Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 19, 2025

SHARE

How Middle East Tensions Are Moving Energy Markets (and How Traders Can Profit)

When Middle East tensions rise, global energy markets don’t just flinch! They often explode with activity. This region has a massive influence on oil and natural gas production. Due to this dominance, even a single headline sends prices soaring or crashing within hours.

From historic events like the 1973 Oil Crisis to modern issues like the 2023 Israel-Gaza conflict, the connection between geopolitics and energy has only grown stronger. For a trader like you, this creates both risk and opportunity.

So, do you want to master oil market trading strategies? In this article, you will learn how to stay alert, react quickly, and think globally. Moreover, we will tell you how our modern real-time market analysis tool, Bookmap, gives traders a real-time edge! You will learn how to use it and gain clear views of liquidity shifts and price action. Let’s begin.

Why Middle East Tensions Directly Impact Energy Markets

The Middle East region is home to some of the world’s largest oil and natural gas reserves. In fact, the Middle East is responsible for producing about 30% of the global oil supply. Such dominance makes it a central player in the world’s energy market.

Because of this heavy reliance, any geopolitical tensions in the Middle East (like conflicts, sanctions, or threats to shipping routes) cause sudden reactions in the market. Please note that energy market volatility can be spiked due to even a small disruption, such as:

- A drone attack on an oil facility

or

- Tensions near the Strait of Hormuz (a vital oil transport route).

Usually, this happens because traders and investors worry about likely supply shortages. This investor stress increases oil prices almost instantly.

