Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 19, 2024

SHARE

Cross-Asset Trading: Opportunities and Challenges in a Diversified Portfolio

Do you know the key to market success? Most successful traders take advantage of varying market dynamics by diversifying their investment portfolios. But how? Well, cross-asset trading is an approach that can help you achieve this.

Do you know the key to market success? Most successful traders take advantage of varying market dynamics by diversifying their investment portfolios. But how? Well, cross-asset trading is an approach that can help you achieve this.

Embracing this approach, traders invest in different types of assets, like futures, stocks, and cryptocurrencies. This strategy is increasingly relevant in today’s globalized markets and helps traders mitigate risks and amplify returns by exploiting inefficiencies.

Through this article, we will explore the opportunities and challenges in cross-asset trading, highlight effective risk management strategies, and offer practical advice on implementing cross-asset trading plans.

Also, you’ll learn how to utilize cutting-edge trading platforms and comprehend the pivotal role of continuous learning in your trading journey. Let’s get started.

What is Cross-Asset Trading?

Cross-asset trading is a sophisticated investment strategy. It involves the trading of multiple asset classes, such as:

- Equities,

- Bonds,

- Commodities,

- Currencies, and

- Derivatives.

The core idea behind this approach is to leverage the varying market dynamics of different asset types to achieve better diversification and manage risk. Also, it helps traders capitalize on unique opportunities that arise from correlations and inefficiencies among these asset classes.

Key Features of Cross-Asset Trading

- Diverse Asset Classes: Cross-asset trading involves trading various types of assets to take advantage of different market behaviors and cycles.

- Global Markets: Cross-asset trading operates across multiple financial markets, including stocks, bonds, commodities, and forex.

- Market Dynamics: Cross-asset trading utilizes the different characteristics and reactions of each asset class to economic events, monetary policies, and market sentiment.

- Risk Management: Cross-asset trading enhances portfolio diversification, thereby potentially reducing overall risk.

- Efficiency Exploitation: Cross-asset trading identifies and capitalizes on inefficiencies and arbitrage opportunities across markets.

Relevance of Cross-Asset Trading in Today’s Globalized Financial Markets

It is essential to note that asset prices are influenced by a myriad of factors ranging from:

- Geopolitical events,

- Economic data releases, and

- Central bank policies.

Through cross-data trading, traders can exploit inefficiencies and enhance their potential returns. Let’s see how.

How to exploit inefficiencies?

Cross-asset traders can exploit inefficiencies that arise from these complex interactions. For example:

- Say there is a change in interest rates.

- Now, this will affect bond prices directly.

- But it can also impact:

- Currency values,

- Equity prices, and

- Commodity prices.

- By monitoring and trading across these assets, traders can capture price discrepancies and inefficiencies.

How Cross-Trading Enhances Potential Returns?

Cross-asset trading allows traders to access a broader set of opportunities and strategies. For example:

- Relative Value Trades: Buying undervalued assets while selling overvalued ones across different classes.

- Macro Trades: Taking positions based on macroeconomic views, such as anticipated changes in inflation or interest rates.

- Arbitrage Opportunities: Exploiting price differences between related assets in different markets.

