Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

News & Announcements

May 6, 2025

SHARE

The US-Canada Trade Rift: How Tariffs and Policy Shifts Could Reshape Markets

Canada and the US are like siblings – mostly friendly but always ready for an argument. In 2025, the fight isn’t about hockey or maple syrup; it’s about tariffs, trade policies, and economic power moves.

Want to know how you can safeguard yourself and still execute profitable trades? In this article, you will learn about the US-Canada trade tensions in 2025 and their impact on stocks, commodities, currencies, and bonds.

You’ll understand how US tariffs on Canada affect the automotive, manufacturing, and energy industries and North American trade policies under USMCA. We’ll also see how tariffs influence stock market volatility, commodity prices, and forex movements (key insights for traders).

You’ll be better prepared to deal with this uncertainty after understanding these trends. Plus, with our pioneering market analysis tool, Bookmap, you can conduct real-time market analysis and stay well ahead of market shifts. Read till the end.

The US-Canada Trade Dispute: What’s Happening?

The US and Canada have always been close trade partners. However, lately, things have gotten a bit tense. US-Canada trade tensions in 2025 are growing and are making industries on both sides of the border nervous.

At the heart of the issue are US tariffs on Canada. These are affecting key sectors like:

- Manufacturing

- Agriculture

- Technology

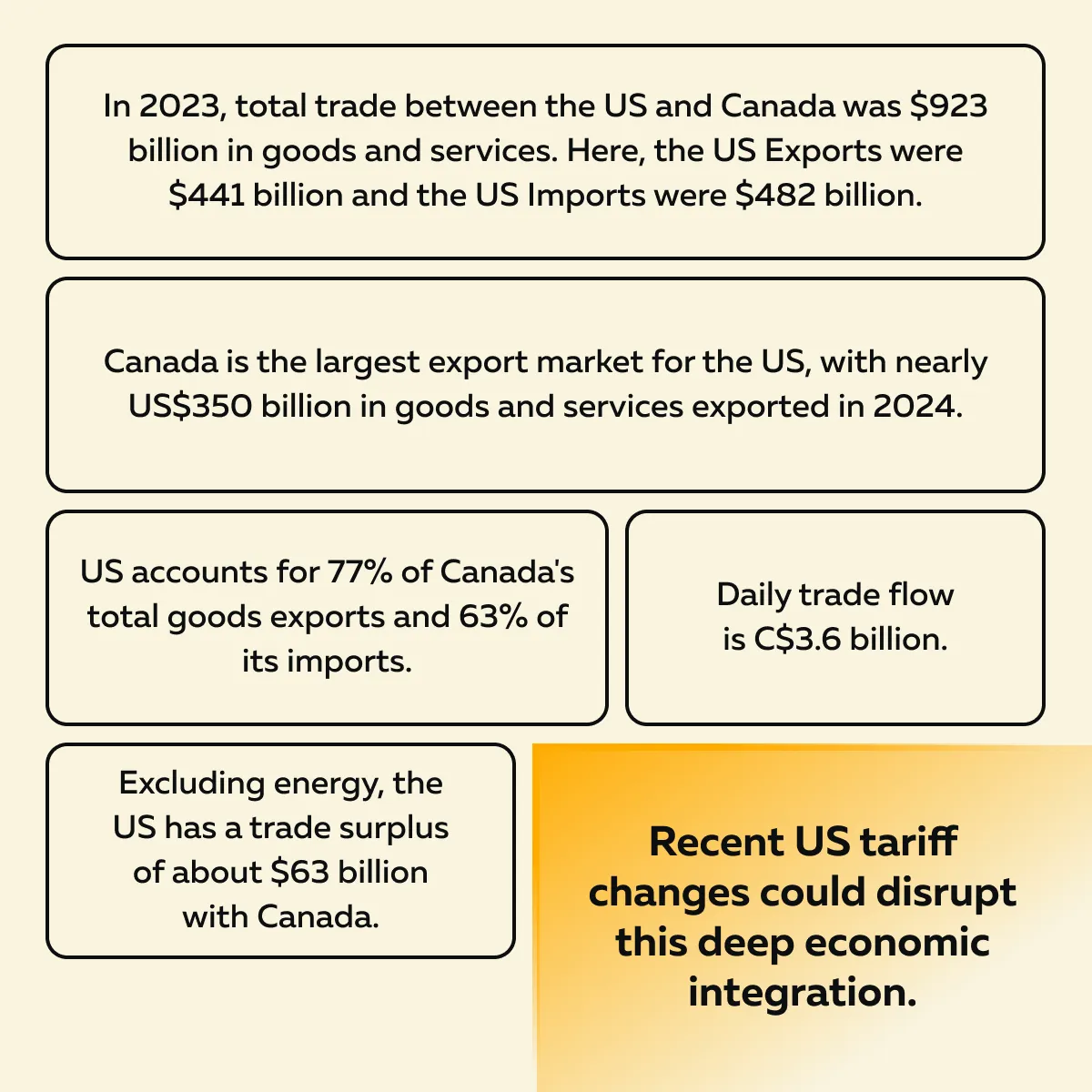

Be aware that the US and Canada trade billions of dollars in goods each year. Check out the graphic below to understand some key statistics:

Please note that when tariffs go up:

- Prices rise,

- Supply chains slow down,

and

- Companies struggle to stay competitive.

Additionally, this isn’t the first time trade disagreements have happened. US tariff changes could disrupt economic integration under NAFTA and USMCA. Both countries have had disputes over dairy, lumber, and even car manufacturing. New policies could shake up North America’s economic environment even further.

And while Americans sometimes joke about Canada being the “51st state,” this trade battle proves otherwise. There exist irreconcilable differences between the two economies. This time, the debate isn’t about hockey or maple syrup but serious trade and financial policies!

A New Trade Rift Under USMCA?

The US-Mexico-Canada Agreement (USMCA) was meant to improve trade fairness after replacing NAFTA. However, tensions are escalating again. The US has recently increased tariffs on major Canadian goods like steel and aluminum.

The US claims that Canada provides unfair subsidies to its producers, which gives them an advantage over American companies. The US is considering tariffs as high as 25% on these materials to counter this.

