Ready to see the market clearly?

Sign up now and make smarter trades today

Market Analysis

March 28, 2025

SHARE

Why Markets Might Be About to Change: Lessons from New Political Leadership

As traders or investors, are we searching for certainty in the financial market? Well, with politics in the mix, certainty is the last thing we can expect. Yes, due to significant market changes expected in 2025 and the impact of the previous Trump administration, we need to be ready for anything. Political decisions have the power to shape entire industries, influence stock prices, and create both new opportunities and risks that can affect the market landscape.

So, how do we stay ahead in such times? In this article, we will delve into how Trump’s leadership impacted market dynamics through measures such as deregulation, tax cuts, and global trade policies. We will also explore how a new administration could change market competition and introduce new rules and even favoritism toward certain industries. By reflecting on lessons learned from the 2008 financial crisis, we can draw valuable comparisons between past and current economic challenges.

Additionally, we will discover trading strategies for politically driven markets, including how to manage volatility and how to use our market analysis tool, Bookmap, to get real-time insights. Finally, we will cover key indicators to watch, like inflation, interest rates, and the Volatility Index (VIX). Want to make smarter trading decisions? Use this knowledge to your advantage. Let us begin.

How Trump’s Leadership Influenced Market Dynamics?

One of the defining aspects of the Trump administration’s economic strategy was its focus on deregulation. The administration implemented policies aimed at reducing restrictions in industries, such as:

- Energy,

- Banking,

and

- Finance.

These policies were specifically designed to encourage investment and economic growth. Additionally, the administration rolled back numerous environmental regulations, which eased restrictions on fossil fuel production and resulted in a significant increase in domestic energy output. Similarly, financial regulations under the Dodd-Frank Act were loosened, providing banks with more operational flexibility.

Overall, all these measures contributed to a period of economic expansion, particularly benefiting corporations that had previously faced regulatory burdens.

The 2017 Tax Cuts and Jobs Act

A key moment that reflected the market’s confidence in the above-mentioned policies was the passage of the 2017 Tax Cuts and Jobs Act. The law significantly reduced corporate tax rates. This measure:

- Increased earnings of companies

and

- Incentivized businesses to expand operations.

As a result, stock markets experienced a strong rally, with the S&P 500 and Dow Jones Industrial Average reaching record highs. This bullish sentiment showed how deregulation and tax incentives influenced investor optimism and economic momentum. Now, the broader implications of these policies will continue to influence market changes in 2025.

Impact on Global Trade

Trump’s trade policies (particularly his stance on tariffs) impacted the global market. His administration imposed tariffs on major trading partners, such as:

- China,

- The European Union,

and

- Canada.

These tariffs were levied to reduce trade imbalances and promote domestic manufacturing. However, these measures increased market volatility because investors reacted to uncertainty over supply chain disruptions and retaliatory tariffs.

The Agriculture and Manufacturing Ruin

One sector significantly affected was agriculture. Farmers faced declining exports due to retaliatory tariffs from China on U.S. soybeans and other crops. Similarly, the manufacturing industry experienced shifts in supply chains. Most companies either:

- Passed increased costs onto consumers

or

- Relocated production facilities.

In this way, tariff negotiations led to fluctuating commodity prices, which deeply influenced seasonal futures trading in both agriculture and energy markets.

What’s in store ahead?

The economic impact of these trade tensions still resonates today. Looking ahead, the influence of the Trump administration’s market impact remains a topic of debate, particularly in assessing how political policies influence:

- Capital flows,

- Corporate decision-making,

and

- Investor sentiment.

Understand how politics shapes trading opportunities with Bookmap’s advanced order flow tools.

What a New Administration Could Mean for Market Competition

When a new administration takes over, it usually changes the country’s economic priorities. This affects how businesses operate and compete.

For example,

- Let us assume that the Trump administration is focused on reducing regulations.

- Now, this will make it easier for companies in industries like banking and energy to expand.

- In contrast, a different leader might take the opposite approach.

- It can introduce stricter rules to:

- Ensure fair competition,

- Protect the environment,

and

- Promote economic fairness.

These changes influence several parameters. Check the graphic below:

Due to these changes, some industries may benefit, while others might struggle with new restrictions. Here, the tech and energy sectors are particularly sensitive to regulatory shifts. A government could introduce tighter constraints on Big Tech if it is prioritizing:

- Data privacy,

- Antitrust enforcement,

and

- AI governance.

Similarly, an administration focused on green energy could impose stricter environmental regulations on fossil fuel industries, which would affect their profitability and long-term investments.

