Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 14, 2024

SHARE

The Influence of Market Participants: Forces Behind Price Movements

In the world of financial markets, prices are in a constant state of flux,

influenced by the decisions of market participants and the ever-shifting

external landscape.

In this article, we will understand how market participants—institutional

traders, retail investors, high-frequency traders, and market makers lead to

price discovery while dealing with external and internal factors.

We’ll also explore the impact of geopolitical tensions, which can send

shockwaves through indices and commodities, and dive into the intriguing

concept of ‘buy the rumor, sell the news,’ challenging our understanding of

market dynamics. So, let’s dive right in.

Unpacking the Influence of Market Participants

A typical financial market comprises several key players, including

institutional traders, retail traders, high-frequency traders (HFTs), and

market makers. Each group possesses unique characteristics and trading

patterns. Let’s delve into their profiles and examine how they shape price

dynamics using real-world examples.

|

Market Participants |

Meaning |

Trading Behavior |

Contribution to Price Dynamics |

Real-world Scenario |

|

Institutional Traders |

|

|

|

|

|

Retail Traders |

|

|

|

|

|

High-Frequency Traders (HFTs): |

|

|

|

|

|

Market Makers |

|

|

|

|

The Factors Driving the Influence of Market Participants on Prices

Now that we’ve explored various market participants, their trading behavior,

and their impact on pricing dynamics, let’s discover how market participants

influence the process of discovery in several ways.

The Weight of Order Size: How Significant Trades Sway Prices

Large trades, often referred to as “block trades,” have the potential to

significantly sway prices and trigger a series of reactions in the market.

Let’s begin with understanding the meaning and origin of block trades:

|

What Are Block Trades? |

Why Are Block Trades Executed? |

|

|

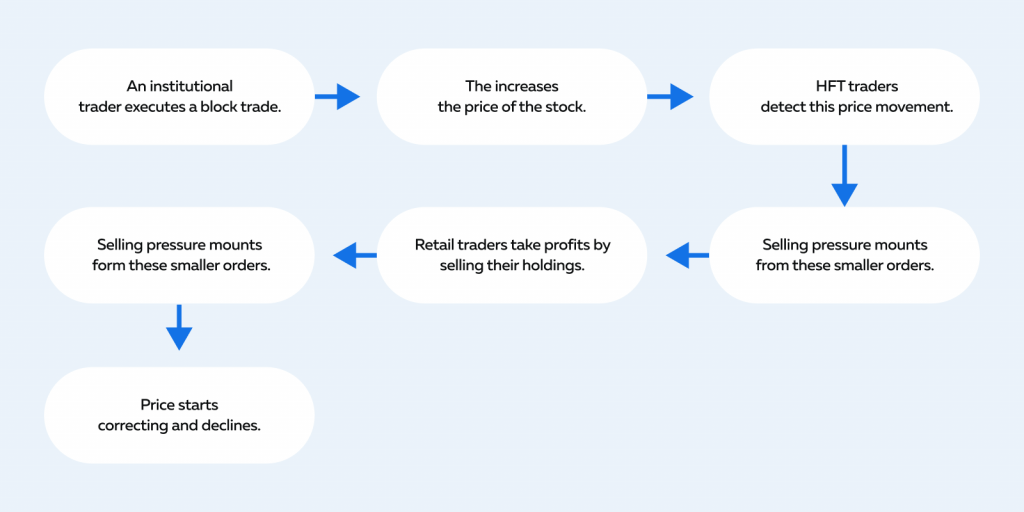

The Butterfly Effect – Created by Block Trades

In financial markets, a significant block trade sets off a chain reaction of

smaller trades. This happens because of other market participants reacting

to the initial large order. This cascade effect is known as the butterfly

effect and leads to notable price movements.

How does this happen?

