Ready to see the market clearly?

Sign up now and make smarter trades today

Education

April 1, 2024

SHARE

Geopolitical Game Changers: How They Shape Commodity Trading Strategies

In commodity trading, geopolitical events like wars, political conflicts, or trade disputes between countries affect prices. These events cause uncertainty in commodity markets and lead to price changes. To trade successfully, traders need to know how to respond to these events.

In this article, we will understand different trading strategies, explore some popular risk management strategies, and also study some real-life case studies. We’ll also see how traders can take advantage of commodity-specific opportunities and trade profitably while protecting their investments in volatile markets. Let’s get started.

Unraveling the Geopolitical Puzzle

Geopolitical events are occurrences on the global stage that involve interactions between nations, governments, and political entities. These often influence the distribution of:

- Power,

- Resources, and

- Territory.

These events are crucial for commodity trading as they lead to fluctuations in prices and supply chains and directly affect the:

- Production,

- Transportation, and

- Availability of commodities.

It is a fact that political instability, conflicts, and trade tensions have significant impacts on commodity prices. Let’s see the three major impacts:

| Supply Disruptions | Trade Policies and Tariffs | Investor Sentiment |

| Political instability or conflicts in key commodity-producing regions disrupt the production and transportation of commodities. |

|

|

Real-Life Geopolitical Events and Their Effects on Commodity Markets

- Iran Nuclear Deal

-

-

- The withdrawal of the US from the Iran nuclear deal led to renewed sanctions on Iran’s oil exports.

- This reduced the global supply of oil and contributed to higher oil prices.

- The nuclear deal also increased uncertainty in global markets, causing investors to turn to safe-haven assets like gold.

- Acting as a hedge against risk, the demand for gold increased, which led to a surge in its price.

-

- US-China Trade War and Agricultural Commodities

-

-

- During the US-China trade war, both countries imposed tariffs on each other’s agricultural products.

- This disrupted trade flows and affected prices for commodities such as soybeans and pork.

-

- Russian-Ukrainian Conflict and Natural Gas

-

- Geopolitical tensions between Russia and Ukraine have led to concerns about disruptions in natural gas supply to Europe.

- These concerns have impacted natural gas prices in the region.

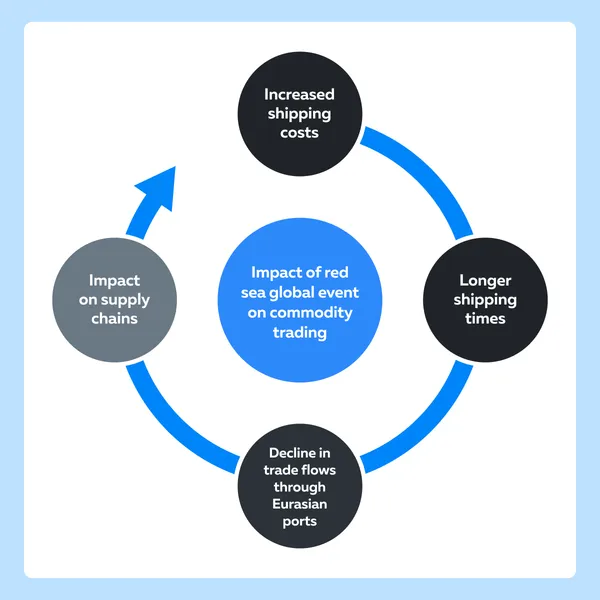

The Red Sea Mess

Recently, geopolitical tensions and conflicts have emerged in the Red Sea region. The reported attacks by Yemen’s Houthi rebels on vessels in the Red Sea have disrupted global shipping. As a result, shipping companies have had to alter their routes to avoid the conflict zone of the Suez Canal and the Red Sea. Most of them are now opting for the longer alternative route, the one around the Cape of Good Hope.

Tailoring Strategies for Commodity Sensitivity

Different commodities react differently to geopolitical events. This creates the need to analyze their unique supply-demand dynamics and then assess their sensitivity. Read the table below to understand the sensitivity of different commodities:

| Type of Commodities | Sensitivity Analysis | Trading Strategies |

| Energy Commodities (Oil, Natural Gas) |

|

Trading strategies involve:

|

| Agricultural Commodities (Grains, Softs) | Agricultural commodities are influenced by geopolitical factors, such as:

|

Strategies involve utilizing weather forecasts to:

|

| Metals (Gold, Silver, Copper) |

|

Trading strategies involve:

|

Popular Commodity Trading Strategies

Let us explore and understand how to implement some popular trading strategies widely used for commodities.

- Trend Analysis

-

-

- Identify long-term trends in commodity prices using historical data.

- Look for patterns and trend reversals to enter or exit positions.

- For example, in oil trading, trend analysis reveals a long-term uptrend due to increasing global demand.

-

- Volume Analysis

-

-

- Analyse trading volumes to assess:

- Market participation and

- Liquidity.

- High volumes indicate strong price movements or potential reversals.

- In agricultural commodities, spikes in trading volume during planting or harvesting seasons signal market trends.

- Analyse trading volumes to assess:

-

- Sentiment Analysis

-

- Monitor news, social media, and expert opinions to gauge market sentiment.

- Geopolitical events, economic indicators, and policy decisions often influence sentiment.

- For example, sentiment analysis predicts short-term fluctuations in gold prices during periods of geopolitical uncertainty.

Additionally, the following commodity-specific trading strategies can be used:

- Weather Forecasting for Agricultural Commodities

-

-

- Utilize weather forecasts to anticipate crop yields and potential supply disruptions.

