Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 4, 2024

SHARE

Crypto Trading for Beginners: Getting Started and Essential Tips

Digital assets like Bitcoin and Ethereum can hold the promise of financial

freedom and innovation. However, the quantum of success you’ll achieve while

trading in cryptos entirely depends upon your level of understanding,

experience, and the strategies you choose to employ.

This article explores the fundamental concepts of cryptocurrency trading,

its decentralized nature, and the crucial role of blockchain technology.

Furthermore, we will examine its distinctions from traditional trading and

delve into how tools such as Bookmap can provide a competitive edge. So,

let’s begin and step into this exciting world of cryptocurrency trading.

What is Cryptocurrency Trading?

Cryptocurrency trading is the practice of buying and selling

cryptocurrencies, like Bitcoin, Ethereum, etc., with the aim of making a

profit. While the concept shares similarities with stock trading, there are

key distinctions, primarily in the nature of the assets being traded.

How Does It Contrast with Traditional Markets?

|

Parameters |

Traditional Stock Trading |

Cryptocurrency Trading |

|

24/7 Nature |

|

|

|

Degree of Centralization |

|

|

|

Availability of Trading Opportunities |

|

|

The Backbone of Crypto: Decentralization and Blockchain

Blockchain is the foundational technology serving as a decentralized ledger.

It plays a crucial role in ensuring transparency and security in crypto

trading.

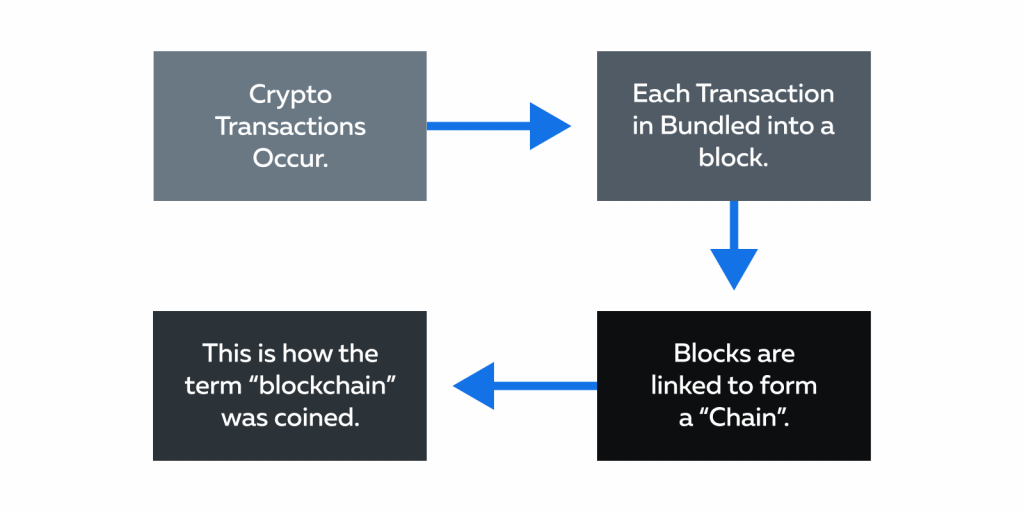

What is Blockchain?

-

Blockchain is a distributed digital ledger.

-

It records all transactions made with a particular cryptocurrency.

-

Each transaction is bundled into a “block”.

-

These blocks are linked chronologically, forming a “chain” — hence

the term “blockchain.” -

It operates on a decentralized network of computers, often referred

to as “nodes”. -

These nodes work together to maintain the ledger.

Decentralization in Blockchain

Unlike traditional financial systems that rely on a central authority, such

as a bank or government, blockchain operates in a peer-to-peer manner. This

decentralized nature of blockchain ensures transparency and security in

crypto trading. Let’s understand its benefits and see how it contrasts with

traditional financial technology.

|

Benefits |

Blockchain Financial Technology |

Traditional Financial Technology |

|

Transparency |

|

|

|

Security |

|

|

|

Consensus Mechanisms |

|

|

|

Decentralized Control |

|

|

How Crypto Trading Differs from Traditional Trading

Crypto trading involves the purchase and sale of digital assets. Being

completely decentralized, crypto trading happens around the clock, unlike

traditional trading, which happens within specific trading hours.