Favoritism and Market Influence

A new administration’s policies can greatly affect which businesses succeed and which struggle. Companies that align their strategies with the government’s priorities often gain advantages, such as:

- Tax breaks,

- Subsidies,

and

- Government contracts.

The practice is sometimes called “kissing the ring,” meaning businesses adjust their strategies to fit political leadership to gain benefits. This phenomenon plays a crucial role in determining industry winners and losers, creating opportunities for some while restricting growth for others.

For example,

- Let us consider a few companies that are investing heavily in renewable energy, infrastructure, or AI-driven automation.

- These may benefit if an administration prioritizes technological advancement.

Now, if we talk about market competition under a new administration, it will likely depend on its policy direction. As an investor, you will be required to assess potential risks and rewards.

Lessons from 2008: Could Markets Change Even More?

The 2008 financial crisis and today’s market share several key similarities. Check out the graphic below to find them out:

In 2008, there was excessive risk-taking in the housing market. It was compounded by financial derivatives, which led to a liquidity crisis. Today, while traditional banking risks remain, new areas of concern are:

- Excessive speculation in the crypto sector

and

- High levels of corporate debt.

Furthermore, monetary policy played an important role in both periods. The Federal Reserve responded to the 2008 crisis with near-zero interest rates and quantitative easing (QE) to stabilize markets. Similarly, post-pandemic policies involved aggressive rate cuts followed by rapid hikes. While this approach effectively reduced inflation, it also introduced market volatility.

Key Differences in 2025

Despite the parallels, the 2025 market environment has unique characteristics that distinguish it from 2008, such as:

- Advanced trading technology,

- The rise of decentralized finance,

and

- Significant geopolitical shifts.

Let us understand them in detail:

Advanced Trading Technology:

Modern markets rely heavily on the following:

- AI-driven algorithms,

- High-frequency trading (HFT),

and

- Real-time data analysis.

These technologies allow traders to react instantly to news and market movements. In 2025, markets will be increasingly shaped by automation and predictive analytics.

Decentralized Finance (DeFi):

Unlike the centralized financial system that dominated past decades, decentralized finance (DeFi) offers alternatives such as:

- Blockchain-based lending,

- Digital assets,

and

- Peer-to-peer trading.

These innovations have the potential to reduce reliance on traditional banks and increase market liquidity. However, they also introduce new regulatory challenges that may be influenced by political influence on markets.

Geopolitical Shifts:

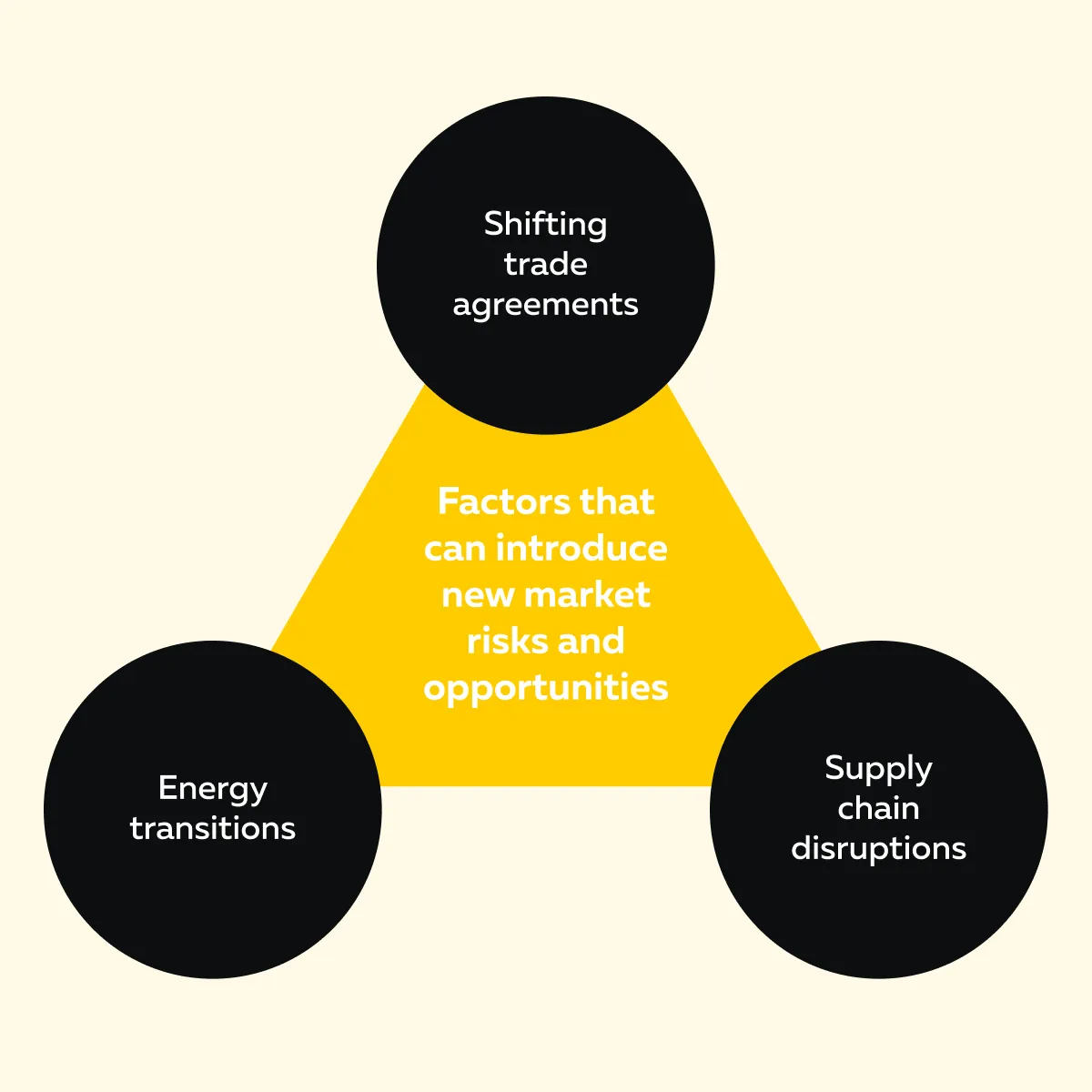

In 2025, global tensions, trade policies, and economic alliances are expected to reshape investment flows. Check out the graphic below to learn what factors can introduce new market risks and opportunities:

These factors make the 2025 market environment distinct. As a trader or investor, you must stay informed about market changes in 2025 and understand how political influence on markets can affect different sectors and investment strategies.

Trading Strategies for Politically Driven Market Changes

One must be aware that politically driven market changes often bring volatility. Most political events significantly impact market trends, resulting in sudden shifts in:

- Liquidity,

- Sector performance,

and

- Investor sentiment.

Therefore, traders must adapt their strategies to better deal with policy-driven volatility. Let us check out the two key approaches to do so:

| Hedging | Sector rotation |

|

|

Stay ahead of policy-driven market changes with Bookmap’s real-time insights.

Use Bookmap and Gain Real-Time Insights

As a trader, you can use our advanced market analysis tool, Bookmap. It allows you to easily track order flow and liquidity in real-time, enabling you to identify where major buyers and sellers are placing their orders. This insight can help you better predict price movements.

When political announcements or new laws impact the market, you can use Bookmap to spot sudden changes in buying and selling activity. For example:

- Let us assume the government announces increased military spending.

- Now, on Bookmap, you can notice heavy buying activity in defense stocks

- Bookmap will show you the large buy orders that are appearing in the market.

- Using this insight, you can act quickly and buy before prices surge.

- Alternatively, you can adjust strategies based on the data.

In this way, by using Bookmap, you can smartly react to market changes in 2025 caused by political influence. This gives you a better chance to profit from these shifts.

