Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

July 17, 2024

SHARE

Fat Tails and Black Swans: Essential Strategies for Weathering Market Storms

Those who prepare for rare events can weather the tide better. This applies not only to life in general but also to the ever-volatile financial markets. Fat tails and black swans are certain rare occurrences, which can cause heavy investor losses and disrupt the whole economy.

This article aims to explain the concepts of fat tails, black swan events, and the psychological aspects of trading, in great depth. Also, it will help you learn how to prepare for unexpected market movements and protect your investments by making more informed decisions as a trader. Let’s begin.

The Science of Predicting the Unpredictable

In financial markets, the key to trading success is your power to predict prices. Predicting the unpredictable sounds like a paradox, doesn’t it? But it’s precisely what fields like statistics, economics, and risk management attempt to do. Let’s understand the two key statistical concepts: “fat tails” and “black swans.”

| Aspects | Fat Tails | Black Swans |

| Meaning |

|

|

| Application |

|

|

The Importance

Understanding fat tails and black swans is crucial for risk management and decision-making in the financial markets. Rather than relying solely on traditional statistical models that assume normal distributions, practitioners must account for the possibility of extreme events. This involves using:

- Alternative statistical methods,

- Scenario analysis, and

- Stress testing.

Recognizing that outcomes can be unpredictable and getting ready for big surprises can help people and companies handle times when they’re not sure what’s going to happen. It’s like having a backup plan for when things go unexpected, so you’re not caught off guard and can deal with whatever comes your way.

What are Fat Tails?

In statistics, the “tail” of a distribution refers to the extreme values. It represents the rare events, which happen more frequently than usual. It’s like if you were playing a game where rolling a 6 on a die is rare, but in this special game, rolling a 6 happens more often than you’d think.

How are fat tails used in market data?

In market data, fat tails are especially significant. Financial markets often exhibit fat tails, meaning that extreme events such as market crashes or major price swings occur more frequently than predicted by traditional models like the Gaussian or normal distribution.

How do fat tails differ from a normal distribution?

The normal distribution, also known as the bell curve, assumes that extreme events are very rare. However, in reality, financial markets are characterized by fat-tailed distributions, where these extreme events are more common.

Why should traders learn fat tails?

For traders and investors, understanding fat tails is crucial for risk management. Ignoring the possibility of extreme events can lead to catastrophic losses. By recognizing the presence of fat tails in market data, traders can adjust their strategies to account for the higher likelihood of extreme outcomes. This involves implementing:

- Hedging strategies,

- Diversifying portfolios, or

- Alternative risk models.

Real-life Examples of Rare Events

Let’s have a look at some rare events, which highlight the importance of recognizing fat tails in market data:

| 2008 Financial Crisis | Dot-com Bubble Burst |

|

|

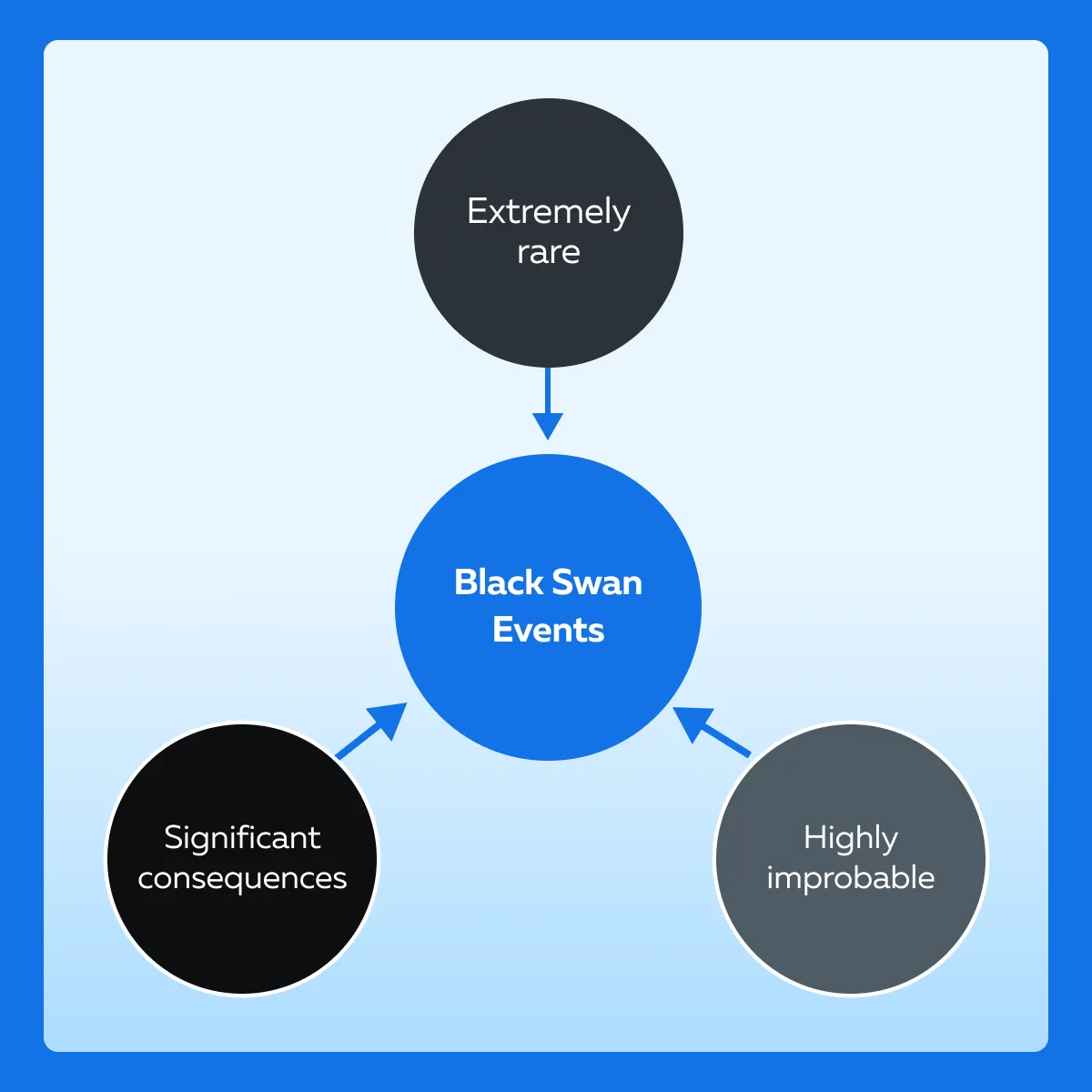

What are Black Swan Events?

Black swan events are highly improbable, unforeseen occurrences that have a profound impact on markets or society. Despite their rarity, black swan events can reshape entire industries, economies, or even the course of history.

Key Feature of Black Swan Events

- One defining feature of black swan events is their unpredictability.

- These events often catch individuals, organizations, and even experts off guard.

- This happens because they fall outside the boundaries of:

- Normal expectations and

- Conventional models.

- In hindsight, people can rationalize the occurrence of a black swan event, but predicting it is exceedingly difficult.

