Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

December 25, 2024

SHARE

Understanding the Crypto Market: Overcoming Its Challenges

Every financial world has its unique language. In the crypto market,

‘whales’ don’t live in the ocean, and ‘HODL’ isn’t a typo. To execute

profitable trades, you must learn the language.

This article simplifies baffling jargon and guides you on how to handle the

crypto market’s volatility, manage risks, and deal with taxation

complexities. We will also understand the need for appropriate tools,

advanced security measures and different regulatory frameworks. So, let’s

begin.

Navigating the Challenges of Crypto Markets

The only thing constant in the crypto space is volatility. This is a popular

saying among traders. And, rightly so!

The infamous crypto market volatility poses significant challenges, but it

also presents opportunities for traders. They can capitalize on this

volatility by:

-

Understanding the factors influencing price movements

-

Managing their emotions

-

Employing technical analysis tools

Let’s understand crypto volatility in depth.

Market Volatility

Cryptocurrency markets are highly dynamic and difficult to predict. Crypto

prices experience rapid and sometimes extreme price fluctuations, which

happen due to market shifts:

-

Regulatory News:

-

Government regulations and policies impact crypto prices.

-

Announcements of bans, restrictions, or supportive regulations

from different countries often trigger significant market

movements.

-

-

Technological Advancements:

-

Upgrades, new features, or vulnerabilities discovered in

blockchain technology or specific cryptocurrencies swiftly

influence market sentiment and consequently lead to price

fluctuations.

-

-

Perceived Future Utility:

-

The perceived future utility and the crypto prices have a direct

relationship. -

Increased acceptance and use of cryptocurrencies in mainstream

industries or by influential companies can create surges or drops in

value.

How Psychological Aspects Impact Crypto Trading

Emotions often run high during extreme market movements. This compels

traders to make

impulsive decisions

. However, traders must remain calm and:

-

Avoid panic-selling,

-

Escape FOMO (Fear Of Missing Out), and

-

Stick to their pre-defined trading strategies.

How to Combat Volatility Through Technical Analysis

Most traders perform technical analysis to understand:

-

Market trends

-

Prevailing & emerging patterns, and

-

Potential entry or exit points.

By gaining such a deep understanding, traders can easily combat market

volatility. The usage of market analysis tools like Bookmap provides

visualizations that aid traders in comprehending order book data. This gives

them a competitive edge and allows them to gauge market depth and price

action in real time.

Security Concerns and Best Practices

Almost since its inception, crypto-related hacks and frauds have been a

significant concern. They have resulted in substantial losses for investors.

According to the

CipherTrace Cryptocurrency Anti-Money Laundering Report March 2023

, crypto losses reached $383 million due to seven major hacks/exploits.

These incidents emphasize the immediate need for robust security measures.

Hot and Cold Storage

Both storage facilities are a kind of crypto wallet. See the table below:

|

Parameters |

Hot Storage |

Cold Storage |

|

Meaning |

Hot wallets are connected to the internet and are |

Cold wallets, like hardware wallets or paper wallets, |

|

Pros |

Easy accessibility and suitable for active trading. |

High security due to offline storage. |

|

Cons |

More vulnerable to cyberattacks. |

Inconvenient for immediate transactions. |

What are Some Advanced Security Measures?

Traders can employ the following measures:

-

Multi-Signature Wallets: These wallets offer a high level of

security by incorporating:

-

Additional layers of authentication

-

The necessity of multiple private keys for transaction authorization

-

Backup Solutions: Traders are strongly advised to regularly back up

their wallets and keys. This precaution helps safeguard against data

loss in case of hardware failure or unexpected circumstances.

Additionally, the traders should:

-

Perform routine checks on their accounts and devices

-

Keep wallets and security software updated to guard against

potential vulnerabilities -

Stay informed about the ever-evolving threat landscape and new

security measures

Understanding Regulatory and Legal Complexities

The absence of uniform crypto regulations worldwide poses challenges and

uncertainties for global investors and businesses. Significant regulatory

changes can lead to:

-

Abrupt price movements

-

A shift in the perception of cryptocurrencies

To navigate regulatory and legal complexities effectively, investors and

businesses need a nuanced understanding of crypto space. Let’s understand

the changing regulatory landscape in detail.

The Shifting Landscape of Crypto Regulations

Cryptocurrency regulations vary significantly across countries. This

variation makes it complex to operate in the crypto sphere. Some nations

have embraced cryptocurrencies, while others have imposed stringent

regulations or outright bans. Examples include:

-

Countries like Switzerland, Malta, and Singapore have:

-

Adopted more welcoming stances,

-

Provided clear guidelines and

-

Created favorable environments for crypto-related businesses.

-

-

Whereas countries like China and India have imposed bans or

restrictions that cause fluctuations in the market due to their

significant user bases and influence.

One notable scenario demonstrating the impact of regulatory shifts was

China’s crackdown on cryptocurrency activities.

|

September, 2017 |

September, 2021 |

|

|

Tax Implications for Crypto Traders

Crypto taxation is ambiguous. The decentralized and relatively novel nature

of cryptocurrencies has made it complex for tax authorities to establish

clear and consistent guidelines. This lack of uniformity across

jurisdictions creates confusion for traders when it comes to taxation.