Let’s understand how the butterfly effect unfolds in the financial markets:

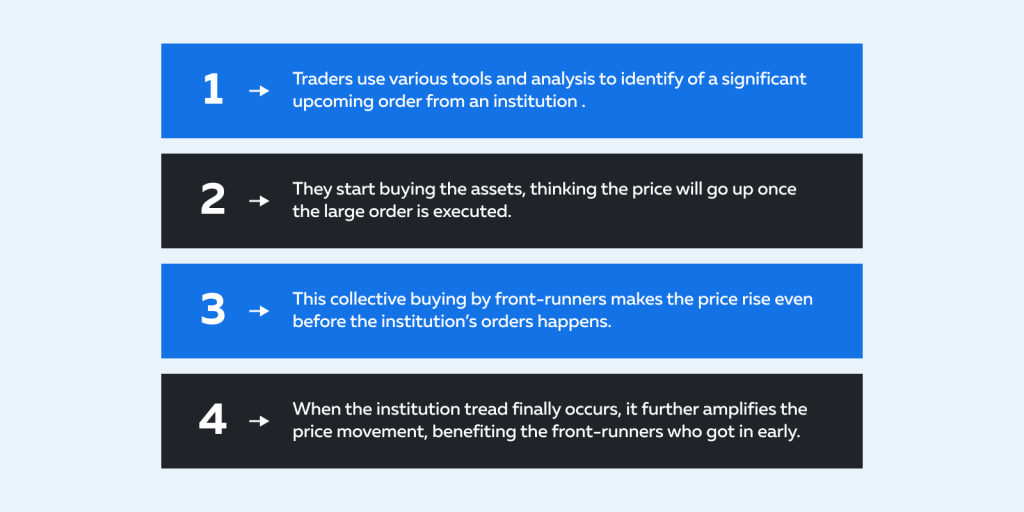

Front-Running and Anticipation of Large Orders:

Front-running is a practice where market participants predict that

institutional investors will make big orders. They do this to try and make a

profit, and this can result in changes in prices.

But how does it work? Let’s see how front-running happens in financial

markets:

Disclaimer: Regulatory bodies often monitor and seek to prevent practices,

such as front-running to maintain market integrity.

Liquidity and Price Movement: A Delicate Balance

Liquidity plays a crucial role in determining price stability. It represents

the ease with which assets can be bought or sold without causing a drastic

price change. A sudden increase or decrease in liquidity directly influences

the process of price discovery. Let’s delve deeper into the relationship

between liquidity and price movement:

High Volume of Trades and Volatile Price Changes

A high volume of trading activity in a market implies increased

participation from various market participants, such as retail traders,

institutional investors, and high-frequency traders.

If this surge in trading volume is not met with corresponding liquidity, it

can lead to volatile price changes. This is because liquidity is essential

to absorb the buying and selling pressure generated by these trades. Without

enough liquidity, even relatively small trades can result in significant

price swings.

Let’s understand through a real scenario.

-

There is a low-liquidity stock that is not frequently traded.

-

Suddenly, a large institutional trader decides to sell a significant

number of shares. -

In a market with insufficient liquidity, there are not enough buyers

to absorb this large supply. -

This sell-off can lead to a rapid and substantial price drop.

Sudden Withdrawals of Liquidity and Rapid Price Drops

Liquidity can be abruptly withdrawn from a market when many participants

simultaneously decide to pull out their offers to buy or sell an asset. This

can occur due to various reasons, such as:

-

News events

-

Economic uncertainties, or

-

Shifts in market sentiment

This sudden withdrawal leads to rapid price drops because fewer buyers are

willing to purchase the asset. This forces the sellers to accept lower

prices to execute their trades. This downward pressure on prices can

intensify as more participants try to exit their positions, resulting in a

cascading effect.