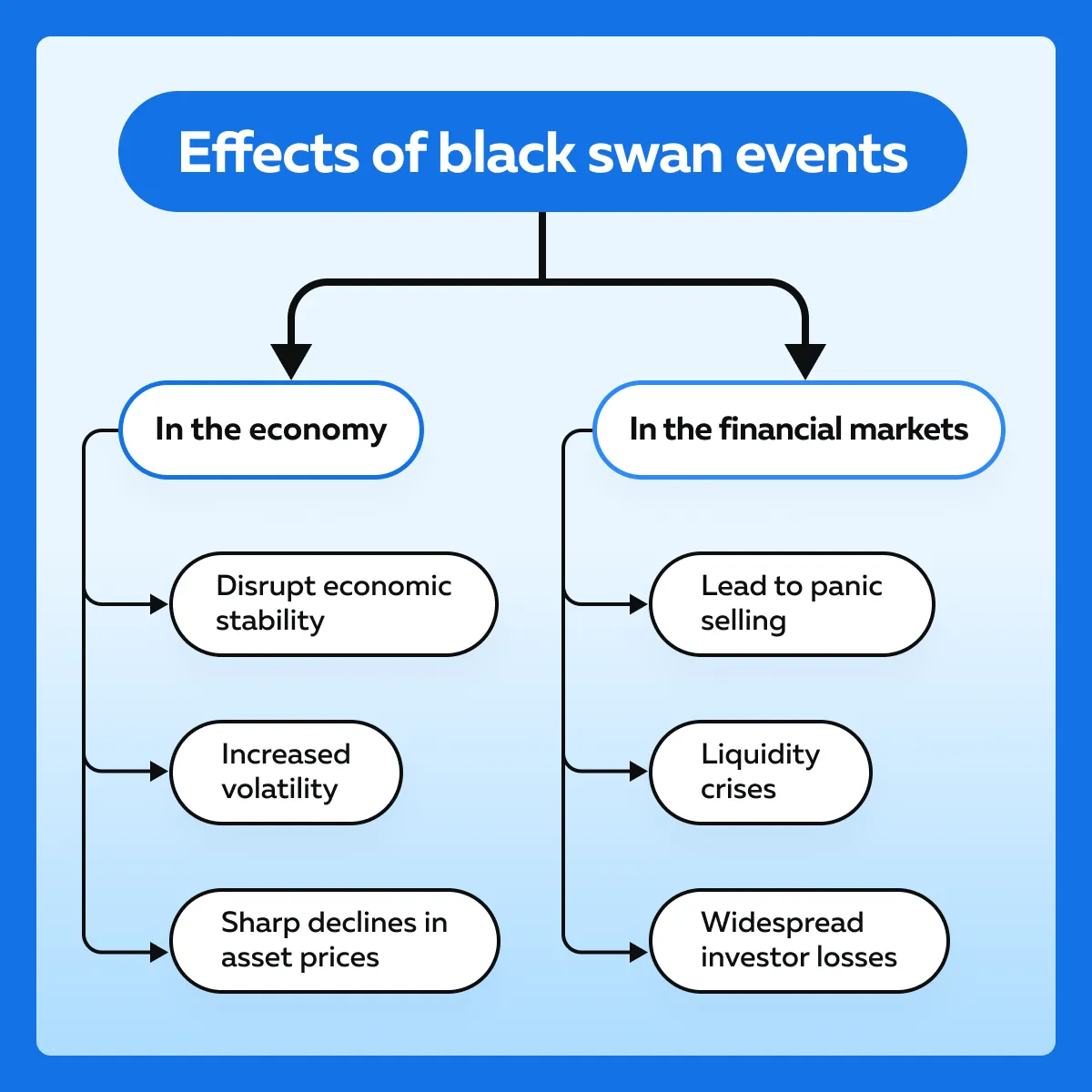

How do black swan events impact the markets?

Real-life Examples

- 2008 Financial Crisis

- The collapse of Lehman Brothers and subsequent financial crisis is often cited as a black swan event.

- While there were warning signs of a housing bubble and subprime mortgage crisis, few predicted the magnitude of the global financial meltdown that ensued.

- The crisis exposed weaknesses in risk management practices

- COVID-19 Pandemic

- The outbreak of the COVID-19 pandemic in 2020 serves as another recent example of a black swan event.

- The rapid transmission of the virus and subsequent lockdown measures precipitated:

- A global economic recession and

- Unprecedented market volatility.

- The sudden disruptions caught many businesses off-guard, affecting:

- Supply chains,

- Consumer behavior, and

- Economic activity.

How to prepare for black swan events?

- Acknowledge the possibility of extreme and unexpected events.

- Incorporate robust risk management strategies into your decision-making processes.

- Diversify across:

- Asset classes,

- Regions, and

- Sectors.

- Pinpoint vulnerabilities by stress testing your portfolios and performing scenario analysis.