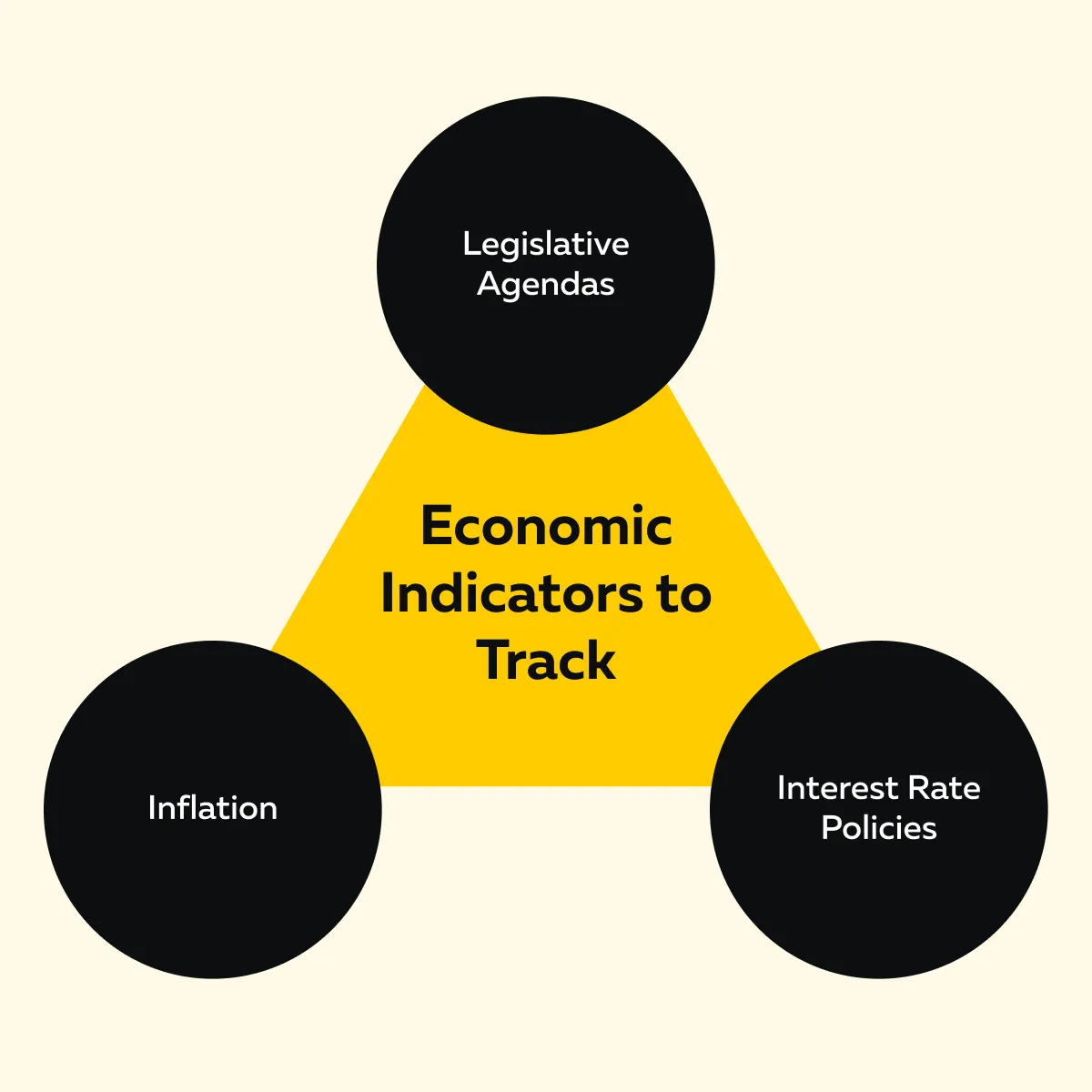

Preparing for the Unknown: What Traders Should Watch

To achieve profitable results in 2025, traders should monitor the major economic indicators closely. The graphic below shows indicators you can track to stay ahead of market shifts:

Now, if we specifically talk about inflation, then rising inflation often pushes central banks to raise rates. This slows economic growth and hurts interest-rate-sensitive sectors like tech and real estate. Conversely, lower rates can stimulate rallies in these areas.

Additionally, government policies also play a significant role in market dynamics. For example, tighter environmental regulations favor renewable energy. In contrast, they create challenges for traditional oil and gas companies. As a trader, you should keep tracking market changes in 2025 and watch for shifts in:

- Fiscal spending,

- Tax policies,

and

- Trade regulations.

Besides these, you should also track the following:

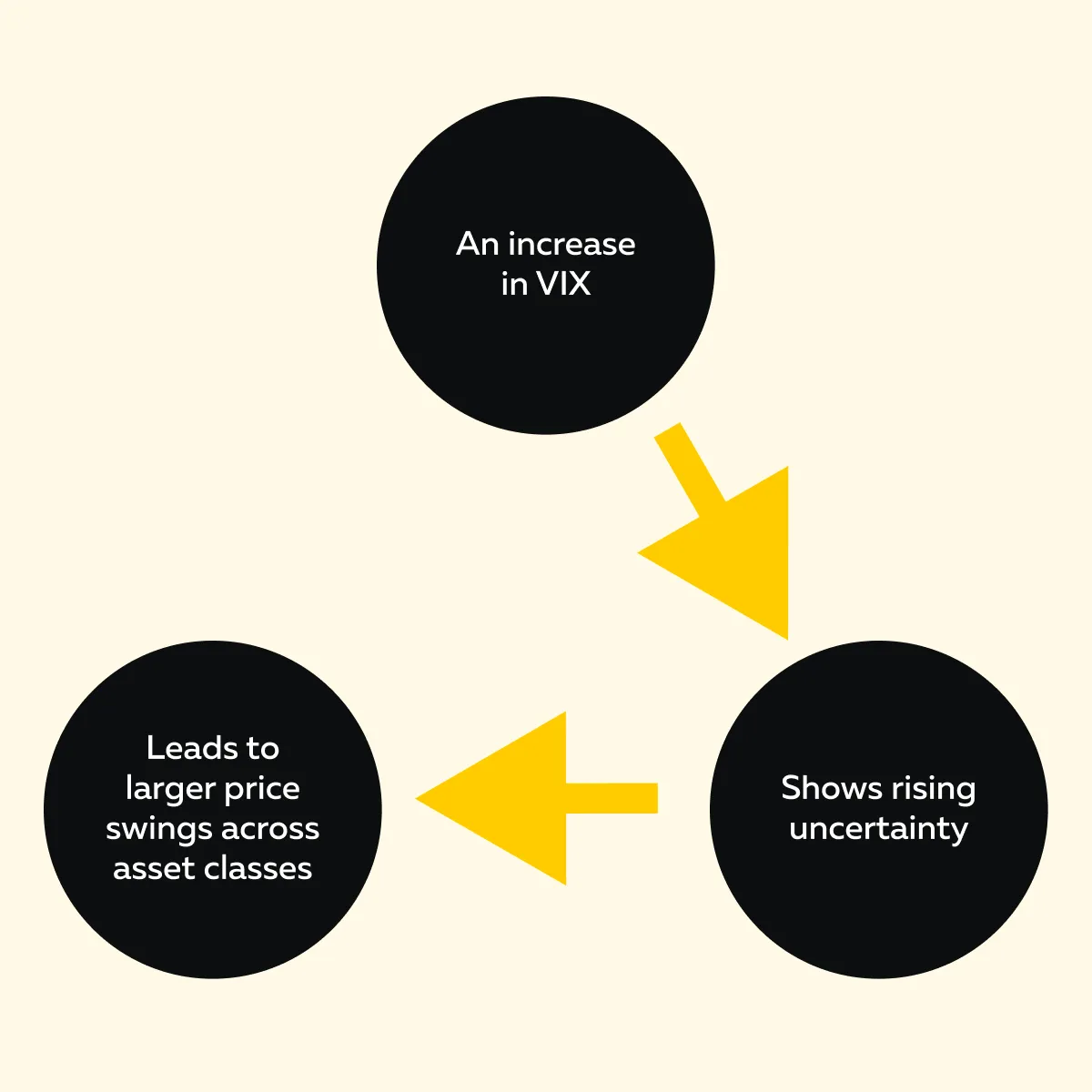

A) Volatility Index (VIX) and Market Swings

The VIX is often called the “fear gauge.” It measures expected market volatility. Check out the graphic below to learn what happens when the VIX rises:

As a trader, you should watch VIX movements to time entries and exits in fast-moving stocks. For example,

- Let us say the VIX spikes due to geopolitical tension or unexpected economic data.

- Now, you hedge your portfolios using options or volatility-based ETFs.

- You adjust your positions in commodities, indices, or fixed-income markets to manage risk or capitalize on price movements.

B) News-Driven Market Reactions

It must be noted that political events and policy shifts can lead to sudden market swings. In 2016, Trump’s unexpected tweets on trade policies caused abrupt sector rotations. This move benefited industries like defense while pressuring Chinese tech stocks.

To navigate these market fluctuations effectively, being prepared for real-time market reactions is essential. By using our avant-garde tool, Bookmap, you can easily spot liquidity shifts after political statements. This will help you to detect institutional moves following policy announcements.

C) Long-Term Impacts on Market Structure

Beyond short-term volatility, political leadership influences long-term market trends. Changes in regulation impact industry competition. It either promotes innovation or develops monopolistic behavior.

For example,

- Let us say an administration is pushing for stricter antitrust measures.

- Now, this could disrupt big tech dominance.

- In contrast, one favoring deregulation might boost consolidation in finance or energy.

Therefore, it is important to assess how different sectors may evolve under new leadership. This insight can help you position for both short-term volatility and long-term structural shifts.

Conclusion

Markets are always changing, and political influence on markets plays a key role in changing the way you invest. A new administration in 2025 could bring shifts in regulations, trade policies, and government spending. These factors will significantly impact various industries, creating both risks and opportunities for traders and investors.

Therefore, to stay ahead, you must be ready to adjust your strategies. By using our real-time data tool, Bookmap, you can easily track order flow and liquidity. This allows you to react quickly to market movements driven by political decisions. Whether it’s defense stocks responding to military spending or momentum stocks gaining from policy changes, you can smartly stay informed by using our Bookmap. Gain clarity in volatile markets. Use Bookmap to track trends driven by political and economic shifts.