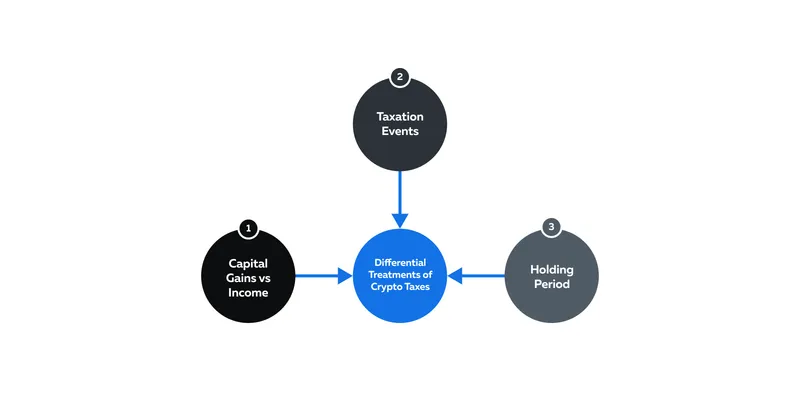

How Crypto Profits are Treated in Different Jurisdictions

Taxation of crypto profits varies based on the jurisdiction. Below are some

key differential treatments:

-

Capital Gains vs. Income:

-

In many regions, profits from cryptocurrency are treated as

either capital gains or income. -

Capital gains are typically taxed at different rates than

regular income. -

This distinction depends on factors such as:

-

The frequency of trading

-

The intent behind the transactions

-

-

-

Taxation Events:

-

Different countries have varying definitions of taxable events

related to cryptocurrencies. -

Some tax when crypto is sold for fiat, while others consider

crypto-to-crypto trades as taxable events.

-

-

Holding Period:

-

Usually, tax rates differ based on the duration for which the

cryptocurrency is held. -

Short-term holdings are taxed differently from long-term

holdings.

-

Importance of Records and Professional Advice

Maintaining detailed transaction records is crucial for crypto traders. Such

documentation is essential for accurately reporting gains or losses to the

tax authorities. The following records must be maintained:

-

Purchase prices

-

Sale prices

-

Dates of transactions

-

Any associated fees

Additionally, given the ever-evolving nature of crypto tax guidelines,

seeking professional advice from accountants or tax experts who specialize

in cryptocurrency taxation is highly recommended.

Crypto Literacy and Risk Management

Crypto trading is a high-stakes game. It is potentially lucrative but also

involves inherent risks. This makes practicing caution and employing risk

management strategies pivotal. The crypto traders must:

-

Invest only what they can afford to lose

-

Diversify portfolios

-

Use stop-loss orders, and

-

Avoid impulsive decisions based on market hype

Additionally, crypto traders should use advanced market analysis tools.

These offer visual representations of market data and help in making

informed decisions.

Crypto Jargons and Concepts

The world of cryptocurrency is teeming with unique terminologies. Given its

novelty and complexity, most newcomers find it daunting. Here’s a

beginner-friendly glossary to help you get started:

|

Common Terminologies |

Meaning |

|

Altcoins |

|

|

Fiat |

|

|

Whales |

|

|

FOMO (Fear Of Missing Out) |

|

|

HODL |

|

|

Initial Coin Offering |

|

|

Wallet |

|

Risk Management in Crypto Trading

Crypto traders and investors must adopt a proactive approach to risk

management. This not only helps in safeguarding capital but also mitigates

potential losses. Let’s understand some common

risk management

techniques:

-

Investing What You Can Afford to Lose

-

Due to the market’s high volatility, it’s essential to allocate

an amount that, if lost, wouldn’t significantly impact your

financial stability.

-

-

Diversification and Stop-Loss Orders

-

Traders must spread investments across different

cryptocurrencies. -

A diversified portfolio offsets loss in one asset with gains in

another.

-

-

Stop-Loss Orders

-

These orders allow traders to predetermine a price at which an

asset should be sold to limit potential losses. -

Implementing stop-loss orders protects against steep declines.

-

-

Avoiding Hype-Based Decisions

-

Cryptocurrency markets are influenced by hype and speculation.

-

Avoid making impulsive decisions based solely on:

-

Market hype or

-

Fear of missing out (FOMO)

-

-

How Does Bookmap Help in Crypto Risk Management?

Bookmap provides visualizations of order book data. This aids traders in

observing:

-

Market depth and

-

Price action in real-time.

Using these observations, traders can understand the market sentiments,

potential entry or exit points, and market trends.

Conclusion

The world of cryptocurrencies is challenging. Crypto traders experience

multifaceted challenges, ranging from market volatility and security

uncertainties to intricate tax considerations and a plethora of specialized

terminology.

However, within these challenges also lie opportunities for those who

approach the crypto space with resilience, caution, and an informed

strategy. The use of analysis tools like Bookmap helps traders visualize the

order book and understand the price action in real-time.

To further grasp the nuances of cryptocurrency trading compared to other

markets, be sure to check out our detailed analysis of

‘How

Crypto Trading Differs From Other Types of Trading’. It’s a great

resource to complement your growing understanding of the dynamic market.