Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

May 5, 2025

SHARE

How Traders Can Navigate Market Volatility Amid 2025’s Growth Scare

In 2025, the only thing moving faster than stock prices is investor anxiety. This year has brought strong uncertainty. Higher-for-longer interest rates, inflation, trade wars, and shifting market sentiment are shaking up the US markets.

But with uncertainty comes opportunity. Want to know how?

In this article, you’ll learn how to manage the growth scare of 2025 and prepare for a stock market correction by using defensive investing strategies.

We’ll also cover market volatility strategies, sector rotations, liquidity trends, and smart trading strategies in a slowing economy. Read the article till the end to stay ahead and to be in the best position to profit!

What’s Driving Market Uncertainty in 2025?

The market over the past two years showed strong performance, with the S&P 500 gaining substantially. However, analysts are cautious about 2025. The initial optimism has been tempered by:

and

- Mixed predictions regarding economic growth.

Goldman Sachs forecasts continued growth for the S&P 500 and projects it could reach 6,500 by year-end. But this outlook is clouded by the uncertainty introduced by new tariffs and potential trade wars. Let’s understand this in detail:

Higher-for-Longer Interest Rates

One of the key reasons behind the growth scare in 2025 is the Federal Reserve’s decision to maintain higher interest rates for an extended period. Despite earlier expectations of rate cuts, policymakers are hesitant to ease monetary policy because of:

- Persistent inflation

and

- Economic resilience.

Now, this has several implications:

| Elevated borrowing costs | Pressure on high-growth stocks | Market shifts |

|

|

|

As a trader, you can opt for market volatility strategies such as sector rotation and hedging with options to mitigate risks.

Persistent Inflation and Wage Pressures

Recently, inflation has cooled in certain areas, like goods and supply chains. However, it remains stubbornly high in:

- Services,

- Housing, and

- Wages.

This poses a challenge for both policymakers and investors. Let’s see how:

- Sticky inflation in services:

-

-

- Unlike goods, service-related costs (healthcare, education, and travel) continue to rise due to strong demand and limited supply.

-

- Labor market shifts:

-

-

- In 2025, tighter immigration policies will constrain the labor supply.

- This labor shortage has pushed wages higher across various sectors.

- To offset the additional expense of increased wages, businesses have raised the prices of their products and services, passing on increased labor costs to consumers.

- This price adjustment measure, in turn, has fueled inflationary pressures in the economy.

-

- Fed’s response and market impact:

-

- If inflation remains above 3%, the Federal Reserve may delay anticipated rate cuts.

- This can lead to further stock market corrections in 2025.

- This can happen as investors might be prompted to reprice assets based on prolonged monetary tightening.

