20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

April 14, 2024

SHARE

What are Market Cycles?

Market prices are barely ever completely static, fluctuating from price zone to price zone. The stock and commodities markets in particular are known for the frequent and repetitive periods of ups and downs which define their cycles.

Defining Market Cycles

A securities market exhibits various trends and patterns in different environments, commonly:

- Business environments

- Legal frameworks

- Operational circumstances and,

- Prevailing political situations

These trends lead to the creation of different market phases, known as market cycles.

How to Define Market Cycles

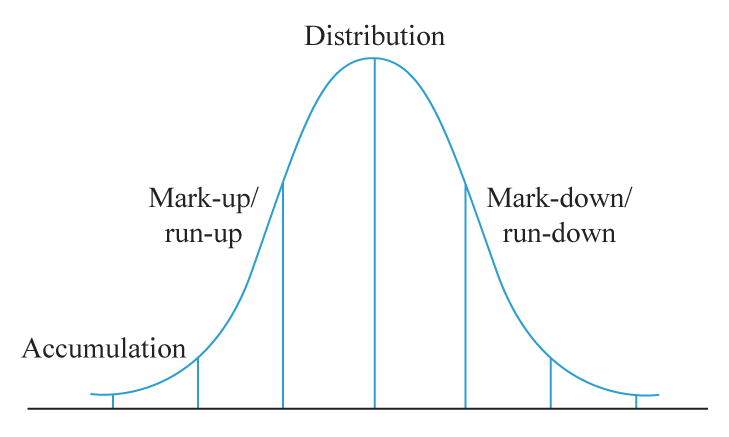

A typical market cycle is usually composed of four different phases, with each one reflecting a particular trend prevailing in the market.

Without making things too complicated, there are traditionally two ways to successfully make money in the stock market: 1) buy low and sell high, or 2) buy high and sell higher. To do either, a trader or investor must understand the 4 phases of every market cycle:

Image source

1. Accumulation

This phase represents the lowest point of a stock’s price history. Of course, understanding this in advance is the holy grail, and a lot easier said than done. However, such prices sometimes come after a significant downtrend. Stock prices are often very low and look to be bottoming out.

This phase will see participation from various ‘smart money’ participants, such as:

- Corporate Insiders: These are a class of senior officers of a company who are generally aware of the material information, which is not available in the public domain.

- Value Investors: These are a brilliant but ballsy class of investors who seek to buy stocks at steep discounts, sometimes more than two-thirds of their ‘intrinsic value’. Value investors never overpay and look for deep discounts.

- Experienced Traders: These players may not even understand the fundamentals of the asset in question, but are experts at analysing market trends and will note that prices are bottoming out and could put them on a watchlist for a potential buy signal.

Such participants usually enter the market during the accumulation phase, assuming that the worst has passed and that perhaps the market is even overly extended to the short side.

2. Markup

All markets are impacted by the forces of demand and supply. Since this theory is based on cycles of the stock market (which tends to rise over time), this phase usually refers to an uptrend. During this accumulation phase, the market experiences a lot of aggressive buying. There is always a buyer for every seller in the market, but in this case it means that for every trader or investor willing to sell their securities, there is a buyer willing to scoop it up at seemingly any price.

This dynamic means the market is in a phase where prices are rising steadily, and is the second wave of buying, the first being the less obvious accumulation phase.

3. Distribution

After witnessing two waves of buying, the market will return to a range-bound period of price action for this phase. Any ‘smart’ money that caught the move will now be looking to sell and cash out their profits, all the while making sure not to push the market down.

It may be hard to identify in real-time, but this phase is a topping phase; where prices are rounding off and could begin to fall.

With this shift in sentiment, the market of strong bulls may become more mixed, this change bringing with it the potential for the beginning of a downward move in prices.

4. Markdown

This last phase of a typical market cycle is triggered during the distribution phase, a wave of heavy selling leading to lower lows and lower highs.

Whether profit taking or even short selling, the market has entered the markdown phase.

It is important for traders or investors that caught the move up but missed the start of the markdown phase to not become overly emotional seeing their paper profits drastically reduced.

On the other hand, it is no time to start bottom picking. True, once the markdown phase is over, an accumulation phase can start, and the entire cycle can repeat again. The caveat being that nobody knows how long the markdown phase will last, and when the accumulation phase will start. Therefore, it is vital to use strict risk management techniques.

Types of Market Cycles

The different market cycles and their associated patterns can also be understood through the two major cycle theories, which are:

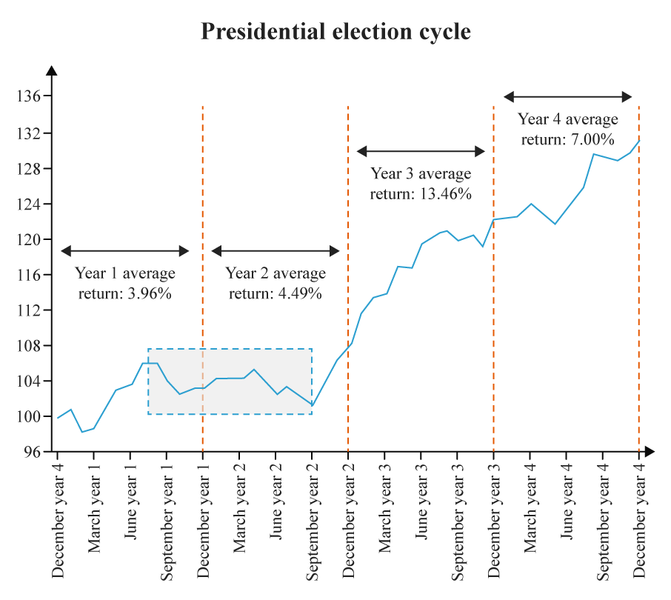

The Presidential Election Cycle

Image source

This theory attempts to understand the stock market pattern after the election of a new president in the United States.

According to this election cycle, the stock market behaves differently in the different years of the presidential term as follows:

| Different years of the Presidential Term | Market Behaviour | Effect on the Stock Prices |

| First-year | The market is at its weakest | Stock prices begin to bottom out |

| Second and Third Year | The market recovers | Stock prices begin to rise |

| Third Year | The market is at its peak | Stock prices are at their highest levels and begin to topl |

| Fourth and Fifth | The market begins to fall | Stock prices begin to fall |

Commodity Price Cycles

Due to their inherent interconnections to the supply and demand of resources, commodity markets often experience clear cyclical patterns.

The main stages of a commodity market cycle are:

| Phase | State of Economy | Effect on the Commodity Prices | Reasons |

| Super Cycle | Expansion | The commodity price starts to increase |

|

| Downswing Phase | Contraction | The commodity price starts to fall |

|

According to the World Bank, commodity cycles last almost 6 years on average.

Conclusion

The different phases define a market cycle, which is typicall divided into four market stages: Accumulation, Markup, Distribution, and Markdown.

Market cycles are not meant to be a holy grail that tells you exactly when and where prices are headed, but they can be very useful for knowing what sort of environment the market is currently in.

Hence, every trader and investor must have a solid grasp of all the major market cycles for risk management, as well as potential alpha generation.

The traders in our community are always exploring new ways of looking at the market, and this includes cycles. Join the conversation for free today.