Ready to see the market clearly?

Sign up now and make smarter trades today

News & Announcements

May 12, 2025

SHARE

How News Analytics Can Drive Smarter Trading Decisions

In trading, following the news is good. But knowing how the market reacts to it is even better. Successful traders don’t just follow headlines; they analyze news sentiment and combine it with real-time market data to make smarter decisions.

Wondering how to do so? This article will explain news analytics trading, how it helps identify market sentiment, and how it can detect critical events. You’ll also learn how to avoid common pitfalls like overreacting to headlines or ignoring liquidity conditions.

Additionally, we’ll show how integrating news-driven trading strategies with order flow visualization tools (like Bookmap) provides deeper insights. You’ll also study how volume surges and order absorption can confirm market reactions. So, do you want to enter or exit trades with confidence? Read this article till the end.

What Is News Analytics in Trading?

News analytics in trading refers to the use of automated systems. These systems:

- Analyse financial news,

and

- Assess how it might impact the market.

Most such systems process vast amounts of information quickly, allowing them to identify key trends and changes in market sentiment. As a trader, you can use them to know whether a particular news update is likely to move stock prices up or down.

Why is News Analytics Important?

With the speed at which financial markets react to breaking news, manual analysis often becomes too slow! To counter this, most traders rely on news-driven trading strategies.

That’s because since markets can respond to news within seconds, using automated systems ensures that they don’t miss crucial opportunities. Let’s understand better through an example:

- In a recent event, regulators announced stricter policies for cryptocurrency exchanges.

- News sentiment indicators immediately reflected negative sentiment.

- This negativity caused a sharp drop in Bitcoin prices within minutes.

- As a trader using news analytics trading systems, you reacted quickly to either:

- Minimize losses,

or

- Capitalize on short positions.

Types of News Analytics Traders Should Know

As a trader, you can benefit from different types of news analytics trading techniques. Below are some methods that can help you interpret market sentiment and predict price movements precisely:

Sentiment Analysis

Sentiment analysis uses algorithms to read and interpret news. It identifies whether the tone is positive (bullish) or negative (bearish). After completing the analysis, it assigns a sentiment score that lets you gauge the market’s mood.

For Example:

- During the Reddit-driven frenzy (involving AMC and GameStop), news sentiment indicators showed highly bullish sentiment from retail traders.

- This bullish mindset caused a significant surge in prices.

- This event demonstrates the power of sentiment-driven price action.

Event Detection and Impact Scoring

In this technique, advanced algorithms identify significant market events in real time. Then, they assess their likely effect on asset prices. Commonly, these events are:

| Earnings Reports | Economic Data Releases | Geopolitical Events |

|

|

|

How Does It Work?

These algorithms scan:

- Financial news,

- Government reports, and

- Press releases.

Such a scanning is done to detect relevant events. Once an event is identified, the system assigns an impact score (based on how likely it is to move prices). This score lets you determine whether they should react immediately or wait for further developments.