Ideal Actions

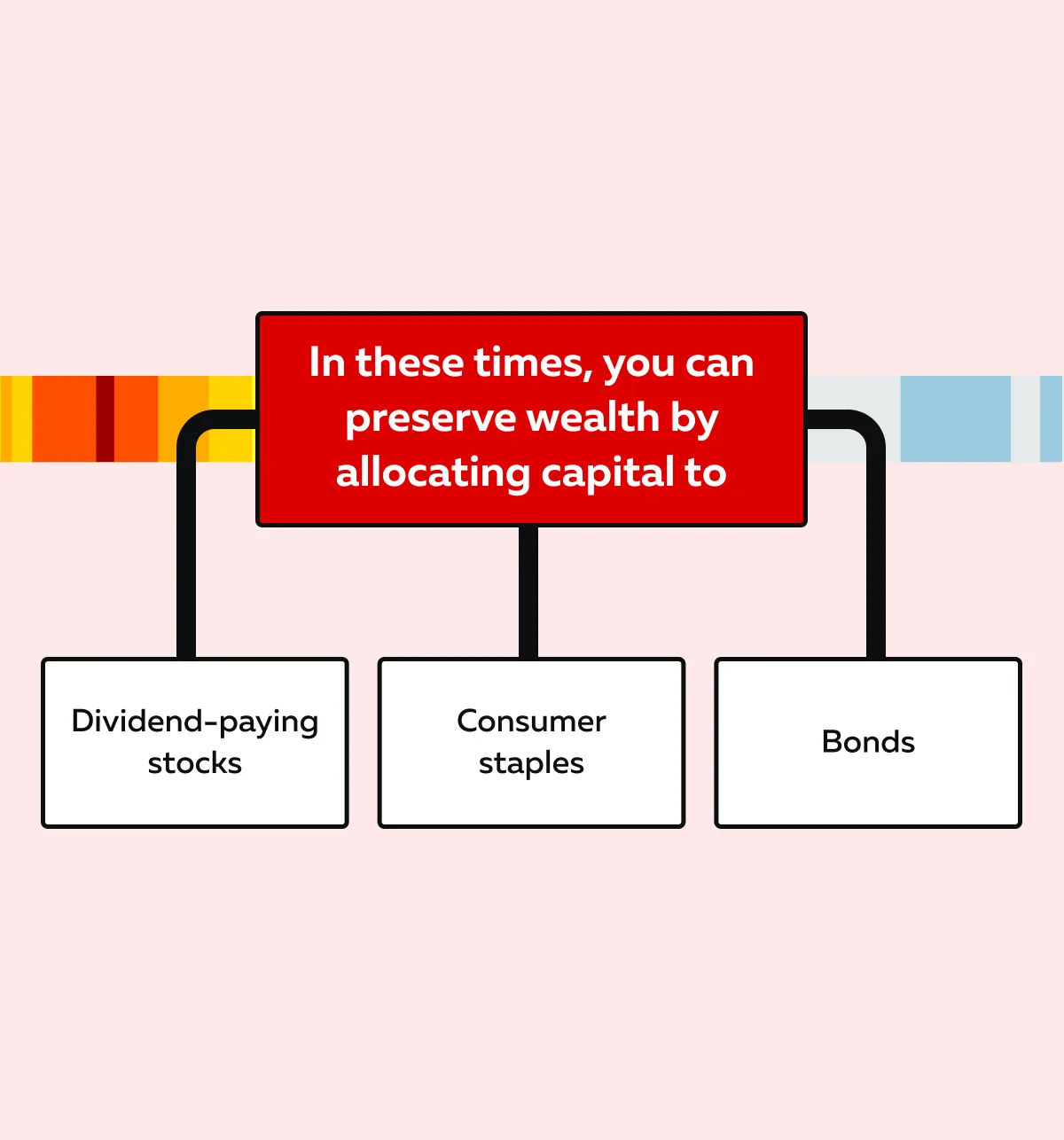

In these uncertain times, you, as an investor, can opt for defensive investing strategies. Check the graphic below:

Meanwhile, as a trader, you can adopt the following trading strategies in a slowing economy:

- Short-selling overvalued stocks,

- Focusing on value investing, and

- Using derivatives to hedge against downside risk.

Trade War 2.0: US Tariffs and Economic Isolationism

Global trade tensions are escalating in 2025. A new phase of protectionism (sometimes referred to as Trade War 2.0) has started with:

- The US is ramping up tariffs on Chinese imports,

and

- The proposed EU auto tariffs.

Both events add to market uncertainty. They could disrupt supply chains and shift capital flows. Let’s understand the impact in detail:

| Impact on capital flows | Shift toward domestic stocks | Currency and market implications |

and

|

|

|

For traders, these shifts present opportunities. To reduce risk, you can use market volatility strategies, such as

- Using options to hedge against currency fluctuations

or

- Rotating into less trade-sensitive industries.

Market Sentiment: From FOMO to Fear

Investor psychology is significantly influencing market movements in 2025. After years of FOMO-driven rallies, sentiment has taken a sharp turn toward caution. Due to this:

- Hedge funds and institutional investors are adopting a more defensive stance.

- Some are even increasing short positions on US equities.

- That’s because they are anticipating a further downside.

