Ready to see the market clearly?

Sign up now and make smarter trades today

Education

March 29, 2024

SHARE

Cracking the Spoofing Code: Inside the World of Market Manipulation

Have you ever witnessed a large order suddenly being canceled? Market manipulators commonly use spoofing and layering as a deceptive practice. These practices involve placing false orders or placing multiple orders on the same side of the order book to mislead other traders and canceling these orders shortly after to gain trading benefits. Spoofing and layering harm investor trust and undermine the integrity of the entire market.

Through this article, we’ll study these strategies and their repercussions on market volatility, investor confidence, and the overall financial landscape. We’ll also understand how certain traders use advanced algorithms to create false impressions of market demand and supply. Furthermore, we will examine real-life cases of spoofing, scrutinize the role of regulatory authorities, and assess the outcomes of such manipulative activities. Let’s get started.

The Mechanics of Spoofing

Spoofing in financial markets is a deceptive trading strategy. Using it, traders create a false impression of market demand or supply by strategically placing and canceling orders. This practice is typically done to:

- Manipulate market participants and

- Gain a trading advantage.

Let’s understand the mechanics of spoofing and cover various important aspects of this controversial trading technique.

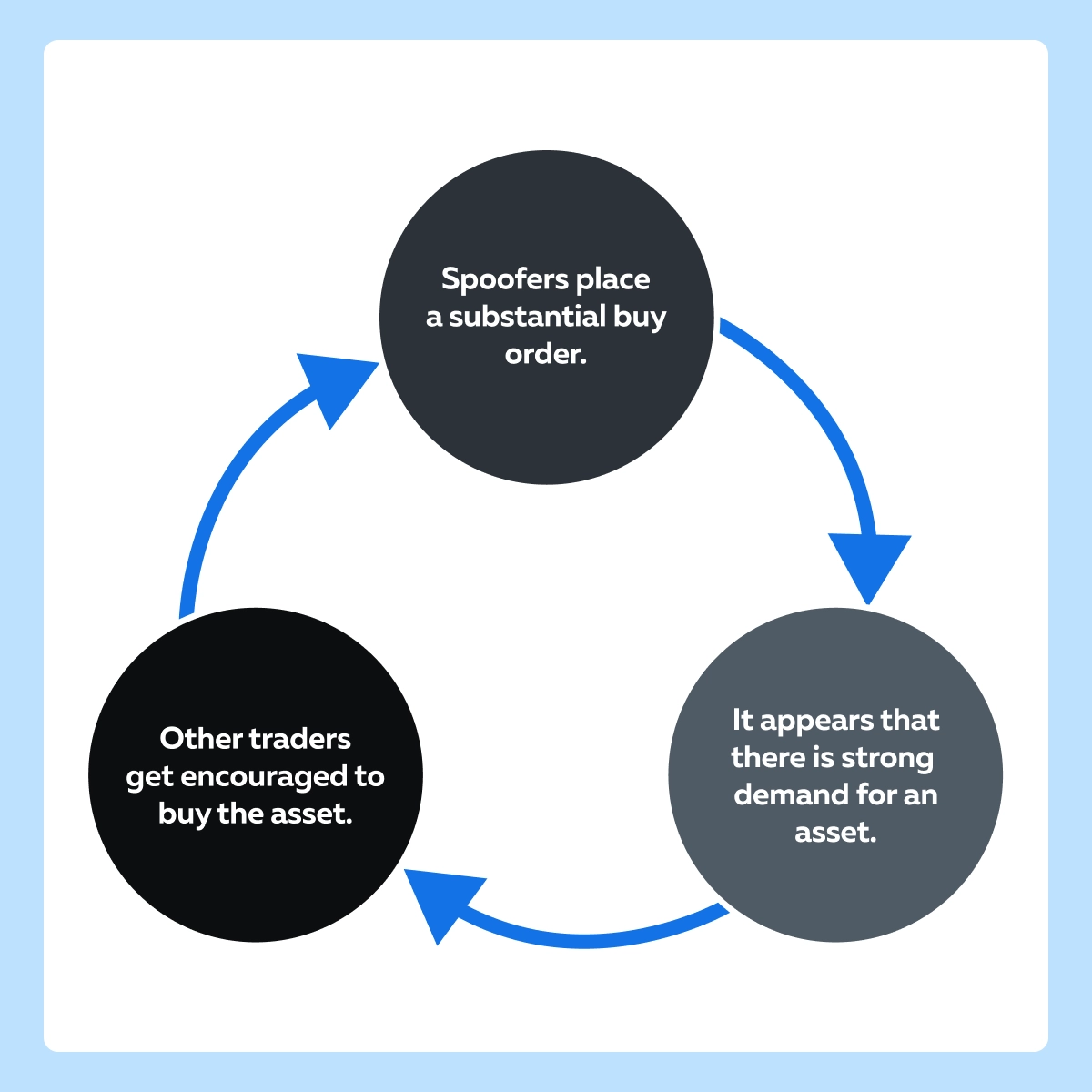

Order Placement

Spoofers strategically place large orders on either the buy or sell side of the order book. This placement is done with the primary objective of influencing the perceived supply or demand in the market. By doing so, spoofers create a false sense of market sentiment and induce other traders to react.

After creating the desired market perception, spoofers often cancel their large orders before they can be executed. This rapid cancellation:

- Prevents the spoofers from actually taking on substantial positions and

- Makes them manipulate the market without committing to the orders they initially placed.

Intent and Deception

The primary intent of spoofing is to deceive other market participants regarding the true supply and demand dynamics. Spoofers create a false impression of market sentiment, which induces other traders into making decisions that benefit the spoofer’s trading strategy.

Spoofers aim to trigger specific reactions, such as causing other traders to enter or exit positions, by creating artificial price movements. This can be better understood in the given points:

- A spoofer places a large sell order to drive prices down temporarily.

- This order prompts other traders to panic-sell.

- Once this occurs, the spoofer takes advantage of the artificially induced market movement for their gain.

