Ready to see the market clearly?

Sign up now and make smarter trades today

Education

March 3, 2024

SHARE

How to Measure Risk in Trading

Risk should be the first thing on every trader’s mind before taking a position. In fact, it’s an unwritten rule amongst experienced traders that as long as you take care of the downside risk, the upside will take care of itself.

But measuring risk can be tricky, since it can be considered to be anything from the probability of an individual trade to the chance of a total market crash. Definitions are broad, and in some sense risk is something that is impossible to absolutely define.

This article will explore some of the ways risk in financial markets can be measured.

What is Market Risk?

How to Measure Risk

How to Reduce Risk

Conclusion

What is Market Risk?

The degree of uncertainty inherent in every financial decision is known as market risk—or systemic risk. Often the root cause of price volatility, risk comes from changes of various interconnected factors that impact the entire financial system, as well as the collective reaction to those changes.

Systematic risk

Systematic risk is market risk inherent to the collective market rather than individual sectors or assets, impacted by economical, financial, and geopolitical factors.

Despite being a risk that is considered to be largely unpredictable, good traders and investors should still keep an eye on global macroeconomic trends and consider tactical hedges or smarter asset allocation.

Unsystematic Risk

Unsystematic risk is risk specific to a security or group of securities. While systematic risk refers more to the complex interplay between things like geopolitics, interest rates, and global macroeconomics, unsystematic risk can be much more specific: e.g. changes in operational costs of a company, or “cooking of the books” with dodgy or outright fraudulent financial statements.

Unsystematic risk can usually be reduced with high-quality portfolio diversification.

How to Measure Risk

Risk might seem scary, and it’s true that there are many “unknown unknown” risks or “black swans”, but there are also some ways to measure risk, which can at least provide peace of mind.

Sharpe ratio

Probably one of the most famous risk/return measurements in finance, the Sharpe ratio shows the performance of an asset or portfolio as compared to a risk-free asset. Essentially, it tells you how much return you get for the extra volatility you need to take on.

The weakness of measuring risk with the Sharpe ratio is that the formula is based on standard deviation, which is not as effective when it comes to measuring fat-tailed distributions or kurtosis.

Beta

Beta is an asset’s sensitivity compared to the market’s overall volatility. For example, a beta of 1.5 means that the security in question will move an average of 1.5 times the market return, both to the upside and downside. It is basically a returns amplifier.

Tech stocks are known to have high beta; moving up further and faster when the broader market is up, but also moving down more sharply when the broader market is lagging.

VaR (Value at Risk)

VaR is the industry-standard risk management metric to measure the risk of loss in normal market conditions, over a set period of time (often 1 day).

The measurement attempts to put a number on the worst-case scenario loss. The downside of VaR is that like Sharpe, the measurement assumes normal distributions. To get around this, savvy traders sometimes stress test a loss of 1-3 or even 10 times the average expected loss.

How to Reduce Risk

As a trader, good risk management means maintaining a good risk/reward across trades. As mentioned early, realistically this means focusing on limiting the downside, since it’s something we have more control of as market participants.

Naturally, lower risk usually means lower reward. But there are some good rules to stick by which should reduce risk without impacting your returns. Here are a few of the best risk management principles to live by.

The 1% Rule

The most commonly cited rule is the 1% rule. This rule states that you should never risk more than 1% of your total trading capital.

Another way to think of this is like having 100 bullets: if you risk 1% of your trading capital on every single trade, you could lose 100 times in a row before your capital would be completely depleted.

Some traders risk a bit more, some less. It really depends on your trading strategy and risk appetite. But the 1% rule is a good place to start. If you trade larger, you will experience larger swings in capital. Since you should use 1% of your active trading capital, the dollar amount will rise and fall with your equity. That means if you lose 10%, you only need to make 11% to reach break even. But if you trade larger and experience a 25% loss, you will need a return of 33% on your now smaller capital size. If you experience a loss of 50%, you will need to return 100% to reach breakeven.

Position sizing should be carefully calculated based on each trade’s distance from entry to your protective stop loss relative to account size. We will explore this further in the next section.

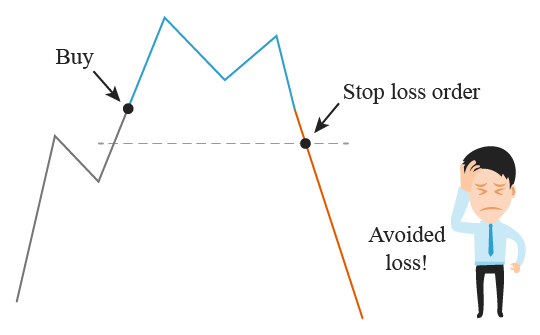

Use a Stop Loss

Taking a loss is hard, but it’s a vital part of good risk management.

Protective stop loss orders are triggered when the market price moves past your maximum loss price. This is usually 100% of the position, but some traders may use them to scale out of positions, rather than closing the entire position at once. Stop losses can be used to enter positions too, but here we are specifically referring to using stop loss orders to close positions.

Traders often put stop losses at areas of market structure, such as swing highs and lows, or support and resistance levels. Arguably this can sometimes be a bad idea, especially if many other market participants have placed their stops in the same area, as price could be attracted to the level. Since stop losses are triggered as market orders, this kind of scenario could lead to a stop cascade. To read more about stops, read our Complete Guide to Stops.

Regardless of the nuances that traders should understand, stop losses are still vital when it comes to risk management in trading, especially when using leverage.

Use Regulated Exchanges and Brokers

Trading is not just about making profit. Successful traders always manage their downside risk too, and an often overlooked element of risk management is the choice of exchange or broker.

Trading on a regulated exchange through a broker with capital protection can be worth the extra cost. Nevermind the outright scam brokers or exchanges, even the legitimate ones can struggle during times of market stress. Exchanges being hacked and money being lost is a big problem in the cryptocurrency space. But even the biggest market in the world—the Foreign-Exchange market—can suffer from problems. When the Swiss central bank broke the 1.2 currency rate peg to the Euro in 2011, the market experienced extreme volatility and many brokers were bankrupted. If you had your capital on an unregulated exchange, you may have lost everything when the broker went down, even if you weren’t trading that particular pair.

Conclusion

The decisions behind every single trade should be made well in advance. Beginner traders like to focus on the amount of money they can make, but the emphasis should be on reducing risk.

Capital preservation with the 1% rule, correctly employing stop losses, and trading only on exchange and through brokers that are regulated can vastly reduce the risks associated with trading financial markets.

Risk is something that is impossible to ignore. Building your trades around large orders on the heatmap can help you clearly define your risk. Try it out today for free. Click here to get started.