Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

October 14, 2024

SHARE

Confirmation vs. Risk/Reward: Striking the Balance for Effective Trading

Imagine you’re at the crossroads of a busy intersection and have to reach

somewhere urgently.

-

In one direction, there’s a sign pointing towards a shortcut through

a dark alley, promising to save your precious time. -

In the other direction, there’s a well-lit, well-traveled road, but

it’s the longer route.

Surely, you’ve found yourself in a similar predicament before, haven’t you?

This scenario mirrors the daily dilemma that traders face. They grapple with

the tension between the need for confirmation and the allure of a promising

risk and reward setup. Both confirmation and risk/reward setup have their

unique merits and pitfalls, but finding the right balance between them is

crucial.

In this article, we will understand the significance of both elements and

how finding equilibrium between them is the key to consistent trading

success. Let’s begin.

Unpacking the Concepts

Financial markets are dynamic, influenced by large investors, traders, news,

and economic events. Therefore, traders must strike a balance between

caution and decisiveness.

Striking this balance is crucial for effective trading and finding the

equilibrium point where confirmation provides confidence.

The Power of Confirmation in Trading Decisions

In the world of trading, ‘confirmation’ refers to the process of gathering

additional evidence or support for a trading decision before executing it.

Traders can gather confirmations from a variety of methods, like:

-

Spotting a supportive candlestick pattern

-

Noting a favorable shift in technical indicators

-

Corroborating market news that aligns with their trade thesis

The primary goal of confirmations is to validate their analysis and bolster

confidence in the trade’s potential success. It fulfills this a essential

role by:

-

Serving as a risk mitigation tool

-

Minimizing uncertainty that surrounds financial markets, and

-

Reducing the odds of making hasty or impulsive decisions

How to Strike the Right Balance?

The quest for balance often divides traders into two camps, each defending

their viewpoint:

|

More confirmations are better |

Fewer confirmations are better |

a. Eliminate as much uncertainty as possible. b. Reduce the likelihood of false signals. c. Offer a safer entry point. |

a. Markets are dynamic and ever-evolving. b. The perfect confluence of signals may not always c. By the time all desired confirmations are gathered,

|

What are the Potential Pitfalls?

Undoubtedly, there are pitfalls associated with both extremes of the

confirmation spectrum:

1. Overreliance on Confirmations:

-

Waiting for an exhaustive list of confirmations can lead to

“paralysis by analysis.” -

Traders may find themselves trapped in an endless loop of seeking

more evidence, ultimately missing profitable trade opportunities.

2. Insufficient Confirmation:

-

Conversely, acting without adequate confirmation can significantly

elevate trade risk. -

Impulsivity and lack of substantiation may result in substantial

losses.

Risk/Reward Ratios – The Trader’s Compass

The risk/reward ratio is a fundamental concept in trading that quantifies

the relationship between the potential loss (risk) and the potential gain

(reward) of a trade. It’s like the compass traders use to navigate the

stormy seas of financial markets.

|

Defining Risk |

Defining Reward |

|

|

|

Illustration:

|

|

The risk/reward ratio is an invaluable tool in a trader’s arsenal when

evaluating the feasibility of a trade. Here’s why it holds such

significance:

-

A favorable ratio ensures that, over time, even with a 50%-win rate

(where half of your trades are profitable), a trader can still be

profitable. -

However, this underscores a crucial principle: it’s not about the

number of wins, but the quality of those wins.

Guide for Setting Stop-Loss and Take-Profit Levels:

-

The risk/reward ratio guides traders in setting stop-loss and

take-profit levels. The stop-loss limits potential losses, while the

take-profit locks in gains. Adhering to a predetermined ratio helps

inject discipline into trading strategies and prevents

emotion-driven decisions.

How Do Different Trading Styles Impact the Risk-Reward Ratio?

