Ready to see the market clearly?

Sign up now and make smarter trades today

Education

February 12, 2024

SHARE

Optimizing Futures Trading: A Guide to Effectively Leveraging Your Existing Leverage

Most successful traders employ leverage in their trading strategies. But they gain only after applying some advanced knowledge. Are you ready to explore those secrets?

Through this article, we will understand “leveraging” in simple terms. Also, we will discover how to spot lucrative opportunities, avoid common pitfalls, and strategically amplify profits. From understanding market trends to managing risks and employing practical strategies, this article covers it all. Let’s get started.

Deep Dive into Leverage Mechanics in Futures Trading

Futures trading involves the use of leverage. It allows investors to control positions that exceed their capital, amplifying both potential gains and losses. The complexity lies in understanding:

- Margin requirements, which act as collateral, and

- Leverage ratios that dictate the extent of position control.

While leverage magnifies profits during favorable market movements, it also intensifies risks, especially in volatile markets. Let’s explore this concept further and examine certain key concepts.

I. Margin Requirements:

Margin is the amount of money that traders must deposit to open a position in the futures market. It serves as collateral and ensures that traders can cover potential losses. Leverage allows traders to control a larger position size with a smaller amount of capital.

The margin requirement can be divided into two parts:

| Initial Margin | Maintenance Margin |

It is the minimum amount required to open a futures position. It acts as a security deposit and varies based on:

|

It is the additional money deposited when traders receive a margin call. It usually happens when losses occur, and the account balance falls below a certain threshold (maintenance margin).

Instead of depositing money, traders can also close out positions to meet the maintenance margin. |

II. Leverage Ratios:

Leverage is expressed as a ratio, indicating the degree to which a trader can control a larger position compared to their margin. Traders can calculate their leverage ratio using the following formula:

Leverage Ratio= Total Position SizeInitial Margin

Let’s understand this concept using an example:

- A trader has $10,000.

- The leverage ratio is 10:1.

- This implies that they can control a position worth $100,000.

III. Impact of Market Volatility:

Market volatility significantly influences the effectiveness and risk associated with leveraged positions. High volatility mostly leads to wider price swings, amplifying both potential gains and losses for leveraged positions. Thus, traders must carefully manage risk when using leverage to avoid significant losses during volatile market conditions.

IV. Enhancing Strategies with Leverage:

Different market strategies can be significantly enhanced through the judicious use of leverage. Let’s understand its practical application through a hypothetical example.

| Event | Strategy | Outcome |

| A trader identifies an upward trend in a commodity future. | They utilize leverage to amplify the position and control a larger contract size with a relatively smaller amount of capital. |

|

This example illustrates how leveraging a position aligns with a bullish strategy. Through effective leveraging, traders can optimize their profit potential during favorable market conditions. However, it is essential to trade cautiously after considering the associated risks.

Advanced Techniques for Identifying Leverage Opportunities

Precise identification of leverage opportunities involves a combination of:

- Predictive analytics

- Algorithmic trading signals, and

- A keen understanding of market indicators

Let’s understand each of these techniques in depth.

| Predictive Analysis | Algorithmic Trading Signals | Sentiment Analysis |

|

|

|

When to Employ Additional Leverage?

Traders must recognize opportunities to further leverage the existing leverage. This process involves a careful analysis of market indicators and patterns. Read the step-by-step guide below:

- Step I: Identify Strong Trends

-

-

- Use technical indicators like moving averages, RSI, and MACD to identify strong and sustained trends.

- Leverage is often more effective in trending markets.

-

- Step II: Recognize Chart Patterns

-

-

- Identify chart patterns such as triangles, flags, or head and shoulders formations.

- Leverage can be strategically employed during the breakout or confirmation of these patterns.

-

- Step III: Volatility Assessment

-

-

- Analyze historical and implied volatility to gauge the potential for price movements.

- Higher volatility can provide opportunities for leveraging existing positions.

-

- Step IV: Utilize Support and Resistance Levels

-

-

- Pinpoint key support and resistance levels.

- Leverage can be applied when the price approaches a:

- Support level in an upward trend or

- Resistance level in a downward trend.

-

- Step V: Candlestick Patterns

-

-

- Monitor candlestick patterns for insights into market sentiment.

- Leverage can be employed when specific candlestick patterns signal potential reversals or continuations.

-

- Step VI: Confirm with Multiple Indicators

-

-

- Use a combination of indicators to confirm signals.

- For instance, if both moving averages and RSI signal a strong uptrend, it may be a favorable situation to further leverage.

-

- Step VII: Continuous Monitoring

-

- Regularly monitor the market conditions and adjust the leverage strategy accordingly.

- Be prepared to scale in or out, based on evolving trends and indicators.

