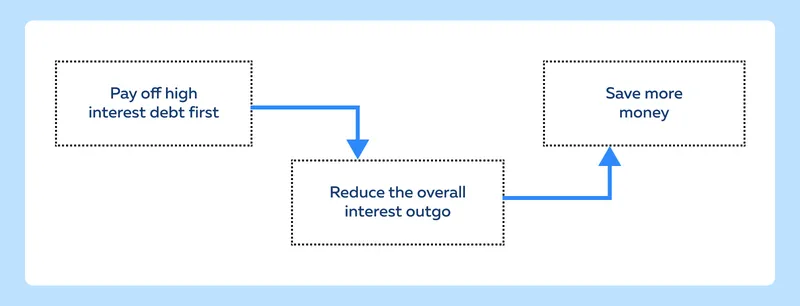

Effective debt management involves prioritizing high-interest debts. By paying off high-interest debts first, you can reduce the overall amount you pay in interest, saving you money in the long run. You can also prevent yourself from falling into a debt spiral, where high-interest rates and accumulating fees make it challenging to pay down the principal amount.

As you pay down your debts, you gain more financial flexibility, which allows you to allocate funds to other financial goals, such as:

- Building an emergency fund,

- Saving for retirement, or

- Investing.

How to Manage Student Loans in 2024?

Young adults can manage student loans in 2024, through several options, such as:

- By exploring refinancing options or

- Opting for government forgiveness programs.

Refinancing student loans can help reduce interest rates and monthly payments. As a borrower, you can shop around with different lenders to find the best rates. Now, let’s have a look at some popular forgiveness programs:

| Plans | Explanation |

| Income-Driven Repayment (IDR) Plans |

|

| Public Service Loan Forgiveness (PSLF) |

|

| Saving for a Valuable Education (SAVE) Plan |

|

| Loan Forgiveness Programs |

|

The Power of Compound Interest

Compound interest is the process of earning interest not only on the initial principal amount but also on the accumulated interest from previous periods. In simple terms, it’s interest-earning interest. This compounding effect has a significant impact on long-term wealth accumulation.

How Compound Interest is Beneficial

- Compound interest magnifies the growth of investments over time.

- By reinvesting earnings, the base on which future interest is calculated increases. This increase leads to exponential growth.

- The compounding effect is particularly powerful in long-term investments.

- It allows individuals to use time to build substantial wealth.

Indeed, compound interest is a powerful weapon that can build wealth over time. However, it’s better if you begin investing as early as possible.

The earlier one starts, the more time their money has to work for them, ultimately leading to greater wealth accumulation. Let’s understand this situation through a real-life scenario.

Let us assume there are two individuals: Alice and Bob.

| Alice starts early | Bob starts later |

|

|

Here’s how their investments grow over time:

- Alice’s Investment:

- At the end of the first year, Alice’s investment grows to $1,070 (initial investment + 7% interest).

- At the end of the second year, her investment grows to $2,161.9 ($1,070 + 7% interest on $1,070).

- This process continues, and by the time Alice reaches 65, her total investment is worth significantly more due to the compounding effect.

- Bob’s Investment:

- Since Bob started later, he has fewer years for compounding to work.

- While he also contributes $1,000 per year and earns a 7% return, his total investment at 65 is less than Alice’s.

Interpretation:

- Even though both Alice and Bob invested the same amount annually and earned the same rate of return, Alice’s early start gave her investment more time to compound.

- The compounding effect means that Alice’s total investment at 65 is substantially higher than Bob’s.

Diversifying Investments: Exploring Various Asset Classes

Diversification is a risk management strategy that involves spreading investments across different asset classes to reduce the impact of poor-performing assets on the overall portfolio. By holding a mix of investments, investors aim to achieve a balance between risk and return.

Illustrating Diversification

- An investor has a portfolio consisting of stocks, bonds, and alternative investments.

- While stocks offer higher returns, they also come with higher volatility.

- On the other hand, bonds provide stability but offer lower returns.

- Alternative investments, such as real estate or commodities, can further diversify the portfolio.

When an investor diversifies, if one asset class underperforms, the impact on the entire portfolio is mitigated by the positive performance of other assets. This balancing act helps protect the portfolio during market fluctuations.

