Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 15, 2025

SHARE

How to Trade a CPI and FOMC Double Header: Navigating the Volatility on June 12

On June 12, CPI and FOMC will drop together. We can safely call it a financial storm that traders like you just can’t ignore!

When inflation data (CPI) and a Fed policy decision (FOMC) land on the same day, markets don’t just move! They lurch, whipsaw, and sometimes reverse twice in one session.

So, do you want to trade this day well today? Remember, it is not about speed. Instead, you must try to read the story behind the movie. That’s where order flow and our real-time analysis tool, Bookmap, come in. They show what big players are doing in real-time; who’s bluffing, who’s serious, and where liquidity is hiding.

Want to avoid the traps on this high-stakes day? Read on.

Why CPI + FOMC on the Same Day Creates Extreme Volatility?

Usually, when the CPI (Consumer Price Index) and the FOMC (Federal Open Market Committee) decisions happen on the same day, the market faces a high level of uncertainty.

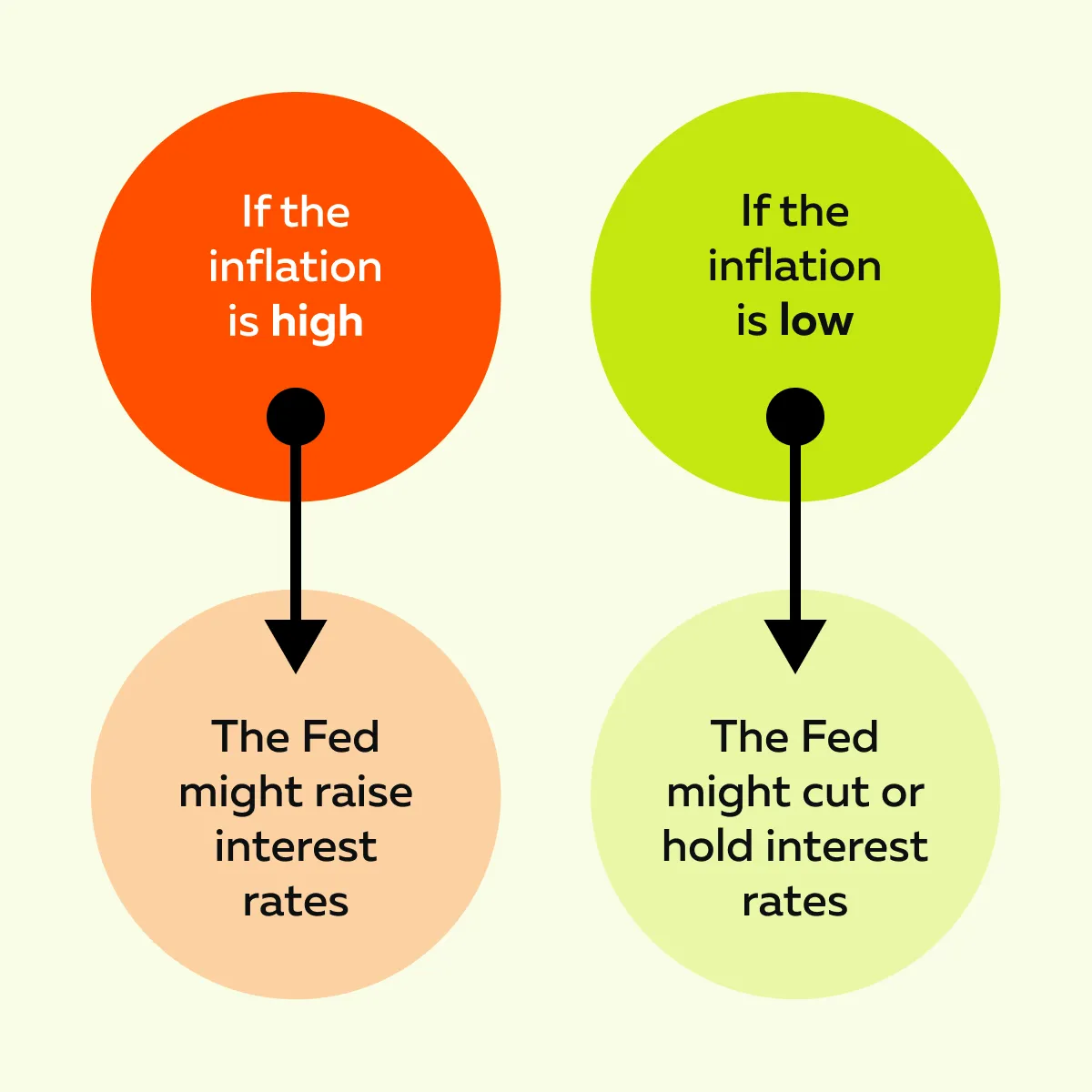

The CPI report shows how fast prices are rising. The Fed uses that data to decide whether to raise or lower interest rates:

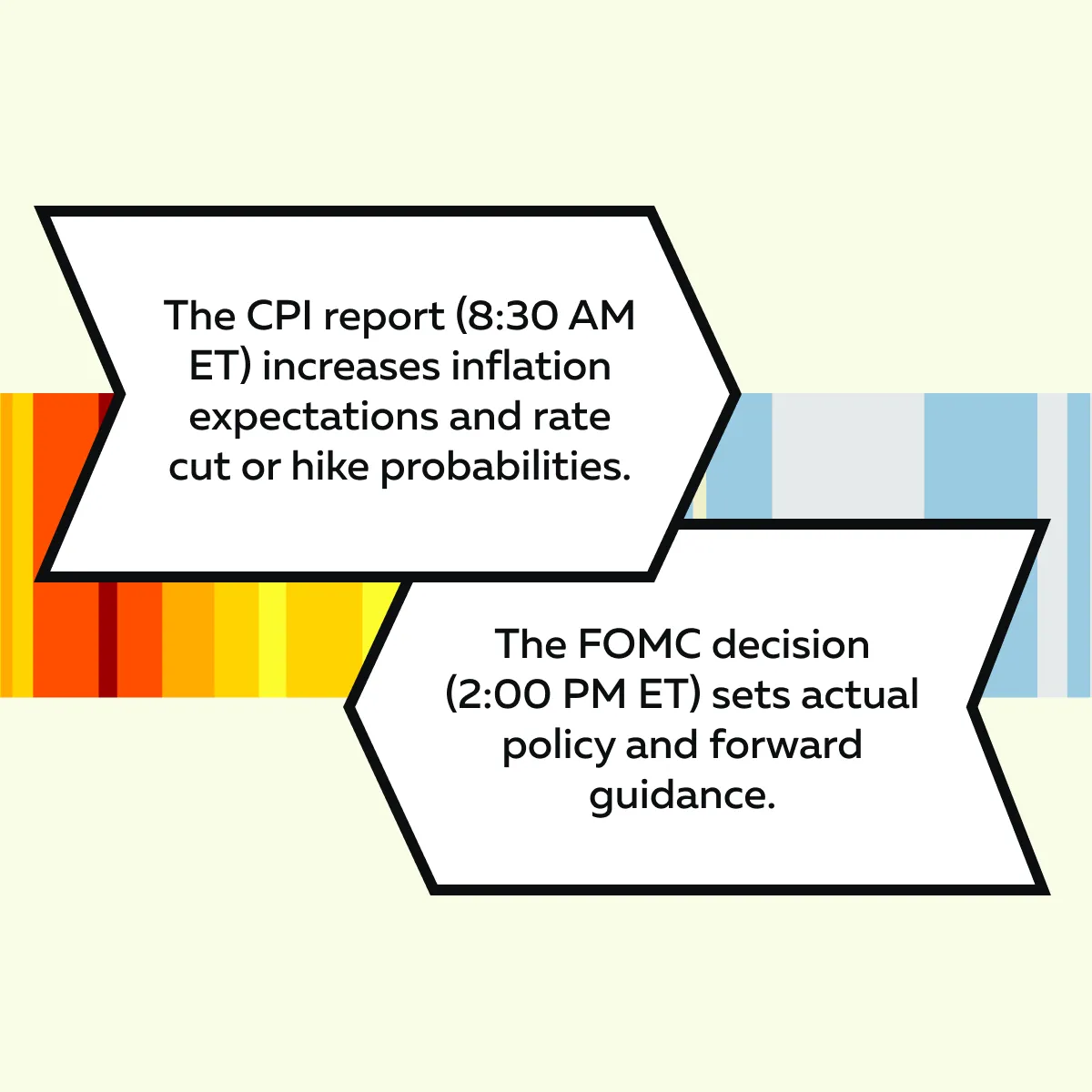

So, CPI influences what traders expect the Fed will do. Later in the day, the FOMC announces its actual policy decision. This includes:

- Changes to interest rates

and

- A press conference from the Fed Chair (often Powell).

Now, because of this schedule, markets get hit twice:

| The first wave of volatility | The second wave of volatility |

|

|

This back-to-back setup causes rapid changes in market sentiment and pricing. You can clearly see this in modern real-time market analysis tools, like our tool, Bookmap. If you are a macro strategy trader, this is one of the most active and risky days of the quarter.

What to Expect from the Market on June 12?

Both CPI and the FOMC decision will be released on the same day, June 12. It will lead to two waves of volatility, as mentioned above. Let’s see how:

- The First Reaction:

-

- The morning CPI report will likely cause the first reaction.

- If inflation comes in hotter or cooler than expected, traders will immediately shift their views on what the Fed might do.

- This sets the emotional tone.

- It also influences the market’s structure for the rest of the day.

- The Second Move:

-

-

- When the FOMC decision and Powell’s press conference happen later, traders are already positioned based on the CPI.

- That means the second move is based not just on the Fed’s words!

- Instead, it is also based on how traders line up or clash with the morning’s inflation data.

-

- Thus, it is expected that June 12 could show classic Fed volatility across major assets.

Now, one key point many overlook is what the market does before June 12. By studying the days leading up to the event, you can get valuable clues. For example,

