20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Interviews

June 27, 2024

SHARE

Trading Depth Interview #5: BitScalp Takes Us on a Journey of Trading Bitcoin, Since the Darknet

In this unusual and mysterious interview, we invite you to learn from the Italian scalper Marco who goes under the pseudonymous Twitter name BitScalp.

Marco started trading forex in 2011. It was the FX golden age, as Marco put it himself, where everybody was fooled to get quick rich with 100x, up to 500x leveraged forex and CFDs, mainly on unregulated and exotic brokers who were taking the opposite side of their clients. Since Marco decided to stay anonymous, you see his dog, a T-bone scalper, on the cover.

Marco, can you reveal your country or do you prefer not to?

I’m from Italy but I’m planning to move to Malta. I’ve been there 2 summers in a row and I love that peaceful little Island. I intend to study the feasibility of running a Bitcoin mining facility there because of the cheap electricity. I run some Ethereum GPU miner here but my production cost is just a little below current market rate.

Please, tell us your story and how you arrived to Cryptocurrencies.

Early on, Bitcoin was only known to be an Internet currency used in the darknet marketplaces.

At that time I wasn’t looking at it as an investment or trading vehicle. I was all on the EUR/USD. Over the years, I switched to regulated markets, trading Stocks, Options, and finally my love, Futures. In late 2017 the cryptomania made me take an Ethereum cash position that harvested an astonishing 400% return in less than 2 months, so I quickly realized the potential of this newly developing market.

Today’s crypto trading frenzy resembles very closely the forex enthusiasm wave of my days but in a larger magnitude. The defragmented, OTC [over-the-counter] and unregulated structure of crypto exchanges is very similar to the foreign exchange market, where a bunch of big players are challenging each other in order to screw the majority of the public. Now that Wall Street and Commercial Banks entered the game, we are beginning to see common market-making price patterns typical of forex, where redundant liquidity (duplicated limit orders placed on multiple trading venues that are suddenly removed once filled) causes fast and violent moves followed by infinite periods of narrow trading ranges.

Crypto-twitter named this pattern the “Bart Simpson”, but it’s nothing new if you were used to trading the EUR/USD. Technically they are just liquidity holes exploited by momentum ignition algos. I like the fact that I can taste the current market sentiment on Twitter like years ago I was reading market thoughts of other currency traders on Forex Factory and similar forums. I know well that HFT [high-frequency trading] Algos are able to read news and retail sentiment in order to take a position, and now that HFT firms are entering the crypto space, we will begin to see their threats to human traders, like last-look and adverse selection practices.