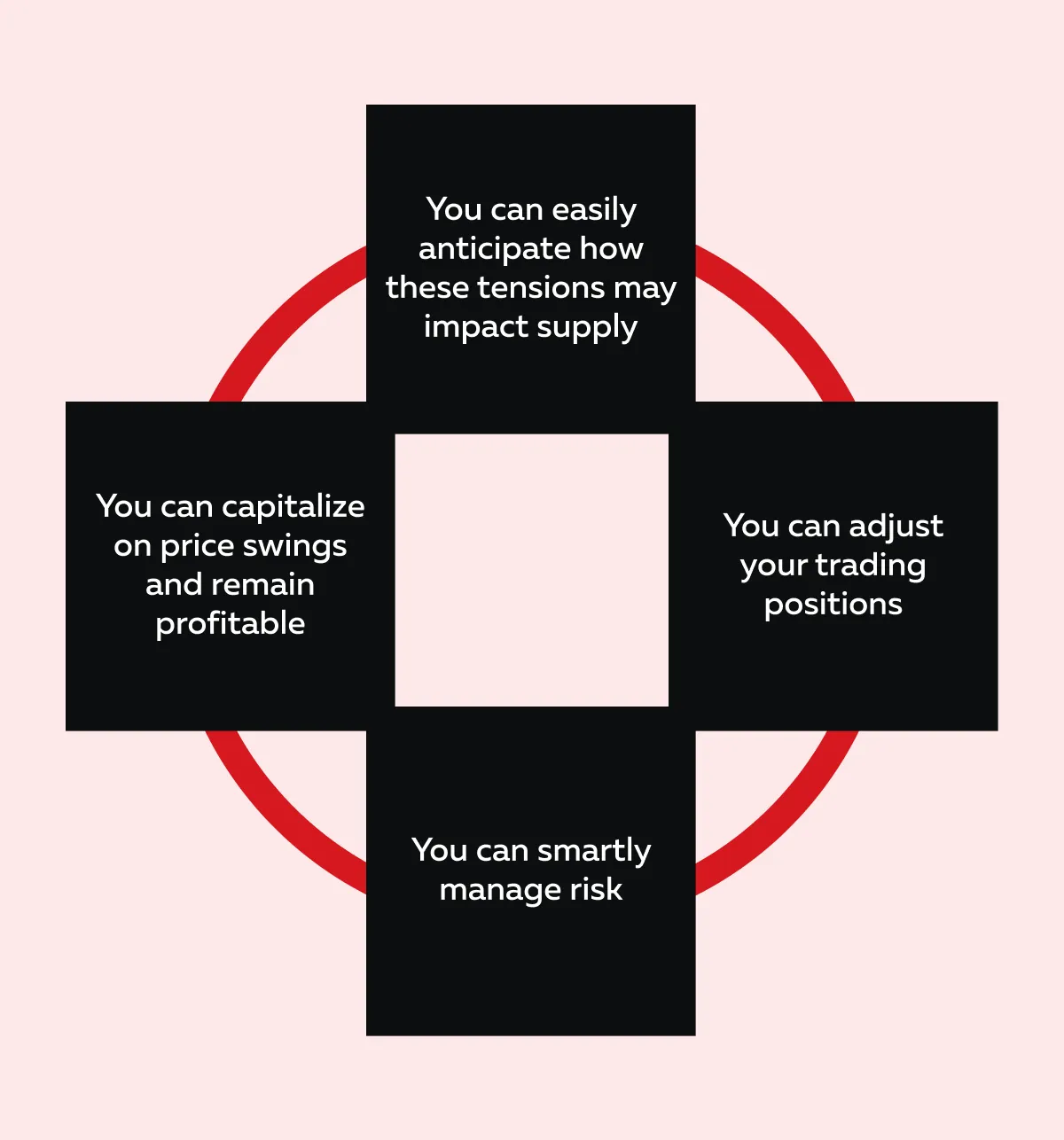

Thus, if you are involved in oil market trading strategies, you must stay updated on Middle East developments. Let’s see how this helps:

Always remember that trading Middle East tensions isn’t just about politics! It’s directly tied to the stability of global energy supplies. Any tensions lead to sharp ups and downs in oil markets.

Historical Context: How Middle East Events Have Moved Markets

Events in the Middle East have always caused sharp movements in oil prices. Time and again, they prove just how connected global energy markets are to tensions and conflicts in the region!

Let’s have a look at major historical events that significantly impacted oil prices:

The 1973 Oil Crisis

In 1973, the Yom Kippur War occurred. In this event, the United States supported Israel. In response, the Arab oil-producing nations retaliated. The members of OPEC (Organization of the Petroleum Exporting Countries) launched an oil embargo against the U.S. and several other countries. They also cut production significantly.

This move created a massive supply shock. As oil became harder to get, prices skyrocketed! As per estimates, the oil prices quadrupled within just a few months. As a result:

- Countries faced fuel shortages,

- Inflation surged, and

- Economies struggled to keep up.

You can think of this event as a clear lesson in energy market volatility. It shows how fast things can change when tensions flare in the Middle East.

Iraq War (2003)

The Iraq War in 2003 is another clear example of how Middle East tensions can shake the global energy market. When the U.S. prepared to invade Iraq, there was a lot of uncertainty about what would happen to oil supplies in the region.

Iraq (being a major oil producer) raised concerns about whether the war would:

- Disrupt production

or

- Spillover into neighboring countries.

This uncertainty caused a strong reaction in the market. Oil prices surged nearly 40% before the invasion even began! During these times, most traders were worried that any conflict in Iraq could reduce the supply of oil coming from the Middle East. This could lead to severe oil shortages.

Even though the actual supply wasn’t immediately cut off, the fear of disruption was enough to trigger sustained energy market volatility.

Through this event, you can learn that oil prices don’t just react to actual events! They also move based on what people think might happen.

Israel-Gaza Conflict (2023)

Please note that neither Israel nor Gaza is are major oil producer. Yet the fear that the violence could spread across the region shook the global energy markets. This fear of “broader regional instability” caused noticeable short-term volatility in the energy market.

Let’s see how:

Please note that this war had no direct impact on the oil supply. Yet, the potential for things to get worse made markets nervous. If you are involved in oil market trading strategies, this was a reminder that even conflicts that don’t immediately threaten oil fields can still affect prices.

That’s why trading Middle East tensions involves not only watching supply levels! Instead, you should also:

- Understand the broader political risks

and

- How can they impact the energy market?

Improve your timing in volatile energy markets—try Bookmap’s advanced liquidity visualization.

Immediate Market Reactions to Middle East Tensions

When tensions rise in the Middle East, international markets respond almost instantly. There are major fluctuations in:

- Energy prices,

- Company stocks, and

- Currencies.

This happens because traders react to the rising risk. Let’s understand some instant reactions to Middle East tensions in detail:

Volatility Spikes in Oil Futures

One of the first and most visible effects of Middle East tensions is a spike in oil futures volatility. As soon as major geopolitical news breaks (like conflict, threats, or supply risks), markets immediately start to price in a risk premium.

This means oil becomes more expensive! Why? Because traders worry it might be harder to get in the near future. For example,

- If we analyze past events, Brent crude futures have jumped 5-10% within hours of big headlines from the Middle East region.

- These quick reactions show how sensitive the energy market is to even the possibility of a disrupted supply.