The optimal risk/reward ratio is far from one-size-fits-all; it hinges on a

trader’s specific trading style. Here’s how various trading styles influence

this ratio:

For instance,

-

Scalping: Scalpers, who thrive on high-frequency trades within short

time frames, often accept a 1:1 ratio. Their focus is on swift,

incremental gains rather than larger profits per trade. -

Swing Trading: Swing traders hold positions for more extended

periods, often days or weeks, and seek substantial price movements.

They typically aim for a 1:3 or even higher risk/reward ratio,

allowing for bigger profits to offset fewer winning trades.

What Are the Pitfalls of Ignoring the Risk-Reward Ratio?

The risk/reward ratio can be considered as a compass not just pointing the

way to profitable opportunities but also keeping traders on a steady course.

Ignoring this crucial ratio can lead to substantial trading pitfalls,

including:

-

Excessive Losses: Without assessing potential risk and reward,

traders may incur losses surpassing their gains. -

Unstable Strategies: Ignoring the ratio can result in shaky

strategies vulnerable to market fluctuations.

The Trade-off Dilemma

Veteran traders often state that trading is a constant battle between two

formidable foes: patience and opportunity. This conflict gives birth to the

trade-off dilemma, where waiting for additional confirmations clashes with

seizing early opportunities.

The financial markets are often divided into types of traders, which are:

|

Parameters |

The Patient Traders |

The Opportunistic Traders |

|

What is their Natural Behavior? |

The patient trader is like a sailor who:

|

The opportunistic trader is:

|

|

How do they react? |

|

|

|

What are the pros? |

|

|

|

What are the cons? |

|

|

How Can You Strike the Right Balance Between Confirmation and Risk/Reward?

Striking the right balance is an evolving journey, demanding ongoing

adjustments as market dynamics shift and your experience grows. This

equilibrium can be achieved when you gain a deep understanding of your:

-

Trading style

-

Risk tolerance, and

-

Market conditions

Here are some strategies that can help you:

-

Define Your Trading Style

-

Are you a scalper, day trader, swing trader, or long-term

investor? -

Your style will influence the balance you need to strike.

-

Scalpers may prioritize quick executions with less confirmation,

while swing traders may opt for more confirmation due to longer

holding periods.

-

-

Set Clear Entry and Exit Rules

-

Establish clear entry and exit criteria for your trades.

-

Define what confirmation signals you need to see before entering

a position. -

Determine stop-loss and take-profit levels based on your risk

tolerance and risk/reward ratio.

-

-

Use Technical and Fundamental Analysis

-

Combine technical and fundamental analysis to build a

comprehensive trading strategy. -

Technical indicators and chart patterns provide confirmation

signals, while fundamental analysis helps you understand the

broader market context.

-

-

Implement Predefined Risk Management

-

Always use stop-loss orders to limit potential losses.

-

Set these levels based on your risk tolerance, not just on

confirmation. -

Implement position sizing that aligns with your risk management

strategy.

-

-

Keep Emotions in Check

-

Cultivate emotional discipline to steer clear of impulsive

decisions spurred by fear or greed. -

Stick to your predefined rules and trust your trading plan.

-

-

Utilize Backtesting and Simulation

-

Put your strategy to test in different market conditions through

backtesting and paper trading. -

This will help refine your approach and gain confidence in your

chosen balance.