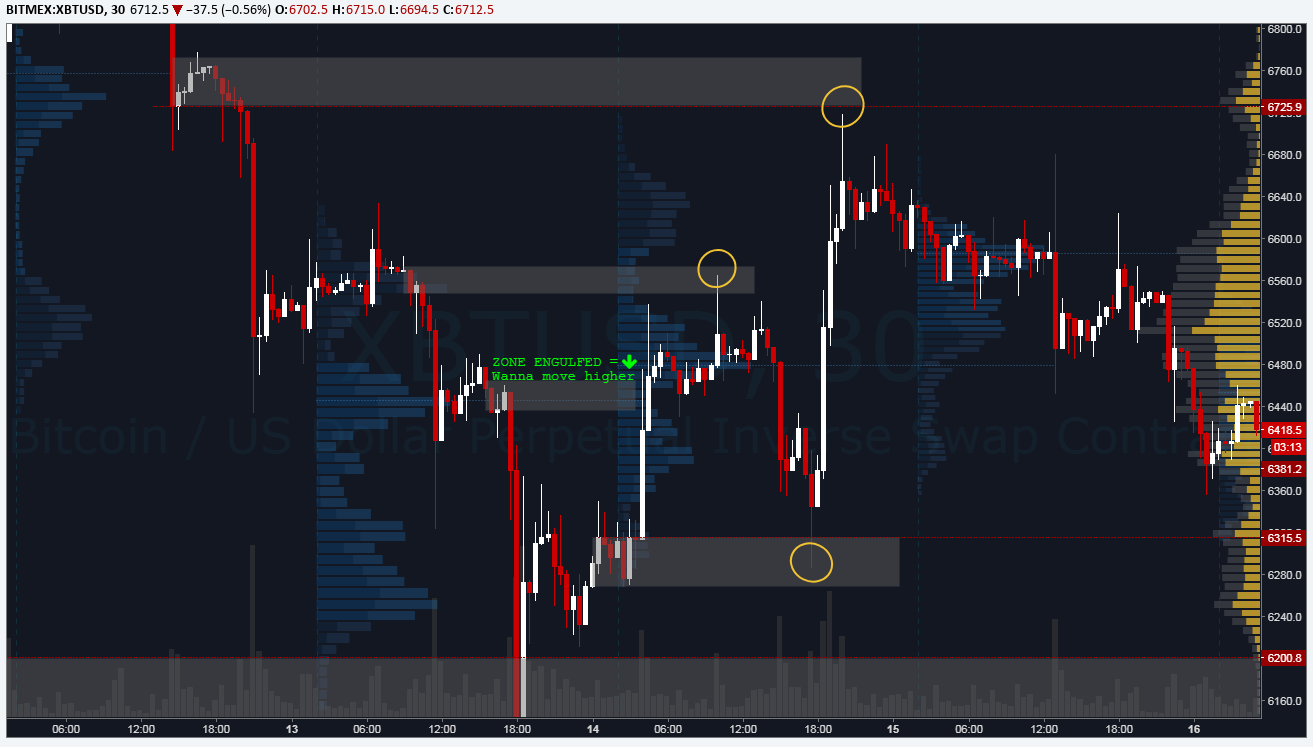

“Supply and Demand zones play out very well on Crypto and Forex

as it is a more natural and human-driven market.”

Why did you use BitMEX platform? How did it benefit you as a trader?

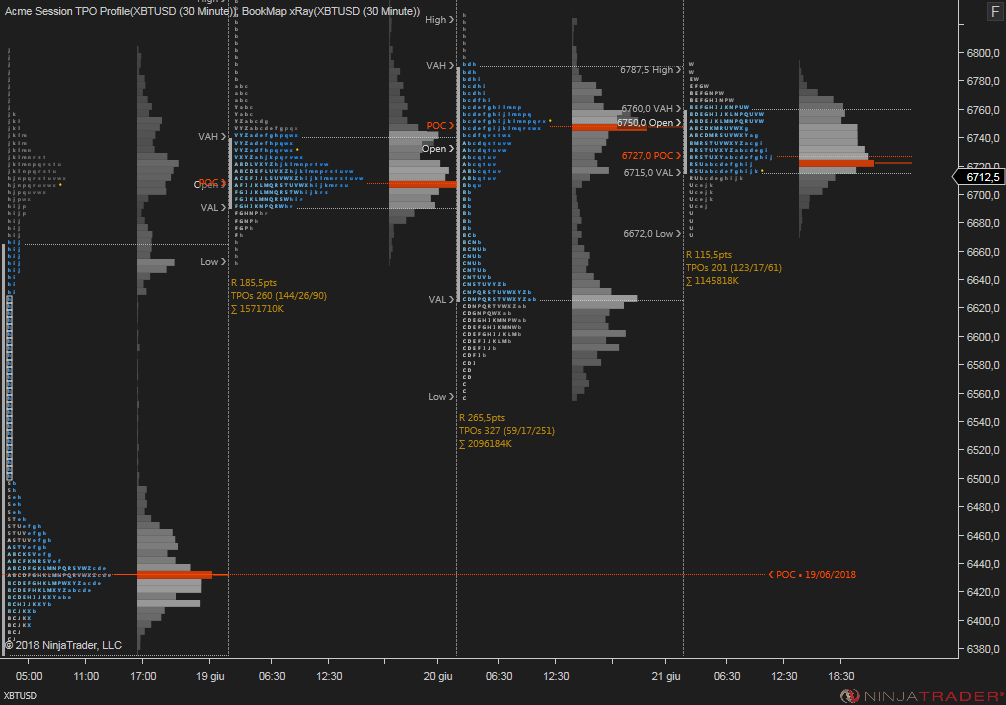

I use BitMex as they offer Ninjatrader connection API, so I can use my favorite charting tools (Market/Volume Profile and BookMap) that I was already using on regulated futures exchanges. Obviously, I am aware of the risks involved in dealing with an offshore unregulated broker, but there are certain advantages into having your trades cleared in bitcoins: in my country crypto profits (under a certain amount) are tax-exempt, as it’s considered a simple currency conversion when I trade BTC back to fiat.

“Futures Trade in Chinese ideogram tattooed on my arm.”

Anyway, I am not converting profits back as my aim is to accumulate as many Bitcoins as possible since I am a true believer of this revolutionary technology. I always have my other Futures and Stock Options trading accounts as my taxed source of income.

