Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 3, 2025

SHARE

How Japan Lowers the Value of the Yen: Understanding Currency Manipulation to Boost Exports

When it comes to currencies, the yen can be as unpredictable as the weather! Its value rises and falls with each twist of economic policy and market sentiment. This happens due to Japan’s strategic maneuvers and currency manipulation. Its central bank, the Bank of Japan, devalues the yen to boost its exports.

But how? Does it make Japanese goods cheaper?

In this article, you will understand the impact of devaluing the yen on its export industry. We will explain the key methods Japan uses to devalue the yen, such as quantitative easing, negative interest rates, and direct currency interventions by the Bank of Japan.

We’ll also analyze how these actions impact global markets and other exporting nations, sometimes leading to currency wars. Additionally, we’ll discuss how traders can capitalize on movements in the yen by using strategies like carry trades and monitoring important economic indicators like the Purchasing Managers Index (PMI). Let’s get started.

Why Japan Devalues the Yen?

It must be noted that Japan relies heavily on exports for economic growth, particularly in key industries, such as these:

- Automobiles (companies like Toyota and Honda)

- Electronics (companies like Sony, Panasonic)

- Machinery (heavy industrial equipment, robotics)

These sectors form the backbone of Japan’s economy. To maintain competitiveness in the global market, Japan devalues the yen. This devaluation supports its export-driven economy. By lowering the value of its currency, Japan makes its goods cheaper in foreign markets. When the value of the yen falls, Japanese goods become cheaper for international buyers who pay with stronger currencies, like the US dollar or euro. As a result, this strategy boosts demand and increases export revenue.

Let’s understand better through an example considering Japanese automaker Toyota:

- Say the yen weakens.

- A Toyota car that costs ¥2 million may be priced at $20,000 instead of $22,000 due to a favorable exchange rate.

- This makes Toyota cars cheaper for American and European buyers compared to local brands or those from other countries.

- As a result, the demand for Toyota cars increases.

- This gives Japanese companies like Toyota a competitive edge over local automobile companies.

- Consequently, they earn higher export revenue.

The Role of Japan’s Central Bank

The Bank of Japan (BoJ) plays an important role in weakening the yen. It does so by using several monetary policy tools. Check the graphic below:

Let’s understand these strategies in detail in the next section.

Key Methods Japan Uses to Lower the Yen

The BoJ uses several strategies to weaken the yen and increase its exports. Let’s understand the various techniques through which the bank makes Japanese exports more competitive globally:

Quantitative Easing (QE)