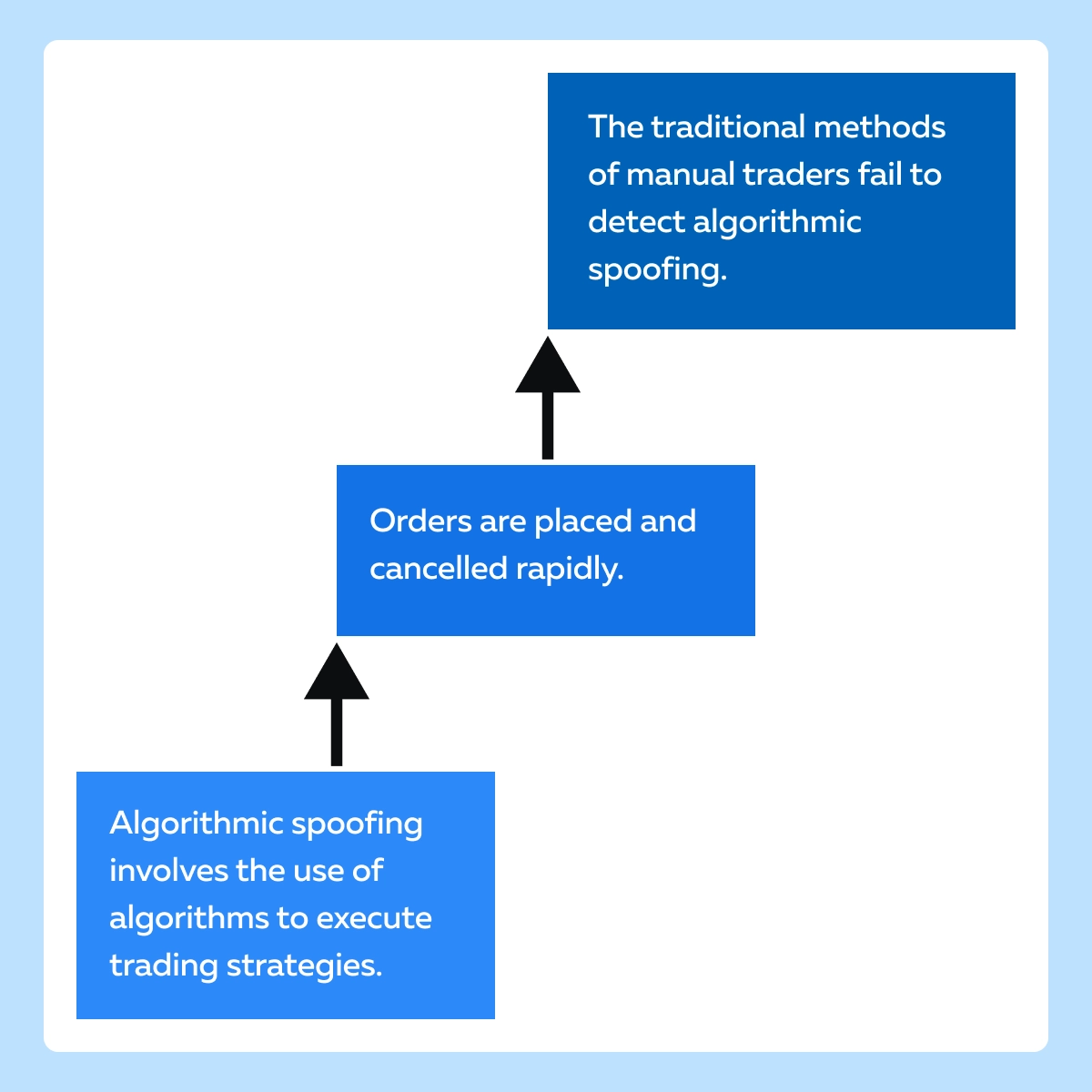

Algorithmic Spoofing

Algorithmic spoofing is carried out through automated trading algorithms, which rapidly place and cancel orders based on pre-programmed criteria. It involves precise and rapid execution of deceptive strategies, which makes it challenging for manual traders to keep up with or detect the manipulation in real time. Traditional market surveillance methods often fail to identify and prevent these manipulative practices effectively.