What about the instruments you trade there? What’s your favorite asset? XBT?

Of course, XBT/USD is the King as it’s the most liquid pair. However, this brings disadvantages too: as I said before, it is developing similar patterns to the EUR/USD. A lot of sideway action surrounded with stop hunting spikes, followed by sudden boom/bust moves. I prefer the ETH/BTC cross, as its price action is more linear and reminds me of the EUR/GBP, of course with a 10x percentage swings. The problem is this contract is pretty illiquid on BitMex and you have to be very careful with executions, or slippage will eat up most of your paper profits.

My recommendation is to always look around for alternatives: there’s the British cryptofacilities.com who offer Altcoin’s leverage trading and the Dutch deribit.com for XBT Vanilla Options.

How can one derive value from scalping in relatively stable markets?

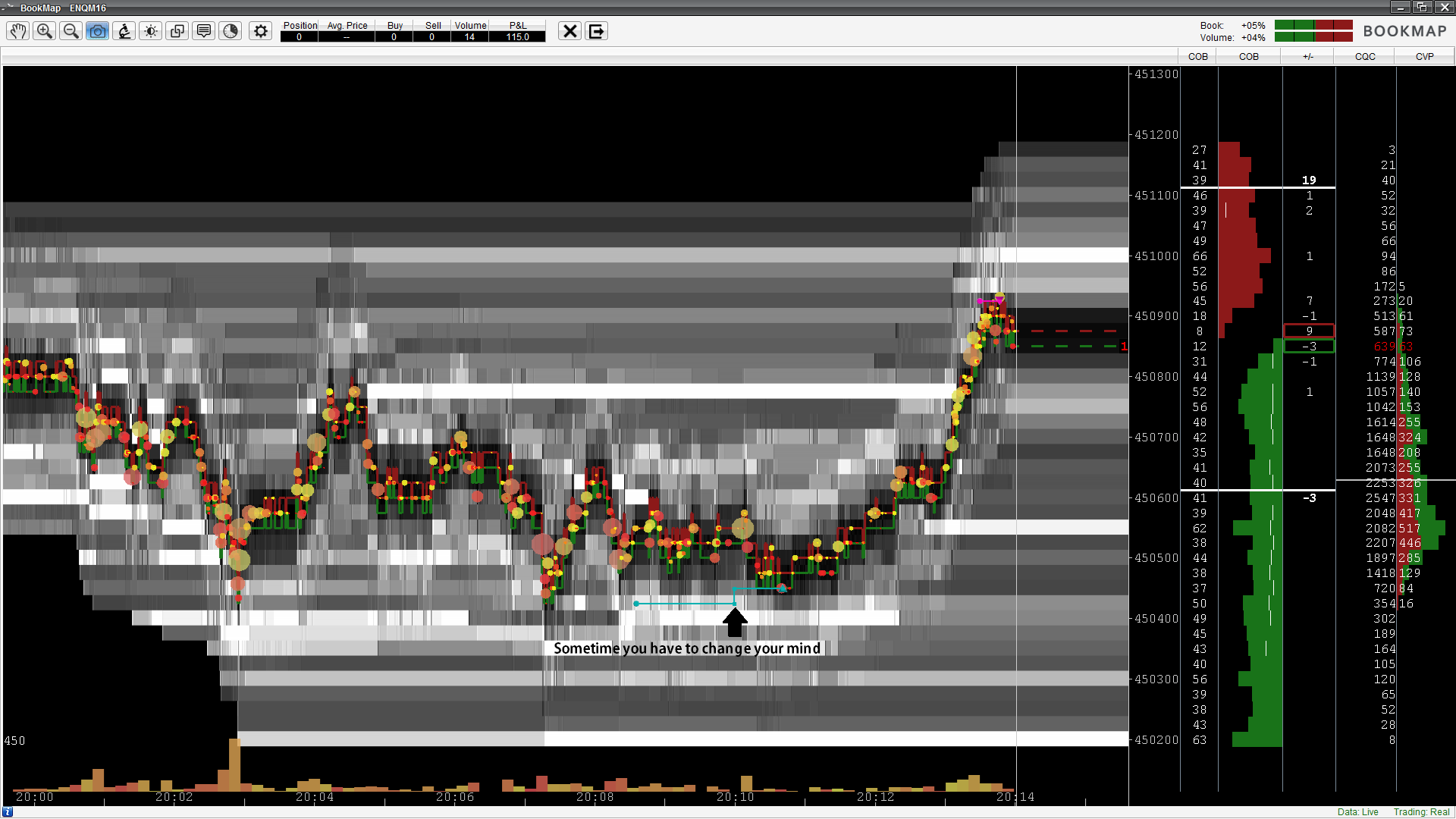

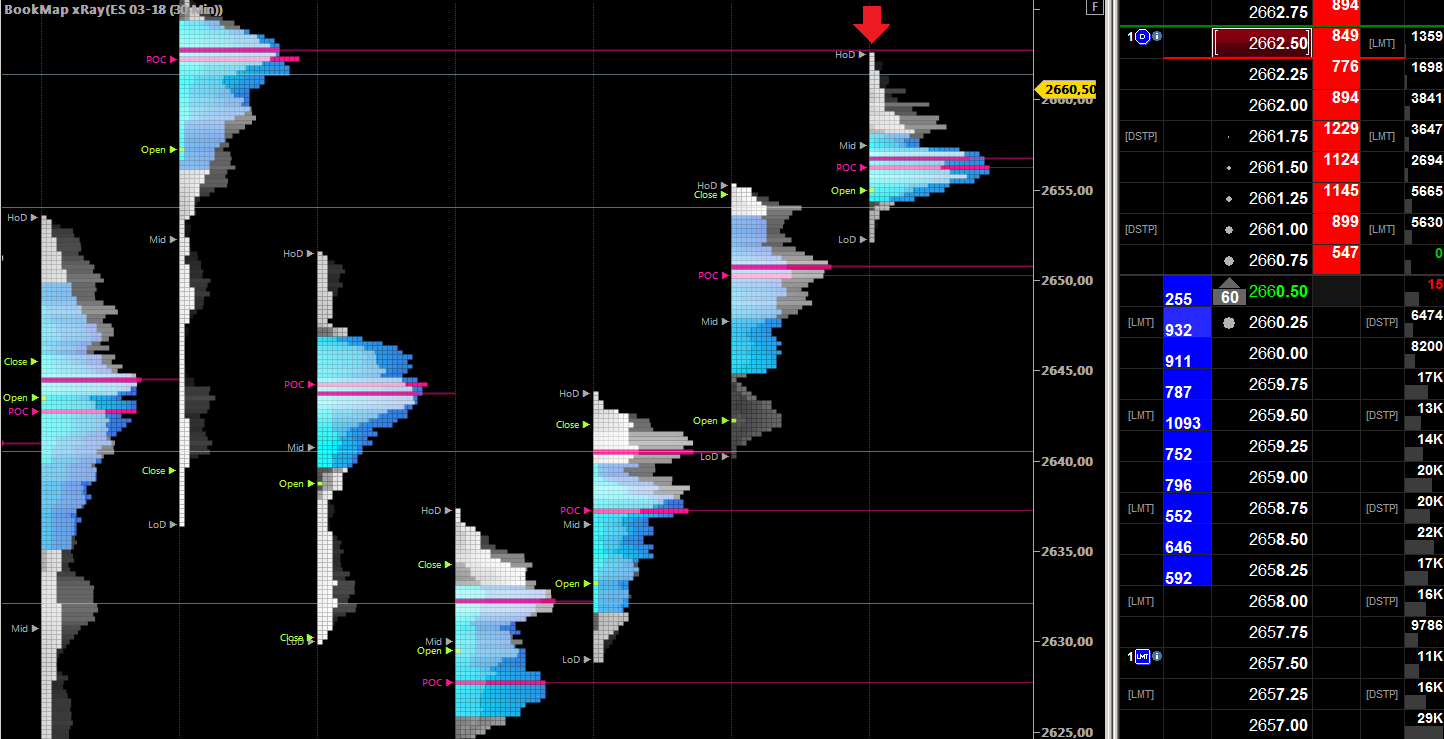

I love thick markets, it’s where my order flow reading skills give me a tangible edge in competing against High-Frequency Traders. Basically, in these markets like the T-note or the EuroStoxx, the price is kept in tight trading ranges most of the time, you can see it on the daily profile chart where most of the days are normal distribution ones. There are thousands of contracts each side of the book all day long, as there’s plenty of secondary markets (Options, ETFs, Intermarket/Calendar Spreads) that Market Makers are serving at the same time.