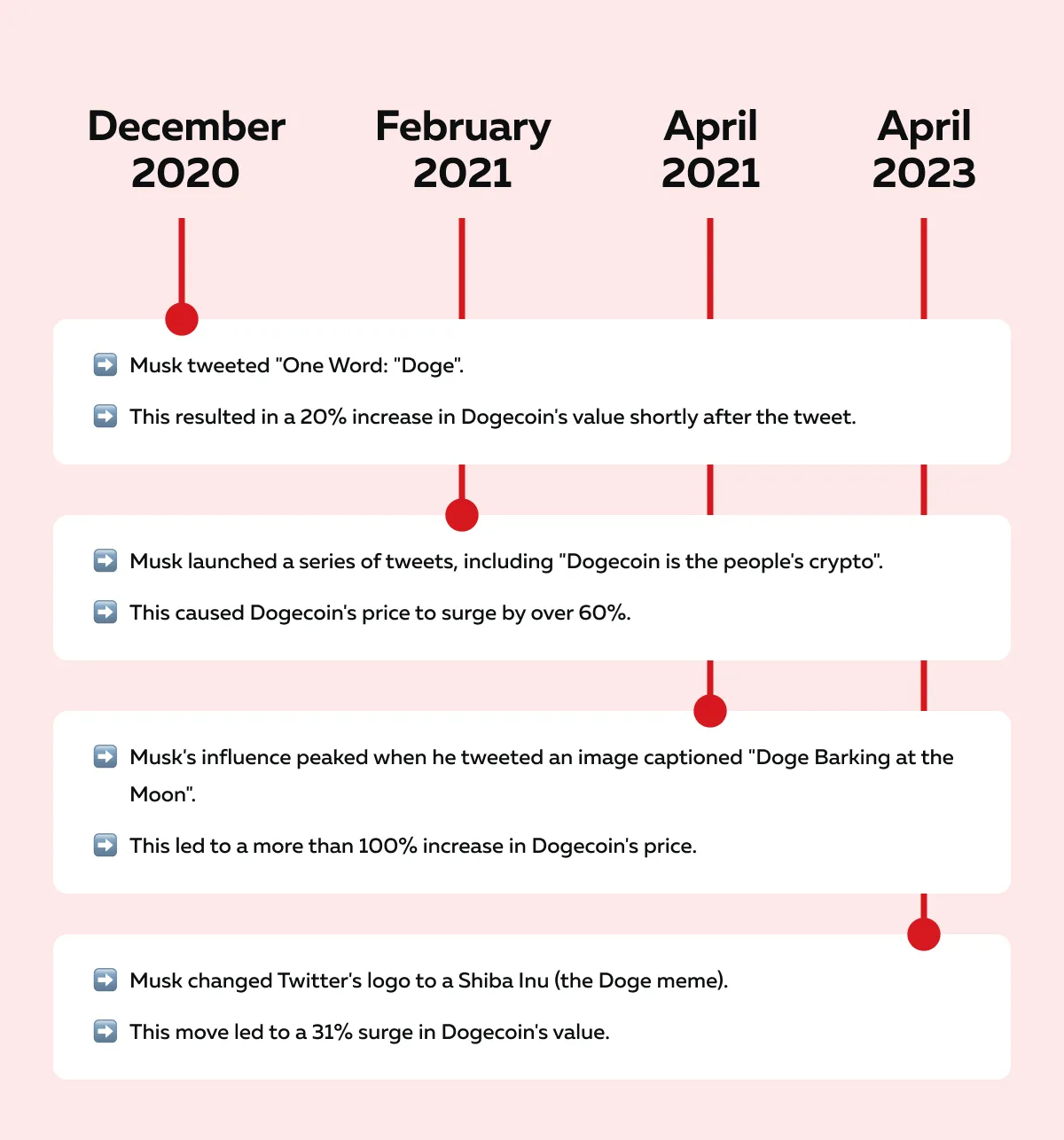

Let’s understand better through an example demonstrated by the graphic below:

Social Media Analytics

Social media analytics tools analysis:

- Trends,

- Opinions, and

- Discussions.

This analysis is performed on platforms like X (formerly Twitter), Reddit, and other online forums to predict market movements. Be aware that with millions of users actively sharing opinions and news, social media platforms can instantly influence asset prices.

How Does It Work?

This system operates in three main ways:

| Keyword Tracking | Sentiment Analysis | Volume of Mentions |

|

|

|

Let’s gain more clarity by learning how Elon Musk’s tweets about Dogecoin consistently influence market sentiment and price fluctuations:

Identify actionable trade setups as news unfolds. See Bookmap in action for futures, stocks, and crypto.

How News Analytics Enhances Trading Strategies?

Using news analytics, you get faster insights, reducing manual delays and leading to quicker decision-making. Also, by interpreting news and sentiment in real time, you can react before the broader market adjusts to new information. Let’s study some of its major benefits:

Anticipating and Reacting Faster to Market Moves

One of the most significant advantages of news analytics in trading is speed. Automated systems can analyze and process breaking news within seconds, giving you a critical edge. Without these tools, you may spend your valuable time manually interpreting news, which can lead to missed opportunities.

How Does This Benefit You?

-

- Real-Time Event Identification:

- News analytics systems detect:

- Earnings reports,

- Economic data, and

- Geopolitical developments as they happen.

- News analytics systems detect:

- Sentiment Assessment:

- Algorithms assign a sentiment score to the news.

- They determine if it’s positive or negative.

- This analysis helps traders predict market direction.

- Real-Time Event Identification:

- Immediate Alerts:

-

- Traders receive instant notifications.

- These alerts allow them to act quickly and adjust their positions.

Let’s study an example:

A company reports earnings that exceed market expectations. As the news breaks, news analytics tools:

- Detect the positive sentiment,

and

- Predict a price surge.

Most traders using these systems immediately buy shares before the rest of the market fully reacts. This quick action helps them secure a favorable entry price, which maximizes likely gains.

Filtering Market Noise

Filtering market noise is a crucial feature of news analytics trading systems as financial markets generate a constant flow of information, but not all of it impacts asset prices. Thus, by using sophisticated algorithms, you can focus on high-impact news while ignoring irrelevant updates.