- Say markets have been slowly rising.

- Now, traders might be positioned long and vulnerable to bad CPI news.

- On the other hand, if the market has been dropping, it may already be pricing in bad data.

By using our tool, Bookmap, you can see how order flow has behaved ahead of the event. This observation reveals whether large players have been:

- Buying,

- Selling, or

- Waiting.

If you are using a macro strategy, you must understand this pre-positioning. Let’s gain more clarity and learn what you can expect from the market on June 12:

Price Action vs. Expectation: Has the Market Already Moved?

Before reacting to CPI or the FOMC decision, you should always ask – Has the market already moved based on what traders expect?

Start by checking the forecast. If inflation is expected to cool down, you would think stocks (particularly ES futures and tech) would rally. But if they’ve been flat or weak all week, that’s a warning sign. It could mean:

- The market already priced in optimism earlier

or

- Traders are unsure and waiting.

Please note that this mismatch between data expectations and actual price action is the key. One clue you can watch here is that:

- Say the market trades higher ahead of the CPI release.

- But, it does so on light volume.

- Now, it may suggest that buying strength isn’t real.

- That kind of setup means the market is unlikely to go much higher unless the CPI number is a major positive surprise.

- On the flip side, if the CPI comes in even slightly hotter than expected, selling could hit quickly, especially if traders were already leaning bullish.

