20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

August 19, 2024

SHARE

Navigating the Market: High-Frequency Trading Influence on Order Flow Explained

The importance of trends in the stock market cannot be undermined. Predicting the future movement of a specific stock’s prices largely relies on its historical price patterns. To decode these patterns, traders often turn to various technical indicators.

However, the landscape of buying and selling has transformed with technological advancements. Going beyond technical indicators, traders now harness the power of sophisticated computer programs, commonly referred to as “high-frequency trading (HFT) algorithms,” to capitalize on market arbitrage opportunities.

The impact of HFT on order flows and its influence on both market participants and regulators are substantial. A comprehensive understanding of its effects is essential, as HFT not only accelerates trading speeds but also reshapes the very structure and depth of the trading landscape. Let’s do a deep dive.

What Is High-Frequency Trading (HFT)?

In the world of stock trading, the goal is to make money from even the smallest price changes. To do this, advanced computer programs and algorithms have emerged, allowing traders to quickly seize opportunities in the stock market. This method involves making lots of trades in a very short time, aiming to profit from rapid price movements.

High-frequency trading is a technology-driven approach that utilizes advanced computers programs to capture even the smallest fluctuations in stock prices, offering traders unique opportunities for profit.

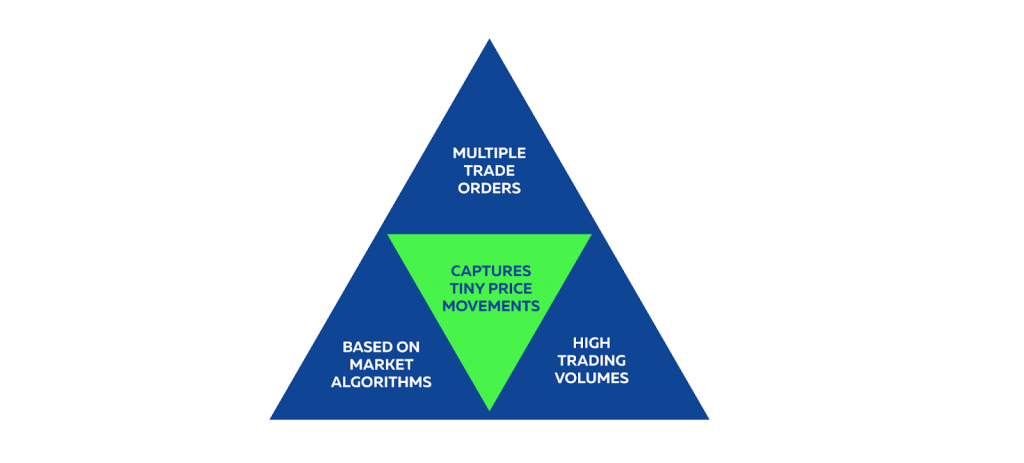

Characteristics of High-Frequency Trading

- Executes Multiple Trades Quickly:

- HFT relies on speed. In this type of trading, the market participants execute multiple market orders within a fraction of a second.

- Dependent on Market Algorithms:

- Complex and pre-defined market algorithms power advanced computers that quickly spot market patterns and emerging trends.

- High Trading Volumes:

- HFT traders usually execute multiple buy and/or sell orders, which contributes to an overall increase in trading volumes.

The Role of HFT In Modern Markets

The impact of HFT on modern markets is big. According to a report by IBISWorld, the high-frequency trading industry grew around 2.90% on average between 2017 and 2022.

Increased usage of HFT affects the modern market in the following way:

- Narrower Bid-Ask Spreads: HFT traders often buy and sell quickly, which makes the difference between buying and selling prices smaller and increases the number of orders.

- Ample Liquidity: Because HFT is so fast, it’s easier to close positions, which adds more activity to the market.

- Reduced Price Volatility: Frequent buying and selling of securities eliminates the occurrence of sudden price swings.

How Does High-Frequency Trading Work?

HFTs depend on a powerful low-latency infrastructure and a variety of market algorithms to execute rapid trades and exploit the smallest arbitrage opportunities. Some common types of market algorithms are:

- Trend-analyzing Algorithms:

- Such algorithms make stock market decisions by analyzing historical price charts and current market trends.

- Using such algorithms, HFT traders can benefit by placing buy or sell orders in the direction of the identified trend.

- News-based Algorithms:

- The stock market is highly-sensitive to the news. A majority of market traders react to it and form their market strategies.

- A news-based algorithm is capable of processing news feeds and accordingly developing profitable trading strategies.

- Order Execution Algorithms:

- Such algorithms are designed to capture several market factors such as order size, current market liquidity, the changing dynamics of order books, etc. to capitalize on bid-ask spreads.

How Long Is The Holding Period?

Capitalizing short-term price movements is the essence of HFT. On average, an HFT trader holds security from a few seconds (even a few microseconds) to a few minutes. Trading in big lot sizes usually occurs throughout the day, significantly contributing to the high day-end trading volume.

The Common HFT Strategies

To take advantage of short-lived price movements, HFT traders must resort to proven strategies, such as:

- Market Making:

- HFT traders provide consistent liquidity to the market by rapidly placing both buy and sell orders. This makes them market makers as they make sure there are enough active orders throughout the trading day.

- Statistical Arbitrage:

- This strategy aims to gain from the discrepancies in the prices of correlated assets, such as ETFs tracking the same industry/sector, Stocks of companies with a similar PE ratio, etc.

- By applying statistical techniques of the correlation coefficient, beta, or co-integration on their historical prices, the HFT traders can identify the future price movement of a particular correlated asset to the other.