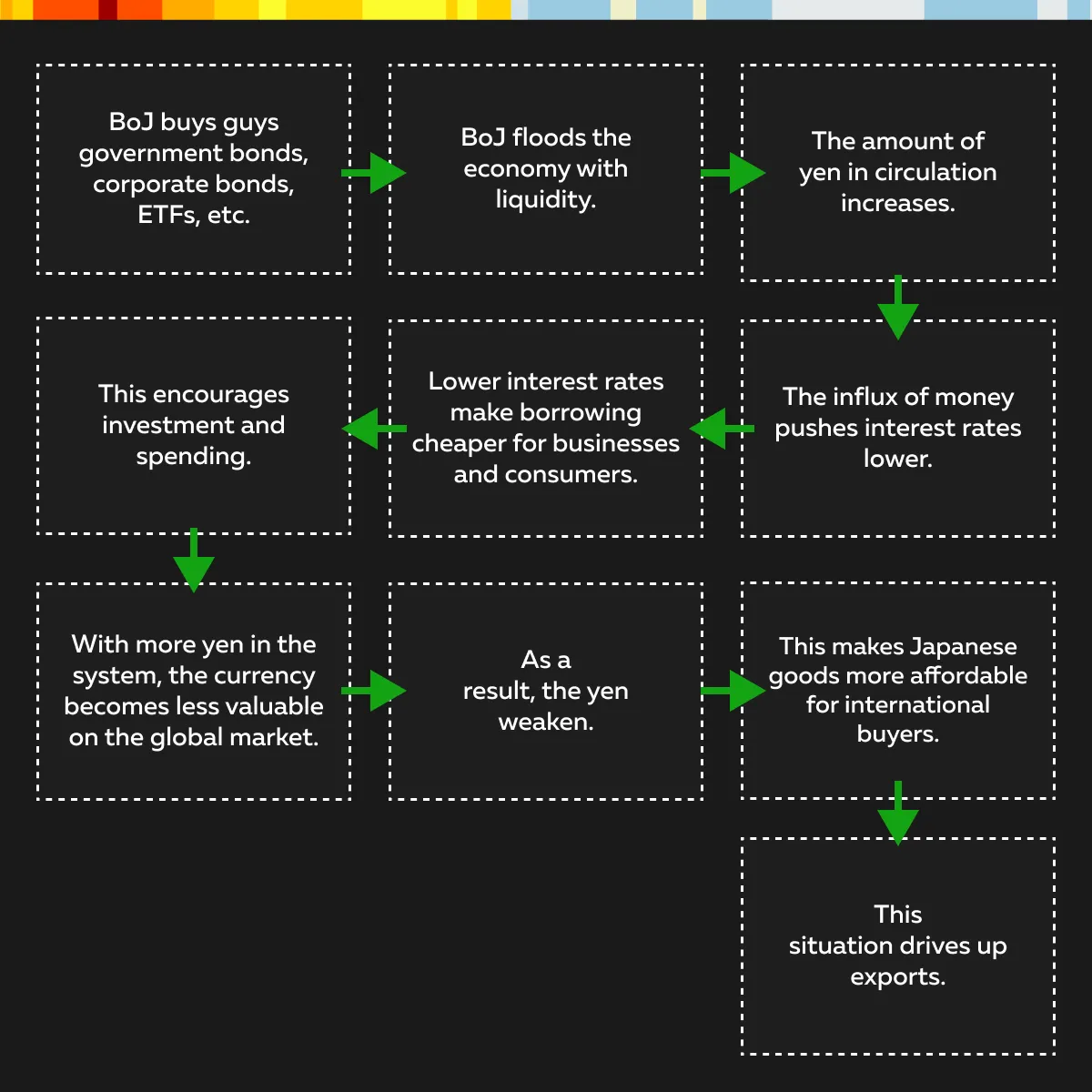

Quantitative Easing (QE) is a monetary policy tool. It is used by the Bank of Japan (BoJ) to inject liquidity into the economy. This infusion of liquidity happens because of the purchase of large amounts of government bonds and other financial assets. This process leads to:

- An increase in the money supply,

- Reduced interest rates, and

- A weakening yen.

In this way, BoJ stimulates economic activity and boosts exports. Let’s understand this process better through the graphic below:

For more clarity, let’s see some examples of significant QE programs:

| Post-2008 Financial Crisis QE | QE During the COVID-19 Pandemic |

|

|

Negative Interest Rates

Negative interest rates weaken the yen and stimulate the economy. By setting negative interest rates, the BoJ, in a way, charges banks for holding excess reserves. This discourages saving and encourages lending and spending. Consequently, the value of the yen reduces, which also decreases the attractiveness of holding yen-denominated assets.

How Do Negative Interest Rates Work?

When the BoJ sets negative interest rates, it means that banks have to pay to keep their excess reserves at the central bank rather than earning interest on them. This policy has three major effects:

| Effect I: Encourages lending | Effect II: Boosts spending and investment | Effect III: Weakens the yen |

| Banks are incentivized to lend money to businesses and consumers rather than keeping their reserves in the central bank. That’s because holding money becomes costly. | Lower borrowing costs for businesses and individuals encourage spending and investment. This drives economic growth. | With lower or negative returns on yen-denominated assets, investors, particularly foreign ones, find it less attractive to hold yen. As a result, demand for the currency decreases. This leads to a weaker yen in global markets. |

What is the Impact on Foreign Investors?