Opportunities in Cross-Asset Trading

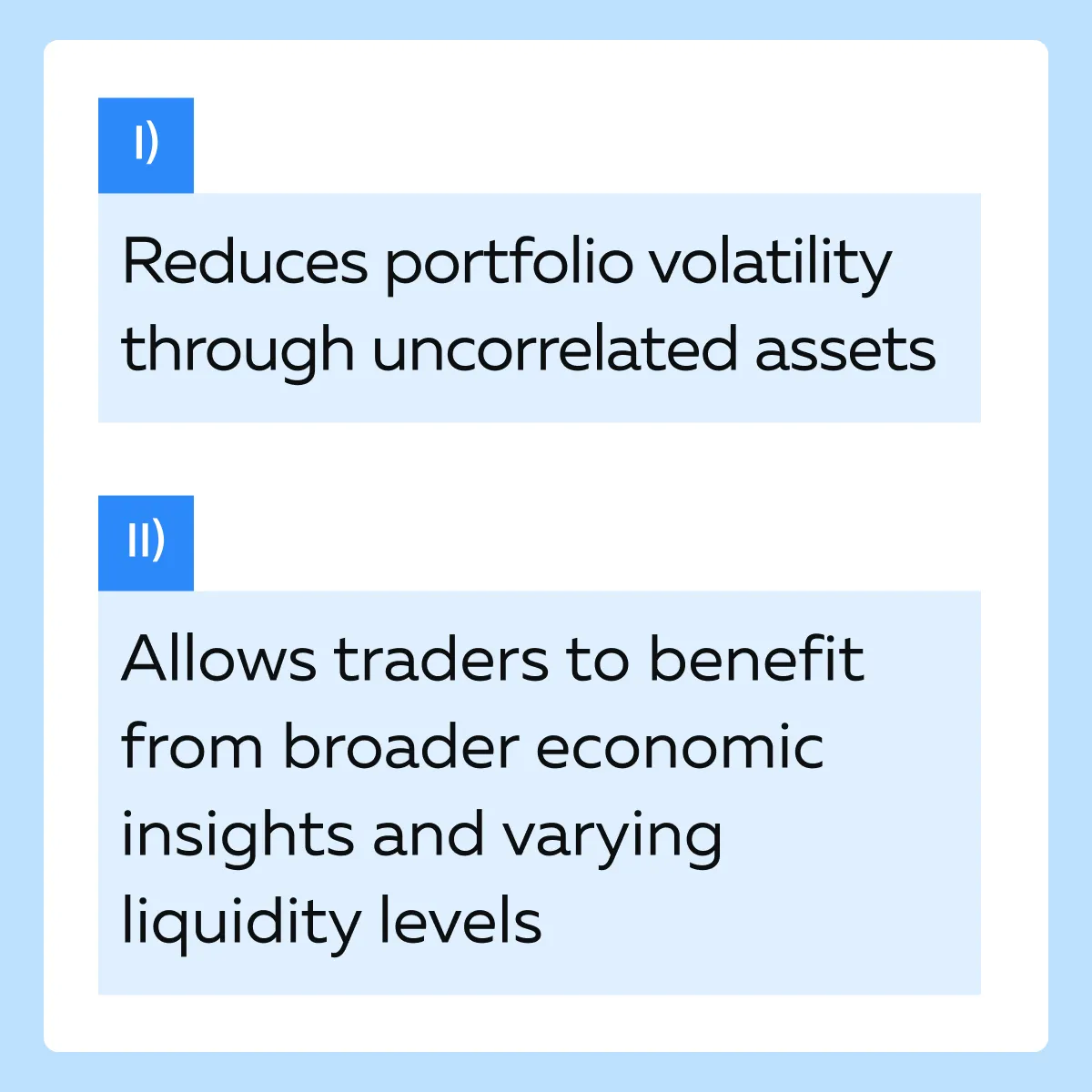

Cross-asset trading offers several opportunities for traders to enhance their returns. By diversifying across futures, stocks, and cryptocurrencies, traders can:

- Capitalize on different market dynamics,

- Exploit arbitrage opportunities, and

- Hedge against economic uncertainties.

See the graphic below to understand how this approach helps:

Now, let’s study in detail the various opportunities offered by cross-asset trading:

Diversification and Its Benefits

Diversification across various asset classes, such as futures, stocks, and cryptocurrencies, is a powerful strategy for managing risk and improving returns. By spreading investments across different types of assets, investors can mitigate the impact of adverse movements in any single market.

Statistical Concept of Correlation:

- Correlation measures the degree to which two asset prices move about each other. It ranges from -1 to +1.

- A correlation of +1 implies that the assets move perfectly in tandem.

- A correlation of -1 indicates that the assets move in opposite directions.

- A correlation of 0 means there is no relationship between the asset movements.

- Impact on Portfolio Volatility:

- Positive Correlation: Investing in positively correlated assets doesn’t significantly reduce portfolio risk since the assets tend to move together.

- Negative Correlation: Investing in negatively correlated assets can substantially reduce portfolio risk because losses in one asset might be offset by gains in another.

- Low or Zero Correlation:

- Investing in assets with low or zero correlation can also reduce overall portfolio volatility.

- That’s because the performance of one asset is less likely to be affected by the performance of another.