-

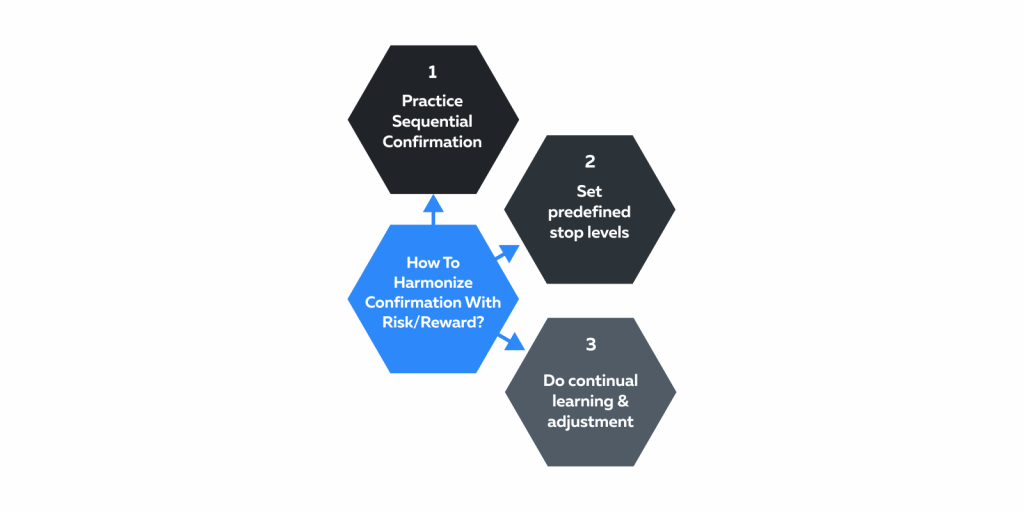

Tips to Harmonize Confirmation with Risk/Reward

Harmonizing confirmation with risk/reward is tough. However, by adopting a

staged approach, setting predefined stop levels and persistently refining

trading strategies enables traders to find the optimal equilibrium between

confirmation and risk/reward.

Let’s explore some proven techniques for harmonizing confirmation with

risk/reward:

1. Practice Sequential Confirmation:

One of the most popular strategies to harmonize confirmation with

risk/reward is to adopt a sequential confirmation approach, in which:

-

Traders start with an initial confirmation that meets their minimum

criteria. -

Instead of going all in, they begin with a smaller position size.

-

As more confirmations align with their trade thesis, they gradually

increase their position.

How does this help?

This staged approach provides a safety net for traders. It allows them to

participate in potentially profitable opportunities even if they have

limited initial confirmation. If the trade continues to evolve as expected,

they can confidently add to their position, capitalizing on the

strengthening confirmations.

2. Set Predefined Stop Levels:

Setting predefined stop-loss levels is paramount in harmonizing confirmation

with risk/reward. Regardless of the level of confirmation, traders should

establish clear exit points based on their risk tolerance before entering a

trade.

How does it help?

Having firm stop-loss levels in place prevents traders from holding onto

losing positions in the hopes that additional confirmation will rescue the

trade. It enforces discipline and limits potential losses, which is

essential for long-term trading success.

3. Continuous Learning and Adjustment:

The financial markets are dynamic, and what works today may not work

tomorrow. To harmonize confirmation with risk/reward effectively, traders

must commit to continual learning and adjustment. This involves:

-

Consistent backtesting of formulated trading strategies.

-

Making real-world adjustments guided by trading outcomes.

How does it help?

By analyzing past trades, traders can refine their approach over time. They

can gain insights into the balance between confirmation and risk/reward that

works best for their unique trading style and objectives. This ongoing

self-improvement process ensures that traders remain adaptable and resilient

in the face of changing market conditions.

Conclusion

In the ever-evolving world of trading, finding the right balance between

confirmation and risk/reward is essential. While there is no universal

formula that fits every trader, understanding the nuances of each concept

and adapting strategies accordingly can undoubtedly lead to improved trading

outcomes.

Traders frequently grapple with the tension between confirmation and

risk/reward. On one hand, we need reassurance, for the safety of multiple

confirmations, and on the other hand, we have the allure of opportunity,

beckoning us to take calculated risks for potentially greater rewards.

In this balancing act, traders must recognize their trading styles, risk

tolerance, and objectives. The key is to stay agile, continuously refine the

approach, and strike that ever-elusive balance between confirmation and

risk/reward.

For an in-depth understanding of how risk plays a role in trading decisions,

don’t miss our comprehensive article on measuring risk in trading. Delve

into expert insights and

strategiesright

here.