Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 28, 2024

SHARE

The Complete Guide to Stops

Introduction

It is important for traders to have a solid, pre-defined method of getting into and out of trades, and stop orders are a very useful way for both closing and opening trades.

A stop order allows for a security to be bought or sold when its price moves past a particular point. This sets up a predetermined entry or exit price point, allowing an investor to protect against a possible loss or lock in a potential profit.

If you’re wondering about why stops are essential in trading and how you can use stops, then read on. We’ll go through it all in this post.

What is a Stop Order?

Stop Order Definition: An order to buy or sell a security when it crosses a specified price point. Stop orders are commonly used by traders to minimize losses by closing out of a position that is moving against them at a set price point. Stop orders can also be used to enter trades.

Types of Stop Orders

Stop orders can be classified into two different types:

Stop Market order: A stop market order can be defined as purchasing or selling a security when price trades at or beyond a specified price: the stop price. If the security reaches that price, it then triggers and becomes a market order, which will be filled at the next available price.

Stop Limit order: A stop-limit order can be understood as executing a trade when it reaches a set price point but only at that price or better.

Both Stop Market and Stop Limit orders are always instructions to buy or sell, no matter whether they are used to enter or exit a trade. The only condition is that buy stops can only be above the current market price, and sell stops below the current market price.

How to use Stops

Stops can be used to get into fast moving markets (such as with a breakout trade) or minimize losses by exiting a trade that is moving against you.

Entering a trade with a stop order: Let’s imagine a trader has identified a resistance level above the current market that if broken, could lead to a price breakout. This trader can set a buy stop (market or limit) order just beyond the resistance level. If market prices breach the resistance level, the trader’s order will execute.

Leaving a resting stop order in the order book reduces the required effort for the trader to constantly monitor prices and potentially miss catching the breakout.

Fig 1: Using a sell stop to enter a trade can be a great way to catch a breakout. It is recommended to use a stop market order, since a stop limit order isn’t guaranteed to execute. However, the sell stop in this scenario may get triggered at a lower price than expected in a fast-moving market.

Exiting a trade with a stop order: A good trader should always be prepared for the trade to not work out and move against them. To reduce risk, a trader can use a stop order to minimize potential losses. If the market price trades beyond the stop order price, the trade will be closed or reduced (depending on the order quantity set in the order).

Where should I put my Stops?

The placing of stops can make or break your trades. It is important to have a logical method for placing stops.

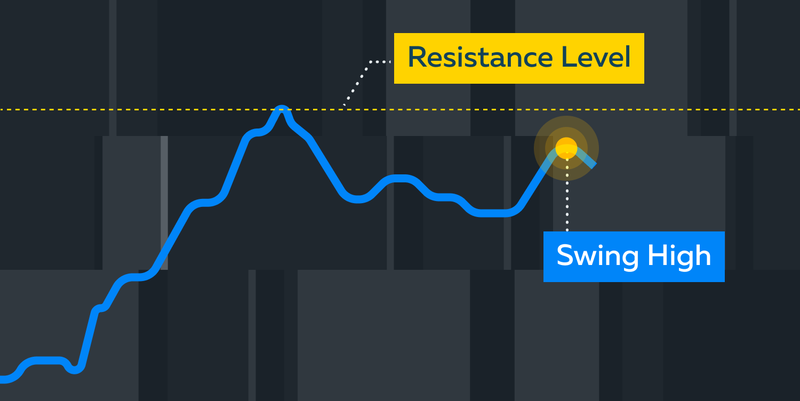

Whether entering a long or exiting a short, traders can place buy stops at various points in market structure, e.g:

Buying:

- Just above resistance

- Just beyond a swing high

Fig 2: A resistance level above a swing high.

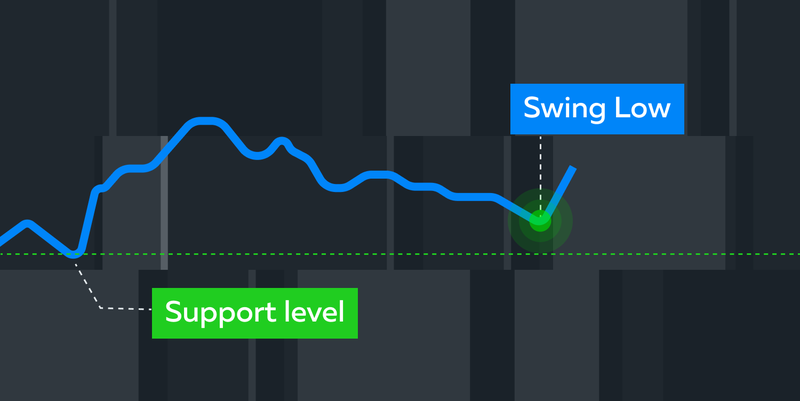

Selling:

- Just below support

- Just beyond a swing low

Fig 3: A support level above a swing low.