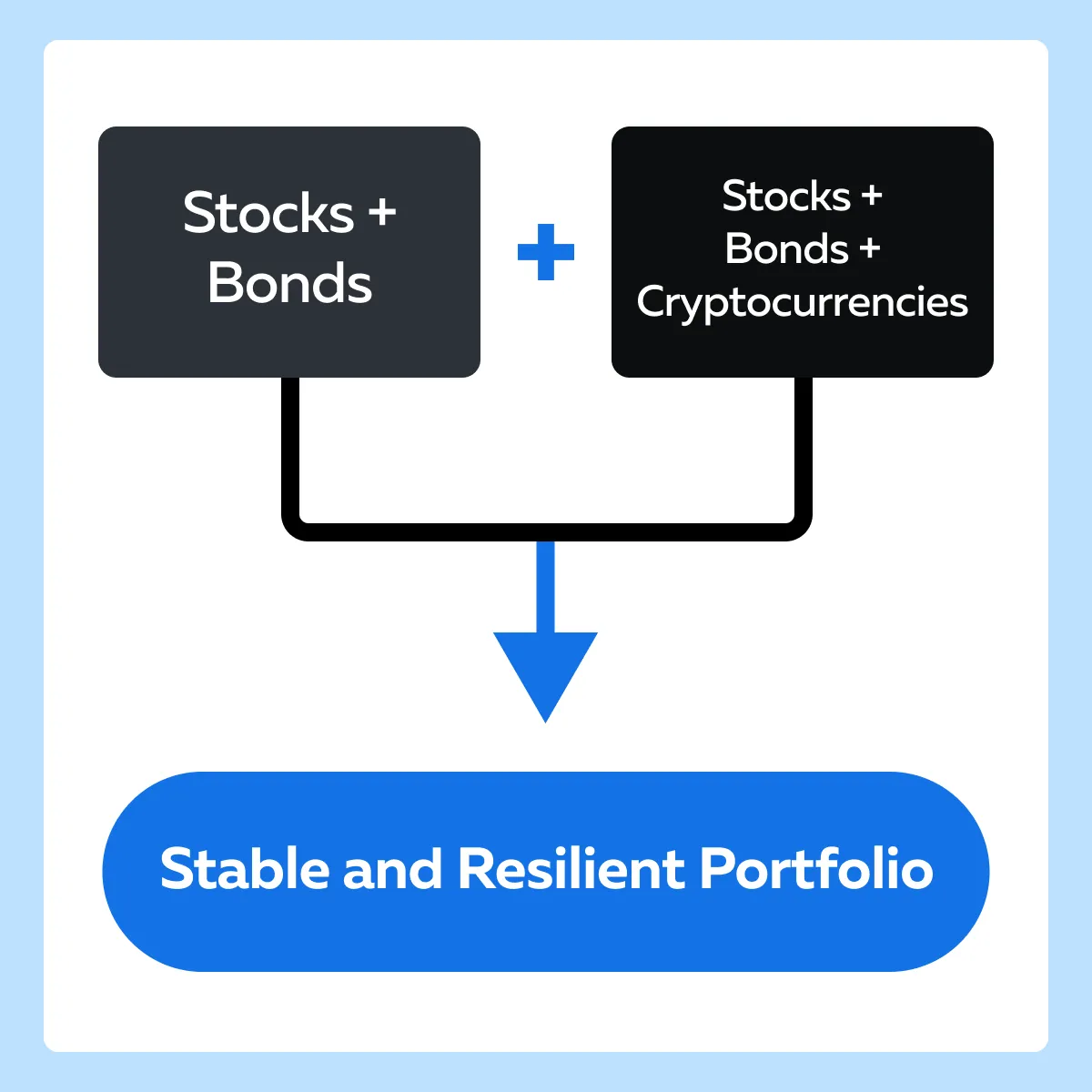

It must be noted that by incorporating a mix of assets with low or negative correlations, such as stocks (typically more volatile) and bonds (usually more stable), or adding alternative investments like cryptocurrencies (which might have different market drivers), investors can achieve a more stable and resilient portfolio.

Hypothetical Arbitrage Opportunities

Arbitrage opportunities arise when price discrepancies exist between similar or related financial instruments across different markets. Let’s have a look at two hypothetical scenarios:

| ETFs and Underlying Stocks Across Exchanges | Futures Contracts and Spot Prices |

and

|

and

|

Hedging with Gold Futures and Cryptocurrencies

Certain assets, such as gold futures and cryptocurrencies are commonly used as hedges to protect portfolios from specific types of risks. Let’s understand this in detail:

- Gold Futures as a Hedge:

- Market Risk:

- Gold is often considered a “safe haven” asset.

- During market turmoil or stock market declines, investors flock to gold.

- This surges the demand for gold and also its price.

- Holding gold futures can offset losses in a declining equity portfolio.

- Inflation Risk

- Gold typically retains its value during inflationary periods.

- By holding gold futures, investors can protect the purchasing power of their portfolios.

- Market Risk:

- Cryptocurrencies as a Hedge:

- Geopolitical Risk

- Cryptocurrencies like Bitcoin are decentralized.

- They operate independently and are not governed by any state authority or central financial institution.

- During times of geopolitical instability, these digital assets act as a hedge against risks associated with:

- Fiat currencies and

- Traditional financial systems.