How to Incorporate Global Economic Events into Leverage Strategies

By incorporating global economic events, policy changes, and news trends into leverage strategies, traders can make informed decisions and manage risks effectively. Here’s what traders can do:

| Events | Trader’s Action | Hidden Leverage Opportunities |

| Policy Changes | Stay informed about central bank policies, interest rate changes, and regulatory shifts. | Leverage opportunities arise in response to policy-driven market reactions. |

| Economic Indicators | Monitor economic indicators like GDP, employment data, and inflation rates. | The traders must adjust leverage strategies based on the economic outlook. |

| News Trends | Incorporate breaking news and geopolitical events into the analysis. | Leverage opportunities emerge during periods of heightened market uncertainty. |

Executing Leverage Strategies

Leveraging existing leverage demands a strategic and disciplined approach. Traders must thoroughly assess risk, position themselves tactically, and perform a risk assessment before increasing leverage by applying the following strategies:

| Strategy | Trader’s Action | Method | Benefit |

| Market Volatility Analysis | Analyze the historical volatility of the specific futures contract. | Utilize standard deviation or other volatility indicators to gauge the potential for price swings. | Assessing volatility helps anticipate the level of risk associated with leveraging. |

| Asset Liquidity Consideration | Understand the liquidity of the underlying asset in the futures contract. | Evaluate average daily trading volumes and bid-ask spreads. | Higher liquidity reduces the risk of slippage and ensures efficient execution when leveraging positions. |

| External Factors Impact Analysis | Consider external factors that could impact price movements. | Stay informed about:

|

Anticipating external influences helps adjust leverage based on potential market shifts. |

How to Maintain a Tactical Position

Tactical positioning is crucial for optimizing leverage outcomes. Here’s how traders can achieve it:

- Determine the optimal leverage level based on risk tolerance and market condition.

- Implement risk management tools to protect against significant losses by using dynamic stop-loss orders that adjust based on market conditions.

- Continuously monitor market conditions and adjust leverage levels accordingly by:

- Setting up real-time alerts and

- Employing automated systems for timely responses.

- Gradually increase or decrease leverage based on market signals. The traders can:

- Scale in as a trend strengthens and

- Scale out as a trend weakens.

How to Maintain a Balance Between Rewards and Risks

Most traders maintain a balance between risk and reward to protect their hard-earned money while aiming for profits. Read this three-step process below to maintain a favorable balance:

- Strategic Positioning

-

-

- Determine the optimal leverage level based on:

- Risk tolerance

- Market conditions, and

- The specific strategy.

- Avoid excessive leverage that may expose you to unsustainable risks.

- Determine the optimal leverage level based on:

-

- Risk Management Tools

-

-

- Stop-Loss Orders:

- Implement stop-loss orders to automatically exit positions if the market moves against the trader.

- Set stop-loss levels based on risk tolerance and market analysis.

- Trailing Stops:

- Utilize trailing stops to adjust stop-loss levels dynamically as the market moves in favor of the position.

- Capture potential profits while protecting against significant reversals.

- Stop-Loss Orders:

-

- Diversification:

-

- Spread leverage across different assets to minimize the impact of adverse movements in a single market.

- This way you can mitigate risk and maintain a balanced portfolio.

Strategic Approaches to Amplify Leverage

Strategically layering leverage involves using a combination of long and short positions to maximize opportunities in both upward and downward market movements. Traders can benefit from market volatility and diverse trends by employing this dual-position approach.

Traders can manage risk in high-leverage situations by hedging against potential losses by taking offsetting positions. For example, pairing a leveraged long position with a smaller leveraged short position to mitigate risk in volatile markets.

How to Dynamically Adjust Leverage Levels

Traders can follow these two approaches:

| Practice Scaling In and Scaling Out | Give Responses to Market Signals |

Scaling In:

Scaling Out:

|

|

How Bookmap Can Help

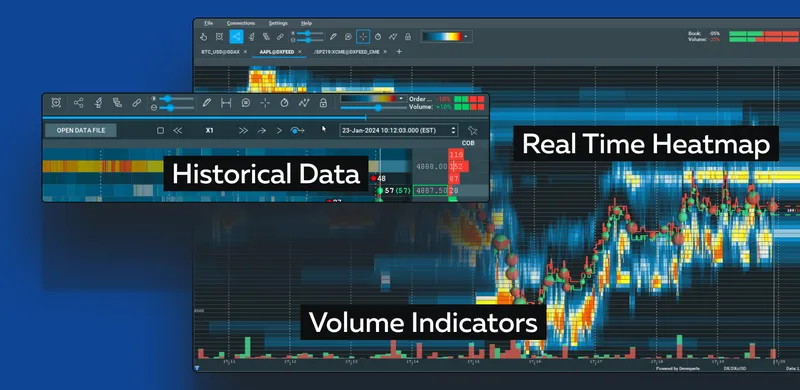

The use of advanced analysis tools, such as Bookmap, provides traders with valuable insights from historical data, real-time heatmaps, and volume indicators. It provides its users with the following:

- Historical Data

-

-

- Traders use historical data provided by tools like Bookmap to identify patterns, trends, and potential market movements.