I look for temporary imbalances in the order book to basically trade a return to the mean. I am a fader. I find it difficult to trade with the trend. Most people are only good at this because they basically lack skills. Everybody is a genius in a bull market, right? They are not traders, their strategy is just to buy and hope. A trader must be able to gain anytime, in trending as in ranging condition, both on the short and on the long side.

“I love to fade the extremes never being a tick under.”

Bitcoin is far from a stable market. However, when there are no wild swings, does it influence your trading strategy?

Bitcoin attracts speculators because of his wild swings. More speculation brings in more liquidity, and more liquidity means less volatility. Eventually, speculation will gift Bitcoin with the so much wished price stability. Many inexperienced traders fell in the overtrading trap during these slow periods. I learned this lesson in a hard way during my early years of forex, so now I just wait patiently for the next crystal-clear setup instead of messing around with trades made out of boredom. In the meanwhile, I trade CME/EUREX or I post on Twitter.

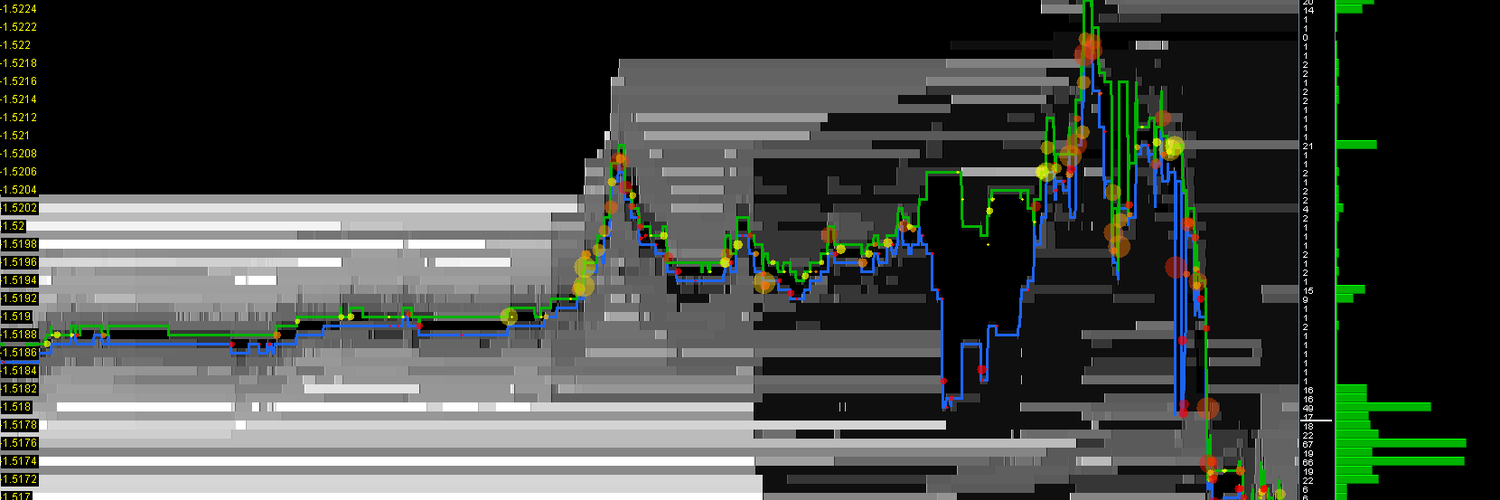

“Market Profile study applied on Bitcoin.”

What strategy did you find as the best fit for your trading style?

I’m strictly a day trader, I’m always flat at the end of the day. Therefore, I can sleep at night to be ready for the next trading session. However, cryptos trades around the clock 24/7, it’s even worse than forex where at least you can rest over the weekend.

I organize my trading differently then I do on Index Futures, where I mainly trade the cash session. I place resting limit orders and price alerts, and once in a position, I am ready to go overnight as I don’t know how much it will take for a move to complete. While I sleep I let the stop loss and the profit taker do the job for me.

“I get excited when I sell the High of the Day.”

Do you use the order flow in trading? How?

I can’t use the order flow on Bitcoin the same way I do on Index Futures. I grab just a few ticks at once. I’m a scalper, and scalping means Order Flow Trading. I could trade without chart and profile, but I would feel blind without BookMap. On cryptos, however, I have to take longer shots. I look at the candlestick charts to spot supply/demand zones left unfilled, and I use them as my entry points and profit targets. By the way, order flow reading skills help me get the best executions. The tape tells me if a movement is getting exhausted ahead of time or if a liquidity area is getting eaten up by incoming orders and price is ready to move to the next level.