A negative interest rate policy makes it less appealing for foreign investors to hold yen because:

- If a foreign investor holds Japanese assets, the returns are reduced or even become negative.

- This happens because of low or negative rates.

- The cost of holding yen in deposits or bonds increases.

- This discourages investment in the currency.

- As a result, demand for the yen drops.

- This leads to a depreciation in the currency’s value.

For example, say a European or American investor shifts their investment to other currencies offering higher returns, such as the US dollar. They make this shift because holding yen-denominated assets yields lower returns due to negative interest rates. This reduced demand for the yen pushes its value down and makes Japanese exports cheaper.

Direct Currency Intervention

BoJ usually engages in direct currency intervention to influence the yen’s value. This strategy is particularly used when the yen:

- Becomes too strong

and

- Threatens Japan’s export competitiveness.

In such interventions, the BoJ sells yen in exchange for foreign currencies like the US dollar or euro. This increases the supply of yen in the foreign exchange market. This action weakens the yen and prevents excessive appreciation. For more clarity, see the graphic below:

dollar or euro. This increases the supply of yen in the foreign exchange market. This action weakens the yen and prevents excessive appreciation. For more clarity, see the graphic below:

Let’s understand better through a practical case study related to the BoJ intervention that occurred in 2011 following the Great East Japan Earthquake:

- In the aftermath of the disaster, the yen appreciated sharply.

- It became a “safe-haven” currency for investors.

- However, a strong yen threatened to hurt Japan’s already struggling economy by making its exports more expensive.

- In response, the BoJ and Japan’s Ministry of Finance intervened in the forex market.

- They sold yen and bought large amounts of US dollars to counter the yen’s rise.

- This intervention weakened the Yen.

- This move supported Japanese exporters (like Toyota and Sony) who rely on foreign markets for revenue.

The Impact of Yen Devaluation on Global Markets

As mentioned in the above sections, a weaker yen makes Japanese exports cheaper. This benefits Japanese firms, but it creates ripple effects globally and leads to currency wars. Following Japan, other countries also feel pressured to devalue their own currencies to maintain their competitive position in global trade. Let’s understand the various impacts of yen devaluation in detail:

- Impacts on Global Trade Balances

When Japan devalues the yen, its exports (such as cars, electronics, and machinery) become cheaper for foreign buyers. This increases demand for Japanese goods in markets like the US, Europe, and Asia. This boosts Japan’s export revenue.

In contrast, imports into Japan become more expensive. This leads to a trade surplus for Japan as the country exports more than it imports. Due to this shift, countries that compete with Japan in export markets see their goods become more expensive. This position reduces demand for their products and impacts their own trade balances.

- Leads to Currency Wars

A currency war arises when multiple countries devalue their currencies. Japan’s yen devaluation forces other exporting nations to reduce the value of their currency. This situation creates instability in global markets. Let’s see how it impacts Japan’s major competitors, South Korea and Germany:

| Impact on South Korea | Impact on Germany |

|

|

Gain Insight into Currency Moves: Bookmap’s advanced order flow analysis can help you anticipate major currency shifts and make better trading decisions.

- Makes Global Currency Markets More Volatile

A weaker yen causes volatility. This happens because investors adjust their portfolios and look for more attractive currencies like the US dollar, the euro, or the Swiss franc. Due to this shift, countries with strong currencies see capital inflows. This situation leads to the overvaluation of their currencies and harms their export sectors. Let’s understand better through an example:

-

- Japanese automakers like Toyota benefit from the yen’s weakness.

- Their cars become more affordable abroad, especially in the US and Europe.

- In contrast, South Korean automakers (like Hyundai) or German companies (like Volkswagen) see their exports decline.

- Their products become relatively more expensive.

- To maintain their market share, automobile companies of these countries feel compelled to:

- Adjust interest rates

or

- Engage in monetary easing.

- These strategies weaken their currencies and level the playing field with Japan.

