20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

September 21, 2024

SHARE

Swing Trading Explained: Strategies for Capturing Short-Term Price Swings

Swing trading, a dynamic approach to financial markets, allows traders to capture short-term price movements within financial markets. By merging elements from both day trading and longer-term investing, swing trading offers traders with a balanced blend of flexibility and versatility.

Through this article, we will explore the fundamentals of swing trading, discuss the key concepts, and delve into the powerful tool of Bookmap, which can enhance swing trading strategies.

Let’s dive in and uncover the essentials of swing trading and how to leverage the advantages it offers.

What is Swing Trading?

At its essence, swing trading is the process of buying and selling financial instruments, such as stocks, currencies, or commodities, to profit from short to intermediate-term price movements. Unlike day trading’s frenetic pace, swing trading thrives on holding positions for a span spanning from a few days to several weeks, with the typical duration hovering around 2-3 days.

Most swing traders use technical analysis tools, such as chart patterns, moving averages, and momentum indicators, to identify potential entry and exit points for their trades.

Why is Swing Trading Attractive to Traders?

-

It allows for potentially quicker and more frequent trades compared to long-term investing or day trading.

-

Swing traders can make better trading decisions by taking advantage of:

-

Short-term news events

-

Market sentiment changes

-

Technical indicators

-

-

By focusing on shorter timeframes, swing traders avoid prolonged market exposure. This reduces the risk associated with holding positions for extended periods.

-

Capturing short-term price swings provides opportunities for earning profits in both bullish (upward trending) and bearish (downward trending) market conditions.

Key Differences: Swing Trading vs. Scalping vs. Day Trading

Swing trading, scalping, and day trading are three distinct trading styles. All of them differ in terms of:

-

Timeframes

-

Objectives, and

-

Risk profiles.

Here are the key differences among them:

|

Trading Style |

Timeframe |

Primary Objective |

Risk Profile |

|

Swing Trading |

The position is held for several days or weeks. This timeframe stands in stark contrast to the rapid-fire transactions of day trading or scalping. |

The aim is to capture short to intermediate-term price swings. |

|

|

Scalping |

Scalpers hold positions for very short periods, often seconds to minutes.

|

Scalping aims to profit from small price movements by executing a large number of trades in a single day. |

|

|

Day Trading |

Day traders open and close positions within the same trading day, with no overnight positions.

|

The goal of day trading is to capitalize on intraday price fluctuations. |

|

Risks Associated with Holding Trades Overnight

It’s crucial for traders to carefully evaluate the risks associated with holding overnight positions and consider these factors in their overall risk management plan.

Holding trades overnight has several risks:

-

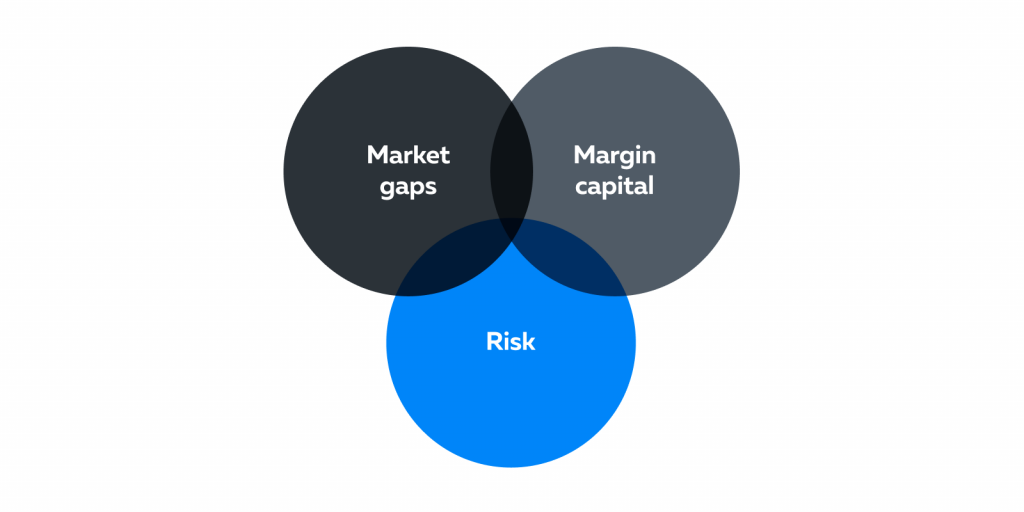

Market Gaps:

-

Outside of regular trading hours, news events or market developments can lead to significant price gaps or shifts when the market reopens.

-

These gaps can result in substantial losses for traders with overnight positions.

-

-

-

Margin Capital:

-

Overnight positions tie up margin capital.

-

This limits the trader’s ability to take other opportunities or manage risk effectively.

-

-

-

Increased Risk:

-

Traders must consider the potential for overnight risks in their risk management strategies.

-

This usually involves:

-

Setting stop-loss orders or

-

Adjusting position sizes to account for potential gaps.

-

-

Fundamentals of Swing Trading Strategies

Swing trading strategies provide a structured framework for making informed trading decisions and managing risk. These strategies help traders avoid impulsive decisions driven by emotions and instead rely on a predetermined set of rules and criteria.