How Does This Benefit You?

- Event Prioritization

- Algorithms rank news based on its potential to move markets.

- This system ensures that only significant updates are flagged for action.

- Relevance Scoring

- Most systems assess the importance of news.

- They do so by comparing it with the following:

- Historical trends,

- Market conditions, and

- Sector-specific triggers.

- Noise Reduction

- Irrelevant news (such as general commentary or minor updates) is filtered out.

- This measure reduces the risk of unnecessary trades.

Let’s study an example:

Say multiple updates flood the market regarding oil prices. Now, news analytics trading systems start to differentiate between:

- A critical oil supply disruption (caused by geopolitical tensions), and

- Less impactful commentary on minor production adjustments.

As a trader using news-driven trading strategies, you would receive immediate alerts about the supply disruption, allowing you to take positions in crude oil futures before volatility sets in.

Boosting Trader Confidence and Decision Accuracy

Boosting trader confidence is another significant benefit of trading using news sentiment. Most automated systems provide data-driven insights, reducing emotional bias and helping traders make objective decisions. Check the graphic below to learn how:

How Does This Benefit You?

- Sentiment Scores and Impact Analysis

- Algorithms quantify the market impact of the news.

- This measure allows traders to assess whether the sentiment shift is meaningful.

- Immediate Feedback

- Traders receive actionable insights almost instantly.

- These insights allow them to react with confidence.

- Reduced Emotional Bias

- Objective data helps traders avoid impulsive decisions.

- Using it, they can stick to well-defined strategies.

Let’s study an example:

Say a central bank announcement signals an unexpected change in interest rates. Now, most news sentiment indicators would detect a sharp sentiment shift. This shift represents the likelihood of increased volatility in bond and equity markets.

Armed with this data, you can confidently enter positions since your actions are backed by real-time insights rather than emotional guesswork.

Integrating News Analytics With Real-Time Order Flow Data

By integrating news analytics with real-time order flow data, you can create a powerful trading strategy. Let’s see how to do so:

Why This Synergy Matters?

To track real-time order flow data, you can use popular order flow tools like our tool, Bookmap. Using them, you can visualize market activity by witnessing:

- Liquidity shifts,

- Volume surges, and

- Price levels where large buy/sell orders accumulate.

Let’s see how this benefits:

| News Analytics | Combined Advantage |

|

|

How Does It Work?

Let’s learn in these easy steps:

- Step 1: News analytics identifies high-impact events and assesses sentiment.

- Step 2: You monitor order flow data on platforms like Bookmap. Here, you observe how liquidity shifts and large orders align with the event.

- Step 3: This combination of sentiment analysis and liquidity visualization lets you decide whether to enter, hold, or exit positions more confidently.

A Practical Example

Let’s consider a scenario where the Federal Reserve (Fed) announces a surprise interest rate hike. Now, the system detects the announcement. It assigns a negative sentiment score for equities due to the expectation of tighter monetary policy.

As a trader using news analytics trading, you receive an immediate alert. These alerts signal possible market downturns.

Gain Order Flow Confirmation on Bookmap

As traders react to the news, Bookmap’s heatmap shows liquidity shifting. Here, it shows how large sell orders appear at key price levels. Also, you can observe volume surges. These surges occur when institutional traders adjust their positions (confirming the market’s negative sentiment).

Now, after seeing both the sentiment shift and real-time liquidity changes, you can quickly decide to:

- Short equities,

or

- Move into safer assets.

In this way, the synergy between trading using news sentiment and order flow data minimizes guesswork. It also ensures decisions are based on both qualitative and quantitative insights.

Common Pitfalls and How Traders Can Avoid Them

Even with the power of news analytics trading, you can make costly mistakes! These slip-ups can happen if you overlook certain key factors, as mentioned below:

Overreacting to Headlines Without Context

One common mistake is overreacting to headlines without considering the broader market context. Traders often jump to conclusions. They do so based on sensational news without verifying its actual impact. Usually, this leads to impulsive decisions and unnecessary losses.

How Does It Happen?

You may misinterpret breaking news. A headline may suggest:

- Regulatory changes,

- Mergers, and

- Geopolitical tensions.

But without the full context, the market impact can be misunderstood by you.

Additionally, sometimes, even impactful news takes time to affect asset prices. Rushing into trades leads to losses in such scenarios.

Let’s study an example:

Suppose a headline suggests that a government plans to introduce strict regulations on cryptocurrency exchanges. Now, panic selling follows and causes a sharp price drop.