How Traders Can Capitalize on Yen Movements

Traders can take advantage of yen movements, particularly during periods when the Bank of Japan (BoJ) implements policies to devalue the currency (say quantitative easing or negative interest rates). Below are some key strategies traders can use:

Strategy I: Carry Trades

Carry trade is a strategy in which you:

- Borrow in a currency with low interest rates (such as the yen)

and

- Invest in assets denominated in a currency with higher interest rates.

When it specifically comes to Yen, Japan usually maintains low or even negative interest rates. In this setting, traders borrow yen at a low cost and then invest in higher-yielding currencies like the US dollar, Australian dollar, or others that offer better returns.

This strategy is profitable during yen devaluation because, due to a fall in the currency value, yen-denominated debt becomes cheaper to repay over time. For example, suppose a trader borrows yen, and the yen continues to weaken. In this scenario, the trader benefits not only from the interest rate differential but also from the lower cost of repaying the yen loan as its value declines.

Strategy II: Trading Yen-Based Currency Pairs

Forex traders capitalize on yen movements by trading currency pairs like USD/JPY or EUR/JPY. When the BoJ signals monetary easing or other measures that weaken the yen, traders take advantage of these changes in the forex market. For more clarity, let’s see the practical application of this strategy in two different pairs:

| USD/JPY | EUR/JPY |

|

|

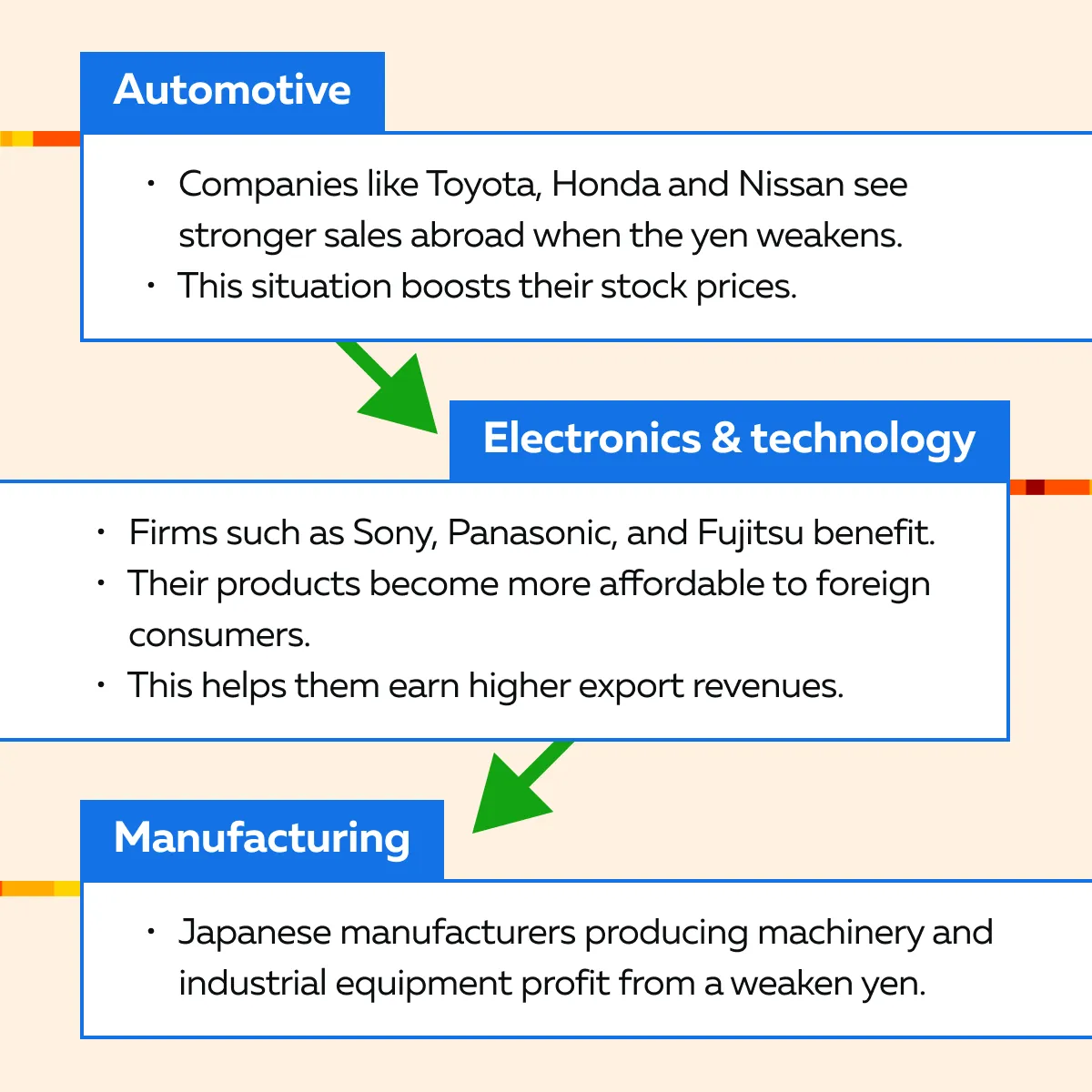

Strategy III: Invest in Sectors that Benefit from the Devaluation

A weaker yen benefits Japanese exporters. Their goods become cheaper for international buyers. This increases demand for products in industries such as the following:

- Automotive

- Electronics

- Manufacturing

When the yen devalues, traders can invest in Japanese companies with significant global exposure, especially those that rely on exports. Check the graphic below to learn about some key sectors:

By investing in these export-heavy industries, traders can capitalize on the gains Japanese companies make when their products become more competitive globally due to the yen devaluation.

The Role of Purchasing Managers Index (PMI) in Yen Movements