- For example,

- In the corn market, a forecast for adverse weather conditions during the growing season signals

- Lower production and

- Higher prices.

- This signal prompts traders to go long on corn futures.

- In the corn market, a forecast for adverse weather conditions during the growing season signals

-

- Geopolitical Tensions for Oil Trading

-

- Monitor geopolitical events in major oil-producing regions such as the Middle East.

- In response to heightened tensions, traders buy oil futures contracts to profit from expected price surges.

Seizing Opportunities Amidst Uncertainty

Identifying and capitalizing on market opportunities amidst geopolitical uncertainty requires a multifaceted approach. Traders can incorporate fundamental analysis, technical indicators, and market sentiment analysis to identify and capitalize on trading opportunities. Let’s understand this in detail:

| Fundamental Analysis | Technical Indicators | Market Sentiment Analysis |

a) Economic data, b) Geopolitical news, and c) Policy developments. |

a) Moving averages, b) RSI (Relative Strength Index), and c) MACD (Moving Average Convergence Divergence). |

a) News sentiment analysis, b) Social media assessments, and c) Surveys of investor sentiment.

|

Some Successful Trades Executed During Periods of Geopolitical Uncertainty

By integrating fundamental analysis and technical indicators, traders can identify potential trade setups and seize opportunities amidst geopolitical uncertainty. This way, they can maximize profits while effectively managing risks. Let us read about the following successful trades executed during periods of geopolitical uncertainty:

- Gold during Geopolitical Tensions

-

-

- During heightened geopolitical tensions, traders turn to safe-haven assets like gold.

- Fundamental analysis reveals increased demand for gold as a hedge against uncertainty.

-

- Technical analysis shows a breakout above key resistance levels in the gold price chart.

-

-

- Traders can combine fundamental and technical analysis with market sentiment to smartly execute long positions in gold futures or ETFs.

-

- Oil Supply Disruptions

-

- Geopolitical events leading to supply disruptions in major oil-producing regions present trading opportunities.

- Fundamental analysis indicates a potential decrease in oil supply due to geopolitical tensions.

- Technical analysis reveals a bullish breakout in oil price charts above a significant resistance level.

- Traders who are anticipating further price increases as supply concerns can capitalize on this setup by entering long positions in oil futures or energy sector stocks.

Popular Case Studies

Let’s understand better through some case studies showing successful trades executed during periods of geopolitical uncertainty, along with the trading strategies employed:

| Event | How did traders profit from the geopolitical tension? | What was the trader’s sentiment? |

| Brexit Referendum (2016) |

|

|

| North Korea Missile Tests (2017): |

|

During periods of heightened tension due to North Korea’s missile tests, traders often sought safe-haven assets. |

| US-Iran Tensions (2020) |

|

Following the US assassination of Iranian General Qasem Soleimani in January 2020, geopolitical tensions between the two countries soared. This event prompted traders to adjust their portfolios to mitigate risk. |

| COVID-19 Pandemic (2020) |

|

|

Safeguarding Capital in Turbulent Waters

Traders can mitigate the impact of geopolitical risk on commodity trading portfolios by implementing robust risk management strategies. Here are some techniques traders can employ:

| Strategies | Meaning | Execution |

| Diversification | Diversification helps cushion the impact of adverse events on specific commodities or regions. |

a) Multiple commodities, b) Sectors, and c) Geographic region.

|

| Position Sizing | This strategy involves avoiding overexposure to high-risk assets by limiting the size of positions relative to the portfolio’s total capital. |

|

| Stop-loss Orders | Stop-loss orders help protect capital by automatically closing out positions if prices move against the trader beyond a specified threshold. |

|

Practical Application of Risk Management Techniques

By implementing risk management techniques, such as diversification, position sizing, and stop-loss orders, traders can safeguard their capital and trade with greater confidence and resilience. Let us study some popular risk management techniques applied in commodity trading scenarios:

- Diversification in Energy Trading

-

-

- A trader with a focus on energy commodities diversifies their portfolio by including not only crude oil but also:

- Natural gas,

- Heating oil, and

- Gasoline futures contracts.

- By spreading investments across different energy products, the trader:

- Reduces the risk associated with any single commodity and

- Mitigates the impact of geopolitical events specific to one energy sector.

- A trader with a focus on energy commodities diversifies their portfolio by including not only crude oil but also:

-

- Position Sizing in Agricultural Commodities

-

-

- A trader specializing in agricultural commodities allocates a smaller portion of their portfolio to weather-sensitive crops like corn and soybeans.

- Recognizing the increased volatility and uncertainty associated with weather-related risks, the trader reduces position sizes in these commodities compared to more stable crops like wheat or rice.

-

- Stop-loss Orders in Metals Trading

-

- A trader investing in precious metals like gold and silver uses stop-loss orders to manage downside risk.

- For example,

- Geopolitical tensions escalate suddenly.

- This escalation causes a rapid decline in precious metal prices.

- The stop-loss orders automatically exit positions to limit losses, thereby preserving capital.

Conclusion

Successful navigation of geopolitical events in commodity trading requires a combination of risk awareness, multi-dimensional analysis, and robust risk management. Traders must remain adaptable and learn continuously to make informed trading decisions.

Furthermore, traders must be aware of and practice popular trading strategies such as trend analysis, volume analysis, and sentiment analysis to capitalize on available trading opportunities while mitigating risks.

Ready to master market correlations and enhance your trading journey? Dive into our

comprehensive guide on the significance of market correlations and their influence on

trading decisions. Explore more here.