Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

Crypto

June 2, 2024

SHARE

What are Liquidations in Crypto?

In crypto, a liquidation is the forced closing of a trading position. This usually occurs because the margin to cover a position has run out, meaning the trade has to be settled, and is a function of leverage.

Leverage is a double-edged sword, and is something we have written about before in our article Futures Margin: Making Leverage Work for You.

The biggest attraction for traders to use leverage is the increased profits for the same position without leverage. You are also able to control greater positions with less capital. However, the downside of this is that losses are also amplified—not to mention the threat of liquidation.

Let’s explore the topic further in this article, and figure out if there are potentially even ways to profit from other traders’ liquidations.

How Margin Works in Crypto

The act of borrowing funds from a cryptocurrency exchange to trade a more significant amount of crypto is known as margin trading. This can give the trader more purchasing power and the possibility for higher returns.

In other words, leverage uses borrowed funds to establish a more significant position than one’s funds allow. Nevertheless, it also involves higher risk for such traders, because leveraged holdings can be swiftly liquidated if the market goes against them.

But margin trading isn’t free money, of course. To establish a leveraged trading position, the exchange requires the trader put up money (either fiat or crypto) as collateral, which is commonly referred to as the “initial margin”.

This capital upfront aims to protect the borrower if prices fluctuate too wildy. The maximum price opposite to the position’s delta is called the liquidation price. If the market price trades there, the position is liquidated.

Since there is little regulation in the cryptocurrency markets and third parties don’t always have the jurisdiction to enforce rules, crypto exchanges prefer to have a function of forced liquidations rather than margin calls, whereby in the traditional a market the broker would “call” the trader, asking for more collateral to cover the position.

When Does Liquidation Occur?

As mentioned, whenever the trader cannot fulfil the margin requirements for their leveraged holdings, they are forced to liquidate positions.

This normally occurs at the market’s maximum “pain points”, especially when trades are crowded. More specifically, this is likely to occur at swing highs and lows, areas of support and resistance as defined by Market Structure, as well as psychological round figures and large handles.

More technically, liquidation occurs when the trader’s margin account falls below the percentage of the total trade value previously agreed upon with the exchange.

With 10x leverage on a $10,000 position, it only takes a 10% dip to wipe you out. To make things worse, exchanges usually include a fee for liquidated trades.

How to Avoid Liquidation

Trading is all about being a good loser. Since avoiding losses is impossible, it becomes about managing those losses properly.

Here are some ways to avoid one of the most painful forms of loss—liquidation.

Use Stop Losses

Stop loss orders can be used for both entering and exiting positions, but in this case we will be focusing on the latter scenario. You can read more about the different functions of stop orders in our Complete Guide to Stops.

When traders use a stop loss to exit positions, they are essentially exercising the discipline to say “this is the maximum loss I can bare on this trade”. If used with the right risk management techniques, exiting a trade that has proven itself to be invalidated is simply good practice that can save you and your capital, allowing you to trade another day.

Placing a stop loss a good distance from where your liquidation price is located significantly reduces your chances of being liquidated. However, since stop losses are triggered as market orders, they are subject to slippage, which means that theoretically, price could gap past your stop loss level in an extreme scenario, potentially leading to liquidation.

Decrease Position Sizing & Leverage

Another option is to simply trade smaller. Trading a smaller position size by definition reduces your risk, and by extension reduces your chances of liquidation.

Leverage and position sizing go hand in hand, so trading smaller will mean you require less leverage, another way to decrease the risk of liquidation.

Monitor Futures Open Interest (OI)

Watch open interest for futures on the exchange you trade on, as historically high open interest can sometimes be an indication that the market is over-leveraged. In the event of market stress, these positions can be liquidated, causing a cascade which can even lead to a flash crash, which there have been plenty of in crypto’s short history.

You can learn more about OI in our article, Understanding Open Interest in Trading.

Introducing The Liquidation Indicator: Know Exactly When Liquidations have Occurred

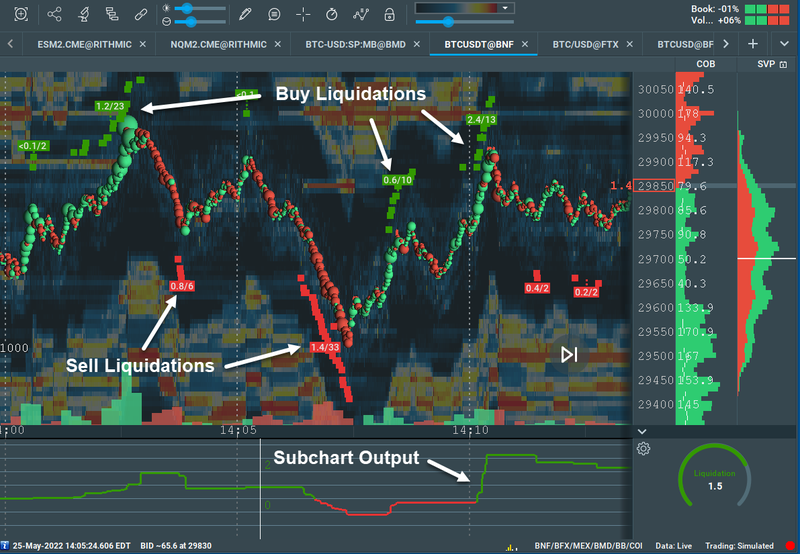

Thanks to another innovative indicator produced by Bookmap’s development team, traders are now able to see exactly where, when, and for how much liquidations occurred on the heatmap.

The addon has 2 visualization modes: on-chart and sub-chart.

Thanks to API data from supported crypto instruments and exchanges, it is now possible to view the precise details of crypto liquidations.

Liquidation Indicator for Crypto

Watch a short video clip about the new Liquidations Indicator!

The liquidation addon can be used to highlight potential reversal points where a price run exhausts, or to see when liquidations are cascading and the market is in freefall (or experiencing a short squeeze).

Conclusion

There are many pitfalls to avoid when trading the highly volatile asset class that is cryptocurrency, and that includes liquidations.

When a trader cannot fulfill the margin requirements for theirleveraged account, the exchange will force them to liquidate their cryptocurrency holdings.

Although using leverage can be a smart move in many instances, it itself is for the faint-hearted nor the beginner trader. It is high-risk and can exacerbate your losses.

Nonetheless, you can decrease the risk of liquidation by monitoring your margins, adjusting leverage based on market conditions, and employing trading tools such as stop loss orders.

Did you know you can try Bookmap for free? Click here to get started.

FAQ

What is a liquidation in crypto trading?

Liquidation happens when a trader’s leveraged position is forcibly closed because they no longer meet margin requirements, typically after the market moves against their trade.

How can I avoid getting liquidated?

You can avoid liquidation by using proper risk management, including placing stop-loss orders, reducing leverage, trading smaller positions, and monitoring futures open interest.

Why do liquidations cause price crashes in crypto?

When many leveraged traders are forced to close positions at once, it can create a cascade effect — accelerating price moves, triggering more liquidations, and sometimes causing flash crashes.

What is the Liquidation Indicator in Bookmap?

The Liquidation Indicator visualizes real-time liquidation events on the heatmap, helping traders spot potential exhaustion points or identify cascading liquidations and short squeezes.