How Young Investors Should Invest

To practice diversification, young investors can refer to different asset classes. Explore them through the table below:

| Assets | Explanation |

| Stocks |

|

| Bonds |

|

| Alternative Investments |

|

| Cryptocurrency |

|

The ESG Investments

Amid all the asset classes mentioned above, there is a growing popularity for an investment asset called ESG (Environmental, Social, and Governance). It represents a set of criteria that investors use to evaluate companies and make investment decisions based on a company’s performance in these three areas.

ESG-focused investments integrate environmental, social, and governance factors into the investment process. Let’s understand its importance:

-

- Companies that perform well in ESG criteria are often better at managing risks.

- ESG investing allows individuals to invest in companies that align with their values.

- ESG investors can support businesses that are:

- Socially responsible,

-

- Environmentally conscious, and

- Exhibit strong governance practices.

The Cryptocurrency Investments

Cryptocurrencies operate on blockchain technology and young adults are early adopters of technology. This inclines many young adults towards investing in cryptocurrencies then traditional assets. Furthermore, the inclination is a result of constantly:

- Seeking alternatives to traditional financial institutions,

- Appreciating the decentralized nature of cryptocurrencies and

- Having the urge to control over their financial assets.

Since its launch, cryptocurrencies have shown the potential for rapid and substantial returns. However, owing to higher volatility and chances of manipulation, young adults should prefer using advanced analytics tools like Bookmap for a competitive advantage.

Key Features of Bookmap’s Crypto Subscription

Bookmap’s crypto subscription is tailored for crypto traders and is designed to meet their unique needs. Using its key features, crypto traders can gain a comprehensive understanding of market dynamics by staying informed about:

- Market movements,

- Depth of Market,

- Trading volumes,

- Advanced analytics, and much more.

Let’s explore some of the key features:

| Key Features | Usage |

| Multibook Technology | Visualize and analyze multiple order books simultaneously. |

| Advanced Trading Insights | Gain in-depth insights into:

|

| Real-time Order Flow | Track buying and selling pressure and identify potential price trends. |

As a young adult, don’t get tricked by veteran crypto traders. To understand the market deeply and make smart trading moves, use Bookmap today!

Embracing Technology in Investing

The rapid advancements in investing technology provide unprecedented access, convenience, and innovation for investors. Currently, there is an increased usage of investment apps and robo-advisors. They have completely changed how individuals manage their portfolios. You can use them easily with just a few taps on your smartphone and can:

- Access real-time market data,

- Execute trades, and

- Monitor your investments from anywhere.

Top 4 Popular Investment Apps of 2024

| Investment Apps | Explanation |

| Bookmap |

|

| Fidelity Spire |

|

| Betterment |

|

| Binance.US |

|

How Does Staying Informed Help?

Staying informed is not just beneficial; it’s a crucial component of successful investing. Digital resources, such as financial news apps, podcasts, and online courses, play an important role in keeping investors up-to-date and educated. Let’s understand their benefits:

- Financial news apps provide real-time updates on:

- Market trends,

- Economic indicators, and

- Breaking news.

- Podcasts offer a convenient way to consume expert insights and analysis while on the go. Investors can tune in to discussions on market trends and expand their knowledge.

- Online courses offer structured learning experiences tailored to specific aspects of finance and investing.

Additionally, young adults and investors can refer to Bookmap’s learning center. It stands as a valuable resource for investors seeking comprehensive educational content. Enhance your understanding of financial markets and trading strategies now. Visit Bookmap’s learning center.

Conclusion

Young adults can begin accumulating wealth in 2024 through smart investing strategies. By starting early, managing debt wisely, and diversifying portfolios they can achieve their financial goals.

Continuously learning via platforms like Bookmap’s Learning Center ensures that young investors stay ahead in the dynamic markets. They must also leverage the power of compounding and allow time to work in their favor. By combining discipline with knowledge, young adults can position themselves for long-term success in 2024.

Ready to take your investment journey to the next level? Dive deeper into the world of trading with our comprehensive guide: Trade via Bookmap: A Detailed Step-by-Step Guide. Discover how Bookmap’s tools can enhance your trading strategy and decision-making process.