- Market Risk

- Cryptocurrencies have shown to sometimes move independently of traditional asset classes.

- Including cryptocurrencies in a portfolio leads to:

- Diversification benefits and

- Reduction in overall portfolio volatility.

- Geopolitical Risk

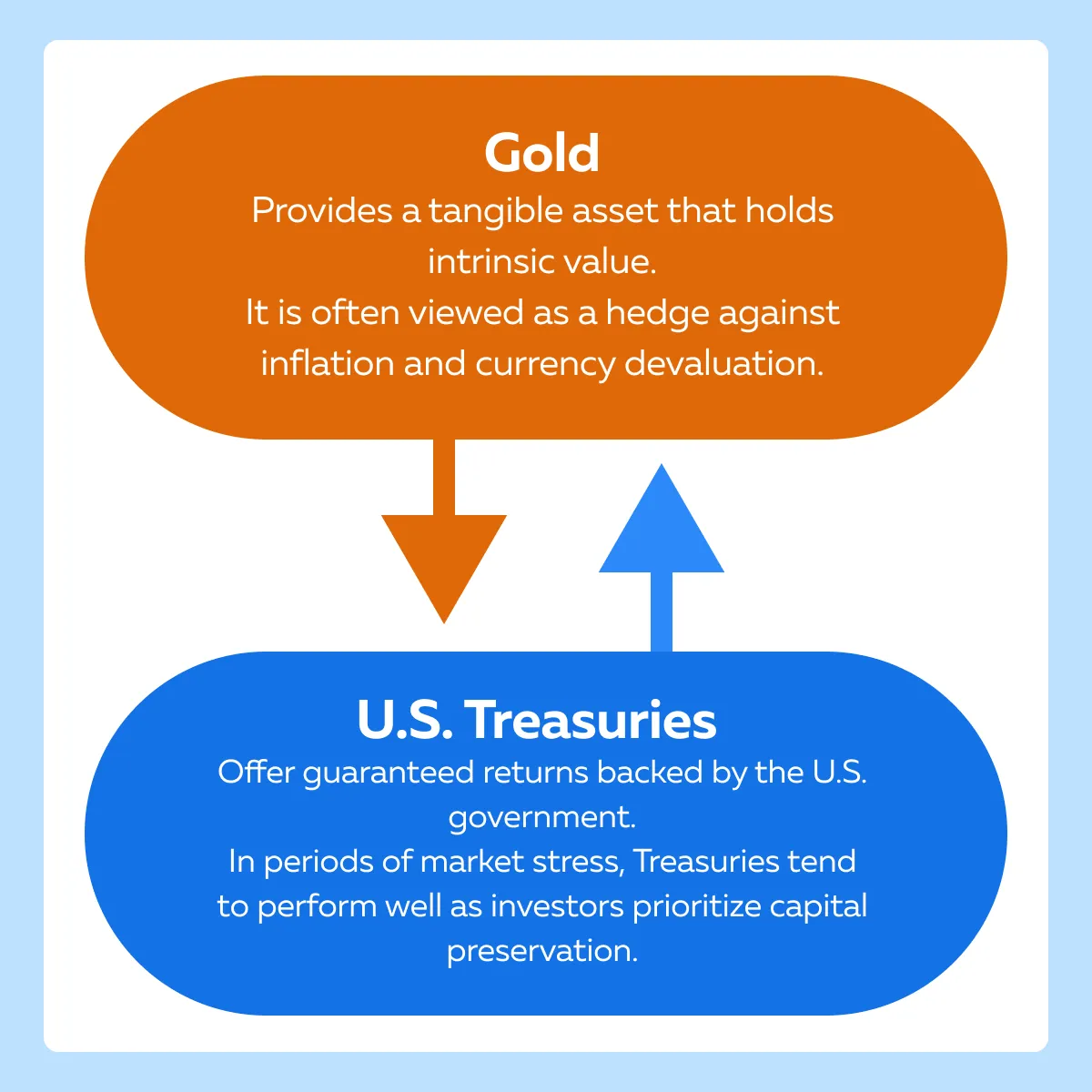

Example – Gold and U.S. Treasuries as Safe Havens:

When equities decline due to economic or political uncertainty, gold, and U.S. Treasuries often rise in value as investors seek safety. Let’s understand this better through the graphic below:

Optimizing Entry and Exit Strategies through Varying Liquidity Levels

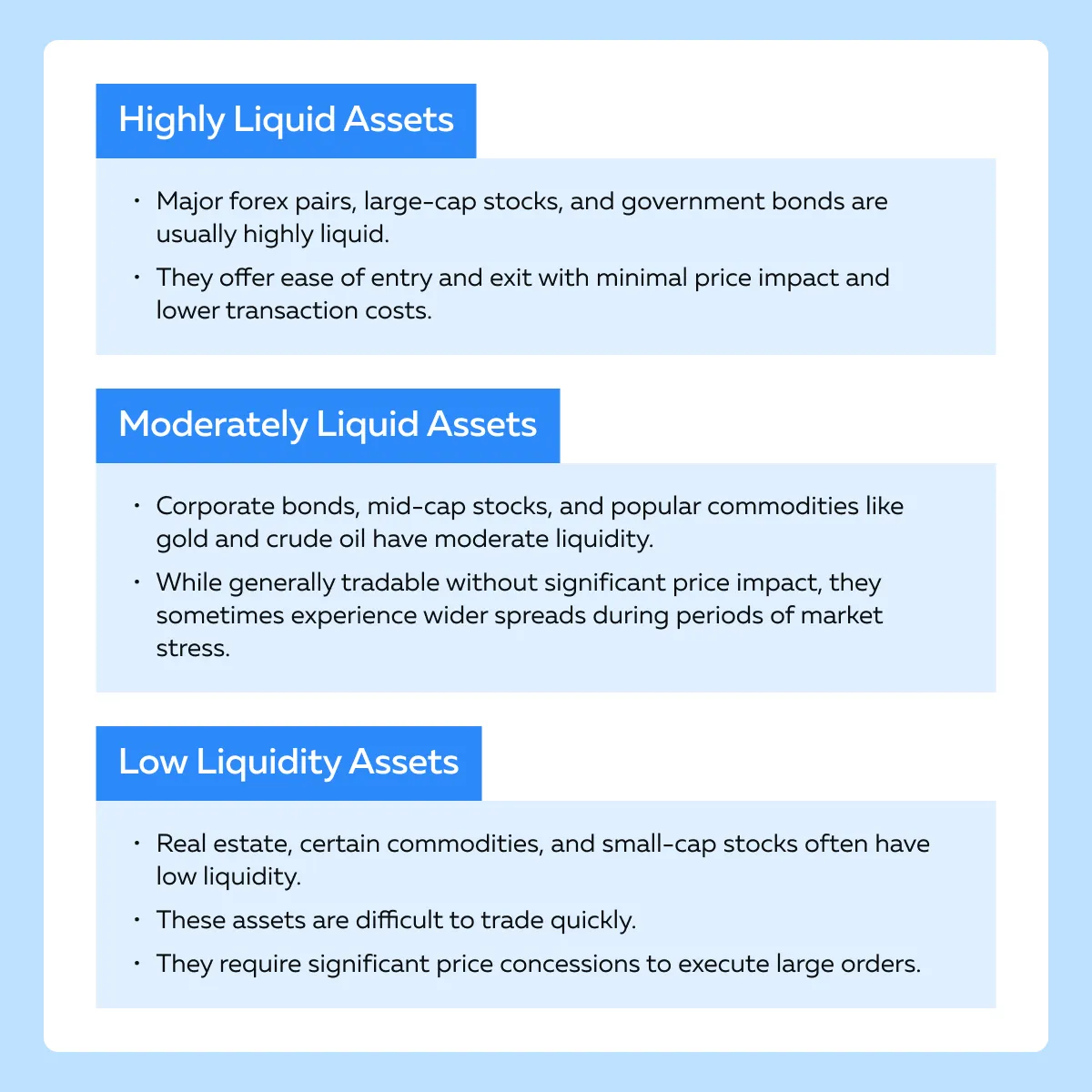

Liquidity refers to how quickly and easily an asset can be bought or sold in the market without affecting its price. Different assets exhibit varying levels of liquidity:

| Highly Liquid Assets | Less Liquid Assets |

| Assets such as major currency pairs in the forex market, large-cap stocks, and government bonds allow for quick and cost-efficient transactions. | Assets such as real estate, certain commodities, and small-cap stocks, may take longer to trade and incur higher transaction costs. |

By engaging in multiple markets, traders can leverage the high liquidity of certain assets to optimize their entry and exit strategies. For example:

- Say a trader uses highly liquid assets like major forex pairs.

- They quickly enter or exit positions based on short-term market signals.

- At the same time, they hold less liquid assets like real estate investment trusts (REITs) for longer-term gains.

This strategy helps reduce the overall trading costs and manages exposure more effectively.

