Ready to see the market clearly?

Sign up now and make smarter trades today

Education

August 19, 2024

SHARE

Economic Events and Order Flow: A Trader’s Guide to Navigating Market Fluctuations

Ever wondered why the stock market sometimes gets stirred up? Well, it often has something to do with unexpected economic events. These events, like reports on how well a country’s economy is doing or decisions from big banks, can send shockwaves through the market. They can make traders excited to buy or worried enough to sell, and this excitement shows up in the way orders are placed.

From good news triggering buying to bad news causing selling, these events can turn the market into a rollercoaster. And with super-fast computer trading, the ups and downs can happen in the blink of an eye.

Join us in this article as we unravel how economic events connect with the way trading orders work. We’ll break down this connection step by step, giving traders insights to help them navigate the twists and turns of market surprises.

Understanding Order Flow

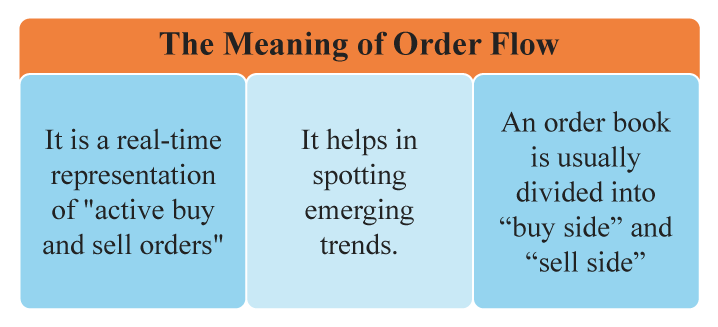

- The Meaning

Order flow is a real-time representation of active buy and sell orders across diverse financial markets of different securities, such as stocks, currencies, commodities, or bonds. An order book is usually divided into “buy side” and “sell side” with each side showing the number of shares available for trading at the bid or ask price.

For example,

At a particular time during the trading day, the stock of Company ABC had the following order flow:

| Buy Side of the Order Book | Sell Side of the Order Book |

| 500 shares at $99.50 | 100 shares at $100.50 |

| 300 shares at $99.25 | 200 shares at $101.00 |

| 800 shares at $99.00 | 600 shares at $101.25 |

Traders assess order books to identify the emergence of trends and form informed decisions. In the instant case, an assessment of the above order book suggests a bullish sentiment and strong buying interest as there are more buy orders at lower prices.

- The Uses

Most successful traders, both individual and institutional, analyze order flows to understand the demand and supply conditions, market sentiments, and potential price movements. This helps them in gaining valuable insights and making informed trading decisions.

A comprehensive assessment of order flows helps the traders to:

- Establish support & resistance levels by identifying imbalances between buy and sell orders.

- Figure out breakouts and impending trend reversals

- Track the institutional activities

- Spot the different market manipulations

- Fine-tune entry and exit points

- A better understanding of how the market reacts to news and events.

The Role of Economic Events in Financial Markets

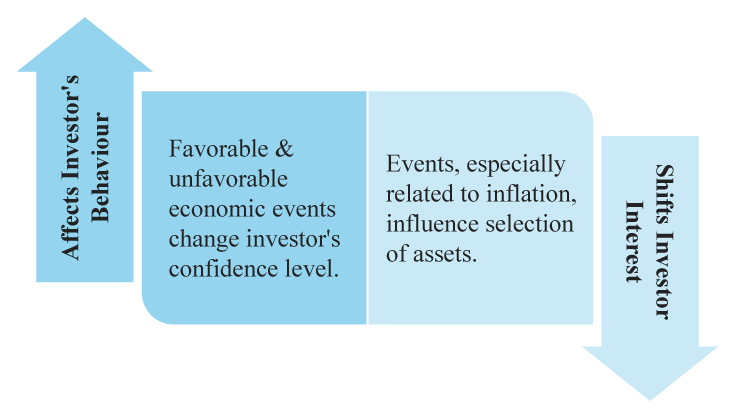

Economic events influence investor behavior, asset prices, and overall market sentiment. How traders understand and react to these events can trigger changes in prices and create fluctuations in the market. As a result, economic events hold a vital role in shaping the broader financial landscape by:

- Changing Investor Confidence Levels:

- The release of favorable economic data boosts investor confidence and leads to positive sentiment. This encourages more buying activity as investors strive to capture the potential returns in the market.

- On the flip side, unfavorable or disappointing data can lead to panic, reducing investor confidence. This often results in a period of pessimism, prompting investors to place sell orders and seek safety in assets considered less risky.

- Influencing Selection of Assets in a Portfolio:

- Economic events, particularly those related to inflation, influence the selection of assets in a diversified portfolio.

- During periods of high inflation, when the real value of money erodes over time, investors prefer to invest in:

- Inflation-linked bonds

- Commodities (mostly, gold, silver, oil, and agricultural)

- Stocks of industries (like energy, materials, and utilities) that pass on higher costs to consumers.