If these tariffs continue to be enforced, Canadian exports could become more expensive. Consequently, it will:

- Disrupt industries like construction and manufacturing,

and

- Add to the overall US-Canada trade tensions in 2025.

This is yet another sign that even under USMCA, trade disputes between these two close partners are far from over.

Canada’s Response: Retaliation or Diplomacy?

Canada isn’t expected to sit back and accept US tariffs without responding. In past trade disputes, Canada has retaliated with counter-tariffs on important US exports.

For example,

- During past trade fights, Canada placed tariffs on US dairy products and whiskey.

- These tariffs hurt American farmers and manufacturers.

There is a possibility it might do something similar again. If tensions keep rising, Canada could target industries like:

- Agriculture,

- Machinery,

and

- Consumer goods.

These tariffs will make American products more expensive in the Canadian market.

The big question is: will this turn into a full-blown US-Canada trade dispute, or will diplomacy win? Both countries are negotiating to find a solution, but if talks fail, the risk of a North American trade war grows. The outcome will influence the future of North American trade policies for years to come!

How do US-Canada Tariffs Affect Markets and Traders?

Trade tensions between the US and Canada don’t just impact businesses! They also create uncertainty for investors. US tariffs on Canada and retaliatory measures will profoundly affect stock markets. The tariffs will also influence key industries and major companies. Let’s understand this in detail:

Stock Market Sectors at Risk

When US-Canada trade tensions rise in 2025, certain industries will feel the impact more than others. Primarily, companies that depend on North American trade policies will face greater risks. Let’s check out some major sectors at risk:

| Automotive | Manufacturing | Retail and Consumer Goods |

|

|

|

For example,

- Canadian companies like Magna International (MGA) and Bombardier (BBD.B) are major players in manufacturing and transportation.

- They could suffer if

- Tariffs make their products more expensive,

or

- Limit their access to the US market.

Monitor commodity futures and North American equity indices as trade negotiations unfold.

The Impact on Commodities and Raw Materials

Please note that Canada is one of the biggest suppliers of natural resources to the US, which includes oil, lumber, and metals. When US tariffs on Canada increase, it also affects commodity prices and futures markets.

Let’s understand how different sectors could be impacted.

| Oil and Energy Markets | Lumber Prices | Metals and Mining |

and

|

|

|

For example,

- During past trade disputes, lumber futures spiked.

