Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

December 4, 2024

SHARE

Exploring Market Data Feeds: Types, Providers, and Benefits

The modern world of financial trading is dynamic. Seasoned day traders and

institutional investors continuously test trading strategies. Whether you’re

a seasoned trader seeking a strategic edge or just beginning your trading

journey, the quality of your data is the bedrock upon which your success is

built.

In this digital age, the old adage “knowledge is power” takes on a new

meaning – “accurate knowledge is profit.” Through this article, we will go

over the different types of market data feeds, their providers, and how the

usage of top-quality data can elevate your trading game. Let’s begin.

What are Market Data Feeds?

In simple words, market data feeds are real-time streams of financial

information and data. These streams relate to various financial instruments

such as stocks, bonds, commodities, currencies, and more. Through market

data feeds, traders and investors gain up-to-the-minute information about

the financial markets, including:

-

Price Quotes

-

Trade Volumes

-

Bid and Ask Prices

-

Historical Data

-

Other relevant statistics

How Do Market Data Feeds Help Traders?

Market data feeds serve a critical role in supplying traders with crucial

data in several ways:

-

Research and Analysis:

-

Traders and financial analysts rely on market data feeds for

in-depth research and analysis. -

They use historical and real-time data to identify:

-

Trends

-

Patterns

-

Correlations

-

-

-

Better Risk Management:

-

Market data feeds enable traders to monitor their portfolio’s

performance and exposure to market fluctuations in real time. -

This helps them to make adjustments as needed to mitigate

potential losses.

-

-

Price Discovery:

-

Market data feeds help in the process of price discovery, where

the market determines the fair value of assets. -

Traders use this information to assess the relative value of

securities.

-

-

Precise Execution of Orders:

-

Traders rely on market data feeds to execute buy and sell orders

effectively. -

Accurate and timely market data ensures that orders are executed

at desired prices and within acceptable timeframes.

-

-

Gauging Market Sentiments:

-

Traders analyze news feeds to gauge market sentiments.

-

This analysis helps in spotting prevailing trends as well as

reversals.

-

The Different Types of Market Data

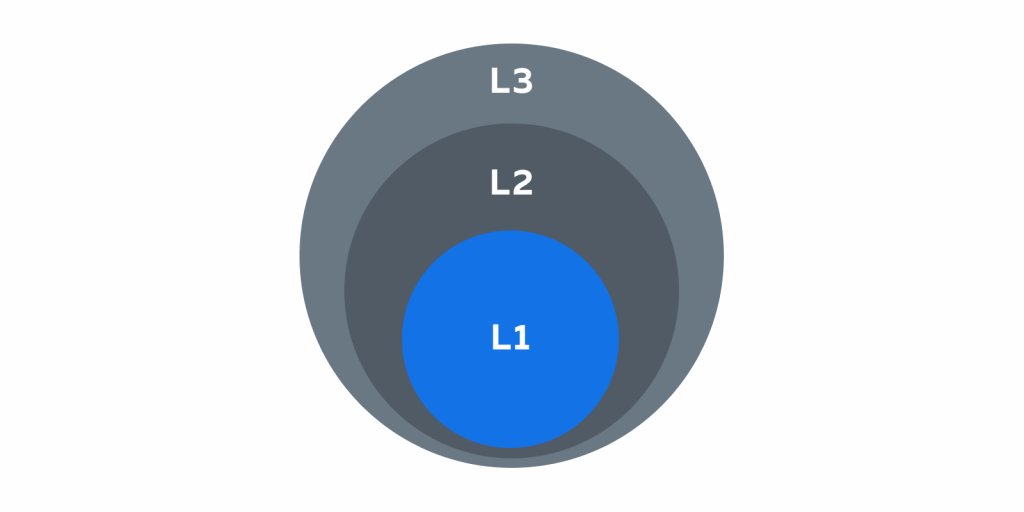

Market data is a spectrum of insights into the world of finance, with

different levels catering to varying depths of information. From the basic

snapshots provided by Level 1 (L1) to the intricate details of Full Depth

Market Data, traders and investors can choose the data that best suits their

strategies and objectives.

What is Level 1 (L1) Market Data?

Level 1 (L1) market data offers a straightforward glimpse into the market’s

current state. It provides top-of-the-book information for specific

financial instruments, such as a stock. L1 data includes:

-

Best Bid Price: The highest price buyers are willing to pay.

