Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 5, 2025

SHARE

US-EU Trade Tensions: How New Tariffs Could Reshape Global Markets

Tariffs don’t just tax goods; they tax markets, economies, and even investor nerves! Be aware that the US-EU trade war is escalating. It is poised to impact global supply chains, stock prices, and economic forecasts.

Want to make smarter trades in these uncertain times? In this article, we will learn how tariffs affect stocks, forex, bonds, and commodities. We will understand the trade war’s stock market impact and the key risks you must monitor.

You’ll also learn how institutional investors react, how to track liquidity shifts with our advanced market analysis tool, Bookmap, and how PMI data can serve as an early warning signal. Read till the end to stay ahead of market shocks.

How the US-EU Trade Tensions Impact Markets

Rising trade tensions between the US and EU are expected to impact global markets (particularly if auto tariffs in 2025 become a reality). As an investor, you must closely watch how industries and stocks react to potential trade barriers.

Stock Market Volatility: Automakers and Industrials at Risk

European automakers like Volkswagen, BMW, and Mercedes-Benz could struggle if US tariffs make their cars more expensive for American buyers. A decline in demand would significantly hurt their revenue.

On the other hand, US automakers like Ford and GM might benefit. More American consumers could turn to domestic brands if tariffs make European cars less competitive. This shift in consumer choice will boost their sales and stock performance.

Beyond automakers, these industrial stocks could feel the impact:

- Machinery,

- Aerospace, and

- Steel.

Tariffs are expected to disrupt supply chains and raise costs for manufacturers, impacting trade efficiency. For example, due to tariffs, Germany’s DAX index (which includes major exporters) may see heightened volatility.

US-EU tariffs could shake markets—track liquidity shifts in auto and industrial stocks with Bookmap.

Forex Market Reaction: Euro vs. US Dollar

The US-EU trade war could also have a significant impact on the currency markets, especially on the Euro (EUR) and the US dollar (USD). Let’s see how through the graphic below:

At the same time, the USD will strengthen. That’s because traders consider it a “safe-haven” currency during uncertainty. If this happens, it could make US exports more expensive but benefit American importers buying European goods at lower prices.