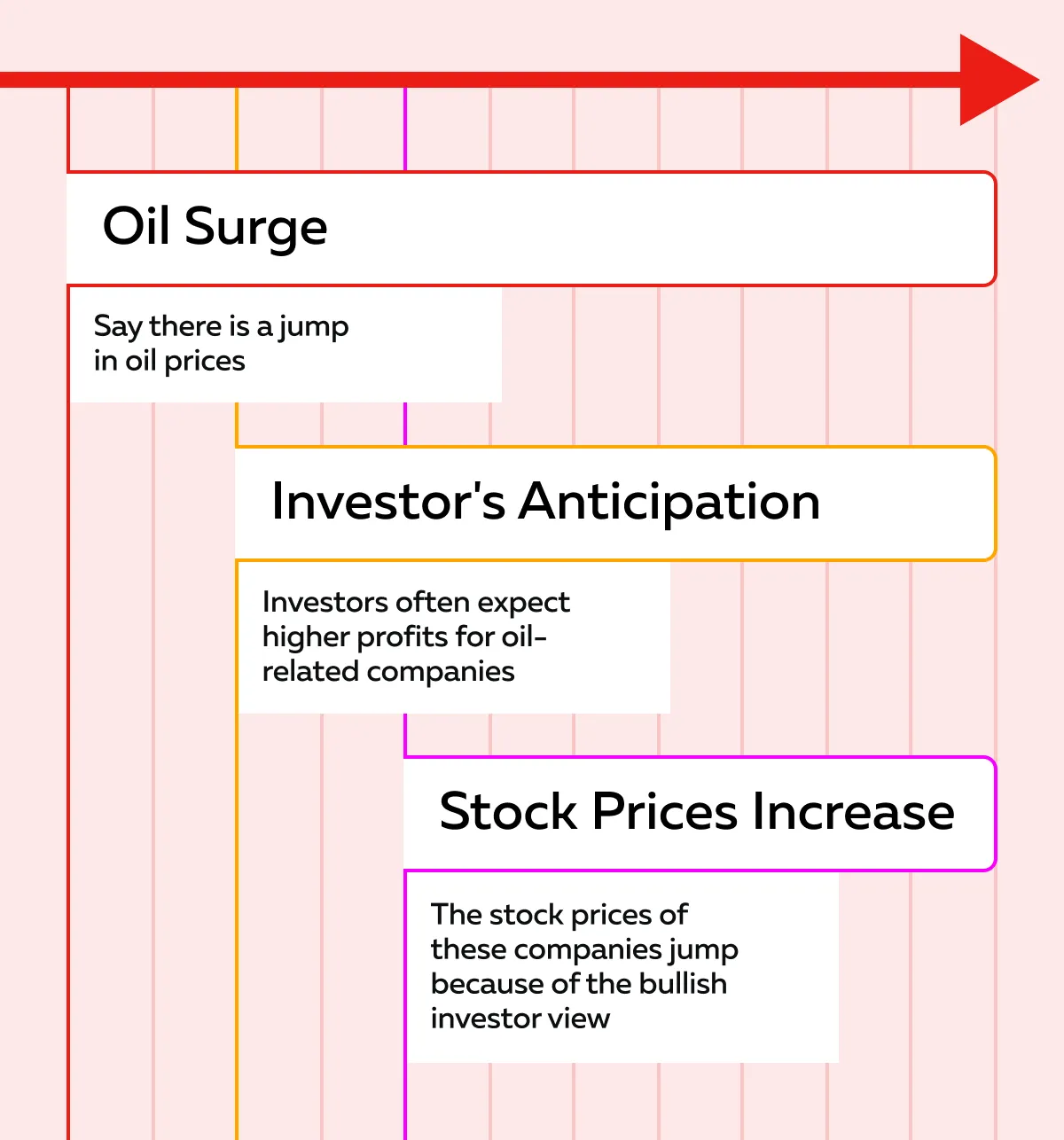

Impact on Energy Equities

Geopolitical tensions don’t just affect oil prices! They also move energy stocks, particularly of companies involved in:

- Oil exploration

and

- Oil production.

Let’s understand how:

Big names like ExxonMobil, Chevron, and BP have seen sharp short-term price movements right after major news events in the Middle East. But remember, this works both ways! If tensions ease or oil prices fall, these stocks can drop just as quickly.

Ripple Effects Across Commodities and Currencies

The effects of Middle East tensions go beyond oil. Other commodities like natural gas and gold also react. Let’s learn how:

At the same time, currencies are impacted too. For example,

- The Canadian dollar (CAD) is closely tied to oil.

- So, when oil prices rise sharply due to Middle East tensions, the CAD often strengthens.

- This creates both opportunities and risks for forex traders.

Meanwhile, the U.S. dollar (USD) might also rise. This particularly happens if global investors seek safety in times of energy market uncertainty.

Actionable Trading Strategies During Middle East Geopolitical Events

When geopolitical events unfold in the Middle East, they often create fast-moving markets. As a trader, you can use specific strategies to:

- Manage risk

and

- Take advantage of price swings during this time.

Let’s check them out:

Short-Term Trading Opportunities

When major news breaks (say about Middle East tensions), a lot of traders and investors react at the same time. This reaction causes a surge in trading volume. Many buy and sell orders hit the market quickly.