-

Best Ask Price: The lowest price sellers are demanding.

-

Last Traded Price: The latest price at which the security was

traded.

Now, let’s break down L1 market data for a stock using a simple example:

For Company XYZ:

-

Best Bid Price: $50.25

-

Best Ask Price: $50.30

-

Last Traded Price: $50.28

These values suggest a relatively narrow bid-ask spread and recent trading

activity around the given prices. Analyzing these figures gives traders a

quick snapshot of the stock’s current status, answering the following:

-

What are buyers offering?

-

What are sellers requesting?

-

What was the stock’s recent selling price?

How Deep is L1 Market Data?

L1 data shows only the best price levels without details of orders lined up

behind the top quote. It lacks information about the full order book and the

volume of orders at different price levels.

The Pros and Cons of L1 Market Data

Pros

-

L1 data is simple and cost-effective.

-

It’s a budget-friendly option, making it accessible for those new to

trading. -

Offers an immediate snapshot, facilitating quick decision-making.

Cons

-

L1 data doesn’t go beyond the best price levels.

-

It doesn’t reveal where large orders are stacked in the order book.

-

Sometimes, it might give an incomplete picture, leading to

inaccurate predictions.

Note: More experienced traders might seek more detailed insights, turning to

higher-level market data like Level 2 (L2) or Level 3 (L3) for a deeper

understanding.

What is Full-Depth Market Data?

As the name suggests, full-depth market data provides traders with a

comprehensive and detailed view of the market’s order book. Imagine looking

through a vast, detailed catalog, each page revealing a new layer of buying

and selling activity. This is what Full Depth offers: a granular view of

every queued order.

What Does Full-Depth Market Data Show?

Full Depth data lays out the intricacies of supply and demand for any

financial instrument. Traders gain insights into:

-

Every available price level for a security.

-

The number of orders at each price point.

-

The volumes of securities ready for transaction.

For example, if Company XYZ’s stock has ten buyers at $50.20 and fifteen

sellers at $50.35, a trader can visualize the depth of demand and supply for

that particular price range.

The Pros and Cons of Full Depth Market Data

Pros

-

Full Depth data offers a comprehensive view of the market.

-

Using it, traders can gain insights into the depth of supply and

demand. -

Traders can identify where large players are positioning themselves.

-

It helps in predicting price movements.

Cons

-

Might be overwhelming for beginners due to the abundance of data.

-

This type of market data is expensive and comes at a premium price.

While L1 data provides a quick snapshot ideal for novices, Full Depth market

data delves into the intricacies of the market, catering to advanced

traders. Choosing the right market data type is pivotal in shaping one’s

trading strategies and ensuring they’re built on a foundation of informed

insights.

An Overview of Leading Market Data Feed Providers

Market data feed providers play a significant role in the financial

landscape. Some prominent ones include: Rithmic, dxFeed, Omnifeed, Cedro,

and Binance. Let’s understand them in-depth:

|

Feed Provider |

Overview |

Type of Data |

Unique Features |

Geographic Coverage |

|

Rithmic |

It is a well-established market data and trade execution

|

Real-time & historical data, including:

|

|

Rithmic provides data and execution services for global |

|

dXFeed |

It stands out as a leading provider of data feed and |

|

|

dXFeed provides data solutions for global markets, |

|

Omnifeed |

It is a market data aggregator and provider that aims to |

|

|

Omnifeed offers global market coverage, allowing users |

|

Cedro |

It is a market data and trading solutions provider that

|

Real-time data and historical data specific to Latin |

|

Cedro primarily caters to Latin American markets, making |

|

Binance |

It is one of the largest cryptocurrency exchanges |

Real-time and historical data for cryptocurrencies,

|

|

Binance has a global presence and provides |

Bookmap, as a market analysis tool, seamlessly integrates with numerous

market data feed providers. Discover the full range of compatible providers

here

.

