Ready to see the market clearly?

Sign up now and make smarter trades today

Education

March 5, 2025

SHARE

Trade Like an Institutional Trader: How to Read the Market Like the Pros

Institutional traders have one major advantage over retail traders: deep liquidity access and order execution strategies that reduce market impact. Unlike retail traders placing small positions, institutional players manage massive order sizes—often thousands of contracts at a time. But trading in large size isn’t as simple as clicking “buy” or “sell.”

The key to trading like an institution is understanding how liquidity interacts with price movement and learning how to position yourself alongside big money instead of against it.

What Is Institutional Trading?

Institutional trading refers to the way professional firms such as banks, hedge funds, and asset managers participate in financial markets. These participants trade large position sizes and must carefully manage execution, liquidity access, and market impact. Instead of reacting to indicators, institutional traders focus on how liquidity forms, shifts, and absorbs volume across key price levels.

Understanding institutional trading helps explain why price often reacts sharply at certain levels and why markets frequently move before obvious technical signals appear.

In this guide, we’ll break down how institutions execute trades, how liquidity influences market moves, and how retail traders can use Bookmap to gain similar insights.

📌 What You’ll Learn

- How institutions manage liquidity and order execution

- Why understanding liquidity zones and market absorption is critical

- How retail traders can use Bookmap’s tools to track institutional activity

🔗 Want to see institutional order flow in action? Compare Bookmap Plans Here

How Institutional Traders Think About Liquidity

Liquidity is the foundation of every institutional trade. Unlike retail traders who can buy or sell 100 shares at market without moving price, institutions must be highly strategic about their execution.

Why Liquidity Matters

- Institutions execute thousands of contracts at a time. If they enter a trade at market price, they could push price against themselves before filling their position.

- They need liquidity providers on the other side—if they’re buying, they need a large pool of sellers at a key level.

- If liquidity is weak or unstable, price will move erratically, increasing execution costs.

How Institutions Use Liquidity to Their Advantage

Institutions don’t chase price. Instead, they target liquidity zones where large orders exist, allowing them to enter positions without causing massive price slippage.

Example:

An institutional trader wants to buy 1,000 NASDAQ futures contracts. Instead of buying at market, they wait for liquidity to appear on the heatmap, indicating where sellers are willing to absorb large orders.

Identifying Institutional Liquidity Zones

Institutional liquidity zones form where large participants repeatedly transact or defend price. These areas often emerge as zones where price pauses, consolidates, or reacts multiple times. Institutions use these zones to accumulate or distribute positions without forcing price to move aggressively against them.

By observing how liquidity behaves as price approaches these levels, traders can assess whether institutions are absorbing volume, withdrawing liquidity, or allowing price to move freely.

The Role of the Order Book & Level 2 Data

Before Bookmap and modern visualization tools, institutional traders had to rely on Level 2 order books to estimate where liquidity was sitting. But raw order book data is limited—many orders are pulled before they ever execute, making it difficult to trust what’s real.

Institutional Algorithmic Trading Strategies

Institutional algorithmic trading strategies focus on execution quality rather than prediction. These algorithms manage order timing, size, and placement based on real-time liquidity conditions. Rather than chasing price, they respond to how the order book evolves and how other participants interact with liquidity.

For traders analyzing order flow, these algorithms often reveal themselves through repeated absorption, consistent liquidity placement, or sudden changes in depth as execution objectives are met.