- Maintain liquidity reserves to enjoy flexibility during turbulent market conditions.

- Be prepared to capitalize on opportunities that arise in the aftermath.

4 Strategies for Mitigating Risks

Fat tails and black swan events can have extreme and significant impacts on financial markets and investments. Traders and investors must use quantitative strategies to:

- Mitigate losses,

- Capitalize on opportunities, and

- Trade with resilience and confidence.

Let’s explore four popular quantitative strategies that can protect your investments from extreme market movements.

Strategy I: Stress Testing and Scenario Analysis

Stress testing and scenario analysis help traders anticipate the:

- Impact of rare market events and

- Identify potential weaknesses in their portfolios.

Let’s understand them individually:

| Stress testing | Scenario analysis |

|

|

Step-by-step Guide

- Identify Scenarios

- Define various scenarios, including:

- Extreme market movements,

- Geopolitical events, or

- Economic shocks.

- Define various scenarios, including:

- Modelling

- Use historical data or statistical models.

- Simulate the impact of each scenario on investment portfolios.

- Assessment

- Evaluate the performance of the portfolio under each scenario.

- Considering factors like:

- Asset allocation,

- Liquidity, and

- Leverage.

- Mitigation Strategies

- Identify vulnerabilities and develop strategies to mitigate potential losses.

- You can consider the following:

- Adjusting asset allocations,

- Implementing hedging techniques, or

- Diversifying risk exposures.

Real-life Cases

Let’s observe how these strategies have helped to effectively manage the past crises:

| Global Financial Crisis (2008): | COVID-19 Pandemic (2020) |

|

|

Strategy II: Value at Risk (VaR) and Conditional Value at Risk (CVaR)

VaR and CVaR are widely used statistical techniques in risk management to quantify and manage market risk. Both of them rely on assumptions about the distribution of asset returns and underestimate the potential for extreme events, such as black swan events. Let’s understand them individually:

| VaR | CVaR |

|

|

It can be noticed that, while VaR provides a useful measure of potential losses, it does not capture the severity of losses beyond the VaR threshold. CVaR addresses this limitation by focusing on the tail risks of a portfolio.

How are VaR and CVaR used practically?

During periods of market stress, VaR and CVaR signal potential danger zones, where losses can exceed expectations. For example, if VaR predicts a 5% loss with a 95% confidence level, CVaR can provide additional information into the severity of potential losses beyond this threshold.

Traders can use VaR and CVaR to:

- Set risk limits,

- Allocate capital more efficiently, and

- Adjust their risk management strategies.

