Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 14, 2024

SHARE

Examining Market Efficiency: Efficient Market Hypothesis and Trading Implications

If you’re just starting your exploration journey of market dynamics, you’ve

come to the right place. In this article, we will explore the fundamental

concept of market efficiency and its implications for trading.

We’ll delve into the tiers of market efficiency: Weak, Semi-Strong, and

Strong. This discussion will shed light on their ramifications for traders.

You’ll learn about the challenges you might face when trading in highly

efficient markets and the strategies you can employ to navigate them with

finesse.

Lastly, we’ll also touch on anomalies and patterns that seem to defy market

efficiency and introduce you to the exciting world of behavioral finance.

Are you ready to enhance your market knowledge? Let’s begin!

What is the Efficient Market Hypothesis (EMH)?

The Efficient Market Hypothesis (EMH) asserts two key points:

-

Financial markets operate with a high degree of efficiency.

-

Asset prices fully incorporate all available information.

The central idea behind EMH is that in an efficient market, competition

among investors ensures that information is quickly and accurately reflected

in asset prices. This means that it is extremely difficult for investors to

gain an advantage by:

-

Analyzing past price movements

-

Financial statements

-

Any other publicly available data

But why is this the case?

The core premise is that, at any given moment, the prices of financial

assets, such as stocks or bonds, already encompass all known information.

Consequently, consistently achieving above-average returns through trading

based on publicly available information is deemed unfeasible.

What are the Three Forms of the Efficient Market Hypothesis (EMH)?

Let’s understand their meaning and impact on trading strategies:

|

What are the three forms? |

What do they state? |

How does it affect trading strategies? |

|

Weak Form |

Asset prices already reflect all past trading

|

Technical analysis and the use of past price data to |

|

Semi-Strong Form |

Asset prices incorporate past trading information and

|

The effectiveness of performing either fundamental |

|

Strong Form |

The strong form of EMH proposes that asset prices |

Insider information is of little benefit, as its impact |

As studied above, there are three forms of market efficiency – weak,

semi-strong, and strong. Each one of them has its implications. Let’s

understand them.

Implications of Weak-Form Efficiency

-

Technical Analysis Is Ineffective:

-

Most traders do technical analysis to forecast future price

movements based on historical price patterns, charts, and

indicators. -

According to Weak-Form Efficiency,

-

Technical analysis is ineffective and will not yield excess

returns. -

This is because all historical price data that technical

analysis relies on is already incorporated into the current

market price.

-

-

-

Close Association with Random Walk Theory:

-

Weak-form efficiency is closely associated with the

“random walk” theory

, which suggests that asset prices follow a random and

unpredictable path. -

The asset prices will behave like random walk if – past price

movements do not contain any useful information for predicting

future prices.

-

-

No Heavy Reliance on Past Data:

-

Weak-form efficiency implies that investors must not solely rely

on past trading information for making investment decisions. -

This is because they will not be able to consistently outperform

the market. -

They must consider other factors such as fundamental analysis or

information not yet reflected in market prices.

-

Implications of Semi-Strong Form Efficiency

-

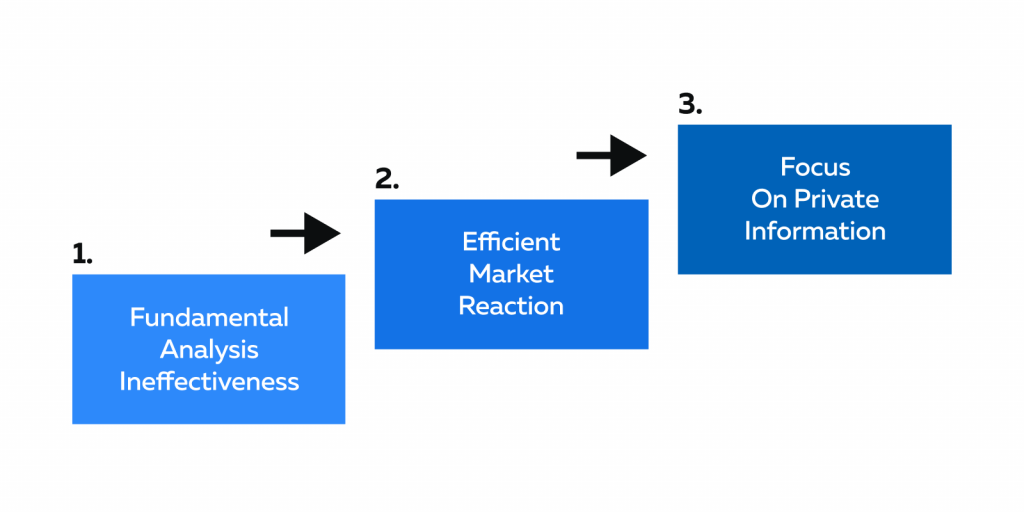

Fundamental Analysis Ineffectiveness:

-

Fundamental analysis involves evaluating an asset’s intrinsic

value based on factors like earnings, financial ratios, and

economic conditions. -

According to Semi-Strong Form Efficiency:

-

Traders performing fundamental analysis will not be able to

produce excess returns because all relevant public

information about a security is already reflected in its

market price. -

They will find it challenging to identify undervalued or

overvalued assets based on publicly available data.

-

-

-

Efficient Market Reaction:

-

Semi-strong form efficiency implies that financial markets react

quickly and efficiently to new information. -

Once news or data is publicized, it swiftly becomes part of

asset prices. -

This leaves minimal room for investors to exploit information

lags or market inefficiencies.