However, news sentiment indicators later show that:

- The regulations are minor,

and

- They won’t drastically impact the crypto market.

Here, all those traders who overreact to the initial news without waiting for clarity may incur unnecessary losses.

Ignoring Fundamental Market Structure

Ignoring market structure is another critical error! Even when trading using news sentiment, your trades may fare poorly when you fail to consider the following:

- Support levels,

- Resistance levels, and

- Order flow dynamics.

Gain instant clarity on market reactions with Bookmap’s advanced order flow tools.

How Does It Happen?

As a trader, you may focus solely on news analytics trading. While doing so, you do not factor in:

- Liquidity zones,

- Resistance levels, and

- Key price areas.

Additionally, you can miss reversals. Be aware that positive sentiment may drive a price rally. However, the price may fail to break through if the asset is near a major resistance level, leading to a reversal.

Let’s study an example:

Say a trader buys aggressively after a company reports strong earnings. They do so because most news sentiment indicators reflect bullish sentiment.

However, they overlook that the stock is approaching a critical resistance level. For the unaware, this level can be identified by liquidity barriers on Bookmap.

As a result, the price struggles to move higher. The trader faces losses despite the positive news.

Underestimating the Importance of Liquidity

Liquidity determines how smoothly large orders can be executed without causing significant price changes. Thus, underestimating liquidity can be a costly mistake. Such an underestimation can result in losses even when traders accurately interpret news sentiment.

How Does It Happen?

- You attempt to enter or exit large positions based on positive or negative sentiment without considering available liquidity.

- Please note that low liquidity can lead to price slippage. Here, the execution price is significantly different from the intended price.

Let’s study an example:

Suppose a trader is using news-driven trading strategies. They see a positive earnings report. As a result, they try to buy a large position in the stock hastily.

However, the order gets filled at much higher prices due to low liquidity at the desired price levels, eroding potential profits. Such a slippage could have been avoided by assessing liquidity before executing the trade.

Actionable Tips for Implementing News Analytics in Trading

To successfully use news analytics in trading, you require a structured approach. Below are some practical tips for using news-driven trading strategies in your routine strategically:

1. Prioritize Immediate News Verification

Always verify breaking news before making trading decisions. You can do so by using automated news analytics systems. They can:

- Filter out irrelevant updates,

and

- Assign a sentiment score to highlight impactful events.

This process ensures that traders don’t overreact to misleading headlines.

Smart Tip

Before committing capital, use news sentiment indicators. This usage will let you assess whether the news is likely to create sustained price movements.

2. Complement News Sentiment Data with Order Flow Visualization

News sentiment alone isn’t enough! Combine it with real-time order flow visualization using our advanced market analysis tool, Bookmap, to confirm market reactions.

Also, you can see how large institutional players are positioning themselves through order flow, giving you a clearer picture of actual market sentiment.

Smart Tip

Perform trading using news sentiment to detect directional bias. Also, validate it by checking whether liquidity and volume trends on Bookmap align with the sentiment.

3. Contextualize News-Driven Trades Within Broader Market Trends

Always analyze the bigger picture! News events can trigger short-term price moves, but you should try to understand:

- Market structure,

and

- Technical levels.

Such an understanding lets you avoid entering trades at unfavorable positions.

Smart Tip

Evaluate support, resistance, and liquidity zones on Bookmap. This analysis ensures that sentiment-driven price moves have room to continue.

4. Benefit from Bookmap’s Unique Capabilities for Real-Time Market Reactions

Bookmap provides unparalleled insights into how markets react to breaking news. Using it, you can visualize the following:

- Liquidity Dynamics:

- You can identify where large orders are building or disappearing.

- Absorption of Large Orders:

- You can recognize when significant buy/ sell orders are absorbed without major price shifts.

- This behavior signals potential reversals or continuation patterns.

- Volume Shifts:

- You can track how trading volume responds to news events.

- The reaction will indicate genuine market interest or hesitation.

Let’s Gain More Clarity Through Some Practical Examples:

| Example 1 | Example 2 |

|

|

Conclusion

Nowadays, prices can shift within seconds! Through news-driven trading strategies, you can quickly interpret market sentiment. Also, you should integrate news analytics trading with real-time market visualization. This combination lets you gain a significant strategic advantage.

To track order flow data, you can start using our modern real-time market analysis tool, Bookmap. It enhances your decision-making ability by clarifying liquidity, volume shifts, and large order absorption.

Additionally, this synergy allows you to anticipate price movements and confirm market reactions, reducing guesswork and improving accuracy. Combine news-driven market moves with real-time liquidity visualization—start using Bookmap today.