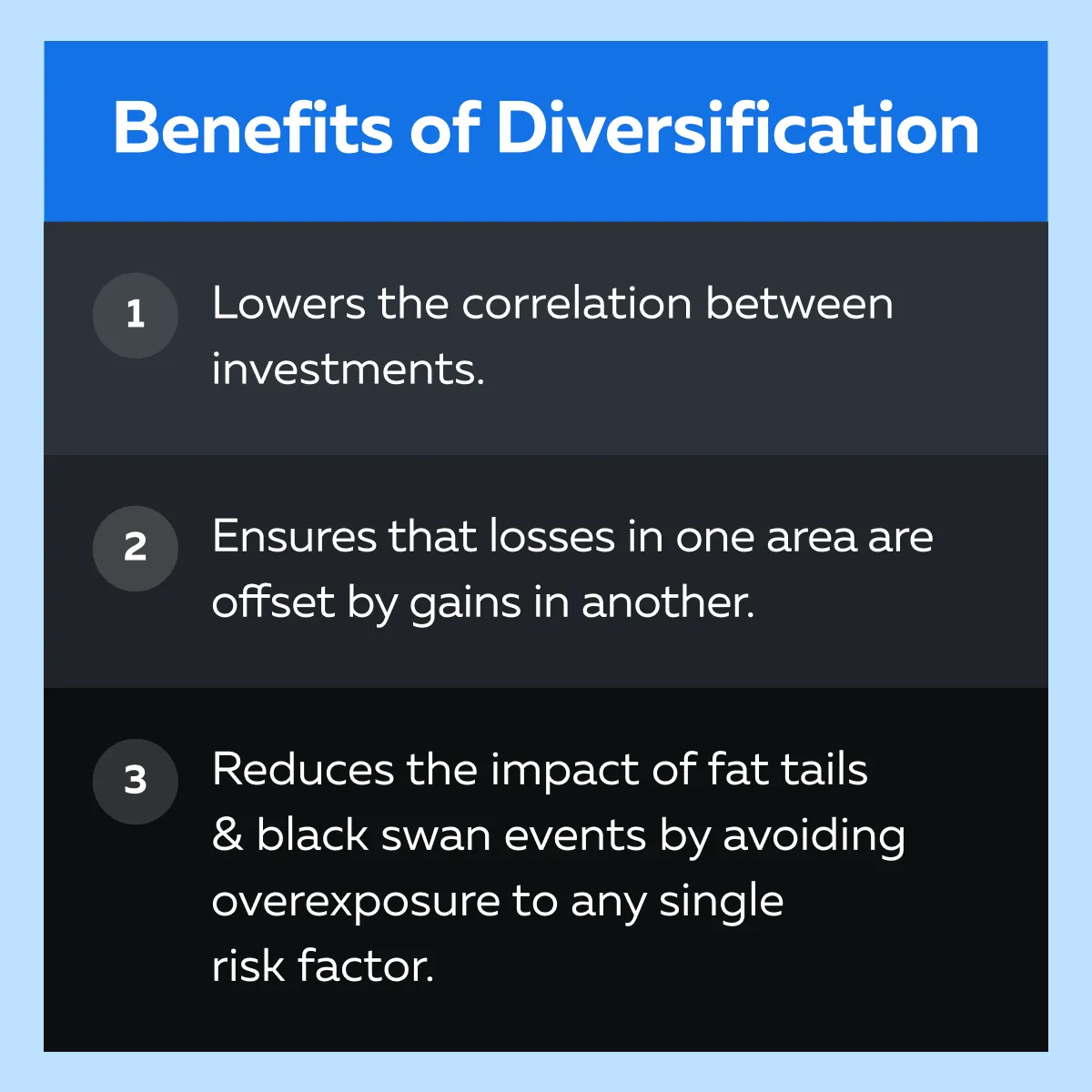

Strategy III: Portfolio Diversification:

Diversification aims to reduce risk by spreading investments across different asset classes or securities.

How to practice diversification?

| Asset Class Diversification | Within-Asset Class Diversification | Correlation Analysis | Tactical Asset Allocation |

Reduce the overall portfolio volatility by investing in a mix of asset classes, such as:

|

Further, diversify risk within each asset class by spreading investments across different securities or industries. |

|

|

Strategy IV: Derivatives and Hedging

Most traders prefer using derivatives and hedging strategies to:

- Protect against downside risk and

- Preserve capital during periods of:

- Market stress or

- Unexpected events.

Let’s begin with the basics.

| What are the options? | Why buy put options? |

|

|

Let’s understand better through a hypothetical example:

- You own 100 shares of Company XYZ, currently trading at $50 per share.

- Worried about potential downside risk, you decide to buy a put option for $2 per share with:

- A strike price of $45 and

- Expiry in one month.

Now, if Company XYZ’s stock price falls below $45 before the option expires, your put option gives you the right to sell your shares at the strike price of $45, no matter how low the stock price drops.

- So, even if the stock price falls to $40 per share, you can still sell your shares for $45 each.

- This right will limit your potential loss to $5 per share (excluding the cost of the put option).

Real-life examples of some successful hedging strategies

| Black Monday (1987): | Global Financial Crisis (2008): |

|

|

Market Volatility: Risk Management in the Face of Fat Tails & Black Swans

Understanding and managing market volatility is crucial. It helps in dealing with the impacts of fat tails and black swan events. Let’s study how traders can adapt their risk management strategies to handle a market’s:

- Unpredictability and

- Extreme volatility.