Furthermore, the CNN Fear & Greed Index has dropped into “extreme fear” territory. For the unaware, this is a level that historically signals excessive pessimism. Here, fear is expected to lead to aggressive sell-offs. However, it even presents contrarian opportunities. Understand institutional trading behavior by analyzing the depth of market insights.

Historical Market Behavior

The last time the sentiment was this weak, the S&P 500 rebounded strongly afterward. This happened as overly bearish positioning led to a short-covering rally.

For those concerned about a stock market correction in 2025, understanding sentiment cycles is key. To capitalize on market swings, you can opt for these trading strategies in a slowing economy:

- Buying oversold quality stocks

or

- Using tactical hedging.

Track real-time shifts in market liquidity with advanced order flow tools.

How Are Traders and Investors Reacting to Market Conditions?

To manage rising uncertainty, investors are adjusting their portfolios. They are opting for defensive investing strategies, and some are even looking beyond US markets. Let’s see in detail what traders are doing:

Rotation to Defensive and Low-Volatility Stocks

Currently, there are concerns about:

- High interest rates,

- Inflation, and

- Slowing economic growth.

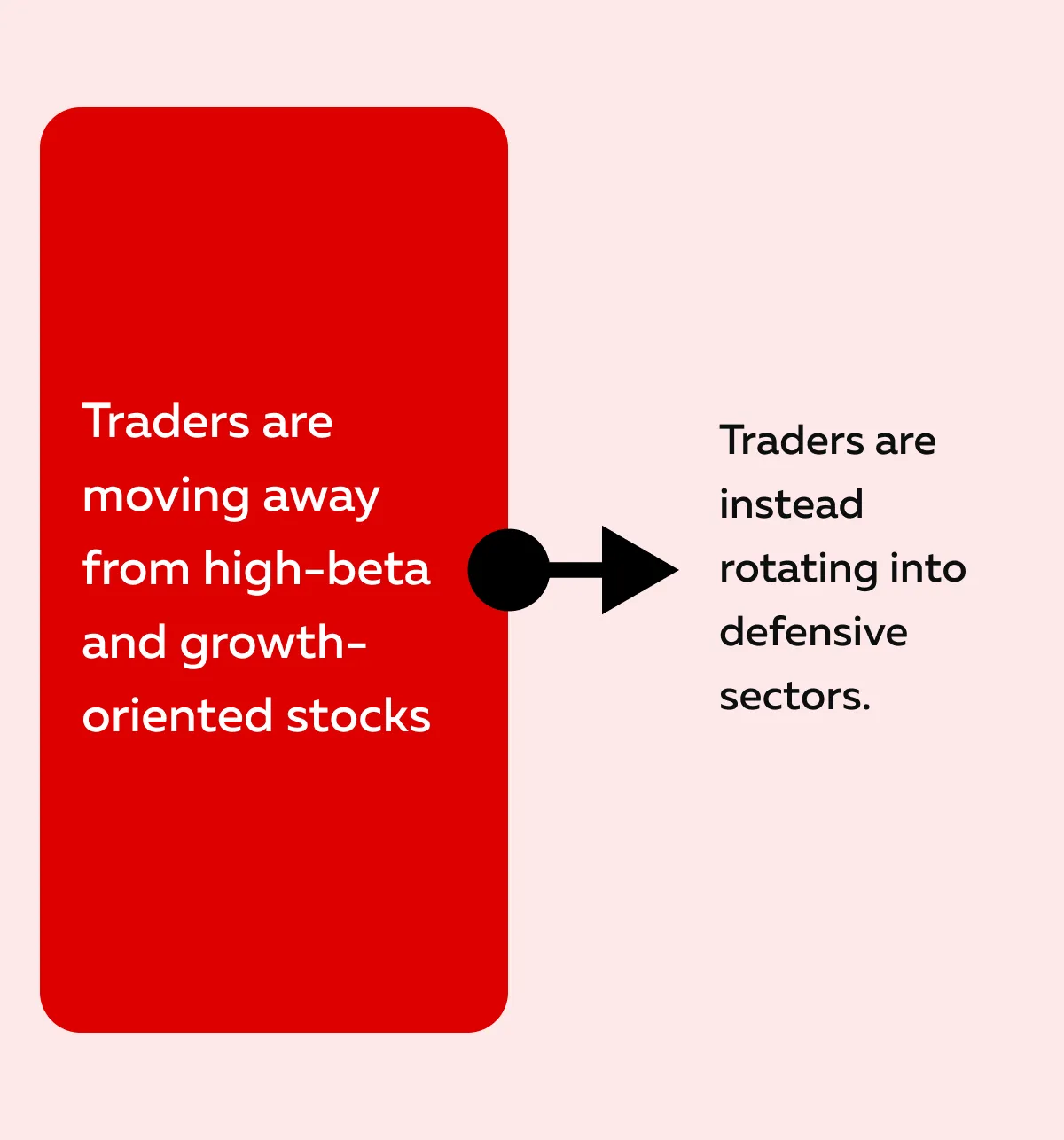

Check the graphic below to learn how traders are reacting to it:

Some defensive sectors attracting inflows are:

- Utilities,

- Consumer staples, and

- Healthcare.

These sectors are seeing increased investment as they are usually more resilient during economic slowdowns. Companies in these sectors provide essential goods and services. This makes them less vulnerable to economic downturns.

Furthermore,

-

- High Performance of Defensive ETFs:

- Funds like iShares MSCI USA Min Vol (USMV) and SPDR Consumer Staples ETF (XLP) have outperformed high-growth sectors.

- This shows a preference for stability over speculative gains.

- High Performance of Defensive ETFs:

- Dividend-Paying Stocks in Demand

-

- There is a rise in dividend-focused investments.

- This shows that investors are interested in capital preservation rather than practicing aggressive growth strategies.

For investors worried about a prolonged slowdown, they can opt for defensive investing strategies such as holding:

- Dividend stocks

and

- Low-volatility ETFs.

Both can provide stability while still offering decent returns.

Looking Beyond US Markets for Growth

The US faces market volatility from prolonged:

- High interest rates

and

- Trade tensions.

As a result, investors are diversifying internationally. They are doing so to hedge against domestic risks. Due to this move:

-

- European and emerging markets are gaining interest:

- ETFs like iShares MSCI Europe ETF (IEUR) and iShares MSCI China ETF (MCHI) are attracting capital.

- This is happening as traders are looking for alternative growth opportunities outside the US.

- European and emerging markets are gaining interest:

- Chinese AI stocks see rotation:

-

- There are concerns about overvalued US tech stocks.

- Thus, some investors are turning to Chinese AI stocks as a high-growth alternative.

- Despite geopolitical risks, China’s AI and semiconductor sectors remain attractive.

How to Hedge against US Uncertainty?

Nowadays, more investors are including foreign equities in their portfolios. This reduces their dependency on the US economy.

Cash and Fixed Income as a Safe Haven

In the current state, risk aversion is the priority. Due to this, cash and fixed-income investments are gaining favor. They are acting as a safer alternative to stocks. Let’s see why:

| Higher yields on safe assets | Buffett’s cautionary stance | High bond yields shifting investor preference |

|

|

|

Key Considerations for Traders in Volatile Markets

In 2025, market uncertainty is expected to remain high. Check the graphic below to learn the key reasons:

As a result, traders must adapt their strategies to handle increased volatility. Let’s see how:

Recognizing Market Sentiment Shifts with Liquidity and Order Flow

Traders must understand how large institutional players move in the market. Many times, when retail traders panic and sell, institutions step in to absorb that selling pressure. To avoid emotional mistakes, you must watch for these hidden demand levels.

Please note that hedge funds and major financial institutions don’t trade like retail investors. Instead of chasing price action, they accumulate positions quietly. By doing so, they absorb retail-driven panic selling.

