Ready to see the market clearly?

Sign up now and make smarter trades today

Market Structure

February 16, 2024

SHARE

Technical Analysis vs. Order Flow: Techniques and Tools for Traders

Table of Contents

- What is Technical Analysis and Order Flow?

- Pros and Cons of Technical Analysis

- Why Order Flow Analysis Offers an Edge

- Key Techniques in Order Flow Analysis

- Essential Tools for Effective Order Flow Analysis

- Integrating Order Flow with Technical Analysis and Sentiment

- Building Trading Strategies with Order Flow

- Case Examples: Trading with Order Flow

- How to Implement Order Flow Analysis with Bookmap

- Conclusion

- FAQs

What is Technical Analysis and Order Flow?

Technical Analysis (TA) involves examining historical market data—primarily price and volume—to identify and predict market trends. Traders utilize patterns and indicators derived from past market behavior to inform trading decisions.

Order Flow Analysis is the technique of observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, to predict immediate future price movements. It provides insight into market participants’ intentions and the underlying dynamics driving prices.

Pros and Cons of Technical Analysis

Pros:

- Simplifies market data into identifiable patterns.

- Defines clear entry and exit points.

- Helps predict trend reversals based on historical data.

Cons:

- Ignores fundamental economic data.

- Can produce conflicting signals, causing confusion.

- Requires extensive practice and understanding to interpret correctly.

Why Order Flow Analysis Offers an Edge

Order flow analysis complements and surpasses TA by providing deeper, real-time insights:

- Market Transparency: Reveals underlying market mechanics through actual trades and orders.

- Early Signals: Identifies shifts in buying or selling pressure before traditional indicators do.

- Precision: Tracks liquidity changes, large trade impacts, and real-time bid-ask spreads.

Limitations:

- Does not incorporate macroeconomic or fundamental news directly (though the effects of these may appear indirectly).

- Requires skilled interpretation and advanced tools.

Key Techniques in Order Flow Analysis

When it comes to financial markets, mastering the art of order flow analysis can be a game-changer. It can be done by learning several techniques employed in order flow analysis. Let’s have a look at some popular techniques and see how you can enhance your chances of profitable outcomes.