Spoofing vs Layering

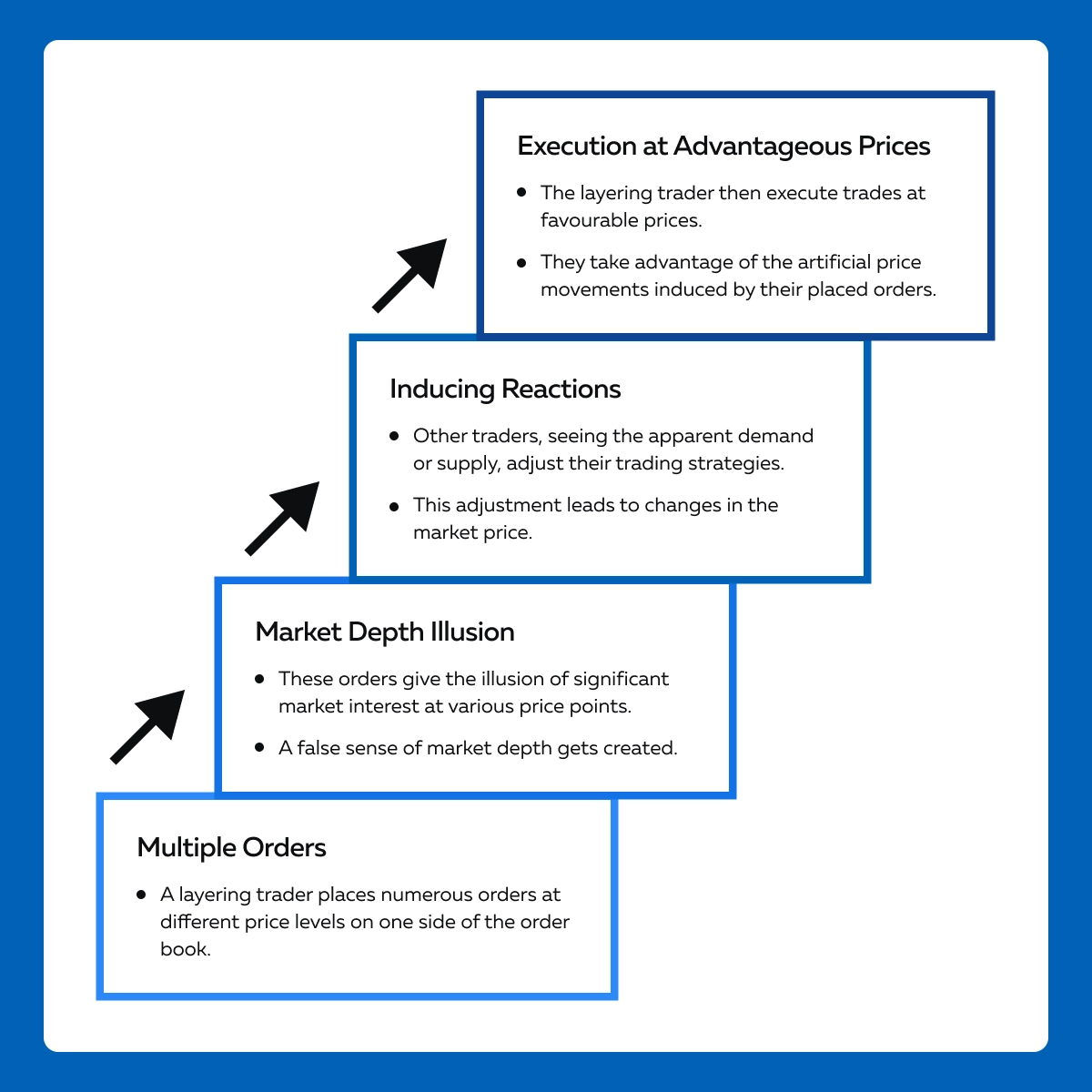

Spoofing is a deceptive trading practice where traders place false orders to create a misleading impression of market demand or supply. On the other hand, layering, also known as quote stuffing or quote layering, is another form of deceptive trading where a trader places multiple orders at different price levels on one side of the order book.

Unlike spoofing, layering involves placing legitimate orders rather than canceling them immediately. The intent behind layering is to:

- Create a false impression of market depth and

- Induce other traders to react to the perceived supply-demand imbalance.

Let’s understand the key differences between spoofing and layering through the table below:

| Parameters | Spoofing | Layering |

| Order Execution | It involves the placement of false orders that are often canceled shortly after creating the desired market perception. | It involves placing multiple orders at different price levels without immediate cancellation, giving the appearance of legitimate market interest. |

| Intent | It aims to mislead others about market conditions to trigger specific reactions and profit from the resulting market movements. | It aims to create a false impression of market depth to induce reactions, with the layering trader intending to execute trades at advantageous prices. |

| Cancellation Behavior | It typically involves the rapid cancellation of large orders to avoid taking on the implied positions. | It involves maintaining orders on the order book for a certain period, making it appear as if there is genuine market interest. |

| Legitimacy of Orders | It involves the placement of orders with the explicit intention of deceiving, as they are not intended to be executed. | It involves the placement of real orders with the intent to execute trades at favorable prices once induced reactions occur. |

| Detection | Detection is challenging due to the rapid cancellation of orders, making it difficult to trace the manipulative intent. | Detection is slightly less challenging as patterns of deceptive order placement and subsequent profit-taking can be identified. |

| Market Perception | It creates a false impression of market demand or supply by manipulating perceptions through canceled orders. | It creates an illusion of market depth to induce reactions from other traders, affecting the market price. |

What Is Layering?

Layering is a form of market manipulation where a trader strategically places multiple orders on the same side of the order book to create artificial price movements. Unlike spoofing, in layering, the orders are not immediately canceled. Understand the mechanics of layering through this graphical representation:

The Impact of Spoofing

Spoofing is a deceptive trading practice, which has significant consequences on financial markets. It impacts various aspects of market dynamics and investor behavior. The consequences of spoofing can be divided into three major parts, let’s explore them in detail.

