20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

March 23, 2024

SHARE

What is Spoofing in Trading?

Spoofing is often associated with HFT, but it has long existed in financial markets. As a zero sum game, traders are always trying to outsmart each other, and sometimes the easier way to outsmart somebody is to simply trick them.

One of the more famous traders that made a name for themselves by utilising questionable practises such as spoofing was known as “The Flipper”, known for luring traders into the market with large orders on the opposite side of his trade.

But spoofing is an illegal practise, that is strictly frowned up in regulated markets, highlighted with the arrest and prosecution of British “Flash Crash” trader Navinder Sarao.

But some think certain traders still find ways around the regulations and manipulation markets, with spoofing being the go-to tactic.

The advent of high-frequency trading (HFT) allows market participants with the know-how to execute multiple trades faster than the blink of an eye (literally). Since markets are basically just prices, and successfully manipulating prices (and getting away with it) can lead to windfall profits, spoofing is still a relevant subject.

If you want to learn more about spoofing and how to identify it, then read on. We’ll dive into the topic in this article.

Table of Contents

- What is Spoofing?

- Why Do Traders Spoof?

- How to Identify Spoofing

- Wrapping Up

What is Spoofing (Order Book Spoofing)?

Spoofing is an illegal practice wherein a trader intentionally places an order to buy or sell a security and cancels it before it can be executed. Placing such an order creates a false sense of supply or demand in the order book and can impact market sentiment and price. The trader utilises this change in sentiment to position himself in anticipation of making financial profits.

Spoofing can be carried out manually but is likely to be carried about by an algorithm. Since electronic markets can move so fast, spoofers often utilise algos for scalping—spoofing or otherwise.

Why do traders Spoof?

Like most things in trading, the ultimate goal of spoofing is to make profits. It could be used as a trading strategy in itself, or it could be used within an investing framework.

For instance, if a trader has purchased security that he wants to sell quickly, the trader might carry out a brief spoofing to increase the price of the security and exit their position. With the help of fake demand, the trader can exit at a higher price.

The risk is, if a trader on the other side wants to call his bluff and hit his bid before he can pull it, he may be stuck with an even bigger purchase than he intended.

How to Identify Spoofing

We have written a lot about spoofing, but admittedly it can be quite challenging to identify. If you see large orders pulling before prices reach them, that’s a strong indication that those orders were spoofing orders—but there isn’t much value in that information after the fact.

Getting a feel for order flow can allow a trader to observe irregularities and identify them, but it’s usually a better idea to just stick to their original trading plan to avoid being swayed by spoofing.

That being said, keeping an eye out for the following order flow irregularities may indicate spoofing and call for caution in trading around those zones:

- Extremely large bids or offers suddenly entering the order book

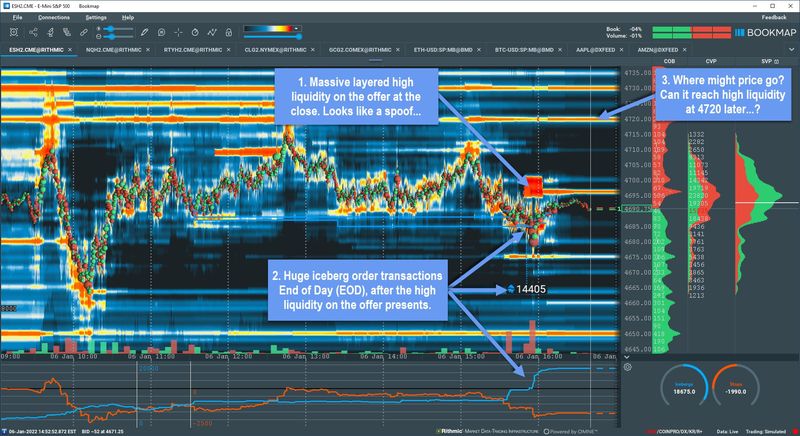

While this could easily be genuine orders entering the book, if they are larger than normal and haven’t been sitting in the book for very long, this could be a large trader attempting to spoof the market. If the order also comes at a specific point in the trading session (e.g. the open or close), then that is another sign of potential trading misdeeds.

A huge layer of orders comes in just as the market approaches the close, indicating a potential spoof.

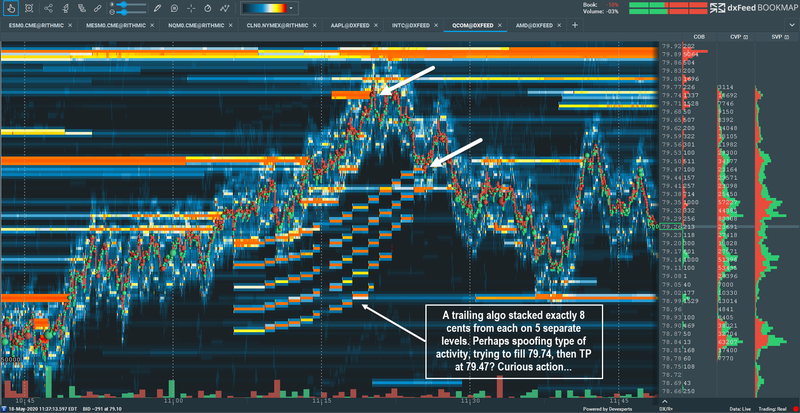

- Limit orders stacked at regular intervals that follow price

This sort of order flow behaviour indicates that an algo is in play. Often prices can retrace or pullback after such activity, likely being the spoofing participant closing out their trade.

Wrapping Up

Spoofing is a highly illegal activity and such price manipulation can result in severe penalties for the guilty trader.

Spoofing can affect all the traders in the market but is most commonly a cause for concern for day traders and scalpers. Although it can be challenging to identify spoofing, it can be a good idea for traders to watch out for suspicious order flow behaviour to avoid potential losses.

Bookmap is a high-performance trading platform that lets you see how the order book changes order time, potentially alerting the knowledgeable trader to spoofing activity.

To see the unseen and view market mechanics, try it out today for free. Click here to get started.