Combining Other Indicators

Extra confirmation for good stop placement can be found by combining these points of market structure with other indicators, such as simple moving average crossovers or order flow tools like The Cumulative Volume Delta (CVD).

Stop Run Examples

What is an Invalidation Point?

An invalidation point is a specific price that if the market trades, the price or order flow pattern is not behaving as expected and is thus invalidated.

Maintaining the discipline to exit a trade that isn’t working is the hallmark of a good trader. Using stop orders as opposed to “mental” stops (price points in your mind at which you tell yourself you will exit) can reduce the amount of discipline required to follow through with taking a loss, and is also likely to be quicker in a fast-moving market.

What is a Confirmation Point?

A confirmation point is a point in which the security’s price or order flow pattern is similar to the pattern the trader expects to see. This point indicates that the pattern is valid, and is often used to enter trades.

What is a Stop Run?

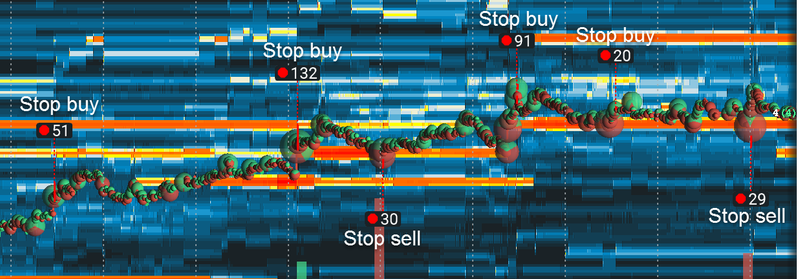

A Stop run is when multiple stop orders are triggered, often cascading and triggering even more stops. It isn’t possible to know if these stops are traders entering or exiting the market, but more often than not, stop runs are known as “pressure points” at which traders are forced to unwind positions.

Fig 4: Hypothetical example of how market prices usually react to stop runs.

It is often thought that stop runs are a form of price manipulation by larger traders or market makers, but this isn’t necessarily the case. Stop runs are an everyday occurrence in financial markets, especially in the crypto and futures markets.

How to Avoid Stop Runs?

While it is likely impossible to completely avoid stop runs, traders can reduce the risk of being victim of a temporary stop run by avoiding setting stops too close to where other stops are likely to be clustered, such as round numbers or major support and resistance zones.

Also, the wider the stop, the less likely it is to be triggered by fluctuations in the market.

How to Profit from Stop Runs?

Since stop orders are not visible in the order book, it is not possible to know where they are located. However, with Bookmap’s unique handling of CME data in the MBO bundle, which includes indicators such as Stops & Icebergs On-Chart & Sub-Chart, it is possible to accurately identify when and where stops have been triggered.

Fig 5: A visual example of stops being triggered, identified with Bookmap’s Stops & Icebergs On-Chart indicator.

This kind of transparency can give you extra insights into the market, and over time a good trader will be able to anticipate when stop runs may be about to occur.

Conclusion

The correct utilization of stops in trading is an effective way to minimize losses or increase profits.

Stops must be placed at logical price points to minimize losses and confirm your trades.

Studying order flow patterns over time will give you a better understanding of stops and their use in trading. Why not join the daily webinars on our Discord chat, where stops are often discussed? It’s completely free!

Stops FAQ

Listed below are some frequently asked questions about stops.

What is the difference between Stop loss and Stop limit?

A stop loss order is executed when the price reaches the set price and the asset is either bought or sold. A stop limit order carries out the same action, but will only execute within a specified price range. The stop loss order ensures that the trade is executed but at potentially worse price, while the stop limit ensures that the trade will only be executed at the specified price.

How does a stop-limit work?

A stop-limit order restricts the purchasing or selling outside the trader’s specified price range. The stop order will only get executed if the price remains within the range.

What is a trailing stop order?

A trailing stop order allows the trader to attach an amount by which the stop will follow price. If the trader has set a sell stop order and the market price rises, the stop price will rise by the trial amount allowing the trader to minimize losses or lock in gains.