The same logic applies to the FOMC. Say everyone expects the Fed to pause rate hikes or sound dovish. However, the market feels heavy or lacks bid interest before the announcement. Now, this may be a sign of weak sentiment. In that case, if Powell’s tone is more hawkish than expected, we could see a:

- Quick fade

or

- Sharp move lower

As a trader using an order flow macro strategy, you should start using our tool, Bookmap. Using it, you can see whether buyers are stepping in or if large players are staying out. If the CPI and Fed messages match current price action, reactions might be mild. But if there’s a disconnect, that’s when the biggest moves usually happen!

Morning Session: CPI Reaction

The CPI report comes out early, usually at 8:30 AM ET. Right before the release, markets often have thin liquidity. This means there aren’t many active buyers or sellers. Such a situation creates a fragile setup, where prices can jump or drop sharply on small orders.

Thus, never chase that initial move. During these times, the market fakes one direction. Then, it reverses once liquidity rebuilds and more players step in. If you use our tool, Bookmap, you’ll see this in the order flow! You will observe that real direction usually shows up only after:

- Volume normalizes

and

- Price starts to hold at new levels.

Avoid traps and fakeouts when the market reacts to double macro releases—learn how with Bookmap.

Midday Lull

After the CPI reaction settles, there is often a midday lull. Liquidity dries up again as traders wait for the FOMC announcement. This part of the day is mostly choppy and hard to trade. That’s because prices drift without purpose, and setups tend to fail.

If you are using a macro strategy, this is usually a time to step back and avoid overtrading. Please note that it is a classic “low-probability” window.

Afternoon Explosion: FOMC Reaction

At 2:00 PM ET, the FOMC releases its policy decision and statement. This creates a sudden liquidity vacuum. In this vacuum, prices move violently in both directions. During these times, it is common to see a sharp spike or drop, sometimes both, within minutes.

Then, at around 2:30 PM ET, Fed Chair Powell holds a press conference. That’s where the second wave hits. For example,

- Assume that the Fed announces a pause in rate hikes.

- In response, the markets rally.

- But later, Powell says that more hikes are still possible.

- Now, that optimism fades, and a reversal starts.

Thus, as a trader, you must focus on the following:

In this afternoon session, true Fed volatility often hits its peak. Also, in this session, most big players make their moves and set the price direction for the next few days.

How to Track Liquidity Shifts and Avoid Traps with Bookmap?

By using our avant-garde market analysis tool, Bookmap, you can track order flow during major events like CPI and FOMC. It shows:

- Where are real buyers and sellers placing orders?

and

- When do they disappear?

On volatile days, this information lets you avoid traps and stay focused on the real market direction. Let’s gain more clarity and learn how you can use our advanced market analysis tool, Bookmap, in simple steps:

Step 1: Watch Liquidity Thinning Before Events

About 5 to 10 minutes before CPI and again before the FOMC announcement, you’ll see resting orders disappearing from the book on the tool, Bookmap. This means traders are pulling their bids and offers. That’s because they don’t want to get caught in the first wave of volatility.

When the order book gets thinner, small orders usually move prices more. This increases the risk of fakeouts or sharp moves that reverse quickly. Also, a thin book means the market can swing wildly without real conviction behind it.

Step 2: Look for Real Liquidity Rebuilding Post-Release

After the initial move from CPI or the Fed statement, real support and resistance levels start to show up again. On our tool, Bookmap, this looks like large orders stacking at certain price levels.

Once liquidity re-stabilizes, traders get a clearer picture of the market’s true direction. For example,

- Say, after a CPI spike, strong buy orders return at a key level.

- Now, this signals that buyers are defending that area.

- This is where a real move can start.

The same goes for the FOMC. The biggest and cleanest moves usually come after the market digests the news and liquidity comes back.

Step 3: Spot Aggressive Volume Patterns

In this step, you will use our tool, Bookmap’s volume dots, to see where large traders are actively buying or selling. Be aware that these dots show aggressive volume (real market orders, not just resting ones). When you see heavy volume stacking at a level after a fake move fails, that’s a key signal.