Let’s understand the domino effect of liquidity withdrawals through a real

scenario:

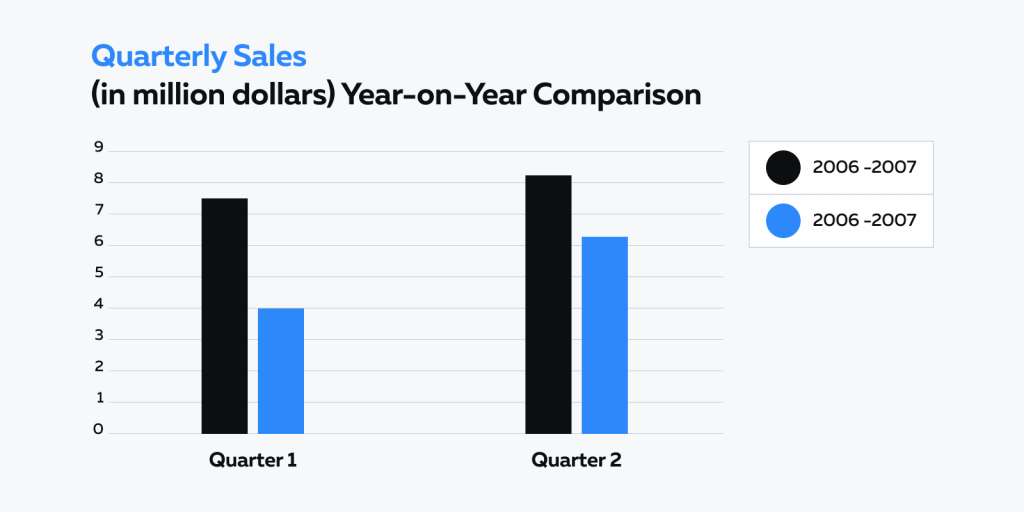

Imagine a situation in the stock market where a particular tech company has

been performing exceptionally well, but during the 2007–2008 financial

crisis, the company’s earnings for two quarters missed expectations by a

significant margin.

Have a look at the y-o-y comparison of quarterly earnings (in million

dollars) through the chart below:

This news caught many market participants off guard, leading to a sudden

shift in sentiment. Several buyers withdrew their buy offers, which suddenly

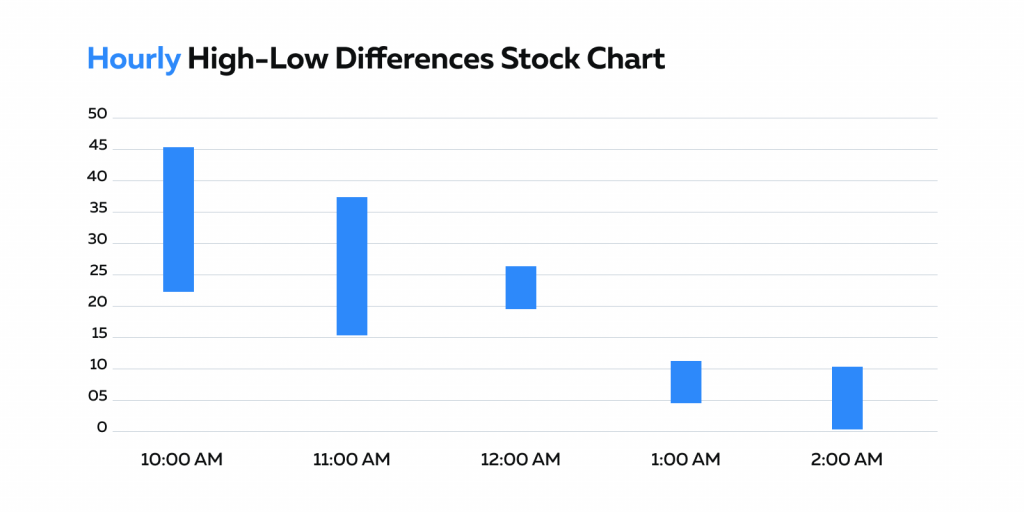

reduced liquidity. What followed was a simultaneous price decline, as

evident in the graph below:

What Can Investors Learn From The Above Scenario?

-

Diversification is Key:

-

Overreliance on a single tech company, no matter how well it’s

performing, exposes investors to significant risk. -

Diversifying across different asset classes can mitigate this

risk.

-

-

Market Sentiment Matters:

-

Even strong companies can be impacted by broad market sentiment.

-

Pay attention to macroeconomic trends and the overall market

environment.

-

-

Financial Crises are Unpredictable:

-

The 2007-2008 financial crisis was largely unforeseen by the

majority of investors. -

Be prepared for the unexpected and have contingency plans in

place.