Also, crypto markets offer diverse trading pairs with varying liquidity,

while traditional markets often use standard currency pairs and are

generally more stable. Let’s delve deeper and understand more about crypto

exchanges.

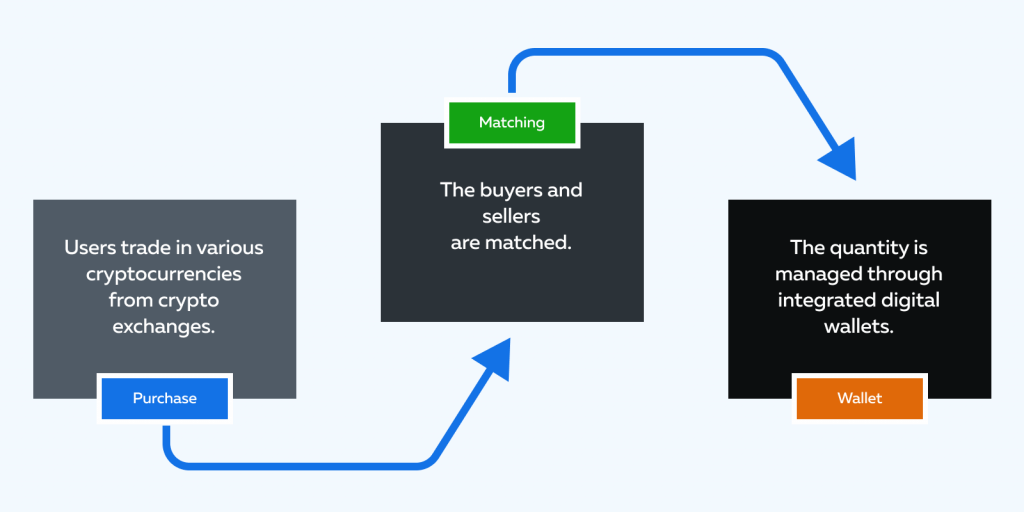

Crypto Exchanges: The Digital Marketplace

Crypto exchanges serve as digital platforms that facilitate the buying and

selling of cryptocurrencies. This is how crypto exchanges function:

-

Marketplace for Digital Assets:

-

Crypto exchanges act as marketplaces where users can trade

various cryptocurrencies. -

Users can place orders to buy or sell these digital assets.

-

-

Matching buyers and sellers:

-

These platforms match buyers and sellers based on their trading

preferences. -

For instance, if one user wants to sell Bitcoin at a certain

price, and another user is willing to buy at that price, the

exchange facilitates the trade.

-

-

Order Types:

-

Traders use different order types based on their trading

strategies:

-

|

Order Types |

Execution Price Level |

|

Market Orders |

Executed at the current market price |

|

Limit Orders |

Executed when a specific price is reached |

-

Wallet Integration:

-

Most exchanges offer integrated digital wallets and allow users

to store their cryptocurrencies securely within the exchange

platform.

-

What are some popular crypto exchanges?

-

Coinbase:

-

Coinbase is one of the most well-known crypto exchanges,

especially for beginners. -

It’s known for its user-friendly interface and strong focus on

regulatory compliance. -

It primarily serves users in the United States.

-

-

Binance:

-

Binance is a global exchange and one of the largest by trading

volume. -

It offers a wide range of cryptocurrencies for trading and has

advanced features for experienced traders.

-

Why Do Price Variations Exist Between Exchanges?

It is a fact that the prices of cryptocurrencies, such as Bitcoin, vary

between different exchanges due to several factors. This largely happens due

to:

|

Factors |

Meaning |

Impact |

|

Liquidity |

The level of trading activity on an exchange, or |

|

|

Regional Demand |

Cryptocurrency demand can vary by region, and this can |

|

|

Localized Events |

Specific events or regulations in a particular country |

News or regulations affecting a specific market can lead |

Trading Pairs and Liquidity

In crypto trading, a trading pair is a simple concept that involves two

different cryptocurrencies or assets paired together for trading. These

pairs tell you how much of one cryptocurrency you can get for a specific

amount of another.