For example,

- The CPI report comes out.

- The market sells off quickly.

- That’s because the data looks hot (higher inflation).

- But then, at a known support level, you see heavy buy volume show up.

- That means real buyers (likely bigger players) are stepping in and taking advantage of the dip.

- The early drop is likely a liquidity hunt, which:

- Draws in sellers

and

- Triggers stop-losses.

- It then reverses as serious money enters.

- This is a common order flow trap.

- It catches traders chasing the first move.

- Later, it reverses once the real intent (buying) shows up.

As a trader using a macro strategy, you can use our tool, Bookmap, in this kind of Fed volatility setup to gain a competitive advantage. It lets you avoid emotional trades and focus only on confirmed liquidity and volume.

Examples of Past CPI + FOMC Day Behavior

When CPI and FOMC land on the same day, the market starts reacting before the numbers are released. Traders build positions based on expectations. That’s why the phrase “buy the rumor, sell the news” shows up so often, particularly on days like these.

During these times, you must have an understanding of:

- Order flow,

- Liquidity, and

- Price behavior.

This lets you avoid getting caught in false moves. For more clarity, let’s have a look at some examples of past CPI + FOMC day behaviors:

Example 1: “Buy the Rumor, Sell the News” on CPI

Let’s say in the days leading up to CPI, inflation expectations are falling. As a result, equities move higher and traders are positioned for a soft number. They are hoping it will support future rate cuts.

The reality

- CPI prints in line with expectations.

- Inflation is cooling, but not by much.

- The market spikes higher at the open, but the rally stalls quickly.

- On our tool Bookmap, you see sell orders stacking just above the spike.

- At the same time, aggressive sellers begin hitting bids and absorbing the buyers.

Now, what does this mean?

- The market had already priced in the good news.

- There was no fresh surprise to fuel more upside.

- Late buyers get trapped, and a reversal unfolds.

- This is a textbook order flow setup where:

- Emotion overtakes logic

and

- Liquidity shifts confirm the turn

Example 2: FOMC Surprise Shifts the Narrative

After the morning CPI volatility fades, the midday session is quiet. Then, at 2:00 PM, the FOMC statement is released. The Fed keeps rates unchanged, as expected.

But during the 2:30 PM press conference, Powell sounded unexpectedly hawkish. He says inflation is sticky and that rate cuts are “not even on the table.”

The order flow response

- The initial market reaction is mildly bullish (maybe due to relief that there was no surprise).

- But soon after, heavy sell volume hits near-session highs.

- Sell orders stack above price, and bids disappear.

- Price rolls over into a second leg down.

What can you, as a trader, learn?

- Even when the headline matches expectations, the tone and language from the Fed can change the entire narrative.

- This is where our tool, Bookmap, and order flow macro strategy matter most.

- They help you see if the market is accepting the news or rejecting it.

Example 3: Unexpected CPI Upset + Hawkish Powell = Trend Day

Please note that this is the most dangerous setup for bulls:

- CPI comes in hot in the morning (much higher than expected).

- Markets drop fast, but then attempt to stabilize around midday.

- Traders hope for a dovish Fed tone to calm things down.

Then comes the FOMC:

- No rate change, but Powell is clearly hawkish in both tone and outlook.

- He reinforces the message: inflation remains a problem, and policy will stay tight.

What happens next?

- After the CPI drop, liquidity rebuilds below the price.

- However, buying still lacks strength.

- Powell’s press conference adds pressure.

- New sell orders appear at every bounce.

- Sellers keep hitting the tape, and no strong buyers step in.

Result

- A trend day to the downside.

- Here, both CPI and the Fed signal tighter conditions ahead.

Trade FOMC and CPI days smarter—see liquidity shifts in real-time with Bookmap.