Assessing Market Volatility

Monitoring market volatility helps in identifying potential fat tail events or black swan occurrences. It has been commonly observed that rising volatility often precedes:

- Market downturns,

- Liquidity crunches, or

- Other adverse events.

Volatility Measurement Techniques

| Historical Volatility | Implied Volatility | Volatility Indices (e.g., VIX): |

|

|

|

Some Popular Tools and Indicators

- Bollinger Bands

- It’s a technical indicator that measures volatility by plotting bands around a moving average.

- Narrowing bands indicate low volatility while widening bands suggest increasing volatility.

- Average True Range (ATR)

- It measures the average price range over a specified period, providing a measure of volatility.

- Volatility Skew

- It examines the relationship between implied volatility levels of options with different strike prices.

- A steep skew indicates market participants’ expectations of extreme price movements.

Adaptive Risk Management Techniques:

Market conditions are dynamic and unpredictable. Thus, it is necessary to adapt risk management strategies in real time to adjust risk exposure and protect capital. Traders must follow the techniques of adaptive risk management to continuously assess:

- Market volatility,

- Sentiment, and

- Macroeconomic factors.

This helps in preserving capital and maximizing risk-adjusted returns. Also, traders can better position themselves to capitalize on opportunities and mitigate risks associated with fat tail events or black swan occurrences.

Now, let’s explore some popular techniques:

| Position Sizing | Recalibrating Stop-Loss and Take-Profit Levels | Changing Portfolio Composition |

| Adjusting position sizes in response to market volatility can effectively manage risk. | This technique involves widening stop-loss orders and adjusting take-profit levels to protect gains and limit losses. | This strategy involves allocating capital to lower-risk assets such as bonds or cash during periods of high volatility. |