Let’s understand with the example of the pair BTC/ETH.

-

BTC (Bitcoin) is the first cryptocurrency

-

ETH (Ethereum) is the second cryptocurrency

-

It tells you how much Ethereum you can buy with one Bitcoin.

Similarly, in the pair BTC/USD, BTC is traded for US dollars. So, it tells

you the exchange rate between Bitcoin and the US dollar.

What is the Significance of Trading Pairs?

-

Trading pairs allow you to trade one cryptocurrency for another or

fiat currency (like USD). -

Traders use these pairs to speculate on the relative value of one

asset compared to another. -

Pairs also provide flexibility, allowing traders to diversify their

holdings and profit from market movements.

What is the Impact of Liquidity on Trading?

Liquidity shows how easily and quickly an asset can be bought or sold in the

market without significantly affecting its price. It’s a crucial factor in

trading as:

-

High liquidity means you can buy or sell an asset quickly and at a

price close to the market rate. But low liquidity can result in

slower transactions and potentially worse prices. -

Liquid markets tend to have more stable prices because large buy or

sell orders don’t cause significant price swings. Whereas illiquid

markets can see drastic price fluctuations with big trades. -

Liquidity reduces slippage, which occurs when the executed price is

different from the expected price. Liquid markets generally

experience less slippage, benefiting traders.

Significance

-

For traders, liquidity is essential because it ensures that they can

enter or exit positions without significant hurdles. -

Highly liquid trading pairs, such as BTC/USD, typically have narrow

spreads (the difference between buying and selling prices) and a

more predictable trading environment. -

Conversely, low liquidity can make trading difficult, riskier, and

less profitable.

What to Use to Advance Your Crypto Trading Journey

In the fast-paced world of crypto trading, having the right tools and

platforms can provide traders with invaluable insights and advantages.

Bookmap is a powerful market analysis tool that provides crypto traders with

a competitive edge. It offers modern visual tools and unique features

specifically designed to enhance market analysis and decision-making.

Some of Bookmap’s visual tools are:

|

Visual Tools |

Explanation |

Usage |

|

Heatmap |

|

|

|

Predictive Insights |

|

|

|

|

How Does Bookmap Help Crypto Traders?

-

Bookmap’s heatmap and visual tools are particularly beneficial for

intraday trading as they provide real-time data. -

The platform helps traders manage risk by providing a clear view of

market liquidity and identifying stop-loss & take-profit levels. -

Bookmap’s visual tools allow traders to see market dynamics and time

their entry or exit positions. -

Scalpers, who aim to profit from small price movements, can benefit

from Bookmap’s fine-grained visual data. This helps them identify

short-term opportunities.

Automated Trading

Automated trading, also known as algorithmic trading or algo trading, is a

strategy for executing trading decisions through computer programs and

algorithms. These algorithms are programmed to buy or sell assets

autonomously, relying on predefined criteria.

|

Pros |

Cons |

|

|

|

|

|

|

What Precautions Can Algo-Traders Take?

Automated trading can be highly beneficial, especially in markets with

high-frequency trading

and complex strategies. However, it’s crucial to exercise caution.

Algo-traders must:

-

Implement robust risk management strategies to protect capital as

automated systems can execute orders rapidly. This can amplify

losses, if not managed properly. -

Regularly monitor and update automated strategies to adapt to

changing market conditions. -

Thoroughly test an algorithm before deploying it in live markets

using historical data. -

Diversify trading activities with a mix of automated and manual

strategies to reduce risk.

Conclusion

In the dynamic world of crypto trading, traders must learn continuously to

thrive. Staying updated on the latest trends, news, and market developments

is essential. Additionally, security should never be underestimated in the

crypto world and traders must focus on securing their digital assets in

wallets, using strong, unique passwords, enabling two-factor authentication,

and being cautious of phishing scams and fraudulent schemes.

Certainly, crypto trading offers incredible opportunities for financial

growth and innovation, but it’s not without its challenges. Usage of market

analysis tools like Bookmap can help you visualize the market and gauge the

market sentiments.

Ready to dive deeper into the world of crypto trading with precision? Equip

yourself with Bookmap’s detailed guide on how to trade effectively.

Start your journey here

.