Using Leverage in Certain Markets

Leverage enables traders to regulate a large market position with a relatively small amount of capital. This practice is particularly prevalent in markets such as:

- Futures,

- Options, and

- Forex.

By using leverage, traders can enhance their exposure to more capital-intensive or less liquid assets without committing the full amount of capital required for direct investment.

Leverage in Futures:

- Futures Contracts require a margin deposit, a fraction of the contract’s total value, allowing traders to gain significant exposure with limited capital.

- Example:

- Say a trader interested in the real estate market uses leverage in the futures market to enhance their exposure.

- They invest in futures contracts related to:

- Construction materials or

- Real estate companies.

- This investment amplifies their potential returns without the need for substantial upfront capital.

Leveraging to Access Commodities:

- Commodities:

- Commodities such as oil, gold, and agricultural products often require significant investment.

- By trading commodity futures, traders can gain exposure to these markets using leverage.

- Example

- Say a trader uses leverage to invest in gold futures.

- This way, they gain exposure to gold prices without the need to physically purchase and store gold.

- This enables the trader to benefit from price movements with a smaller initial investment.

Gaining Insights from Broader Economic Indicators

Trading across multiple assets allows traders to gather insights from various economic indicators. The information gained enhances their ability to make informed decisions. It’s worth mentioning that different asset classes react differently to economic events. This kind of reaction provides a more comprehensive view of market conditions.

Now, let’s have a look at some broader economic indicators:

| Interest Rates | Inflation Data | Economic Growth Indicators |

|

|

|

Challenges in Cross-Asset Trading

Understanding and predicting the behavior of different asset classes in cross-asset trading is analytically complex due to the diverse factors influencing each market. Let’s study some key challenges:

- Multifactor Analysis:

- Economic Indicators:

- Different assets react differently to economic indicators such as:

- GDP growth,

- Inflation,

- Unemployment rates, and

- Interest rate changes.

- For example, while equities may rally on strong GDP growth, bonds might suffer due to anticipated interest rate hikes.

- Different assets react differently to economic indicators such as:

- Geopolitical Events

- These can have varied impacts across asset classes.

- A geopolitical crisis drives up oil prices due to supply concerns, while simultaneously causing a sell-off in equities due to increased uncertainty.

- Sector-Specific Factors

- Within equities, different sectors (e.g., technology vs. utilities) react differently to the same economic data.

- Similarly, industrial commodities respond differently compared to precious metals.

- Economic Indicators:

- Correlation Dynamics:

- Changing Correlations

- The correlation between asset classes is not static and can change over time, especially during periods of market stress.

- For example, the correlation between stocks and bonds can turn positive during financial crises, undermining diversification strategies.

- Predicting Correlations

- Forecasting the correlations between different asset classes is challenging due to the influence of myriad factors, including:

- Macroeconomic policies,

- Investor sentiment, and

- Global events.

- Forecasting the correlations between different asset classes is challenging due to the influence of myriad factors, including:

- Changing Correlations

- Data Overload:

- Volume and Complexity

- Traders must analyze vast amounts of data from multiple markets, each with its own set of influencing factors and technical indicators.

- This complexity requires sophisticated analytical tools and models to process and interpret the data accurately.

- Volume and Complexity

Varying Levels of Liquidity

Different assets exhibit varying levels of liquidity. This liquidity significantly impacts:

- Execution strategies and

- Potential costs.

For the unaware, liquidity refers to how quickly an asset can be bought or sold without affecting its price. Let’s have a quick look at the different liquidity profiles and their impact on the execution strategies:

Liquidity Profiles

Impact on Execution Strategies:

- High Liquidity

- Allows for more dynamic and frequent trading strategies, such as day trading or high-frequency trading, where quick entry and exit are crucial.

- Low Liquidity:

- Requires more careful planning and longer holding periods.

- Traders must account for the potential difficulty in exiting positions quickly and the associated costs.

- This might necessitate staggered entry and exit strategies to minimize market impact.

Example – Real Estate vs. Stocks:

| Real Estate | Stocks |

|

|

Navigating Different Regulatory Landscapes

One of the significant challenges in cross-asset trading is navigating the varying regulatory landscapes across different asset classes and jurisdictions. This complexity is especially pronounced with newer assets like cryptocurrencies. Let’s understand this in detail:

- Regulatory Complexity:

- Cryptocurrencies

- Regulations for cryptocurrencies vary widely around the world.

- Some countries, like the United States and the European Union, have implemented stringent regulations to combat money laundering and ensure investor protection, while others, like certain countries in Asia, have more relaxed or evolving frameworks.

- Navigating these disparate regulations requires careful attention to compliance and legal advice.