Here are the fundamentals of swing trading strategies:

-

-

Trend Identification:

-

Swing trading helps in the identification of prevailing market trends.

-

Swing traders typically focus on trading in the direction of the trend, whether it’s bullish (upward) or bearish (downward).

-

Trend identification is mostly done through technical analysis, which involves analyzing:

-

Price charts

-

Moving averages, and

-

Trendlines.

-

-

-

-

Support and Resistance Levels:

-

|

Meaning |

Support levels represent prices at which an asset tends to find buying interest, preventing it from falling further. |

Resistance levels are price levels where selling interest tends to emerge, preventing the asset from rising further.

|

|

Relevance |

|

|

Identifying Trends for Swing Trading

Recognizing and acting on trends is pivotal for successful swing trading. The importance of identifying both uptrends and downtrends lies in the following aspects:

-

Identifying trends allows swing traders to spot potential trading opportunities.

-

In an uptrend, swing traders seek buying opportunities to profit from upward price swings.

-

In a downtrend, they look for selling opportunities to profit from downward price swings.

-

-

Trading in the direction of the prevailing trend increases the likelihood of profitable trades.

-

Recognizing trends is also crucial for risk management. Swing traders can set stop-loss orders and exit positions when the trend reverses.

Major Tools and Indicators for Identifying Trends

Swing traders use various tools and indicators to recognize and act on uptrends and downtrends. Here are some commonly used ones:

|

Tools & Indicators |

Explanation |

|||||||||

|

Moving Averages |

|

|||||||||

|

Trendlines |

|

|||||||||

|

Relative Strength Index (RSI): |

|

|||||||||

|

Moving Average Convergence Divergence (MACD): |

|

Understanding Support & Resistance in Swing Trading

Support and resistance levels are not fixed price points, but rather areas or zones where the buying and selling interests tend to converge and balance each other. The price may fluctuate within these zones, but it is unlikely to break out of them unless there is a significant change in the supply and demand forces.

Here’s an explanation of support and resistance in swing trading and their significance in the trading process:

|

Aspects |

Support Level |

Resistance Level |

|

What does it mean? |

|

|

|

How It Helps Swing Traders |

|

|

|

Why do Support and Resistance Levels Matter? |

|

|

Entry and Exit Techniques in Swing Trading

Timing is crucial in swing trading. Well-timed entry and exit decisions are essential for achieving success in this trading style. Swing traders aim to capture price swings within a broader trend, and their profitability often hinges on accurately identifying the optimal points to enter and exit trades.

Here’s an exploration of the importance of timing in swing trading:

-

Timing entry and exit points correctly can significantly impact a trader’s profitability. Entering near support levels and exiting near resistance levels can help maximize profits within the price swing.

-

Proper timing is essential for managing risk. Setting stop-loss orders and taking profits at the right time helps limit potential losses and protect gains.

-

Swing traders aim to hold positions for a relatively short period. Timely exits prevent extended exposure to market volatility. This reduces the risk of adverse price movements.

Techniques for Entry and Exit in Swing Trading

Various techniques aid swing traders in making informed decisions regarding trade entry and exit:

-

Identifying support and resistance levels

-

Drawing trendlines on price charts

-

Observing moving averages to identify the trend’s direction

-

Spotting candlestick patterns, such as engulfing patterns or doji formations

-

Applying oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator to gauge overbought and oversold signals.

-

Using multiple moving averages and watching for crossovers as potential entry signals.

-

Examining trading volumes to confirm the validity of price movements.

Common Mistakes and How to Avoid Them

Swing trading can be a profitable trading strategy, but it’s not without its challenges. Here are some frequent pitfalls swing traders encounter and strategies to evade them:

|

The Mistake |

The Meaning |

Potential Solution |

|

No Defined Trading Plan |

|

|

|

|

|

|

Ignoring Risk Management |

|

|

|

Failing to Adapt to Changing Market Conditions |

|

|

|

Overemphasizing Past Performance |

|

|

|

FOMO (Fear of Missing Out): |

|

|

|

Overleveraging |

|

|

Leveraging Bookmap for Swing Trading Success

Bookmap is a powerful market analysis tool. Most successful swing traders use it to identify:

-

Trends

-

Support and resistance levels, and

-

Potential entry and exit points.

Here’s how Bookmap’s features can benefit swing traders:

|

Features |

Explanation |

Practical Market Usage |

|

Heatmap |

|

|

|

Volume Dots |

|

|

|

Historical Depth Data |

|

|

|

Order Book Imbalance |

|

|

|

Iceberg Detector |

|

|

Conclusion

Identification of trends in swing trading is paramount. Most successful swing traders perform effective leveraging, spot support and resistance levels, and master the recognition of entry and exit points.

Bookmap, as a market analysis tool, aids swing traders with its array of powerful features, such as heatmaps, volume dots, iceberg detectors, and more.

Ready to elevate your swing trading game? Discover how Bookmap can give you an edge in the market. Dive deep into real-time data, visualize market dynamics, and refine your swing trading strategies with unparalleled clarity. Unlock your advantage with Bookmap now!