- Historical analysis aids in making more informed decisions about when to apply leverage.

-

- Real-Time Heatmap

-

-

- Most traders utilize real-time heatmaps to visualize:

- Order book dynamics and

- Market liquidity.

- Heatmaps help identify key support and resistance levels, guiding leverage decisions.

- Most traders utilize real-time heatmaps to visualize:

-

- Volume Indicators:

-

- By incorporating volume indicators provided by Bookmap, traders can gauge the strength of market trends.

- This volume analysis assists in understanding the conviction behind price movements.

Managing Risks in High-Leverage Trading

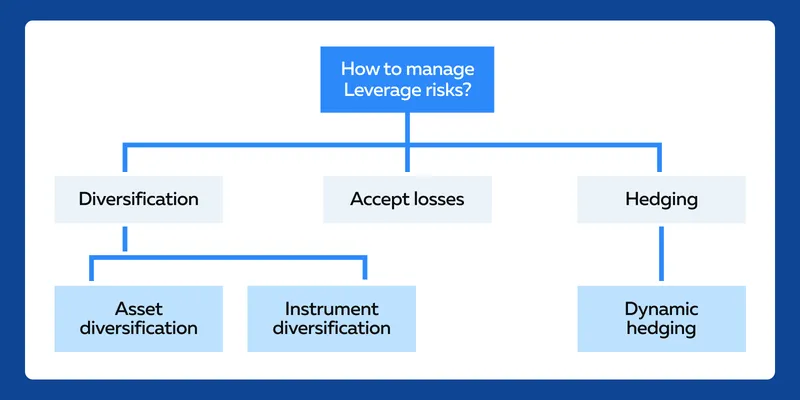

Trading with high leverage is a mental game. Staying disciplined and maintaining a calm mindset can help you better manage the ups and downs. Let’s explore some of the best strategies to manage risks in high-leverage trading:

-

- Diversification

- Asset Diversification:

- Spread leverage across a diversified portfolio of assets.

- This will mitigate the impact of adverse movements in a single market.

- Instrument Diversification:

- Use various financial instruments to achieve exposure to different markets.

- Diversifying your employment of financial instruments provides additional risk mitigation.

- Asset Diversification:

- Hedging Strategies

- Employ hedging strategies, such as options or futures contracts, to offset potential losses in leveraged positions.

- Practice dynamic hedging in which you must continuously reassess market conditions and adjust hedges accordingly.

- Diversification

- Learn to Accept Losses

-

-

- In the world of high-leverage trading, losses are like waves; they come and go.

-

- Learning to accept losses is crucial.

-

- Remember that each loss is a lesson, not a defeat. This will help you emerge stronger and wiser.

How to Address the Mental and Emotional Aspects

High-leverage trading can induce heightened emotions. Thus, traders must maintain discipline and avoid impulsive decisions by developing a trading plan and sticking to it, regardless of emotional fluctuations.

To effectively address mental and emotional aspects, traders must acknowledge the psychological toll of high-leverage trading and adopt stress management techniques. This can be done by:

- Taking regular breaks

- Mindfulness, and

- Maintaining a healthy work-life balance.

Navigating Pitfalls in High-Leverage Trading

To avoid amplified negative outcomes, traders must avoid overexposure. They must resort to diversification, not only across assets but also across trading strategies. This helps in avoiding concentration risk by spreading exposure across different market conditions.

Additionally, traders must regularly assess the risk-reward profile of leveraged positions and adjust leverage levels based on changing market conditions and risk assessments.

How to Maintain Margin Calls and Account Liquidations

Traders must try to stay well above maintenance margin levels to avoid margin calls. This can be achieved by:

- Monitoring account balances and

- Being prepared to inject additional funds if necessary.

Also, traders can implement protective measures, such as predefined stop-loss orders, to prevent account liquidations.

How Traders Can Address Psychological Challenges

Maintaining discipline in sticking to trading plans and exercising patience, especially during volatile market conditions, can help traders address psychological challenges associated with leverage trading. Furthermore, traders must adopt an open stance where they analyze past leveraging errors and use them as opportunities for improvement.

Conclusion

Mastering leverage in futures trading requires a strategic approach and vigilant risk management. Traders must balance potential gains with increased risks by utilizing advanced analysis techniques.

Diversification, hedging, and addressing emotional aspects are crucial for managing risks in high-leverage scenarios. Furthermore, traders can avoid potential pitfalls by avoiding overexposure, monitoring margins, and learning from their mistakes.

Are you interested in leveraging futures margins more effectively? Visit our Futures Margin: Making Leverage Work for You blog post for deeper insights. Elevate your trading strategies with Bookmap today.