Consistency versus improvisation: what do you prefer?

I would say a trader must be “a consistent improvisator”. Financial markets speculation is an art and you can’t stand on strictly rules-based systems. Such systems have a really poor edge you can spot only over hundreds of trades and they usually suffer long drawdown periods. I’d shoot myself in the head if I had more than 3 losses in a row lol. But from time to time the losing streak comes and you have to be strong and preserve your capital. After the infamous 3 losses, I cut down on my leverage and reduced my risk per trade until I have recovered my equity curve. I know it’s not the best efficient Money Management but it works for the sake of my peace of mind.

If I had such a mechanical system, however, I would just hire a programmer to code a trading algo and let the computer do the job. What’s the purpose of staring at the charts all day long if the only thing you have to do is to take no-brainer IF/ELSE decisions? Our brain is not designed that way, there are millions of nuances in trading and every situation is slightly different from the previous, even if similar.

What you have to be consistent at instead, is the size of your bets and the mental discipline to respect your stop points and taking profits when you have to. Sometime you’ll be tempted to widen your stop, just to give the price “more breathing room”, while other times greed will make you move your take profit farther away. The tricky part is that there will be situations where breaking your own rules would have been the right thing to do! What you must learn to discern if they are your emotions that are making you break own rules, or a new market-generated information. Gut feelings and unconscious mind pattern-recognition come only after many years of experience so, if you still don’t have tens of thousands hours spent in front of the screens, just stick to your DAMN trading plan.

“Broken heart pattern of Pound Sterling traders.

Price never traded again at these prices after the crash,

as a reminder that price does not always come back to you.”

You trade BTC and ETH, any other cryptos?

I gave a try at Binance Altcoins but swing trading is not for me. I need leverage. I can’t waste days and days of waiting and put at risk 20-30% of my capital every time. I can take a dozen leveraged scalps with that capital at risk and have a better return in a shorter period of time.

Furthermore, trading Altcoins is basically like trading pink sheets or low caps but without any sort of fundamental information on the company. The liquidity, by the way, is far better there than on OTC stocks. Binance market makers algos are doing a great job at keeping these markets active. Maybe I could sell some cash-secured put in the future like I do on stocks if the crypto market will evolve in that sense. For now, I stick to trading the two majors, bitcoin and ether [Ethereum]. I’m a specialist, I do it better at focusing on only a few instruments at a time, to better know their personalities.