-

-

Emphasis on Private Information:

-

As per Semi-strong form efficiency, investors seeking an

advantage may focus on obtaining private information not yet

publicly available.

-

Implications of Strong-Form Efficiency

-

All Information is Priced In:

-

As per Strong-Form Efficiency, all information, whether it’s

public knowledge or confidential insider information, is already

incorporated into asset prices. -

Actively seeking out private information or relying on insider

tips is unlikely to result in a sustainable competitive edge. -

Instead, investors may opt for passive investment strategies,

such as index funds, which aim to match the overall market

performance.

-

-

Advocates Efficient Allocation of Resources:

-

As per Strong-Form Efficiency, financial markets efficiently

allocate resources and information to the benefit of all

participants. -

Investors do not need to expend significant resources or effort

trying to uncover hidden information or seeking an edge through

insider connections.

-

-

Establishes Market Integrity:

-

From a regulatory perspective, Strong-Form Efficiency

underscores the importance of maintaining market integrity and

preventing insider trading.

-

Trading in an Efficient Market

Trading in highly efficient markets is challenging. The table below

highlights the common challenges faced by the traders and suggestions to

overcome them:

Challenges for Traders in Efficient Markets:

-

Limited Opportunities for Arbitrage: In highly efficient markets,

price disparities due to mispricing or information lags are quickly

corrected. Traders must not try to profit from price discrepancies

as there is little room for arbitrage opportunities. -

High Competition: Efficient markets attract a large number of

informed and professional traders. Due to high competition, traders

must be well-prepared and have access to advanced tools, like

Bookmap, and information to stay competitive. -

Risk of Overtrading: Traders frequently engage in trading in search

of short-term gains, leading to high transaction costs and potential

losses. To avoid overtrading, traders should stick to their

pre-developed backtested strategy and maintain trading discipline.

Navigating Trading Challenges:

Successful trading in efficient markets requires discipline, patience, and a

commitment to ongoing education and improvement. Traders can overcome these

challenges by:

-

Understanding the Form of Efficiency: Traders should determine which

form of market efficiency (Weak, Semi-Strong, or Strong) best

describes their market. This knowledge helps set realistic

expectations regarding trading opportunities. -

Practicing Diversification: Spread investments across various assets

or asset classes to mitigate risks and achieve a more stable

portfolio performance. -

Managing Trading Risk: Set stop-loss orders and position sizing

limits to control potential losses and protect capital. -

Maintaining a Long-Term Perspective: In efficient markets, consider

adopting a long-term perspective. Avoid trying to time the market or

make frequent trades, focusing on long-term investment goals to

weather short-term market volatility. -

Exploring Alternative Strategies: Explore alternative trading

strategies, such as quantitative trading, algorithmic trading, or

options trading, to leverage technology and sophisticated models for

trading opportunities in efficient markets. -

Continuous Learning: Markets evolve, and new information is

constantly becoming available. Engage in continuous learning to stay

updated with market developments, trading strategies, and emerging

trends.

Market Efficiency vs. Real-World Trading

While the Efficient Market Hypothesis (EMH) suggests that markets are highly

efficient and that anomalies should not exist, real-world trading often

reveals patterns and behaviors that challenge perfect market efficiency.

Behavioral finance sheds light on the psychological factors that contribute

to market inefficiencies, while tools and platforms like Bookmap provide

traders with real-time insights to navigate these complexities. Let’s

discuss further.

Anomalies and Patterns in Real-World Trading

Despite the Efficient Market Hypothesis (EMH), real-world markets often

exhibit anomalies and patterns that appear to contradict the idea of perfect

efficiency.

Some common examples include:

-

The January Effect: Stocks often exhibit superior performance in

January. -

The Momentum Effect: Stocks that have previously performed well tend

to continue their streak. -

Value Investing Strategies: Traders consistently gravitate towards

undervalued stocks.

These anomalies suggest that markets may not always be perfectly efficient.

Behavioral Finance and Market Inefficiencies

Behavioral finance emphasizes the role of cognitive biases and psychological

factors that influence investor decision-making. Several biases can lead to

irrational trading decisions and create market anomalies, such as:

-

Overconfidence

-

Herding behavior

-

Loss aversion

Utilizing Market Analysis Tools

While anomalies and inefficiencies may exist, traders must exercise caution.

Even if a pattern or anomaly appears to contradict market efficiency, it may

not persist. Advanced tools like Bookmap provide traders with:

-

Real-time insights into market dynamics

-

Visual representations of order book data

-

Display of the distribution of buy and sell orders at different

price levels

This information helps traders identify support and resistance levels,

detect sudden shifts in supply and demand, and make more informed trading

decisions.

Integration of Machine Learning and AI

Machine learning algorithms and artificial intelligence are increasingly

used by traders and investors to analyze large datasets and identify

patterns or trading opportunities that may not be immediately apparent to

human traders. These technologies possess the adaptability to respond to

shifting market conditions and continuously refine trading strategies.

Conclusion

Understanding market efficiency is paramount for traders when formulating

effective trading strategies. Recognizing the level of efficiency in a

market, whether weak, semi-strong, or strong, imparts valuable insights into

the potential for discovering trading opportunities and aids in setting

realistic expectations.

Given that markets are dynamic and conditions evolve, traders must maintain

a continuous commitment to education and adapt their strategies based on

evolving market conditions.

Access to advanced market analysis tools, like Bookmap, provides a

competitive edge and helps in making informed trading decisions. Wondering

how to apply these insights on market efficiency to your trading strategy?

Dive deeper and

learn how to backtest your trading strategy effectively with our

comprehensive guide

.