- This spike made homes more expensive to build.

- As a result, US homebuilders like DR Horton (DHI) and Lennar (LEN) were affected.

- That’s because they primarily relied on Canadian lumber for construction.

If new tariffs are introduced, you must watch the commodities market closely as a trader. That’s because North American trade policies have a direct impact on:

- Supply

- Demand

- Overall market stability

Bond Market Reaction: Safe Haven Flows and Yield Fluctuations

If US-Canada trade tensions rise in 2025, bond markets will also feel the impact. This is bound to happen because most investors often move their money into safe-haven assets (like US and Canadian government bonds) to protect themselves from uncertainty.

Let’s see how US tariffs on Canada and trade disputes can affect bonds:

-

- Risk-Off Sentiment:

- When markets get nervous, investors look for safety.

- This scramble for safety means investors will be buying more government bonds.

- This demand for bonds pushes yields lower (because bond prices and yields move in opposite directions).

- Risk-Off Sentiment:

- Inflation Concerns

-

-

- Mostly, tariffs make everyday goods more expensive, leading to increased inflation.

- Now, if inflation rises, bond yields may also increase.

- That’s because central banks could respond by tightening monetary policy.

-

- Interest Rate Expectations

-

- The Federal Reserve (Fed) and the Bank of Canada (BoC) closely observe trade issues.

- If tariffs slow economic growth, they might cut interest rates.

- But if inflation rises, they could do the opposite and tighten policy.

Use order flow analysis to identify key levels impacted by trade-driven volatility.

Real-World Example

During past US-Canada trade disputes, the US 10-year Treasury yield fell because investors moved money into bonds for safety. Additionally,

- Canadian government bonds also saw higher demand, which lowered yields during trade uncertainty.

- Corporate bonds in industries hit by tariffs (like manufacturing and automotive) saw widening spreads. That’s because investors demanded higher returns due to the increased risk.

