Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

Education

April 27, 2024

SHARE

What is Carry Trading?

Carry trading involves borrowing an asset, and using it to fund the trade of a higher interest-rate bearing instrument. This method is more suitable for traders with substantial capital. This style of trading can sometimes be volatile and result in large losses if the trade is not correctly executed.

Carry trades can result in high gains for the trader but must be understood in detail before executing. Read on if you are interested in knowing more about carry trading, how to execute them, and the risks associated with these trades.

Table of Contents

How Does a Carry Trade Work?

A carry trade involves borrowing money at a low interest rate and then investing it in a financial asset that produces higher returns. The difference between the returns by the financial security and the interest to be paid is the trader’s profit. However, volatility in the market can lead to excessive losses while executing a carry trade.

A trader can make profits only when the financial security being invested gives a higher interest rate than the borrowed rate of interest. Utilizing a carry trade requires extensive knowledge of the market and financial stability to ensure that losses are within the limits of the trader.

Understanding The Carry Trade

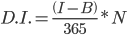

Carry trades allow the trader to earn daily interest on the financial security invested in the financial market. This interest can be calculated using the following formula:

Where D.I. stands for “Daily interest”, I for “Interest on Investment”, B for “Interest on Borrowed value,” and N for “Notional Value”.

Daily interest is essentially the profit of the trader.

Investment interest is the rate of interest received by the trader on the financial security.

Interest on Borrowed value security is the rate of interest on the total value that the trader must pay back.

Notional Value is the Value invested in the security which has been borrowed.

Risks of Carry Trading

All trading styles have risks. After all, you have to risk money to make money.

The biggest risk of carry trading in currencies is in the exchange rate. If the rate moves against the carry trader’s position in a short enough amount of time, it can completely wipe out any profits (and then some). Not only that, but sometimes carry trades can be crowded as everyone is looked for the same yield, which can lead to massive unwindings of positions if prices move against many traders, especially when leverage is involved.

It is also necessary to keep track of the potentiala future direction of interest rates. If there is a dichotomy in the monterary policies of the two respective central banks that issue the currencies in the carry trade, it could drastically affect the trade.

Wrapping Up

Carry trading can offer a relatively easy profit-making opporuntiy in the right circumstances, but it isn’t without its risks.

It is necessary to understand the calculations that go into the trade, as well as keep track of currency rates and shifts in monetary policy that could potentially impact the trade.

Bookmap comes with multiple tools that can be useful when executing a carry trade. Try out the array of indicators available today for free. Click here to get started.