Key Currency Pairs to Watch

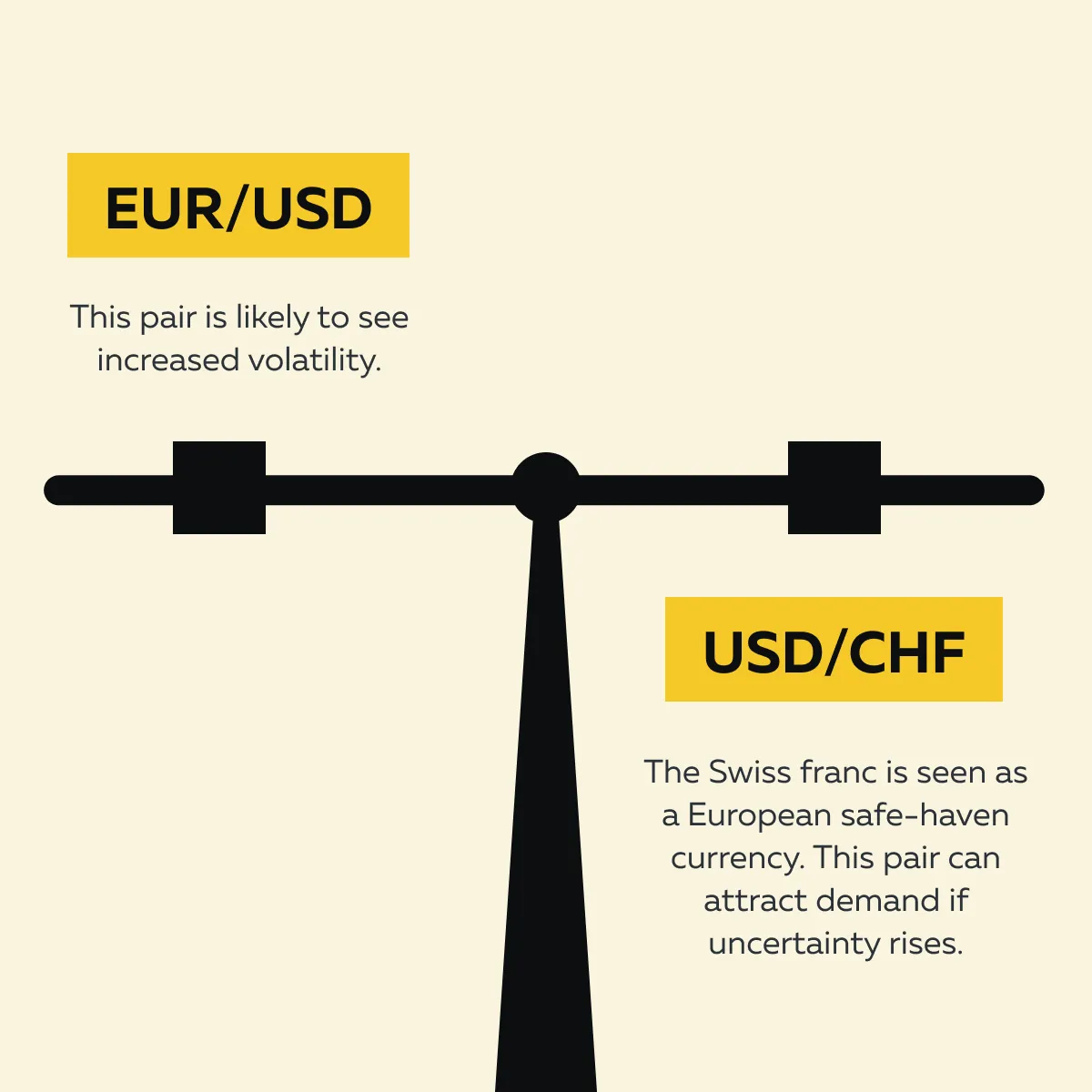

- EUR/USD: If tariffs slow Eurozone growth, the Euro may decline against the dollar.

- USD/CHF: The Swiss franc (CHF) could attract investors seeking a European safe-haven currency.

Commodity Markets: Steel, Aluminum, and Energy Impact

The US-EU trade war can also impact commodity markets (particularly steel, aluminum, and energy). If the US imposes auto tariffs in 2025, supply chains could be disrupted, leading to price volatility in metals used for car production. Let’s understand in detail:

Steel and Aluminum

- Tariffs on steel and aluminum would make raw materials more expensive for manufacturers.

- This spike will affect automakers and industrial sectors on both sides of the Atlantic.

- US and European companies that rely on imported metals might face higher costs.

- These higher costs will lead to price swings in global markets.

Energy Markets

- A slowdown in European industrial production could also reduce energy demand.

- The shrinking of energy demand will impact oil and gas prices.

- For example,

- Let’s assume Germany’s manufacturing sector weakens.

- Hence, Germany’s oil demand levels could drop.

- This drop could affect key benchmarks like WTI and Brent crude.

Bond Market Reactions: Eurozone Yields Under Pressure

The US-EU trade war could have a significant impact on European bond markets, which affects both:

- Government (sovereign)

and

- Corporate debt.

If trade tensions hurt economic growth, investors may shift their money into safer assets. This move will lower some bond yields.

Key Trends to Watch

The trade war’s stock market impact goes beyond just equities! It also plays a major role in the bond markets and influences:

- Yields,

- Investor sentiment, and

- Capital flows.

As an investor, you should track the following trends:

| German Bunds | Peripheral Eurozone Bonds | US Treasuries vs. Euro Bonds |

|

|

|

Using Order Flow Insights to Navigate Trade War Volatility

When US-EU trade tensions rise, major investors (institutions) often adjust their stock positions ahead of key events, like auto tariffs in 2025. What can you do as a trader? Ideally, you should watch order flow data.

This lets you understand how the market reacts and prepare for expected price swings. Let’s learn how you can do so:

| Spot Institutional Activity | Use our Bookmap to Track Market Activity |

|

|

Identifying Fake Breakouts in Tariff-Driven Markets

Trade war headlines often trigger news-driven trading. It causes false breakouts and liquidity traps. For example:

- Let’s assume GM stock jumps after a positive tariff-related news report.

- If institutions secretly unload shares at resistance levels, the rally might not last.

- This move would trap retail traders who bought in late.

How to Avoid Liquidity Traps?

Follow these tips:

- Confirm volume strength: A real breakout should have high buying volumes.

- Monitor iceberg orders: These hidden orders reveal whether big players support the move or absorb liquidity before reversing the trend.

Tracking PMI Data for Early Trade War Signals

The Purchasing Managers’ Index (PMI) is a key economic indicator. It provides an early warning about how US-EU trade tensions and auto tariffs in 2025 might affect:

- Business sentiment,

and

- Supply chains.

Be aware that PMI reflects the health of the manufacturing and services sectors. Thus, most traders and investors use it to anticipate market movements before they happen.