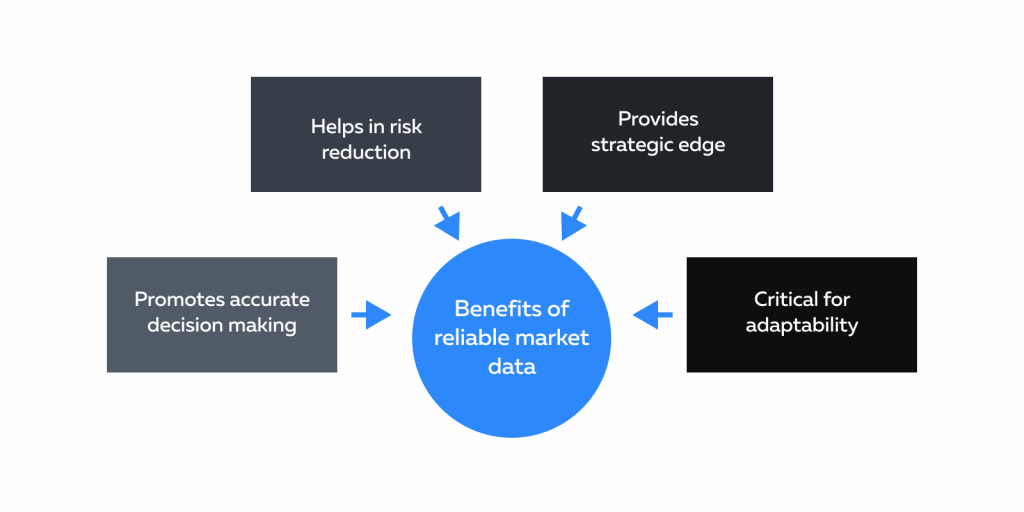

The Benefits of Reliable Market Data in Trading Strategies

In modern trading, even split-second decisions can mean the difference

between success and failure. This makes possession of reliable market data

paramount. Let’s understand some critical benefits of having reliable market

data in trading strategies.

(A) Promotes Accurate Decision Making

Profit Maximization:

-

Accurate market data helps in executing trades at the right price

and time, which maximizes profit potential and minimizes losses. -

When traders have a precise and up-to-date view of the market, they

can seize opportunities and manage risks more effectively.

Reduction of Blind Trading:

-

Blind trading is inherently risky, and it often leads to suboptimal

outcomes. -

With precise information about price movements, order book depth,

and trade volumes, traders can avoid making decisions in the dark.

(B) Helps In Risk Reduction:

Timely Entry and Exit:

-

Volatile markets can change rapidly.

-

Accurate and real-time data enables traders to identify entry and

exit points precisely. -

This timeliness is crucial for avoiding losses and capitalizing on

profit opportunities.

Setting Informed Stop-Loss and Take-Profit Points:

-

Reliable data empowers traders to set stop-loss and take-profit

levels based on solid information. -

Traders can use precise data to determine these points

strategically, ensuring that they are not triggered prematurely or

missed altogether.

Minimization of Errors:

-

Reliable data also minimizes the potential for costly errors.

-

Using reliable data, traders avoid the mistake of placing orders at

incorrect prices by misunderstanding market conditions.

(C) Provides Strategic Edge

Strategic Advantage:

-

Accurate market data provides traders with a competitive edge.

-

It allows them to:

-

Spot emerging trends

-

Identify anomalies, and

-

Adapt their strategies swiftly in response to changing market

conditions.

Essential for Algorithmic Trading:

-

Real-time data is essential for algorithmic trading strategies.

-

Algorithms rely on the most up-to-date information to make

split-second decisions. -

Traders can leverage algorithmic tools that respond to real-time

data by;-

Automating trading strategies and

-

Executing orders with precision.

-

(D) Critical for Adaptability:

Navigating Market Shifts:

-

Diverse data feeds provide traders with a well-rounded view of the

market. -

Traders can cross-reference multiple data sources and identify:

-

Emerging trends

-

Changing sentiment

-

Unusual market behavior

-

Refining and Iterating Strategies:

-

Continuous access to a variety of data sources allows traders to

refine and iterate their trading strategies for better outcomes. -

By analyzing data from different angles, traders can uncover

patterns and opportunities they might have otherwise missed.

Conclusion

The quality of your market data is the foundation of your trading strategy.

It is the key to reducing risk, gaining a strategic edge, and staying

adaptable in the face of changing markets.

Should you work with the best, most accurate, and real-time data feeds

available to you? The answer is likely a resounding “yes.” So, explore and

integrate high-quality data feeds into your trading toolkit. Platforms like

Bookmap offer seamless integration with leading data providers. This allows

you to access the most reliable and up-to-date information.

Ready to elevate your trading experience with top-notch market data? Dive

into Bookmap now and discover the advantages firsthand.

Explore Bookmap →