- Traditional Assets

- Even for traditional assets like stocks, bonds, and commodities, regulations can differ significantly between countries.

- For example, securities laws in the U.S. (regulated by the SEC) differ from those in the UK (regulated by the FCA) or Japan (regulated by the FSA).

- Cryptocurrencies

- Tax Treatments:

- Varied Taxation Policies

- Different jurisdictions have different tax treatments for various asset classes.

- Cryptocurrencies, in particular, pose unique challenges.

- For example,

- In the U.S., cryptocurrencies are treated as property for tax purposes, meaning that every transaction is subject to capital gains tax.

- In contrast, some countries have more favorable tax treatments for crypto transactions.

- Cross-Border Taxation

- Traders dealing with international assets must also consider the implications of cross-border taxation.

- They should also consider double taxation treaties and the need to report foreign income.

- Varied Taxation Policies

Exposure to Geopolitical and Economic Events

While diversification can mitigate risk, it also exposes traders to several geopolitical and economic events that can affect global markets in interconnected ways. Let’s see how:

| Aspects | Geopolitical Events | Economic Policies |

| Meaning | Events such as trade wars, political instability, or geopolitical tensions have widespread effects on global markets. | Central bank policies, such as interest rate changes or quantitative easing, in one country, can have ripple effects across global markets. |

| Example | A trade war between major economies like the U.S. and China can impact equities, commodities, and forex markets globally. | Changes in the U.S. Federal Reserve’s interest rate policy can influence global bond yields, equity prices, and currency exchange rates. |

Increased Correlations During Market Stress

During times of market stress, correlations between asset classes can increase unexpectedly. Due to this increase, the benefits of diversification are reduced drastically. This happens because, in times of crisis, investors often engage in a “flight to safety,” where they:

- Liquidate risky assets and

- Move into safer ones like cash, gold, or government bonds.

This behavior causes assets that usually have low or negative correlations to move together. Furthermore, financial crises often reveal systemic risks that affect multiple asset classes simultaneously.

For example, the 2008 financial crisis saw equities, corporate bonds, and real estate prices fall together, despite their usual low correlations.

How to Manage Risks in Cross-Asset Trading?

Effective risk management in cross-asset trading is necessary. It includes a combination of:

- Diversified asset allocation and

- Strategic hedging to mitigate potential losses.

Let’s understand both of them in detail:

How to do Diversified Asset Allocation?

Spread investments across various asset classes, such as:

- Equities,

- Bonds,

- Commodities,

- Real estate, and

- Cryptocurrencies.

This kind of diversification will help reduce the impact of adverse movements in any single market. Also, it acts as a buffer against sector-specific risks and economic events that might affect one asset class more than others.

How to Perform Strategic Hedging?

Use financial derivatives such as options, futures, and swaps. They can protect against adverse price movements. For example,

- Put options offer downside protection for equity holdings.

- Futures contracts hedge against commodity price fluctuations.

Furthermore, it must be noted that the effectiveness of diversification relies heavily on the assumption that different asset classes do not move in perfect tandem. Thus, by regularly reviewing and adjusting correlation assumptions you can manage exposure effectively. Let’s see how:

- Correlations between asset classes change due to evolving:

- Market conditions,

- Economic cycles, and

- Geopolitical events.

- Regularly monitor these changes which will help you adjust your portfolios proactively.

- Conduct stress tests on the portfolio to simulate various market scenarios.

- This will help you identify potential increases in correlations during periods of market stress.

- Also, you will understand how the portfolio might behave under adverse conditions and in planning appropriate hedging strategies.

Cross-Asset Trading as a Risk Management Strategy

Cross-asset trading itself is viewed as a risk management strategy. That’s because it inherently involves spreading investments across different asset classes to:

- Manage risk and

- Enhance returns.

Let’s see how this approach helps in managing risk:

-

- Risk Mitigation:

- By trading multiple asset classes, traders naturally mitigate risks associated with any single market.

- For example, a decline in equity markets might be offset by gains in commodities or bonds.

- Enhanced Returns

- Diversified exposure to various asset classes enhances potential returns by capturing opportunities across different markets.

- This approach allows traders to benefit from positive movements in any of the invested asset classes.

- Risk Mitigation:

- Holistic View

-

-

- Engaging in cross-asset trading provides traders with a holistic view of the global financial market.

- This broader perspective helps in making informed decisions based on comprehensive market insights and trends.

-

- Adaptive Strategies

-

- Cross-asset traders adapt their strategies based on:

- Macroeconomic indicators,

- Geopolitical events, and

- Market dynamics.