How does the PMI Signals Trade War Impact?

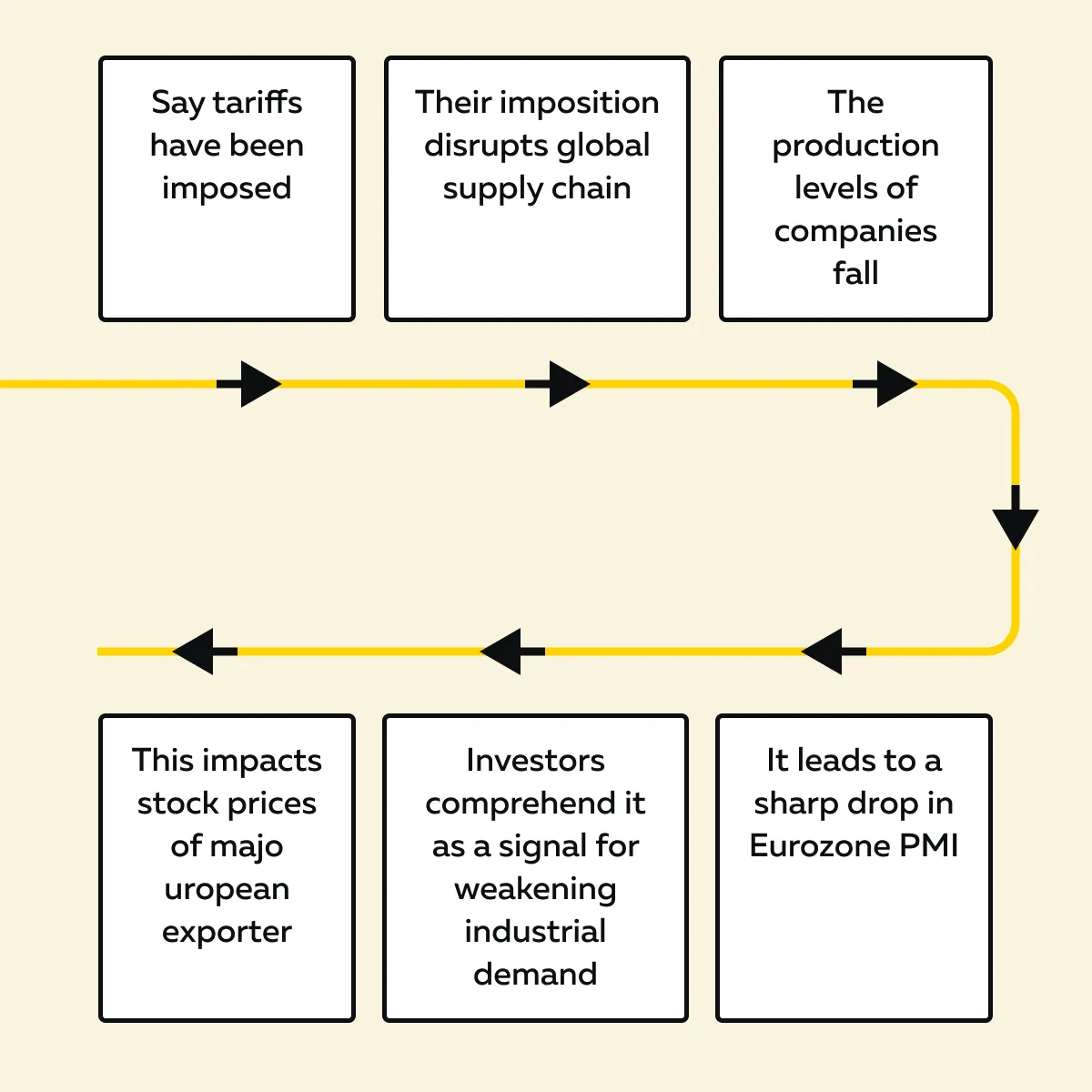

If tariffs disrupt global supply chains, companies may slow production, leading to a lower PMI. A sharp drop in Eurozone PMI (after a new tariff announcement) means weakening industrial demand. This affects major European exporters like Volkswagen and Airbus.

Let’s gain more clarity through the graphic below:

Similarly, if the US manufacturing PMI declines, it may indicate that American factories are struggling with higher input costs, hurting industrial stocks like Caterpillar.

How to Use PMI in Order Flow Analysis?

You can anticipate how institutions react to PMI data through order flow analysis. Let’s see how you can use it:

- Watch for institutional reactions:

- Say PMI numbers come in weaker than expected.