Market Consequences

- Market Volatility

-

-

- Spoofing contributes to short-term market volatility.

- It creates artificial signals of supply or demand.

- When spoofers place and then rapidly cancel large orders, it induces other traders to react.

- This reaction often causes sudden and exaggerated price movements.

-

- Price Distortion:

-

-

- Spoofing distorts the true supply and demand dynamics.

- This distortion leads to inaccurate price discovery, which is the determination of an asset’s fair value based on the interaction of buyers and sellers in the market.

- When price discovery is inaccurate, market participants cannot determine the true value of an asset or make sound decisions.

-

- Market Liquidity Challenges:

-

- Spoofing discourages liquidity providers from participating in the market.

- The false signals created by spoofers make it difficult for other traders to assess genuine market interest.

- This event, in turn, reduces overall market liquidity, which is the ability to buy or sell an asset quickly and easily without affecting its price.

Investor Consequences

- Erosion of Investor Confidence

-

-

- Spoofing erodes investor confidence by creating a perception that markets are not fair and transparent.

- Investors question the integrity of price signals and become hesitant to engage in trading.

- They fear that they may be exposed to manipulated market conditions.

-

- Losses for Unsuspecting Traders

-

- Spoofing leads to losses for unsuspecting traders who react to the false signals created by spoofers.

- Traders make decisions based on manipulated market conditions.

- This erroneous decision-making results in financial losses when the market corrects itself.

Regulatory Consequences

- Increased Regulatory Scrutiny

-

-

- Instances of spoofing prompt regulators to intensify their scrutiny of market activities.

- Regulators use sophisticated surveillance tools and algorithms to identify and investigate potential cases of spoofing.

-

- Penalties and Legal Actions

-

-

- Regulatory bodies impose significant penalties and take legal actions against individuals and entities found guilty of engaging in spoofing.

- These measures deter market participants from employing manipulative strategies.

-

- Technological Advancements in Surveillance

-

- Regulators invest in advanced technological solutions to enhance their surveillance capabilities.

- The patterns of spoofing activities are identified using:

- Data Analytics,

- Artificial Intelligence, and

- Machine Learning.

Real-Life Examples

| Who was involved? | What did they do? | How were they caught? | What were the legal consequences? |

| Navinder Singh Sarao | He was a British trader, engaged in spoofing activities that were linked to the 2010 Flash Crash in the U.S. equities market. | Sarao’s spoofing activities were identified during an investigation into the Flash Crash, which saw a rapid and severe drop in stock prices. |

|

| Michael Coscia | Michael Coscia, the founder of a high-frequency trading firm, engaged in spoofing in the futures markets. | Coscia’s spoofing activities were detected using:

|

|

| JPMorgan Chase & Co. | Traders at JPMorgan Chase were accused of engaging in spoofing activities in the precious metals markets. | The spoofing activities were identified through regulatory investigations into the precious metals markets. | In 2020, JPMorgan Chase agreed to pay a substantial settlement to resolve allegations of spoofing. |

What Can Traders Learn?

These real-life examples illustrate the tangible impact of spoofing on financial markets. In each case, the detection of spoofing activities led to legal actions, including:

- Criminal convictions,

- Settlements, and

- Substantial fines.

The outcomes depict the commitment of regulatory authorities to maintaining market integrity. These cases also highlight the evolving nature of market surveillance and the collaboration between international regulators to address cross-border manipulative activities.

Conclusion

Spoofing is a manipulative trading practice that disrupts fair and clear financial markets. Spoofers trick others by placing fake orders and creating false impressions of supply and demand. This deception compromises market fairness and hurts investor’s trust.

Most regulators use advanced technology and algorithms to detect and punish manipulative actions. The cases of Sarao, Coscia, and JPMorgan Chase show that regulators are committed to maintaining market integrity and deterring traders from engaging in such practices by imposing hefty penalties.

Ready to dive deeper into the world of market manipulation and spoofing? Learn how to identify and protect yourself from these deceptive practices. Get started now by reading our article on Probing, Testing, and Spoofing.