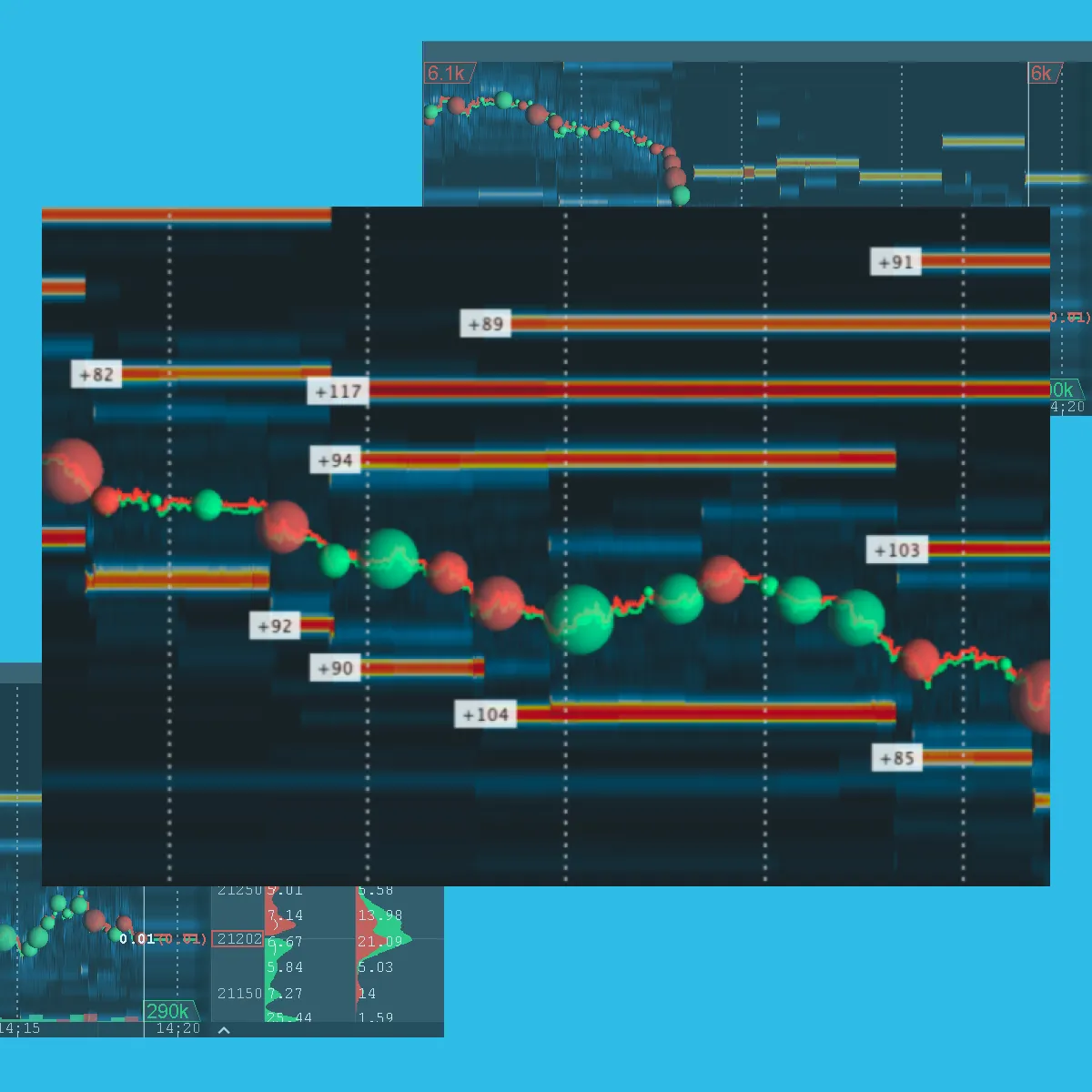

Using Bookmap to Read Institutional Liquidity

With Bookmap’s heatmap, traders can see:

- Where large bids and offers are sitting in real time.

- Whether liquidity is holding or disappearing (spoofing activity).

- How price reacts when it reaches a liquidity level.

Example:

If price approaches a large bid order at $4,000 and that liquidity remains firm, it suggests buyers are absorbing sell pressure. But if that liquidity disappears before price arrives, it could mean a fake wall was created to manipulate price.

How Institutions Execute Trades Without Moving the Market

Institutions use algorithms and execution strategies to prevent large orders from pushing price against them. Here’s how they do it:

A. Iceberg Orders: Hiding Large Trades

- Iceberg orders allow institutions to disguise their true order size by only showing a fraction of it on the book at any given time.

- Retail traders who aren’t using order flow tools won’t see the hidden size behind an iceberg, leading them to misread supply and demand.

How Institutions Hide Their Orders

Institutions rarely place their full order size directly into the market. Instead, they rely on algorithmic execution strategies designed to reduce signaling risk and minimize market impact. Large orders are broken into smaller executions and routed over time, interacting with visible and hidden liquidity.

Techniques such as iceberg orders, passive absorption, and liquidity-seeking algorithms allow institutions to execute size while remaining difficult to detect using price alone.