Because of this rush, prices swing sharply up or down in a short amount of time. This happens because the market is reacting to:

- Uncertainty

and

- New information.

At the same time, liquidity also shifts quickly. The number of available buy and sell orders at different price levels disappears or moves suddenly. Let’s see how:

- Say, large sell orders that were sitting in the order book should be cancelled if traders get nervous.

or

- New buy orders pop up quickly if traders think the news will push prices higher.

This shifting liquidity makes it harder to enter or exit trades smoothly. Also, it increases energy market volatility.

How to Smoothen Your Trade Entry and Exits?

In such times, as a short-term trader, you can start using our advanced market analysis tool, Bookmap. It offers a modern heatmap. Using it, you can:

- Visually track where buy and sell orders are stacked.

and

- Spot moments when liquidity suddenly pulls away from the sell side (hinting at a possible price jump).

These signals usually reveal strong entry opportunities for fast trades.

Swing Trading and Longer-Term Plays

If you are a swing trader and hold positions for several days or weeks, Middle East tensions can create valuable opportunities (beyond the initial market reaction). That’s because geopolitical stories develop over time! As a trader, you can spot trends and patterns that signal where prices might be headed next.

For example,

- During ongoing conflicts or uncertainty in the region, oil futures often show persistent bullish liquidity patterns.

- This means that even after the initial spike, there’s strong buying interest over several trading sessions.

- Again, you can visualize this using Bookmap.

As a trader, if you recognize these patterns, you may choose to hold positions longer. This will let you benefit from a continued uptrend (caused by sustained energy market volatility).

Please remember that this type of strategy involves more patience than short-term trading. However, it can be highly effective when tensions remain high or continue to escalate.

Hedging and Fundamental Awareness

When trading during Middle East tensions, it’s not just about spotting opportunities! It is also about protecting yourself from unexpected moves. That’s where hedging strategies and staying aware of fundamentals come in.

Most traders who are worried about sudden oil price spikes or crashes use options to manage risk. Let’s see how:

-

- Say you’re holding short positions in energy stocks.

- You fear a sharp rise in oil prices due to new tensions.

- You buy out-of-the-money (OTM) call options on oil futures.

- Now, this acts like insurance.

- If oil jumps, your losses on the short position could be offset by gains from the call option.

The Alternative Approach

Another approach is using “option spreads.” It can lower the cost of hedging. Instead of buying just one option, you buy one and sell another at a different strike price. This reduces the premium cost while still providing some protection or upside.

Keep Watching Fundamental Reports

At the same time, you must watch fundamental reports that can influence the market. A key one is the EIA Crude Oil Inventories report. It is released every Wednesday. This report shows how much oil is in storage.

By analyzing this report, you can predict oil price movements. For example,

- Say inventories are lower than expected during a time of Middle East conflict.

- Now, this means prices could surge even more.

Leveraging Bookmap to Navigate Energy Market Volatility Clearly

Having the right tools can make all the difference! Our Bookmap is a powerful platform. It allows traders to visualize what’s happening behind the scenes in real time. Using it, you can see:

- Liquidity,

- Order flow, and

- Where large traders are positioning themselves.

Please note that when geopolitical news breaks, markets often react before headlines fully sink in. Using Bookmap, you can clearly observe rapid liquidity shifts (such as large buy or sell orders suddenly disappearing or appearing). This lets you react faster than those relying only on price charts.

Let’s gain more clarity through an example:

- Say there is a major headline about Middle East unrest.

- On Bookmap, you spot heavy liquidity.

- This liquidity is building at a key support level in oil futures.

- This signals that big players are getting ready to buy.

- Also, it hints at a likely price bounce or reversal.

- By recognizing this early, you entered a long position with more confidence.

Additionally, by using Bookmap, you can avoid false breakouts. For example,

- Say on Bookmap, the price approaches a level with little liquidity support.

- Then, it quickly reverses.

- Now, this indicates a lack of conviction behind the move.

- During trading Middle East tensions, this kind of real-time order flow insight is extremely valuable.

By combining Bookmap’s visual tools with geopolitical awareness, you can build a solid understanding of oil market trading strategies.

Conclusion

Geopolitical tensions in the Middle East often lead to energy market volatility. Even minor conflicts or threats cause sudden price spikes (particularly in oil and natural gas). Thus, for traders like you, understanding global events is just as important as reading charts.

By using our avant-garde real-time analysis tool, Bookmap, you can get a clear advantage. Using it, you can visualize order flow and liquidity changes. This lets you react quickly when market conditions shift. So, do you want to stay prepared and trade profitably in the energy markets? Identify clear trade setups amid geopolitical uncertainty using Bookmap.