- Now, large investors may start aggressively selling stocks in affected sectors.

- Compare with liquidity clusters:

- If institutions position themselves ahead of a PMI release, their order flow could reveal expectations about the data before it’s published.

- For example,

- Say liquidity clusters form in DAX index stocks.

- It could suggest that big investors expect negative PMI data for the Eurozone.

- Monitor sector-specific impacts:

- If the US manufacturing PMI drops, industrial stocks like Caterpillar might decline.

- At the same time, a weak Eurozone PMI could put pressure on Germany’s DAX index.

Don’t let trade war headlines catch you off guard—use Bookmap’s order flow data to stay ahead of market volatility.

Trading Strategies for Navigating US-EU Tariff Volatility

The US-EU trade war and expected auto tariffs in 2025 could create high volatility in global markets. Thus, you must adjust your strategies to exploit such market shifts. Below are three key trading approaches to do so:

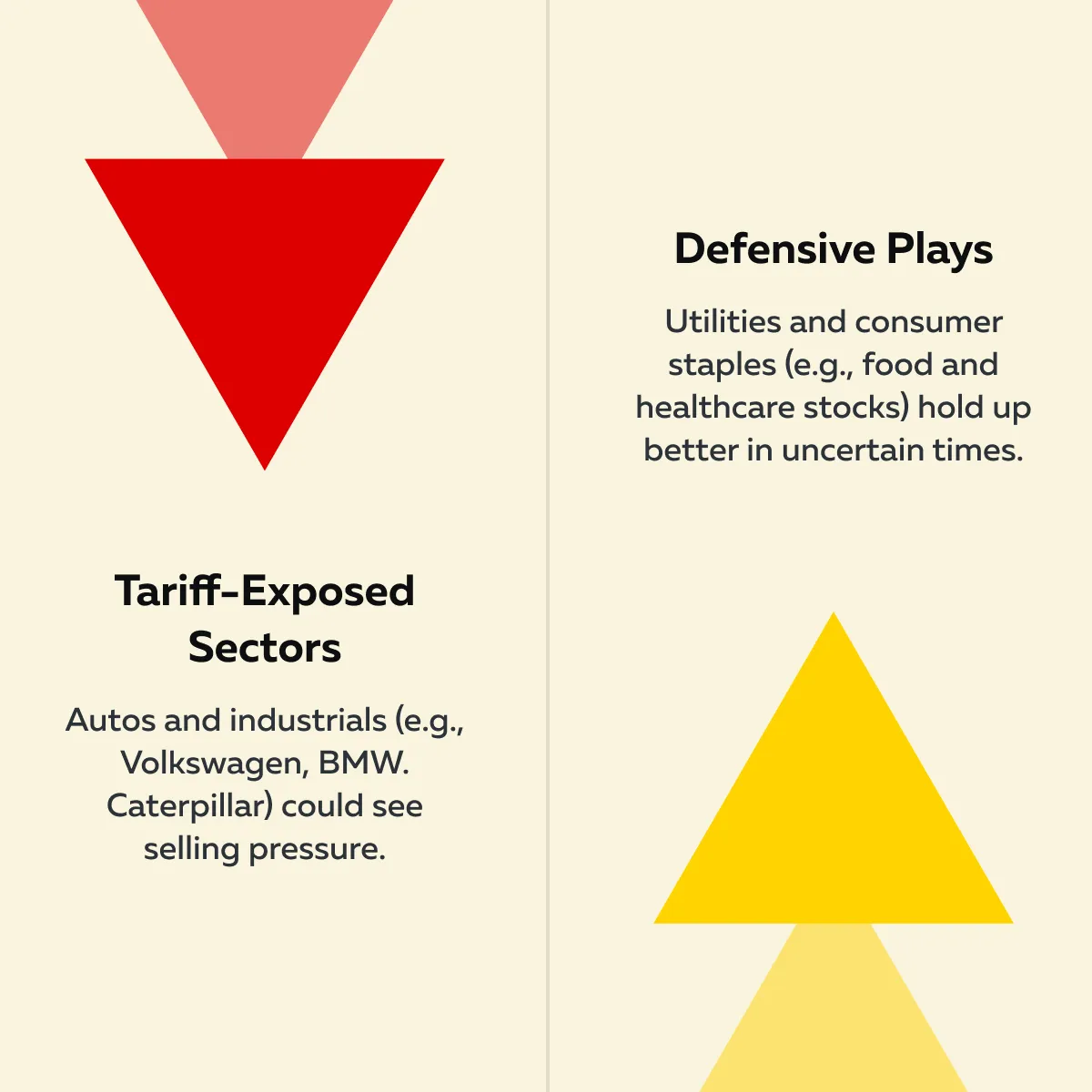

1. Sector Rotation in Response to Trade Policies

When tariffs are introduced, you can rotate capital from sectors that the policy could hurt into safer investments. Check out the graphic below:

For Example:

- Let’s assume new US auto tariffs go into effect.