- During periods of low inflation, investor interest shifts to assets that offer growth potential, such as:

- Stocks of companies with strong growth prospects (say, technology)

- Longer duration bonds

- Cash and Short-term investments

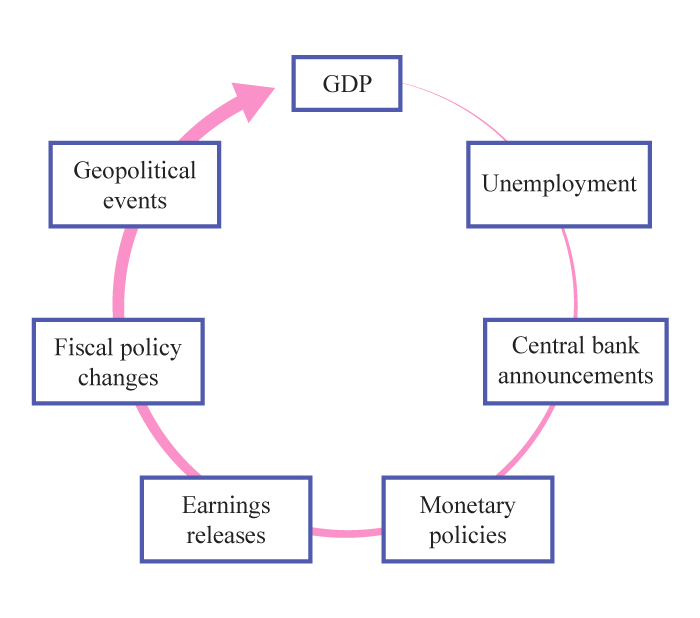

Types Of Economic Events and Their Impact On Investor Sentiments

There are different types of economic events capable of influencing investor sentiment. Here’s an overview of the major event categories and their effects:

a) Macroeconomic Indicators:

- GDP Figures:

- Gross Domestic Product (GDP) measures the total value of goods and services produced within a country.

- A rate of GDP growth reflects the overall health and size of an economy.

- Where positive GDP growth indicates economic expansion and positive sentiments, negative growth suggests contraction and negative sentiments.

- Unemployment Rate:

- Employment reports, which provide insights into labor market conditions, also affect investor sentiment.

- A strong job market can indicate economic strength and boost investor confidence, while high unemployment can signal economic challenges.

b) Central Bank Actions:

- Central Bank Announcements:

- The central banks of every country assess the economic conditions and accordingly alter their policy decisions, including changes in:

- Levels of interest rates

- Monetary policy stances, and

- Quantitative easing programs.

- These announcements influence borrowing costs, the value of the currency, and eventually investor sentiments.

- The central banks of every country assess the economic conditions and accordingly alter their policy decisions, including changes in:

- Monetary Policy Meetings:

- Most central banks hold periodic meetings to review and adjust monetary policies.

- Decisions related to money supply impact economic conditions and financial markets.

c) Corporate Earnings Reports:

- Quarterly Earnings Releases:

- Publicly traded companies are required to report their financial performance, including revenue, profit, and earnings per share (EPS), every quarter.

- An assessment of these reports helps traders gain insights into a company’s financial health and growth prospects.

- Using these insights, investors can assess the company’s future performance and accordingly develop their trading strategy.

d) Government Policy Announcements:

- Fiscal Policy Changes:

- Changes in government spending and taxation policies can impact economic growth and market sentiment.

- Expansionary fiscal policies indicate government support for recovery, boosting market sentiment and investor willingness to invest.

- Conversely, announcements depicting rising budget deficits or government debt levels, make investors more cautious and increase volatility in the market.

e) Global Events and Geopolitics:

- International Trade Disputes:

- Events related to disputes between countries impact cross-border trade, supply chains, and economic growth, thereby depleting investor confidence.

- Geopolitical Events:

- Adverse political developments, conflicts, war-like situations, or crises in different parts of the world create uncertainty, push the market into periods of pessimism, and lead to market volatility.

These are just a few examples of the various economic events that can influence financial markets. Most successful market participants closely monitor these events to make informed investment decisions.

How and Why Economic Events Affect Order Flow

Economic events wield a significant influence over market participants, shaping their decisions and impacting trading activities. This influence, in turn, alters supply and demand dynamics and order flow.

The Immediate Impact of Economic Events

The release of economic data that deviates from market expectations triggers immediate spikes in trading activity, leading to shifts in order flow. This phenomenon is driven by several key factors:

| Critical Factors | Explanation |

| The Surprise Element |

|

| High-frequency Trading |

|

| Heightened Market Volatility |

|

| News Trading |

|

The Long-Term Effects of Economic Events

Beyond the short term, various economic events can exert lasting impacts on order flow, influencing trading behavior over extended periods. Let’s see how these long-term effects take place:

- Trend Reversals:

- The market always has certain expectations and forecasts about outcomes.

- When a series of significant economic events that consistently deviate from expectations are released, it leads to “trend reversals”.

- This affects the order flow in the direction of the emerging trend.

- Central Bank Decisions:

- Regular changes in interest rates and shifts in monetary policies impact trading behavior and the dynamics of order flow.

- Sector Rotation:

- It refers to a trading strategy where investors adjust their portfolio by allocating a budget to sectors that are anticipated to perform well.

- Changes in consumer preferences or technological advancements lead to sector rotations over time.

- Gradually, a shift is seen in order flows favoring industries that benefit from evolving economic conditions.

By examining both the immediate and long-term effects of economic events on order flow, traders gain insights that inform their trading decisions and strategies.

Conclusion

Economic events play a pivotal role in guiding the course of financial markets. From GDP figures to global events, each economic event not only influences market sentiments but also shapes the delicate balance of supply, demand, and order flow.

Traders closely monitor macroeconomic indicators, central bank actions, corporate earnings reports, government policy announcements, and geopolitical events.

When economic data is unveiled, it’s akin to an unexpected surge in activity, set into motion by both automated trading and shifts in investor sentiment. This synchronized interplay illustrates how economic events intricately shape the movements of order flow.

Ready to navigate economic events with ease? Sign up for Bookmap and gain the tools you need to understand and leverage the impact of these events on order flow.