Strategy I: Reading the Order Book

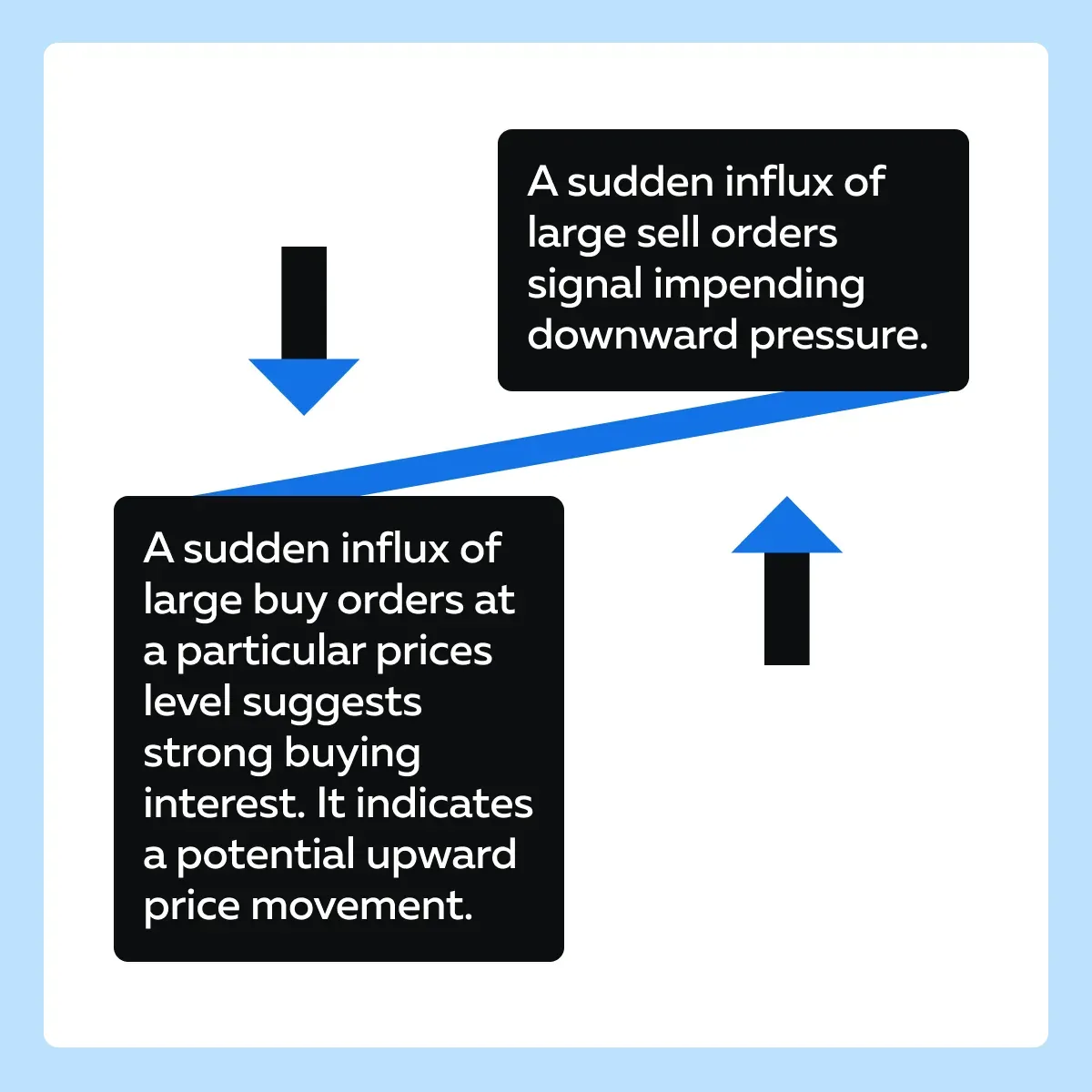

By reading the changes in the order book, traders can better predict upcoming price movements. See the graphic below to understand how:

Let’s understand better using a hypothetical example:

- Assume that an asset is trading at $50.

- The order book shows a significant increase in large buy orders (e.g., 10,000 shares each) at $49.90.

- This accumulation suggests strong demand at this price level and acts as a support zone.

- If the current price is close to this level, it may bounce upwards due to the buying pressure.

Strategy II: Volume Analysis

In this strategy, traders analyze volume at specific price levels. Let’s see how:

| Volume Clusters | Pivot Points |

|

|

Let’s understand better using a hypothetical example:

- Assume that an asset consistently shows high volume at the $100 price level.

- Each time the price approaches $100, it either bounces back or drops.

- This price action indicates a strong resistance or support zone.

- By analyzing these volume spikes, traders set their entry or exit points near this level.

Strategy III: Time and Sales (Tape Reading)

In this strategy, traders interpret the time and sales feed (also known as the tape). These tapes provide real-time data on every executed trade, including the following:

- Price,

- Volume, and

- Time of execution.

Mostly, large block trades significantly impact market direction. By closely monitoring these trades, traders can anticipate potential price movements. For example, here’s a scenario to understand this better:

- Assume that while monitoring the tape, a trader notices a series of large sell transactions (e.g., blocks of 5,000 shares each) executed within a short period.

- This sudden surge in selling pressure leads to immediate price drops.

- The trader recognizes this pattern and decides to:

- Sell their position

or

- Enter a short trade.

- They are anticipating further price decline.

Essential Tools for Effective Order Flow Analysis

Traders must note that they will need sophisticated tools to use order flow analysis. These tools will help capture and interpret the complex data involved. Among the several tools, Bookmap, and advanced market analysis tools stand out and provide useful features for effective order flow analysis. Let’s have a look at some common features available across all the platforms:

- Real-time Data

- Instantaneous updates on order flow

- These updates ensure traders have the latest market information.

- Historical Data

- Access to past order flow data

- It helps in developing backtesting strategies and understanding historical market behavior.

- Custom Alerts

- Notifications based on specific criteria, such as:

- Large orders

or

- Sudden changes in volume.

- These notifications help traders react promptly.