Use Bookmap to Gain a Competitive Edge

Most successful traders use our advanced market analysis tool, Bookmap. Using it, you can track liquidity and large buy/ sell orders that aren’t visible on traditional charts.

Also, the absorption indicator on Bookmap shows where big players might be stepping in to buy while the market appears weak.

For Example:

- Say Bookmap shows large “volume dots.”

- These dots appear while the price isn’t moving lower.

- Now, it could mean that institutions are aggressively buying.

- This suggests a possible rebound.

- Using this insight, you can time entries more precisely in a slowing economy.

Risk Management in a Shifting Environment

For the unaware, market volatility means prices can move sharply in either direction. Thus, managing risk is key to surviving in uncertain conditions. You can do so by:

- Avoiding excessive leverage:

- A high VIX (Volatility Index) often signals increased market uncertainty.

- It shows the potential for sharp reversals.

- Overleveraging in such an environment can lead to significant losses.

- Using options for controlled risk:

- Instead of taking outright long or short positions, traders can use options strategies like vertical spreads or protective puts.

- This limits downside risk.

Let’s understand better through an example:

- Say a trader holds high-beta stocks but expects volatility.

- They can buy a put spread to hedge against losses.

- This strategy allows traders to stay in the market while having downside protection in case of a sell-off.

- This is especially useful in times of stock market correction, such as in 2025, where sudden declines can be severe.

Watching Key Macro Indicators for Market Direction

By tracking these major economic indicators, you can anticipate market moves before they happen:

| Fear & Greed Index as a contrarian signal | Bond yields and credit markets |

|

|

For Example:

- Say there is a sudden spike in bond yields.

- It can be an early warning sign that the Federal Reserve might shift its policy stance.

- Traders who track these moves adjust their portfolios accordingly before major announcements.

Alternative Trading Approaches for 2025’s Market Conditions

To manage ongoing uncertainty in 2025, traders are looking for new ways to deal with it, such as:

- Selectively buying the dip,

- Shifting capital into stronger sectors, and

- Using options for risk management.

Let’s understand in detail how you can manage stock market corrections in 2025:

Buying the Dip—But Only Selectively

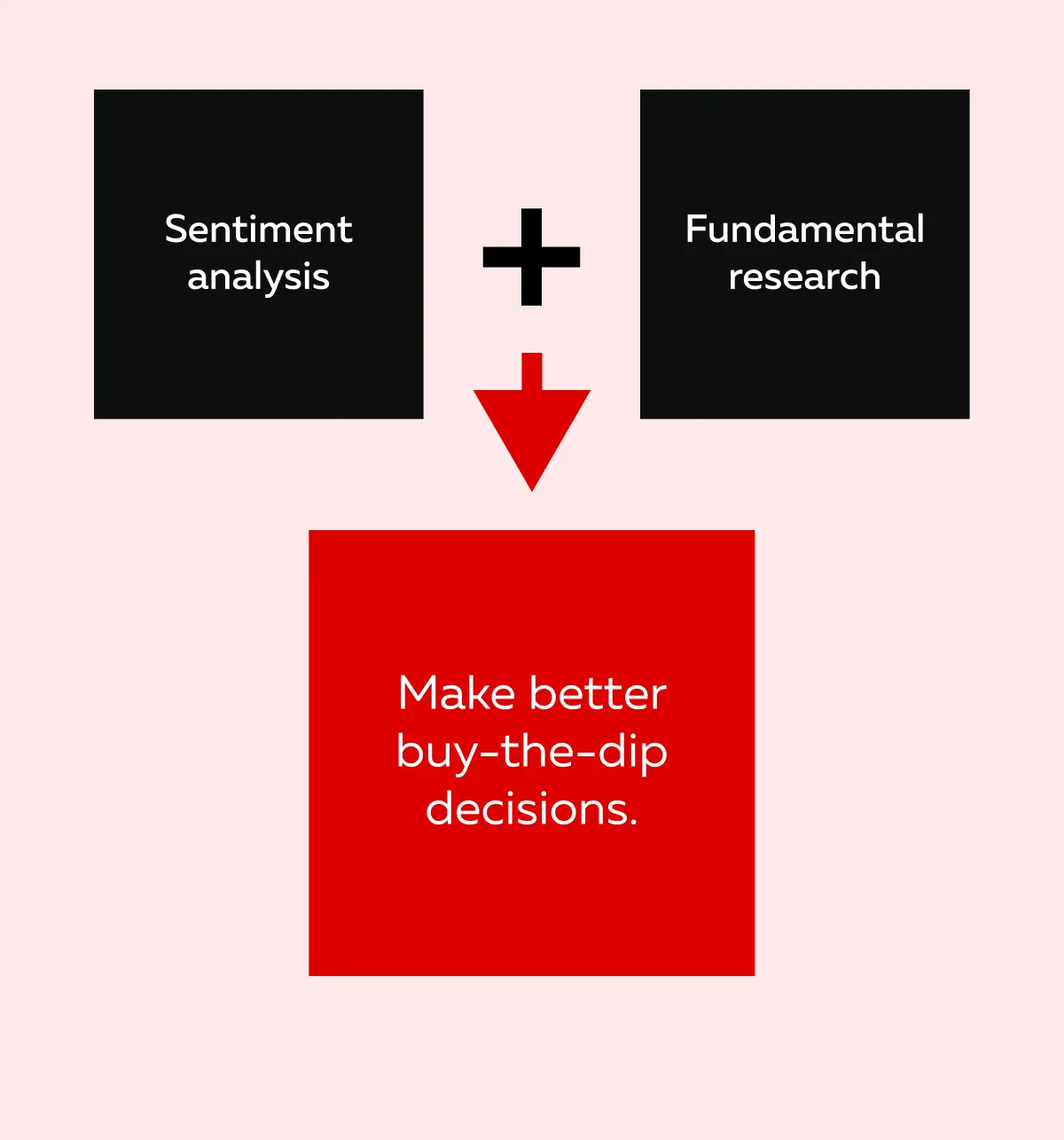

In a volatile market, some traders look to buy stocks that have been heavily sold off. They do so, hoping for a rebound. However, please understand that not every dip is worth buying. Selectivity is key.

As a contrarian trader, you must focus on quality. Experienced traders only buy companies with:

- Strong fundamentals,

- Solid earnings, and

- Sustainable business models.

Also, the CNN Fear & Greed Index has dropped into “extreme fear” territory. This has historically signaled that the market is oversold. When sentiment is this negative, it often precedes a rally.

- In past downturns, whenever the Fear & Greed Index hit extreme fear, the S&P 500 rebounded shortly after.

- While not a guarantee, it suggests that excessive pessimism may create opportunities for a short-term recovery.

Check the graphic below to know what you, as a trader, should do:

Sector Rotation: Playing Shifts in Market Leadership

As the economy evolves, different sectors take turns leading the market. By understanding where capital is flowing, you can position yourself for potential gains. Let’s see how:

| Direct capital flows to defensive sectors | Use commodities as inflation hedges |