For the unaware, Purchasing Managers Index (PMI) data is a key indicator of the health of a country’s manufacturing and services sectors. PMI reports provide information on the level of economic activity. Traders often use this data to anticipate movements in currencies like the yen. By using the PMI data, traders can predict the yen’s strength or weakness. Let’s see how:

| Rising PMI | Declining PMI |

|

|

How do Traders Use PMI to Develop Their Strategies?

PMI data from Japan and its major trading partners help traders anticipate how the yen might move in response to changing economic conditions. Read the below-mentioned points to understand how traders can use PMI data:

- A) Currency Trading

- If Japan’s PMI rises, traders anticipate strong economic activity.

- Traders anticipate yen strength and increase in value.

- They look to “go long” on yen-based currency pairs like JPY/USD or JPY/EUR.

- On the other hand, if Japan’s PMI declines, traders expect the yen to weaken.

- They take “short positions” on the yen.

- B) Monitoring Trading Partners’ PMI

Traders also pay close attention to the PMI data of Japan’s key trading partners, such as the below-mentioned countries:

- United States

- China

- South Korea

- Germany

Strong PMI data from these countries indicate stronger demand for Japanese exports. This leads to yen strength. Conversely, weak PMI reports from these nations signal reduced demand for Japanese goods. This increases the likelihood of yen depreciation.

Conclusion

Japan strategically devalues its currency, the yen, to boost its exports. By devaluing the yen, Japan makes its goods more affordable for international buyers. This enhances the competitiveness of key industries like automotive and electronics. Through this approach, the Bank of Japan tries to stimulate economic growth.

To deal with the currency markets smartly, traders need to closely monitor Japan’s economic indicators and the actions of the Bank of Japan. The following are some key factors that should be analyzed:

- PMI data,

- Interest rate changes, and

- Any announcements related to quantitative easing or currency interventions.

By understanding these signals, traders can anticipate movements in the yen and make informed trading decisions. To enhance their ability to track market moves, traders can start utilizing our advanced market analysis tool, Bookmap. With powerful visualization features, Bookmap allows users to see currency fluctuations and react quickly to changes in market sentiment. Track Market Moves in Real-Time: With Bookmap’s powerful market visualization tools, you can stay ahead of currency fluctuations like Japan’s devaluation of the yen.