What are some of the unique features and capabilities offered by Bookmap?

| Bookmap’s Features | Meaning | Benefit |

| Real-time Heatmaps |

|

|

| Volume Bubbles |

|

and

|

| Execution Insights |

|

|

Why should you integrate order flow data with other market data?

Order flow analysis as a standalone tool is effective. However, this effectiveness increases manifolds when it is integrated with other technical indicators and sentiment analysis tools. This integration enables traders to perform a “comprehensive analysis”. Let’s see how:

| Technical Indicators | Fundamental Analysis | Market Sentiment Tools |

|

|

|

Furthermore, this integration provides a rounded approach to market analysis and leads to better trading decisions by:

- Enhancing Decision-making

- Integration creates a multi-faceted approach that includes:

- Order flow,

- Technical data,

- Fundamental data, and

- Sentiment data.

- This approach leads to more informed and balanced trading decisions.

- Risk Management

- By cross-referencing different data sources, traders can better manage risks.

- They can avoid doing trades based on incomplete or misleading information.

- Offering Strategic Flexibility

- The ability to see the market from multiple perspectives allows traders to:

- Adapt their strategies to varying market conditions

and

- Improve overall performance.

Building Trading Strategies with Order Flow

Order flow suits various trading styles:

| Trading Style | Strategy |

| Scalping | Quick trades based on micro-trends and immediate liquidity shifts. |

| Day Trading | Identify intraday high-volume zones for precise entry/exit points. |

| Swing Trading | Utilize cumulative volume data to determine broader market momentum. |

Adjusting Strategies:

- Continuously monitor real-time order flow data.

- Use predefined risk management rules.

- Avoid emotionally driven decisions.

For a detailed guide on creating a trading strategy, journaling, testing, and management, refer to this Bookmap blog post.

Case Examples: Trading with Order Flow

- Successful Trade: Spotting high volume at support levels indicating strong buying interest.

- Cautionary Tale: Ignoring order cancellations, resulting in failed support.

- Mixed Scenario: Effective scalping disrupted by unexpected news highlights the importance of diversified analysis and risk management.

