Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

February 4, 2024

SHARE

What are Cryptocurrency Futures?

A cryptocurrency futures contract is a leveraged financial instrument. In addition to being used to speculate on a cryptocurrency’s future price, they can also be used as a means of hedging price risk.

Nowadays there are countless exchanges offering high-quality futures products to trade. In this article, we will further explore what cryptocurrency futures are and how they can be used.

Table of contents:

Types of Cryptocurrency Futures Contracts

How to Analyze Cryptocurrency Futures

What is a Cryptocurrency?

Cryptocurrencies are digital assets. Unlike fiat currencies, cryptocurrencies are powered by peer-to-peer networks rather than backed by central banks. Bitcoin, the original and most famous cryptocurrency is maintained by a Proof of Work (PoW) blockchain.

Up to 100 millionth of a coin can be freely transacted, and it’s miners that validate transactions on the network. The PoW algorithm compensates miners for increasing the security of the network and not allowing things like double-spending.

What is a Futures Contract?

A futures contract is an agreement to buy or sell an asset at a predetermined price at a specific future date. Both speculators and commercial traders use futures contracts to generate returns and reduce risks.

Traditionally, a futures contract is physically settled, meaning one party must deliver the product. Since cryptocurrencies are digital assets, they are settled monetarily, and with the addition of perpetual futures contracts, an expiry date isn’t even necessary for settlement.

Why Use Futures Instead of Spot?

Most beginners can easily understand spot trading, since the asset is delivered immediately. But for traders who are willing to delve a bit deep, futures can be lucrative if used correctly.

Before trading futures, they should be fully understood. Here are some of the unique characteristics of futures contracts.

Leverage

Trading futures gives you access to leverage. Requiring only maintenance margin, a trader can take the same size position as in a spot market for a fraction of the cost. This is a double edged sword, however, since leverage can increase both the size of wins and of losses.

Lower Fees

Trading usually means getting into and out of positions on a regular basis. For this reason, traders are incentivized to use futures contracts, as they are usually cheaper than spot. If bulk trading many thousands of times per month, such market participants will usually get a reduction in commissions, making trading even cheaper.

Types of Cryptocurrency Futures ContractsTypes of Cryptocurrency Futures Contracts

Perpetual contracts

A perpetual contract, or perpetual swap, is the same as any other futures contract, only that they do not have a defined termination date or settlement date, allowing them to be held or traded indefinitely.

A perpetual contract enables traders to hold leveraged positions without worrying about an expiration date, which is why these contracts are gaining traction in the crypto world. The perpetual funding rates of perpetual contracts mean the index price for the underlying asset is closer to the index price of the future.

An important feature of perpetual contracts is the funding rate, which is the mechanism to ensure that futures and index prices converge on a regular basis. This is done by paying or charging longs or shorts (usually every 8 hours) based on the difference between the contract and spot prices.

The Chicago Mercantile Exchange

One of the most recognizable exchanges, the CME provides trading of futures and options in various industries, including agriculture, energy, stock indexes, foreign exchange, interest rates, metals, real estate, and even weather.

Aware that the way is an uncertain place, money managers and commercial organizations are expected to hedge their risk and lock in pricing critical to their operations. Commodity futures allow merchants to more precisely calculate their balance sheets and for how much they can sell their items on the market.

But as mentioned previously, futures are often used by speculators too. The CME has Bitcoin and Ethereum cash-settled futures, and has more recently introduced options for Bitcoin as well.

Long-dated futures

A quarterly futures contract refers to a transaction where an underlying asset is purchased or sold in the future at a fixed price. This type of futures contract has an expiration date instead of the perpetual futures contract. Regardless of where the underlying asset’s price is at when the quarterly futures contract is due, both parties must execute the contract. A higher settlement price results in a buyer gain, while a lower settlement price results in a seller gain.

How to Analyze Cryptocurrency Futures

Looking at futures contracts requires a slightly different method of analysis from other markets, which usually involves looking at multiple expiries. Here are some of the basics

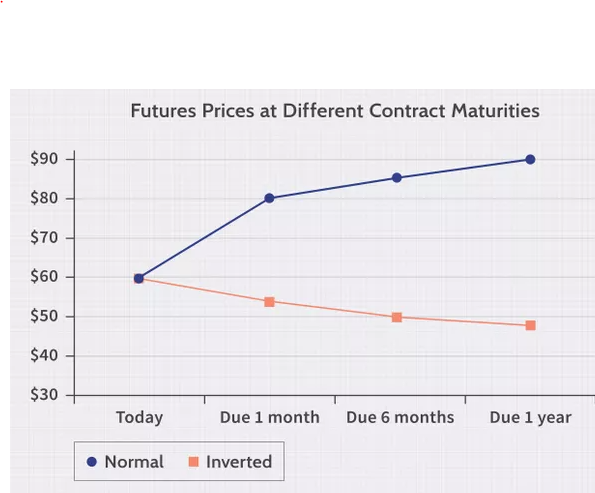

Fig 1: Hypothetical futures prices across different maturities. Source: Investopedia

Forward curve

Forward curves show the price at which a delivery or payment for the future can made today. The forward curve illustrates the pricing term structure and can give insights into whether the market thinks prices prices will be higher in the future, or lower.

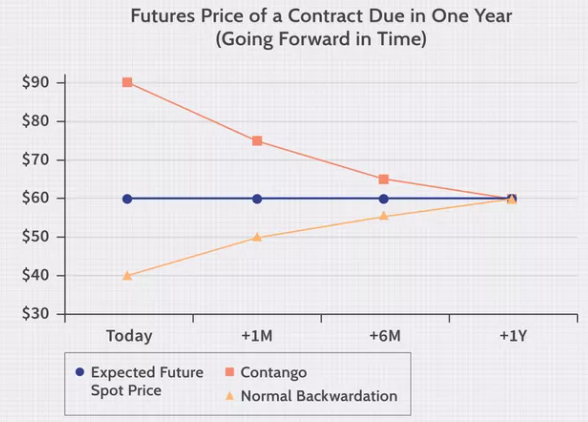

A scenario in which the futures price of an asset is greater than the spot price is referred to as contango. When sentiment is bullish and the market believes the price of the asset will rise, contango usually develops, resulting in an upward-slanting forward curve.

Backwardation

An asset in backwardation is when the current price is higher than the prices on the futures market, causing an inverted futures curve.

Fig 2: Hypothetical futures prices showing a market in contago vs in backwardation. Source: Investopedia

ConclusionConclusion

Access to leverage is one of the biggest advantages of cryptocurrency futures. Speculators can use cryptocurrency futures to speculate on the future direction of a digital asset, but can also be used to hedge cryptocurrency price risks.

Cryptocurrency futures can at first glance seem like complex financial products: which they are. But using Bookmap to analyse the order flow of crypto futures—even those across multiple exchanges—can offer you a better chance of success when facing this often volatile market.

You can try it out for free today. Click here to get started.