Trading Tips for June 12

When CPI and FOMC fall on the same day (like they will on June 12), the market often delivers two waves of volatility. As a trader, you must treat these as separate events. Below are some tips to manage the day without getting caught in the noise:

A) Prepare Two Separate Trading Plans

Don’t lump CPI and FOMC together! That’s because reactions to both these events usually conflict.

For example,

- Say CPI suggests inflation is cooling.

- However, the Fed could still deliver a hawkish message.

- Now, you must be ready for both possibilities with two distinct game plans.

B) Size Down and Use Tight Stops

Both events trigger whipsaw moves. These moves are sharp spikes in both directions before a real trend appears. At this time, you must:

- Reduce position size

and

- Use tighter stops to manage risk.

Also, expect to take small losses before the true move sets up. This is part of the game on high-volatility and dual-event days. Your ultimate goal should be to protect your capital until a clean setup shows up.

C) Be Patient – Real Moves Come After Liquidity Rebuilds

The first move after CPI or FOMC is often a fakeout. Don’t chase it! Instead, you must wait for liquidity to return and stabilize.

Also, look for clear support or resistance zones where the market starts to respect price levels. This is where smart money often engages.

If you are using an order flow macro strategy, the real opportunity is after the initial reaction, when emotion fades and positioning becomes more deliberate.

Track Liquidity Live with Bookmap

By using our Bookmap’s heatmap, you can easily identify where the market is absorbing the price. You can read the signals in the following ways:

| Ways | Meaning | Ideal trader reaction |

| Say liquidity disappears during the spike (the heatmap goes blank or fades). | It means big players pulled their orders. | The market is unstable. Don’t jump in yet! |

| Say liquidity comes back. |

|

That’s a better time to trade. |

Please realize that fakeouts often fail once real liquidity returns. That’s where the market shows its true direction. So, by using our heatmap, you can:

- Avoid reacting emotionally

and

- Wait for solid setups backed by real buyer or seller interest.

Conclusion

When trading on a day like June 12 (the CPI and FOMC will happen back-to-back), you must remain patient. That’s because the market will move quickly, but most of those early reactions are noise! Real trades usually come after the dust settles and liquidity rebuilds.

By using our real-time market analysis tool, Bookmap, you can easily see what’s real and what’s just a bluff. Using it, you can track order flow and spot where buyers or sellers are truly committing. This lets you avoid emotional traps.

Additionally, if you want to get better prepared, use Bookmap’s replay tools. Study past CPI and FOMC days, watch how price, liquidity, and volume interacted, and sharpen your setup for June 12. Re-watch past macro event volatility using Bookmap’s replay tools and improve your edge.

FAQ

1. What happens when CPI and FOMC land on the same day?

When CPI and FOMC happen on the same day, the market often moves twice:

- Once in the morning, after the inflation report

and

- Again, in the afternoon after the Fed’s decision.

Please note that each event affects interest rate expectations differently. These back-to-back surprises also cause sharp price swings and make the day more unpredictable than usual.

2. How does order flow help during CPI and FOMC events?

By tracking order flow, you can see where big traders are actually buying or selling after news comes out. Instead of guessing, you should watch how volume builds at certain prices.

This lets you avoid getting caught in moves that look real but quickly reverse. Also, it gives you clues about whether the market is truly changing direction or just reacting emotionally for a moment.

3. What is a common mistake when trading macro double-header days?

A common mistake is trading right after the news drops. Please realize that the first move often fakes people out. At this time, many orders disappear before the release.

Thus, if you jump in too early, you can get caught on the wrong side! Ideally, you should wait for the price and liquidity to settle. This gives you better entries and lets you avoid losses from emotional reactions.

4. How can Bookmap help during high-volatility macro events?

By using our tool, Bookmap, you can observe live data on where big orders are sitting and how much volume is hitting the market. During events like CPI and FOMC, this lets you spot where real buying or selling is happening.

If big players step in or suddenly pull orders, Bookmap makes that clear! So, you can avoid fake breakouts and trade with more confidence.