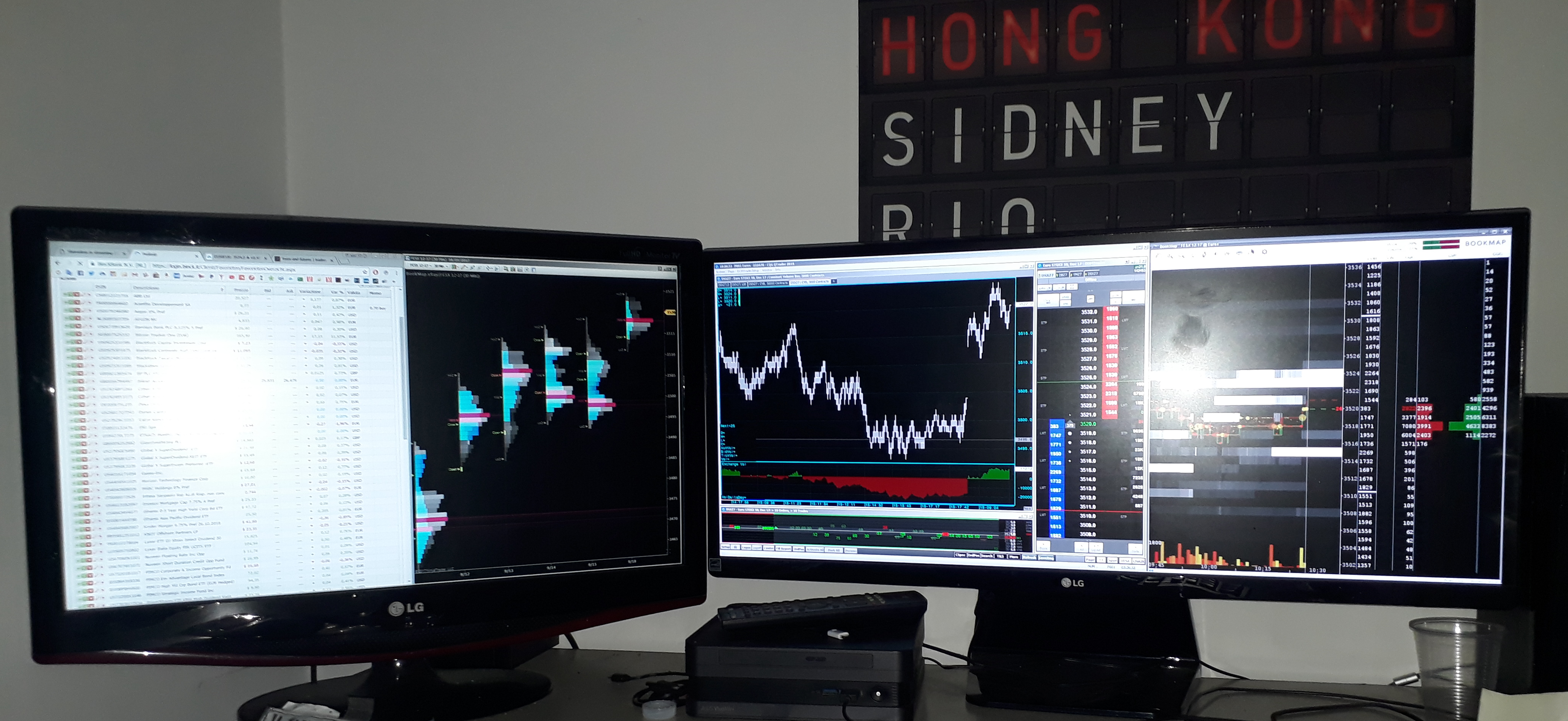

BitScalp’s trading desk

Have you studied some fundamental sciences to use it in trading? Like math or social psychology? If yes, how do use this knowledge?

Math was never my best subject at school. I have read “Irrational Exuberance“, “Misbehaving” and other books on the subject. My first trading mentor taught me very well about the market psychology, there’s a precise human participant’s behavior behind classic chart pattern like flags, triangles, H&S etc. You can apply the same principles used in daily charts on intraday traders. It’s basically all about fooling the majority of uninformed and unskilled market participants.

Can we assume that most of your knowledge you take from forums and practice? If so, what would be your advice to innovative trader amid “sticking to the trading plan”?

I come from IT and graphic design sector, I have zero financial background. You don’t need it to become a market timer. “Only the game can teach you the game” (Jesse Livermore). There was a great floor trader who had no idea of the inverse relationship between bond yields and their prices, but he was a master at taking the extreme of the T-Note session while everyone else was puking their positions. Most people don’t have the stomach for successful trading, it takes years of losses before becoming comfortable with being in the red and actually losing money for a living. You have to be a bit reckless and you must fully commit yourself in the game above all.

Average Joe is too lazy and too afraid to exit his comfort zone. He would never trade his beer and TV for his financial freedom. That’s why you find a lot of BS on internet forums, most users are wannabe losers who only bully each other. You have to isolate yourself with a small group of determined traders in order to grow. I was in several chat group of traders, one of them was a prop trader for Futex, the same firm of Nav Sarao. He introduced me to the EuroStoxx contract. He was scalping forex on his personal account while at work (!).

