Ready to see the market clearly?

Sign up now and make smarter trades today

Education

February 12, 2024

SHARE

Trading in Volatile Times: Tips and Strategies

Market volatility significantly impacts trading. It increases uncertainty, influences price movements, and affects the risk and reward dynamics of various trading strategies. However, volatility is not the same as risk; rather, it is the only source of opportunity.

In this article, you will understand the essence of market volatility, its causes, and its effects on various asset classes. You will also learn how to apply various trading strategies, from options examples like going long on puts to broader approaches like swing trading and pairs trading, to profit from market volatility.

Besides technical skills, emotional discipline and psychological resilience are pivotal during market turbulence. You will also gain practical tips for maintaining focus and preventing impulsive decisions. Lastly, we will highlight the role of advanced market analysis tools like Bookmap in aiding traders with real-time data and market insights. Let’s get started.

What is Market Volatility?

Market volatility refers to the degree of variation in the trading price of a financial instrument, such as stocks, bonds, commodities, or currencies. It is a statistical measure of the dispersion of returns for a given security or market index.

What Causes Market Volatility?

Economic indicators, such as GDP growth, employment reports, and inflation data, can impact market sentiments composed of investor emotions, such as fear and greed. This influence plays a significant role in triggering market volatility. Following are some other factors that influence investor emotions:

- Political instability, elections, or geopolitical tensions

- Earnings reports and guidance from companies

- Changes in interest rates

- Inflation expectations, and

- Overall market conditions.

How Trading Opportunities Arise from Volatility

Market volatility presents challenges and risks, but it also provides opportunities for traders and investors to profit. Through careful analysis and strategic decision-making, investors can understand the causes and effects of market volatility and form a profitable trading strategy.

Read the table below to understand some common trading opportunities available during a volatile market:

| Opportunities | Explanation |

| Higher Option Premiums |

|

| Heightened Trends |

|

| Intraday Swings |

|

| Elevated Volatility Post-Earnings |

|

| Using the Fear Index |

|

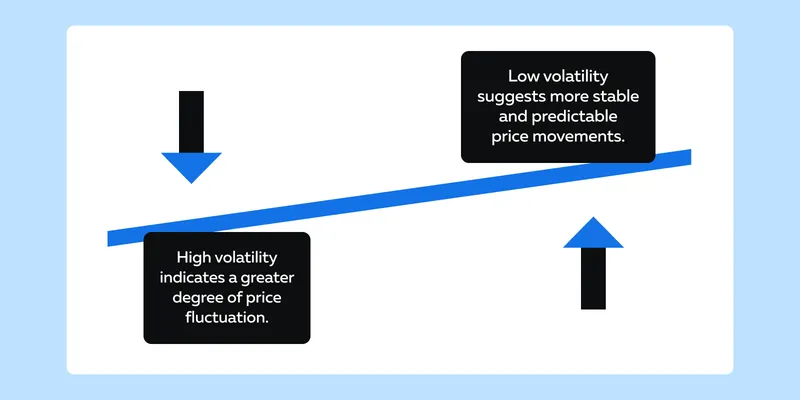

How to Detect Market Volatility

By paying attention to certain indicators, traders and investors can better identify periods of increased market volatility. Let’s understand these indicators, how to identify them, and what each of them imply.

1. Significant Price Swings and Gaps:

- Candlestick Patterns:

- Look for large and erratic candlestick patterns on price charts.

- Volatile markets often exhibit wide-ranging candles with long upper and lower wicks.

- Gaps on Charts:

- Gaps occur when there is a significant difference between the closing price of one trading session and the opening price of the next.

- Gaps indicate rapid and unexpected market movements.

2. Sudden and Large Price Movements:

- Intraday Volatility:

- Increased volatility is signaled when there is a sudden and sharp intraday price jumps or drops within short time frames, especially outside regular trading hours.

- Percentage Change:

- Calculate percentage changes in prices over specific periods.

- Higher percentage changes indicate more volatile market conditions.

3. Trading Volume:

- Volume Spikes:

- A sudden increase in trading volume often precedes or confirms heightened market volatility.

- Large volume spikes indicate increased participation and are a sign of significant market moves.

- Volume Analysis:

- Compare current trading volume to historical averages.

- Unusually high volume can be an early indication of increased volatility.