Currency Volatility: USD vs. CAD

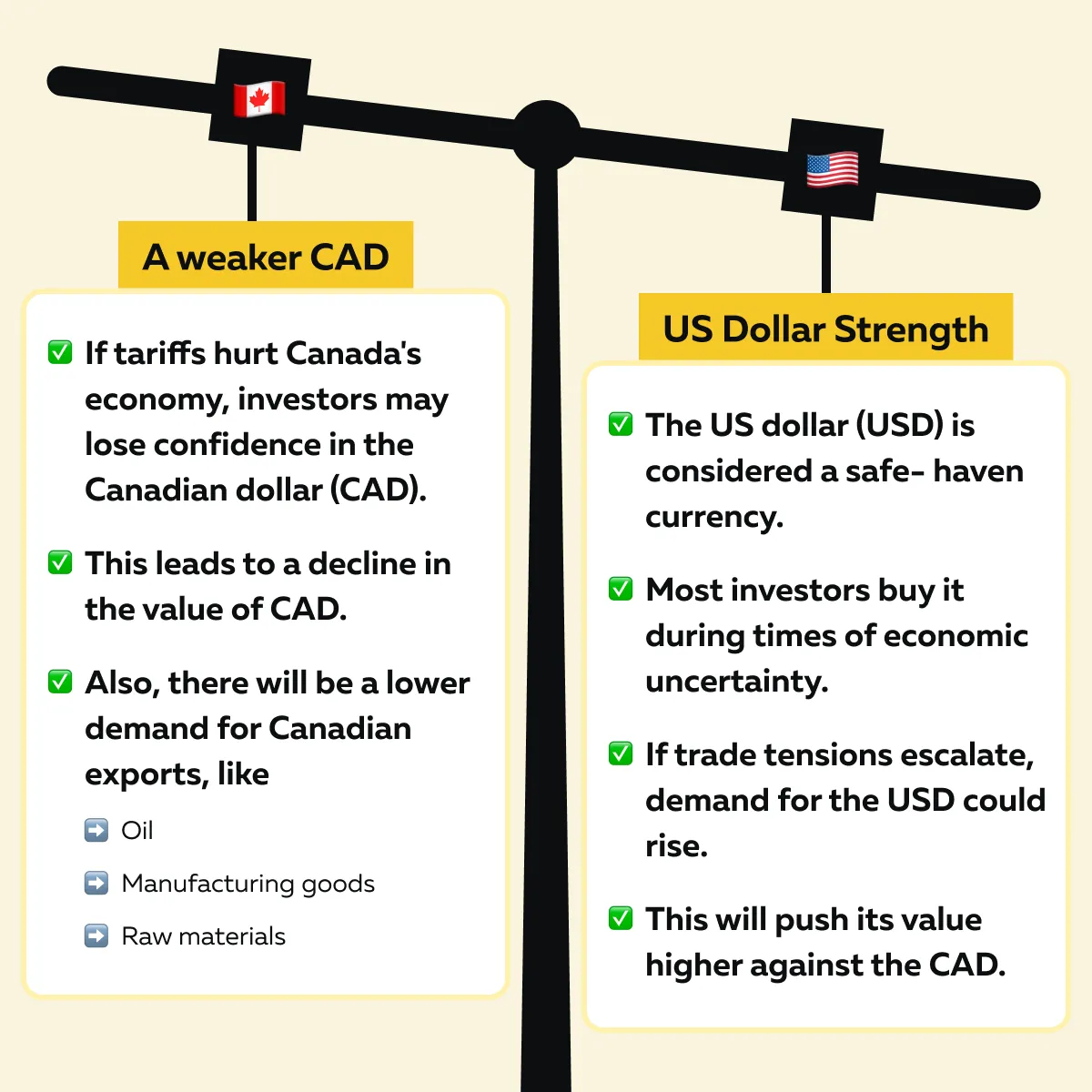

US-Canada trade tensions are also expected to impact currency markets (particularly the USD/CAD exchange rate) because trade disputes create uncertainty, which in turn causes currency volatility as investors react to economic risks.

Let’s learn through the graphic below how a US-Canada trade dispute could influence the exchange rate:

For example,

- During past US tariffs on Canada, the USD/CAD exchange rate spiked.

- The Canadian dollar lost value against the US dollar.

- This value constriction occurred because investors worried about:

- Reduced Canadian exports,

and

- An overall economic slowdown.

What Traders Should Watch for in 2025

With US-Canada trade tensions in 2025 growing, you need to stay alert to:

and

- Central bank actions.

US tariffs on Canada and changes in North American trade policies are expected to create ripple effects across markets. They will impact stocks, bonds, commodities, and currencies. Let’s see what you should watch to manage this situation:

Tracking Economic Indicators for Market Moves

To understand how tariffs and trade disputes affect markets, you should closely monitor economic data, such as:

| Economic data you should monitor | Explanation |

| GDP Growth Rates |

|

| Inflation Data |

|

| Employment Reports |

|

For example,

- Let’s assume that US tariffs on Canadian goods remain in place for an extended period.

- Canada’s economy could slow as a result, leading to:

- Weaker GDP growth,

and

- Lower equity market performance.

- If this happens, Canadian stocks will be less attractive to investors.

How Central Banks May Respond?

Please note that both the Federal Reserve (Fed) and the Bank of Canada (BoC) closely watch North American trade policies because they affect:

- Inflation,

- Employment, and

- Economic stability.

Some possible responses could be:

| Rate Cuts | Rate Hikes |

| If tariffs slow economic growth and hurt businesses, the BoC or Fed may cut interest rates to stimulate the economy. | If tariffs increase prices and cause inflation concerns, central banks might respond by hiking interest rates to keep inflation under control. |

For example,

- Let’s assume the BoC expects prolonged US-Canada trade disputes.

- This prediction may prompt the BoC to intervene to stabilize the Canadian dollar.

- It will do so by adjusting interest rates or taking other monetary policy actions.

Conclusion

The US-Canada trade dispute will be a significant risk factor for 2025. It will affect stocks, commodities, and currency markets. Tariffs and trade policy changes can create market volatility and impact the automotive, manufacturing, and energy industries.

As a trader, you must make it a point to stay informed. Watching economic indicators such as GDP growth, inflation, and employment data will help you to predict market reactions.

Additionally, you can use strategies like order flow analysis, futures trading, and currency hedging to deal with this uncertainty. A powerful tool for this is our advanced market analysis tool, Bookmap. It allows you to perform real-time market analysis by tracking liquidity, volume, and price action. Track real-time market reactions to tariff news with Bookmap’s liquidity tools.