📌 How to Spot Icebergs in Bookmap:

- Look for repeated small orders absorbing large amounts of liquidity at a key level.

- Use the Stops & Icebergs tool to identify whether institutions are placing hidden buy or sell orders.

B. Liquidity Absorption: Identifying Strong Support & Resistance

Institutions absorb liquidity at key price levels to build or unload positions without alerting the market.

How This Looks in Bookmap:

- Strong liquidity remains at a level despite multiple price tests → Sign of true institutional demand/supply.

- Price moves toward a level and liquidity disappears before impact → Sign of potential spoofing or fake orders.

Example:

A hedge fund wants to accumulate 1 million shares of a stock but doesn’t want to drive the price up. Instead of buying everything at once, they slowly absorb liquidity at a key support level over multiple hours or days.

Retail traders who only follow price action might not see this happening, but order flow traders can spot aggressive buying with liquidity absorption in Bookmap.

Institutional Trading and Market Structure

Institutional trading plays a central role in shaping market structure. Large-scale portfolio adjustments, risk management activity, and capital rebalancing all contribute to liquidity shifts that influence price movement. These actions are part of normal capital markets activity and are continuously reflected in order flow and depth-of-market behavior.

Understanding this context helps traders interpret why markets transition between balance and imbalance and why liquidity often precedes price movement.

Trading Alongside Institutional Players: Key Strategies

While retail traders can’t move the market like institutions, they can position themselves in ways that align with institutional activity.

A. Trade Off Liquidity Zones, Not Just Price Action

Many retail traders chase breakouts or react to price movements, but institutional traders focus on liquidity levels instead.

📌 How to Adjust Your Approach:

- Identify major liquidity levels before entering a trade.

- Watch how price reacts at those levels—does liquidity get absorbed, or does it disappear?

- Use Bookmap’s Cumulative Volume Delta (CVD) to confirm if buyers or sellers are truly in control.

B. Understand Market Sweeps & Trapped Traders

Institutions will often push price into liquidity zones to trigger stop losses and force retail traders to exit at bad prices.

📌 How to Avoid Getting Trapped:

- If price sweeps through a liquidity level but fails to follow through, it may be a false breakout or reversal signal.

- If price sweeps through and continues with strong momentum, institutions are likely still accumulating.

Example:

A large buy wall appears at $100 on a stock. Price sweeps through it aggressively but fails to continue higher. This signals a possible fakeout, meaning sellers are still in control.

Retail traders who blindly buy breakouts without checking liquidity could end up trapped, while those reading the order flow correctly can fade the move and short at a premium price.

Conclusion: Applying Institutional Trading Techniques to Your Strategy

Institutions don’t trade based on indicators or lagging signals—they trade based on liquidity, market structure, and order flow dynamics. Retail traders who learn to read liquidity, spot absorption, and track iceberg orders can gain a huge advantage over those who rely solely on price action.

How to Apply This to Your Trading

✔ Use Bookmap’s heatmap to find true support & resistance levels based on liquidity.

✔ Watch for iceberg orders and absorption to confirm if a level is being defended.

✔ Track sweeps and false breakouts to avoid getting trapped.

✔ Align your entries with institutional execution strategies for better trade timing.

📌 Want to improve your ability to track institutional activity? Compare Bookmap Plans Here.

FAQ

What is institutional trading?

Institutional trading involves large-scale market participation by banks, hedge funds, asset managers, and other professional firms. These participants focus on efficient execution, liquidity management, and minimizing market impact.

How do institutions execute large trades without moving the market?

Institutions use algorithmic execution methods that divide large orders into smaller pieces. These methods interact with visible and hidden liquidity over time to reduce price disruption.

How can traders identify institutional liquidity zones?

Institutional liquidity zones often appear where price reacts repeatedly or where liquidity remains present despite heavy trading. Observing absorption, holding behavior, or sudden liquidity removal can provide clues.

Do institutions rely on indicators when trading?

Institutions primarily rely on liquidity, order flow, and execution behavior. Indicators may provide context, but execution decisions are driven by real-time market conditions.

Are institutional traders mainly banks or hedge funds?

Institutional traders include banks, hedge funds, asset managers, pension funds, and proprietary trading firms. While their objectives differ, their execution constraints are similar.