- Event Arbitrage:

- Buy the rumor, sell the news. The stock market is governed by this popular saying.

- This strategy analyzes market-moving events, such as mergers, acquisitions, earnings reports, central bank announcements, or other significant news items.

The Importance of Order Flow in Trading

Achieving financial success in the competitive stock market is no easy feat. In this dynamic landscape, making informed decisions is key. Enter order flow – the representation of buying and selling interest in securities at a specific moment. This data serves as a valuable tool for market traders, enabling them to predict price movements and devise more effective trading strategies.

Order flow assists in pinpointing:

- Bullish and bearish market sentiments

- Future price movements

- Support and resistance levels

- Current market liquidity

- Changing market conditions and patterns

The Impact of High-Frequency Trading on Order Flow

The swift and high-volume trading of securities within fractions of a second has a profound influence on the dynamics of order flow. Here’s how high-frequency trading (HFT) shapes order flow:

- Increased Active Orders:

HFT traders often act as market makers, providing abundant liquidity to the market. Their swift execution of buy and sell orders significantly boosts the number of active orders.

- Alters Priority of Trades:

Due to their advanced algorithms and lightning-fast computing systems, HFT traders frequently secure priority in placing buy or sell orders. This disrupts the sequence of trades and sometimes puts retail traders at a disadvantageous position.

- Tighter Bid-Ask Spreads:

HFT players capitalize on even the tiniest price movements, causing bid-ask spreads to contract. This stabilizes the order flow by minimizing price discrepancies.

- Impact on Distribution of Buy and Sell Orders:

The rapid and frequent trading driven by HFT intensifies order frequency and results in an influx of smaller-sized orders within the order book. Additionally, many HFT traders employ stop-loss strategies, leading to a clustering of orders near stop-loss levels.

HFT and Market Liquidity

HFT’s influence on stock market liquidity has both positive and negative aspects:

| Positive Impact | Negative Impact |

| Increased liquidity due to rapid execution of market orders. | The absence of HFT traders during periods of extreme market volatility leads to a temporary shortage of liquidity. |

| Faster order matching and reduced time to complete a trade. | High-frequency trading can trigger flash crashes and squeeze market liquidity. |

| Higher trading volumes again boost liquidity. | Certain HFT traders engage in the technique of quote stuffing*, which can have a detrimental impact on liquidity within the market. |

*In quote stuffing, an HFT trader floods the stock market with a large number of market orders, but of very small quantities, like 1 share.

Volatility and Flash Crashes

HFT is often linked to increased volatility in stock prices and is considered a potential catalyst for flash crashes. Here’s why:

Advanced market algorithms and low-latency computing systems allow HFT traders to rapidly place and cancel orders, amplifying market volatility. While HFT traders and firms often retreat from the market during volatile periods, volatility itself presents profit opportunities.

However, it’s worth noting that predatory HFT strategies like Quote Stuffing, Front Running, Layering, and Spoofing can exacerbate volatility and contribute to flash crashes, creating liquidity imbalances.

How To Use Bookmap To Understand HFT and Order Flow

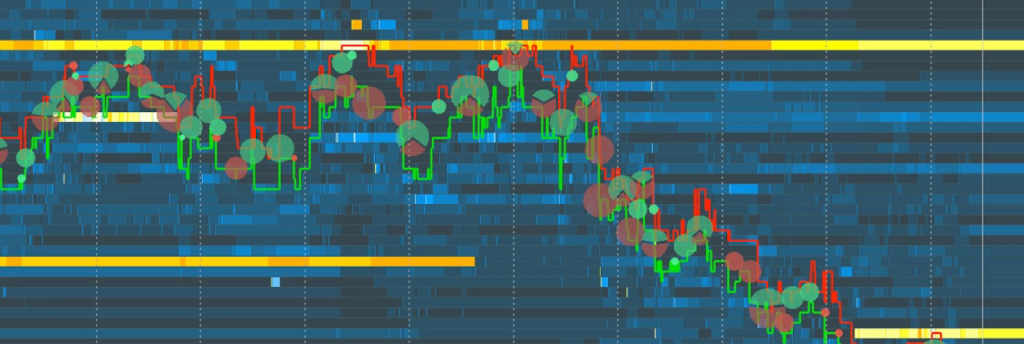

Bookmap is a versatile trading tool designed to provide traders with real-time visualization of order flow dynamics. With Bookmap, you can gain valuable insights into market movements, including the influence of High-Frequency Trading (HFT) activities.

One of the standout features of Bookmap is its interactive heatmap. This feature offers a visual representation of historical order flow data and incoming real-time data, allowing you to understand the distribution of buy and sell orders within the order book. By using Bookmap, traders can enhance their decision-making process and gain a deeper understanding of market dynamics.

Ready to gain deeper insights into High-Frequency Trading and its effect on order flow? Sign up for Bookmap today and revolutionize your trading strategy with cutting-edge analysis tools.

Conclusion

In the rapidly changing landscape of stock trading, technology has reshaped the way trades are executed, with advanced algorithms enabling lightning-fast transactions. This has given rise to High-Frequency Trading (HFT), transforming the dynamics of order flow. Grasping this intricacy is vital for informed decision-making in today’s trading arena.

Tools like Bookmap illuminate this complexity. With Bookmap’s heatmap visualization, traders can decipher order flow effortlessly. It provides a glimpse into emerging market trends and the influence of HFT. Embrace the future of trading with Bookmap and navigate markets with confidence. Start your journey to insightful trading now.