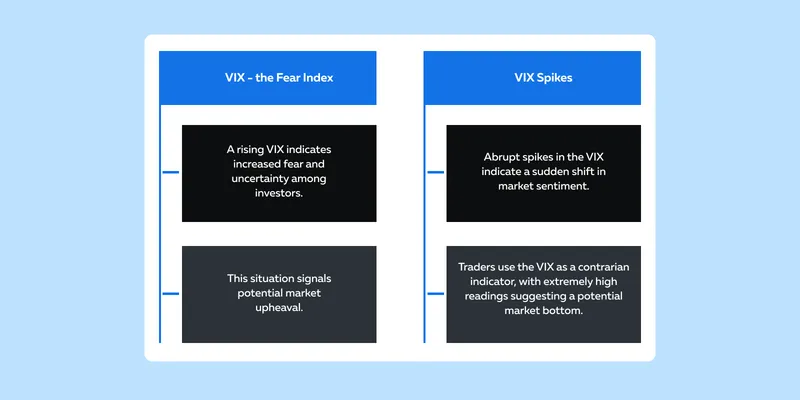

4. Volatility Index (VIX):

- VIX as an Indicator:

- The Volatility Index (VIX) is a widely used measure of market expectations for future volatility.

- A rising VIX suggests increasing market uncertainty and potential volatility.

- VIX Levels:

- Watch for VIX levels spiking above historical averages.

- Higher VIX readings indicate a higher level of expected market volatility.

5. Option Prices:

- Implied Volatility (IV):

- Implied volatility, derived from options pricing, reflects market expectations for future price fluctuations.

- Increased implied volatility levels indicate anticipated volatility.

- Option Chains:

- Analyze option chains for various strike prices and expiration dates.

- An increase in option premiums suggests higher expected price volatility.

6. Economic Events and News:

- Calendar Events:

- Stay informed about upcoming:

- Economic releases

- Earnings reports, or

- Major geopolitical events.

- These can trigger increased volatility.

- Stay informed about upcoming:

- News Flow:

- Monitor news flow and sentiment indicators.

- Sudden news developments can lead to rapid market reactions.

7. Technical Indicators:

- Bollinger Bands:

- Bollinger Bands widen during periods of increased volatility.

- Wide bands suggest higher price volatility, while narrow bands indicate lower volatility.

- Average True Range (ATR):

- ATR measures market volatility by accounting for price gaps and limit moves.

- Higher ATR values indicate increased volatility.

8. Historical Volatility:

- Lookback Periods:

- Examine historical price data to calculate historical volatility.

- Comparing current volatility to historical levels provides context for assessing the market’s current state.

Which Factors Trigger Market Volatility?

Some common factors include:

- GDP Releases

- Employment Data

- Wars and Conflicts

- Trade Disputes

- Central Bank Decisions

- Corporate Earnings

How does the Volatility Index (VIX) spot volatility?

The Volatility Index (VIX) reflects market expectations for future volatility. Here’s how traders and investors can use it:

How to Use Technical Indicators for Predicting Market Volatility

By using technical indicators, traders and investors can enhance their ability to anticipate and respond to potential market upheavals. Read the table below to understand their correct usage:

| Indicator | Explanation |

| Relative Strength Index (RSI) | Extremely high or low RSI values signal overbought or oversold conditions, potentially preceding volatility. |

| Moving Averages | Crossovers and divergences in moving averages indicate changes in market trends and potential volatility. |

| MACD (Moving Average Convergence Divergence) | MACD is a trend-following momentum indicator that helps in spotting volatility by identifying potential changes in the:

|

| Fibonacci Retracement Levels | These levels, based on the Fibonacci sequence, identify potential reversal points in price trends and assist in predicting market volatility. |

| Stochastic Oscillator | Overbought or oversold conditions indicate potential volatility. |

Diverse Trading Strategies for Volatile Markets

In volatile markets, there are various trading strategies to consider. When it comes to options and other general situations, specific examples can be particularly effective. Let’s explore some practical approaches:

Trading Strategies Specific to Options

| Strategies | Explanation | Ideal Trade Setup |

| Going Long on Puts | Buy put options to profit from anticipated downward price movements. |

|

| Shorting Calls | Sell call options to profit from anticipated flat or bearish market conditions. |

|

| Short Straddles or Strangles |

|

|

| Ratio Writing | Sell more options than purchased. For example, you should sell two call options for every call purchased. |

|

| Iron Condors | Simultaneously sell an out-of-the-money (OTM) call and put while buying a further OTM call and put. |

|

Other General Trading Strategies for Volatile Markets:

General trading strategies provide a variety of approaches to effective trade in volatile markets. Let’s explore them:

- Scalping for Quick Profits:

-

-

- Scalping is a short-term trading strategy, where traders aim to capitalize on small price changes.