- This adaptability is crucial for effective risk management and seizing profitable opportunities.

- Cross-asset traders adapt their strategies based on:

Implementing Cross-Asset Trading Strategies

A clear trading plan is essential for successful cross-asset trading. This plan should account for the interaction between different asset classes and include defined:

- Risk tolerance and

- Investment goals.

Let’s study in detail:

| Risk Tolerance | Investment Goals |

|

|

How to Account for Interaction Between Asset Classes?

- Asset Correlation

- Analyze how different asset classes interact with each other.

- Understand correlations.

- This understanding will help you construct a balanced portfolio that can withstand market volatility.

- Economic Indicators

- Incorporate economic indicators that impact multiple asset classes.

- For example, interest rate changes can affect equities, bonds, and currencies differently.

The Role of Advanced Trading Platforms

Advanced trading platforms are critical for handling multi-asset trading. They provide the necessary analytical tools and support efficient trade execution. Let’s have a look at the multiple capabilities of advanced platforms:

- Multi-Asset Support: Platforms should support trading across various asset classes, such as equities, commodities, and cryptocurrencies.

- Analytical Tools: Essential tools include real-time data analytics, technical analysis indicators, and fundamental analysis resources.

- Efficient Execution: Ensure the platform offers quick and reliable trade execution to capitalize on market opportunities without delay.

Ongoing Education and Staying Updated

Continual education and staying abreast of the latest market and technological developments are vital for managing a diversified trading portfolio effectively. Let’s learn how you can stay updated:

- Webinars and Workshops

- Engage in monthly webinars and workshops.

- This engagement will help you stay informed about market trends and advancements in trading technology.

- Financial Literature and Trader Forums

- Regularly review financial literature.

- Participate in forums to exchange insights and strategies with other traders.

Practical Example Related to Cross-Asset Trading Strategy

Strategy Overview:

- Goal: Diversify investment risk and capitalize on different economic cycles affecting various asset classes.

- Asset Classes Involved:

- U.S. equities (technology stocks)

- Commodities (gold)

- Cryptocurrencies (Bitcoin)

- Risk Tolerance:

- Moderate

- Make a strategic allocation geared toward

- Long-term growth and

- Capital preservation.

Strategy Execution:

- Asset Allocation:

- Equities (50% of the portfolio):

- Focus on high-growth technology stocks.

- Benefit from strong performance during economic growth phases.

- Commodities (30% of the portfolio): Invest in gold as a hedge against inflation and economic uncertainty.

- Cryptocurrencies (20% of the portfolio): Allocate to Bitcoin to capitalize on high-growth potential and further diversification.

- Equities (50% of the portfolio):

- Trading Plan:

- Entry Strategy:

- Equities: Buy signals are generated from a combination of earnings growth and MACD crossovers.

- Gold: Entries are timed around geopolitical tensions and inflation data.

- Bitcoin: Purchases are made during market pullbacks to average dollar costs.

- Exit Strategy:

- Equities: Trailing stop losses set at 15% below the market price.

- Gold: Trailing stop losses set at 10%.

- Bitcoin: Trailing stop losses set at 20%, adjusted according to volatility levels and market conditions.

- Entry Strategy:

- Use of Technology:

- Trading Platform:

- Utilize a sophisticated platform that supports

- Real-time data analytics,

- Technical analysis,

- Automated trading algorithms, and

- Risk management features.

- Utilize a sophisticated platform that supports

- Market Data Integration: Integrate API for live economic indicators, news feeds, and custom alerts.

- Trading Platform:

- Risk Management:

- Monitoring Correlations:

- Continuously monitor the correlation between asset classes.

- This monitoring will ensure diversification remains effective.

- Adjust portfolio allocation quarterly based on correlation data and volatility assessment.

- Derivatives for Hedging: Employ options and futures to hedge against unwanted exposures, particularly in equities and commodities.

- Monitoring Correlations:

Conclusion

Cross-asset trading provides significant advantages by diversifying investments across multiple asset classes like futures, stocks, and cryptocurrencies. This diversification helps manage risk, improve returns, and take advantage of different market conditions. Traders can benefit from various market dynamics and exploit price discrepancies between similar financial instruments across different markets.

However, cross-asset trading also comes with complexities. Grasping the distinct behaviors of various asset classes and managing varying levels of liquidity can be challenging. Also, it is pertinent to note that the correlations between assets can change unexpectedly, especially during market stress. Thus, traders must remain committed to education and keep up with the latest market trends and technological advancements.

To learn more about the advantages of cross-asset trading and how to visualize cross-exchange liquidity, visit this blog post.