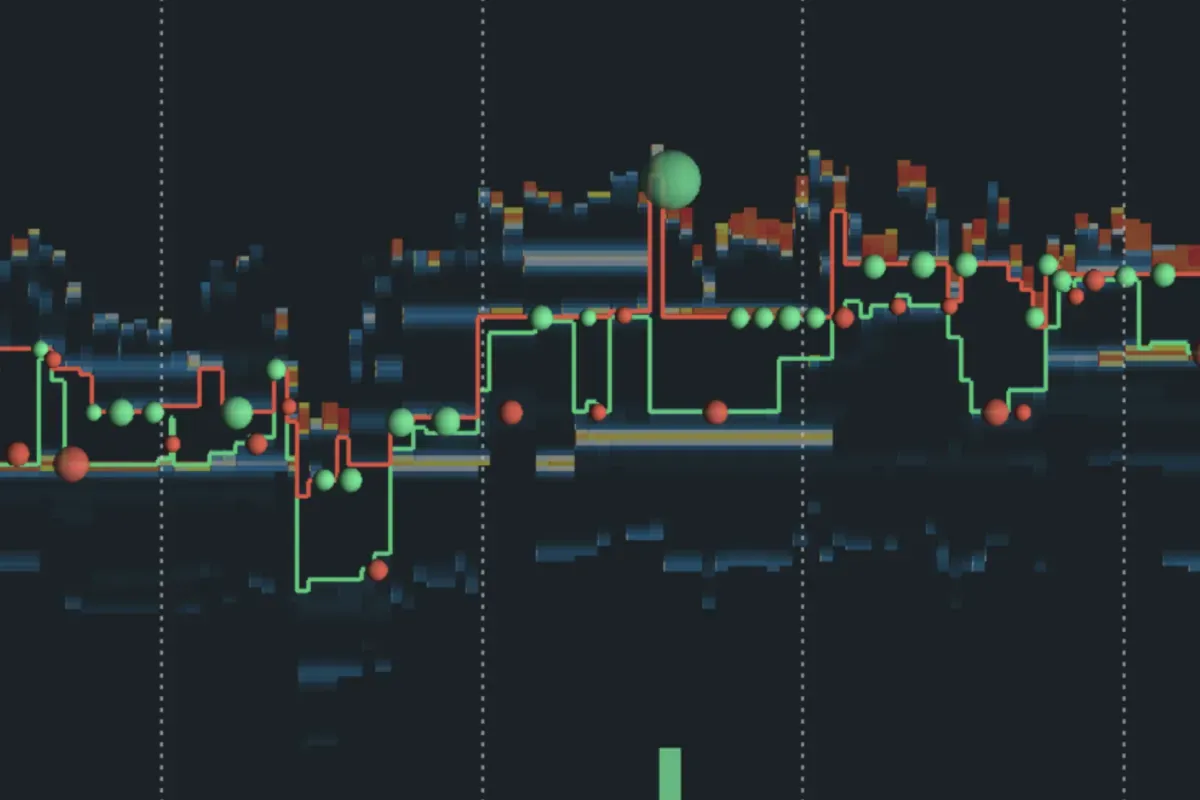

How to Implement Order Flow Analysis with Bookmap

Order flow analysis becomes particularly powerful when paired with advanced visualization tools like those offered by Bookmap. Traders can significantly improve their trading strategies by using Bookmap’s:

- Real-time heatmaps,

- Volume dots,

- Liquidity trackers, and more.

For a comprehensive guide on order flow analysis, refer to Bookmap’s Learning Center.

Now, let us see how you can use Bookmap’s visualization tools:

Heatmaps

Bookmap’s heatmaps visually represent liquidity. They show where large orders are placed in the market. Different colors indicate varying levels of liquidity, with brighter colors representing higher concentrations of orders.

Example

- Assume a trader is observing a heatmap.

- It shows a large cluster of buy orders at $100 for a particular stock.

- As the price approaches this level, the trader anticipates strong support.

- When the price dips to $100 and large buy orders start getting executed (indicated by the heatmap turning bright), the trader enters a long position.

- The price then rises due to the buying pressure.

- The trader enjoys a profitable trade.

Volume Dots

Volume dots on Bookmap display “executed trades.” The size of these volume dots represents the trade size. Larger dots indicate higher-volume trades, which often signify institutional activity.

Example

- A trader notices multiple large-volume dots (indicating high-volume trades) around the $105 level

- This activity suggests strong buying interest

- Recognizing this as a potential accumulation phase by institutions, the trader decides to buy.

- Soon after, the stock price surges

- This happens because:

- The accumulation leads to a breakout

and

- The trader’s entry point gets validated

Large Lot Tracker

The large lot tracker highlights trades involving large quantities. These trades are mostly executed by institutional investors. By following these large trades, traders learn about big market players’ activities. For example,

- A trader observes consistent large buy orders.

- This situation indicates institutional accumulation and a bullish trend.

For our better understanding, let’s observe a hypothetical example showing how visualization helped identify a key entry point before a major price movement.

- Assume that a trader is observing a stock trading around $150 using Bookmap

- The heatmap shows substantial liquidity at:

- $148 (strong support)

and

- $152 (resistance).

- As the price nears $148, the trader sees a series of large buy volume dots and high liquidity on the heatmap.

- The trader recognizes strong support and institutional buying interest.

- The trader decides to enter a long position at $148.

- The price holds at $148 due to the large buy orders and begins to rise.

- The trader then notices the price breaking through the $152 resistance.

- The increasing volume of dots confirms the upward momentum.

- The trader exits the position at $155.

- They secure a profit from the identified entry point.

Conclusion

Order flow analysis offers traders actionable insights by revealing real-time market dynamics, enhancing precision in entries and exits. Combining these insights with advanced tools like Bookmap provides clarity, improved decision-making, and risk management.

Ready to integrate order flow into your trading? Start with Bookmap today.

FAQs

What are chart patterns? Visual formations created by price movements used to predict future market direction.

Common Technical Analysis Tools:

- MACD

- Moving Averages

- RSI

- ADX

- Stochastic Oscillator

- Bollinger Bands

Ready to explore more? Join Bookmap now.