- Now, you can move money into US-based manufacturers like Ford.

- This move reduces your exposure to European automakers like Volkswagen.

How to Use Bookmap?

As a trader, you can use Bookmap to identify volume spikes in defensive sectors. The volume spikes signal institutional buying. Also, you can spot institutional repositioning in response to tariff news by tracking order flow and liquidity clusters on Bookmap.

2. Trading Retests of Key Liquidity Zones

Markets often retest major liquidity levels after a trade war announcement. This market behavior gives you opportunities to enter or exit positions strategically. For example,

- Let’s assume Tesla stock surges on tariff news.

- However, Bookmap heatmaps show strong sell-side absorption at a resistance level.

- Now, this indicates that traders are expecting a price rejection.

- You should look for a short-selling opportunity.

How to Use Bookmap?

On Bookmap, you can track bid/ask imbalances at key levels. This feature will allow you to see if buyers or sellers are in control. Additionally, you can confirm real buying strength. If the price moves up without substantial volume, it could be news-driven hype rather than genuine demand.

3. Forex Pairs to Watch for Tariff Fallout

Please note that the forex market is susceptible to trade tensions. The EUR/USD pair is particularly vulnerable if tariffs hurt the Eurozone trade. For example:

- Let’s assume the Euro weakens due to fears of a slowing EU economic outlook.

- Now, traders might look for pullbacks into resistance as opportunities to short EUR/USD.

Check out the graphic below to learn about what other forex pairs you can watch:

Managing Trade War Volatility: Key Risks to Watch

The US-EU trade war could create significant market volatility in 2025. This volatility will occur as investors react to new auto tariffs in 2025 and the expected countermeasures. By understanding the key risks, you can manage the uncertainty more effectively. Let’s learn about some key risks you must watch:

1. Market Overreactions and Policy Uncertainty

Financial markets often overreact to trade war headlines. Such an overreaction causes exaggerated price swings. Several traders are influenced by this volatility and rush to buy or sell based on short-term news.

However, they don’t realize that the market will correct itself once the full impact of tariffs becomes clear.

For Example

- US industrial stocks rally because tariffs seem to favor American manufacturers.

- However, later, the EU announced countermeasures.

- Due to this, the rally faded quickly.

- It led to sharp reversals.

The trade war’s stock market impact can confuse traders who don’t look beyond the initial reaction.

2. Prolonged Uncertainty and Retaliation Risks

One of the biggest risks is that trade tensions drag on. They create long-term volatility across multiple asset classes. If the EU retaliates with its own tariffs on US goods, market instability could last for months.

For Example

- Let’s assume the EU imposes tariffs on American products like agriculture, steel, or technology.

- Now, this hurts companies that rely on European sales.

- As a result, investors started selling stocks in both the US and Europe.

- They fear an extended economic slowdown.

Such situations negatively affect the EU economic outlook and add pressure on:

- European bonds,

- Currencies, and

- Equities.

3. Sector-Specific Fallout

While automakers are the most obvious target, other industries could also experience significant disruptions. Check out the graphic below to learn about industries that could see major price swings:

For Example

- Let’s assume a few US tech firms rely on European suppliers.

- They might face higher costs if tariffs raise import prices on components.

- If steel tariffs increase, manufacturing costs could rise for companies like Boeing and Caterpillar, putting pressure on their stock prices.

Similarly, agricultural exports to Europe could decline, affecting US farmers and commodity markets.

Conclusion

The US-EU trade war increases volatility across stocks, forex, and commodities. It renders markets unpredictable. As auto tariffs in 2025 and other trade policies take effect, you should expect rapid price swings and shifts in capital flows.

You must stay ahead of institutional activity to trade profitably in such an environment by monitoring key indicators like order flow, liquidity zones, and PMI data. For this purpose, you can start using Bookmap’s heatmaps.

Through it, you can identify where large players are positioning themselves, reducing the risk of getting caught in false breakouts or liquidity traps. See how major stocks react in real time to trade tensions. Spot institutional moves before the market does with Bookmap.