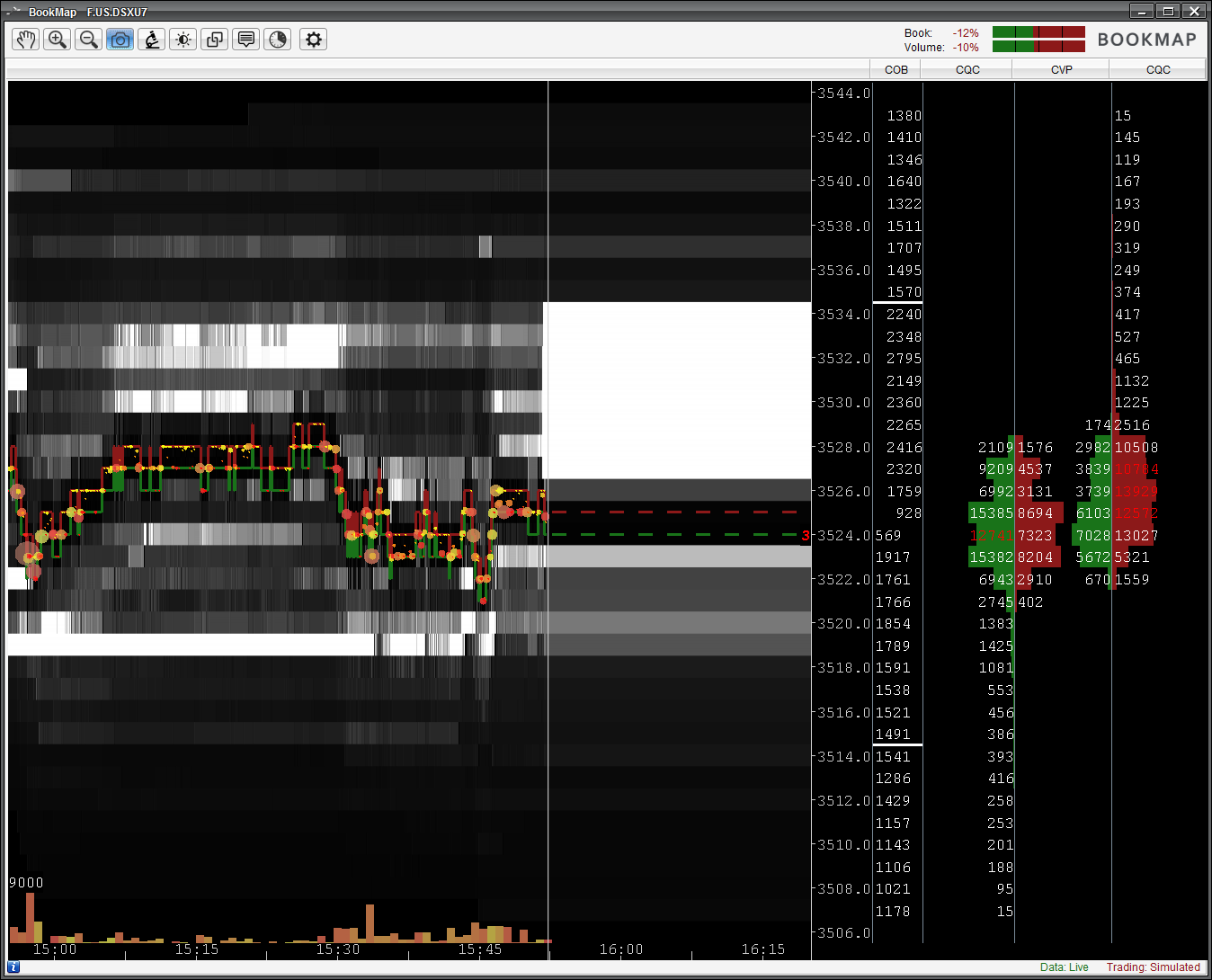

“A giant block of Sellers on the Stoxx and how I use the Bookmap Columns,

Volume traded vs. Flashed quotes.”

Another one is a great Asset manager who taught me about stock options volatility plays. I’m really grateful to all of them for helping me along my path, I learned something from each of them.

Apart from the web, I took my knowledge from the books, here’s a list of those I would recommend:

- Studies in Tape Reading, Wyckoff

- Tape Reading and Market Tactics, Neill

- Reminiscences of a Stock Operator, Lefévre

- Markets and Market Logic, Steidlmayer-Koy

- Mind over Markets, Dalton

- Markets in Profile, Dalton

- Pit Bull, Schwartz

- The Art of War, Tsu

- Trading and Exchanges, Harris

- Order Flow Trading for Fun and Profit, Goldsmith

- Auctions, Hubbard-Paarch, MIT Press

- The Big Short, Lewis

- Trading in the Zone, Douglas

- Blink, Gladwell

Many thanks to Marco aka BitScalp. It was a deep overview of the bitcoin scalping scene and trading psychology. Let us know in the comment section if you liked it too.

Key takeaways:

- A trader must be able to gain anytime, in trending as in ranging condition, both on the short and on the long side

- Don’t mess around with trades made out of boredom

- While you sleep, let the stop loss and the profit taker do the job for you

- There will be situations where breaking your own rules would have been the right thing to do

- But you you must learn to discern if they are your emotions that are making you break own rules, or a new market-generated information

- If you don’t have tens of thousands hours spent in front of the screens, just stick to your trading plan

- Most people don’t have the stomach for successful trading, it takes years of losses before becoming comfortable with being in the red and actually losing money for a living

- Average Joe would never trade beer and TV for his financial freedom

This is part of the Depth of Trading project, a series of inspiring interviews with successful traders. For more interviews with traders follow our Twitter and Facebook.