-

-

Maintain Long-Term Perspectives:

-

Don’t consider short-term fluctuations.

-

A long-term investment horizon can help ride out turbulent

periods in the market.

-

-

Avoid Herd Mentality:

-

Don’t follow the crowd blindly.

-

Sometimes, contrarian thinking can be a valuable strategy during

market uncertainty.

-

Temporal Factors: Trading Windows and Market Sentiment’s Influence on Prices

Temporal factors commonly refer to the timing of trades and market sentiment

during specific events. They play a significant role in shaping price

dynamics in financial markets.

Let’s explore the implications of temporal factors in different market

scenarios:

-

Trading during Market Open or Close:

-

The opening of a trading session, accompanied by the release of

overnight news and order accumulations, results in increased

activity and volatility. -

Analogous to market openings, the closing minutes of a trading

session can also witness intensified activity as traders rush to

execute last-minute orders. -

This flurry of activity can create price spikes and increased

market volatility.

-

-

Collective Sentiment During Major Announcements

-

Events like Federal Reserve interest rate decisions, corporate

earnings reports, or economic data releases can have a

substantial impact on market sentiment. -

Market participants react to these announcements based on their

expectations and interpretations of the news. -

The collective sentiment prevailing during major announcements

can swiftly swing prices.

-

-

Trading Halts and Post-Resumption Frenzy:

-

Trading halts are temporary suspensions of trading.

-

They are triggered to prevent panic selling or buying.

-

After a trading halt is lifted, there is often a frenzy of

trading activity as participants rush to adjust their positions. -

This post-resumption frenzy leads to significant price

volatility as traders respond to the events precipitating the

trading halt and seek to establish new positions.

-

The Impact of External Stimuli: From News to Global Events

External stimuli, such as news events and global occurrences influence

market participants’ perceptions and actions, often leading to significant

price movements. Let’s illustrate this with a real-scenario and its

aftermath:

-

A pharmaceutical company announces a breakthrough in the development

of a new drug. -

This news swiftly catapults the company’s stock price.

-

Investors, foreseeing significant future profits, rush to grab

shares. -

A buying frenzy unfolds as investors compete to own a piece of the

company.

The Aftermath

-

The actual impact of breakthrough development on the company’s

financials would not materialize immediately. -

As a result, once the news is digested and the initial excitement

subsides, the stock undergoes a correction phase.

Geopolitical Tensions and Their Effects:

Geopolitical tensions, exemplified by trade wars involving major economies

like the United States and China, significantly affect financial markets.

Participants closely monitor developments and react to:

-

Tariffs

-

Trade agreements

-

Other policy changes

These tensions lead to market volatility, as uncertainty about the future of

international trade influences investment decisions.

Buy the Rumor, Sell the News

The adage “Buy the rumor, sell the news” captures the tendency of market

participants to anticipate news events and adjust their positions

accordingly. This anticipation leads to price movements in the lead-up to an

event. However, once the news is officially revealed, the market’s reaction

may not align with earlier expectations, leading to a reversal in prices.

For example,

-

Prior to an earnings announcement, traders buy a stock in

anticipation of strong results. -

This collective anticipation drives its price higher.

-

When the actual earnings report was released, it failed to meet the

elevated expectations. -

Investors sold their positions, causing the stock’s price to

decline.

In this way, the market’s reaction often underscores the delicate balance

between anticipation and reality, highlighting the profound impact of

collective market sentiment on price movements.

Conclusion

In this article, we explored how institutional traders, retail traders,

high-frequency traders, and market makers each influence prices in their

unique ways. Also, how the weight of order size can trigger cascades of

reactions and how sudden liquidity withdrawals can lead to rapid and

dramatic price changes.

Understanding these dynamics and the implications of temporal factors is

paramount for efficient trading. In our next article, we will delve even

deeper into how market participants influence price movements.

Looking to gain a deeper understanding of market participants and their

influence on price movements? Arm yourself with advanced tools and insights

at Bookmap. Sign up today to enhance your trading strategies.

Start with Bookmap Now →