- In volatile markets, frequent and rapid price swings provide more opportunities for scalpers to profit from short-term movements.

-

- Swing Trading with Momentum Indicators:

-

-

- Swing trading seeks to capture gains in a financial instrument over days to weeks.

- In volatile markets, using momentum indicators helps identify potential entry and exit points, based on the prevailing trend.

-

- Mean Reversion Strategies:

-

-

- Mean reversion strategies are based on the assumption that markets tend to revert to their average or historical mean over time.

- In volatile markets, prices deviate significantly from the mean.

- This deviation creates opportunities for traders to profit by anticipating a return to the average.

-

- News-Based Trading:

-

-

- News or event-based trading involves capitalizing on specific events such as:

- Earnings reports,

- Economic releases, or

- Corporate announcements

- Volatile market conditions often accompany significant events.

- News or event-based trading involves capitalizing on specific events such as:

-

- Volatility Breakout Strategies:

-

-

- These strategies focus on identifying moments when the market breaks out of a trading range.

- This strategy capitalizes on the potential for significant price movements following a period of consolidation, which is common in volatile markets.

-

- Pair Trading for Risk Mitigation:

-

- Pair trading involves taking opposing positions in two correlated stocks or assets.

- In volatile markets, this strategy can help mitigate risk, as the gains in one position can offset losses in the other.

- However, it is always important to know your trading environment.

- Traders must be aware of the:

- Broader market conditions and

- Factors influencing the correlated stocks.

- This awareness aids in making informed decisions and adjusting strategies accordingly.

Emotional Discipline and Psychological Resilience in Volatile Markets

Maintaining emotional discipline and building psychological resilience are critical aspects of successful trading, particularly in volatile markets. Traders can enhance their decision-making capabilities by:

- Adhering to predefined rules,

- Managing stress, and

- Viewing market volatility as a learning opportunity.

Let’s understand deeply.

Why is Emotional Discipline Important?

During periods of high market volatility, fear, and greed can drive impulsive decisions. Emotional decision-making can lead to suboptimal trading outcomes, including excessive risk-taking, panic selling, or chasing losses. Thus, emotional discipline is crucial to avoid:

- Falling prey to impulsive emotions and

- Making irrational choices

How to Avoid Impulsive Decisions

Volatile markets can induce stress and impact decision-making. Traders must implement stress management techniques such as deep breathing, meditation, or regular exercise to maintain a calm and focused mindset. Also, they must:

- Take breaks to avoid burnout.

- Detach personal emotions from trading decisions.

- Maintain an objective perspective by focusing on data analysis and established trading plans.

Furthermore, adhering to predefined trading rules and sticking to the established plan is of paramount importance in trading. Read the table below to see how you can do it:

| Predefined Trading Rules | Stick to the Plan |

|

|

How to Build Psychological Resilience

Traders can build their psychological resilience by managing stress levels and maintaining objectivity. Given below are some other useful tips:

- Develop the ability to adapt to changing market conditions.

- View periods of market volatility as valuable learning experiences.

- Analyze past trading decisions, both successful and unsuccessful, to identify patterns and improve future strategies.

- Avoid being overly influenced by short-term market fluctuations. Maintain a long-term perspective.

- Keep the broader financial goals in mind to withstand the emotional impact of volatility.

- Assess the effectiveness of risk management practices during volatile periods.

Conclusion

Executing profitable trades in volatile markets requires a commitment to continual learning and adaptability. Traders should regularly update their knowledge of market trends, trading tools, and strategies to stay ahead. By utilizing advanced market analysis tools like Bookmap, traders can maintain focus and make informed decisions during times of market volatility. Bookmap offers the following features:

- Real-time data visualization

- Depth and liquidity insights

- Trade execution transparency

- Order flow analytics

- Advanced charting and analytics

By using these features, traders can develop emotional control and psychological resilience in volatile markets. Interested in delving deeper into the role of volatility in trading and how it impacts your trading strategies and decisions? Explore our insightful article, “Why is Volatility Important in Trading?” on the Bookmap blog.