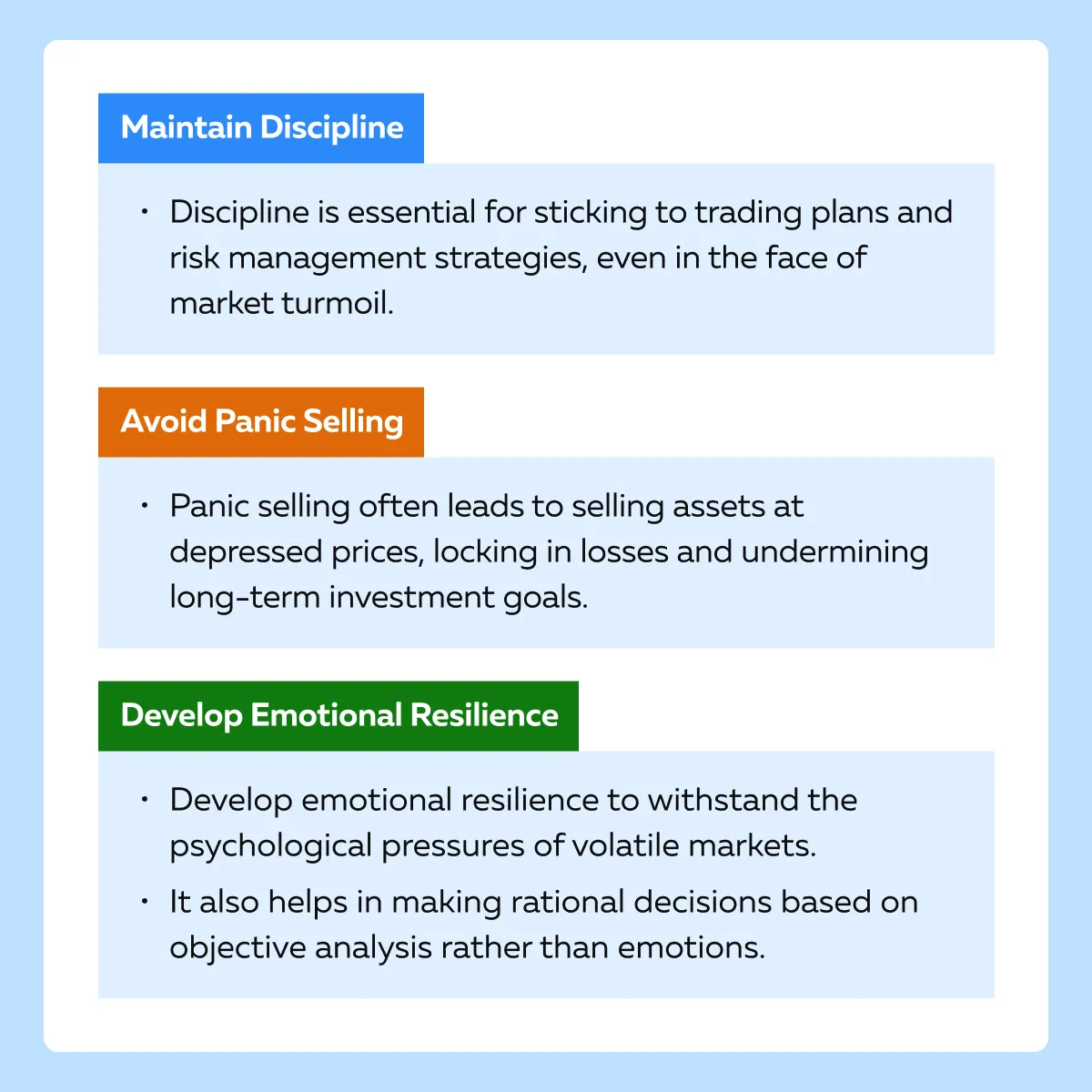

Psychological Aspects of Trading in Volatile Markets

Trader psychology often leads to losses due to fear and anxiety overriding rational judgment. It poses the following challenges:

- Fear and Anxiety

- High volatility triggers fear and anxiety among traders.

- This leads to impulsive decision-making and panic selling.

- Uncertainty

- The unpredictability of fat tails and black swan events create feelings of uncertainty and doubt.

- These feelings make it difficult for traders to maintain confidence in their strategies.

- Emotional Rollercoaster

- Extreme market swings evoke a rollercoaster of emotions, from euphoria during bull markets to despair during bear markets.

Why maintain discipline and emotional resilience?

Tips for Staying Grounded

- Stick to Your Plan

-

-

- Have a well-defined trading plan with clear entry and exit points.

- Follow your plan, even amidst short-term market fluctuations.

-

- Manage Risk

-

-

- Implement robust risk management techniques, such as:

- Setting stop-loss orders and

- Diversifying your portfolio.

- Implement robust risk management techniques, such as:

-

- Stay Informed, but Avoid Overwhelm

-

-

- Keep abreast of market developments and macroeconomic indicators.

- Avoid information overload as it leads to decision paralysis.

-

- Focus on the Long Term

-

-

- Embrace a long-term perspective and steer clear of the distractions caused by short-term market noise.

- Remember that volatility is a natural part of investing, and market downturns can present buying opportunities.

-

- Practice Self-Care

-

- Prioritize your physical and mental well-being.

- Get enough rest, exercise regularly, and seek support from friends and family.

How to prepare yourself psychologically?

- Visualize yourself remaining calm and composed in the face of market volatility.

- Rehearse how you will respond to different scenarios.

- Practice mindfulness and meditation techniques.

- Cultivate mental clarity and resilience in stressful situations.

- Surround yourself with a supportive network of fellow traders or mentors, who can provide guidance and encouragement during challenging times.

Conclusion

Fat tails and black swan events are rare occurrences that are often ignored by most traders. However, since financial markets are unpredictable, it is crucial to account for them.

In essence, fat tails represent extreme events that occur more often than expected, and black swan events are unforeseen occurrences that can lead to market turmoil and unexpected. Traders must acknowledge the potential for these events and incorporate robust risk management strategies. This will help in protecting portfolios and capitalizing on opportunities that arise during market turbulence. Also, it’s essential to stay disciplined, maintain emotional resilience, and adhere to a well-defined trading plan to address the psychological challenges of volatile markets.