|

|

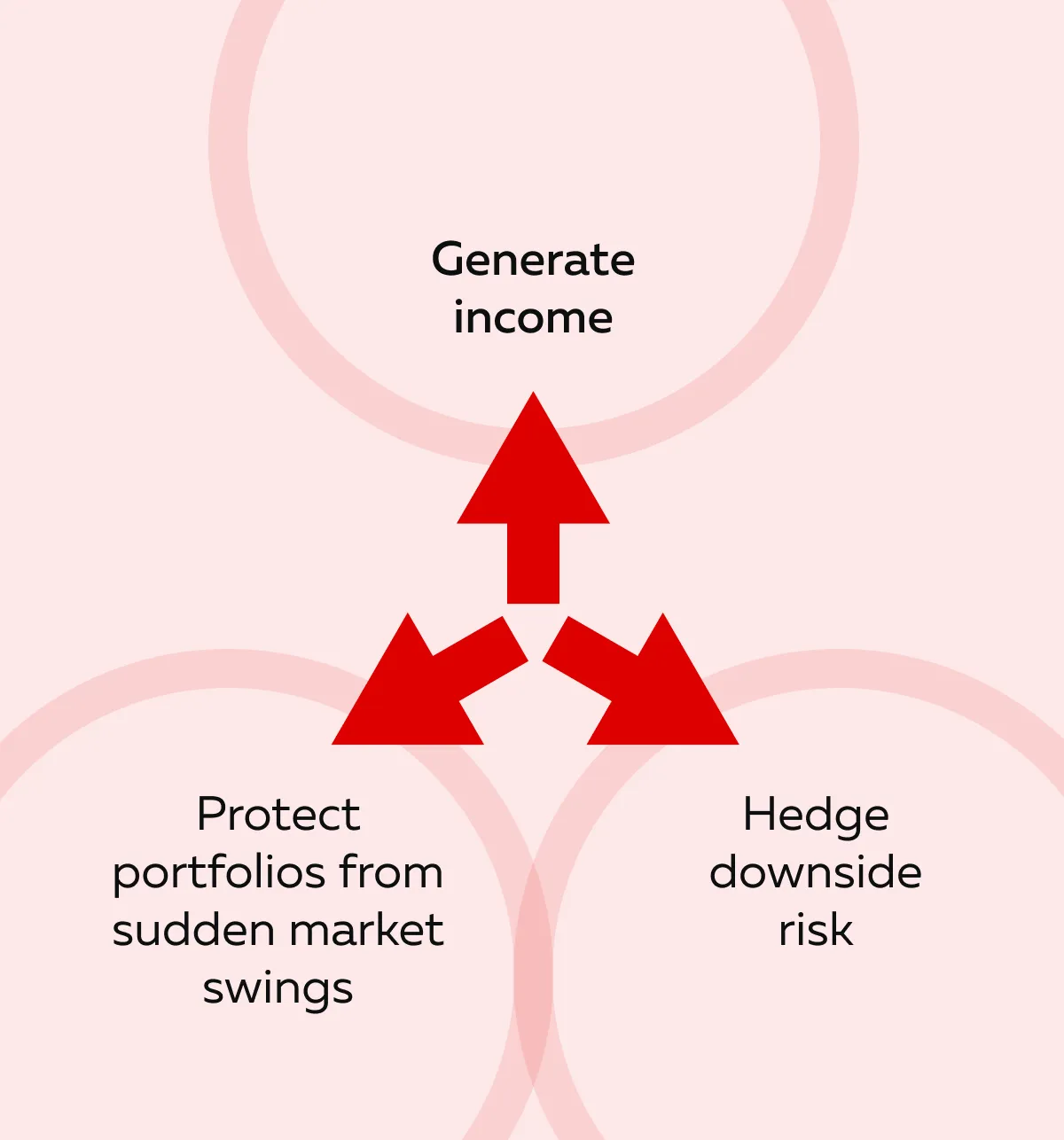

Options-Based Hedging Strategies

In uncertain markets, options can be a valuable tool for managing risk. Let’s learn how traders are using options:

Additionally:

- Traders sell covered calls for extra income. By selling covered calls on defensive stocks, traders collect premiums. This reduces their downside exposure. This is a great way to earn passive income in a choppy market.

- Traders buy protective puts for downside protection. By buying protective puts, traders can limit losses if the market takes another downturn. This is especially useful for high-beta stocks that are prone to large swings.

For example:

- Let’s say there is a trader concerned about overvalued tech stocks.

- They use put spreads to hedge against a decline.

- They also hold dividend-paying stocks for stability.

- Now, this strategy balances risk and reward.

- It ensures that portfolios remain protected while still generating returns.

Conclusion

The growth scare of 2025 has brought uncertainty. However, it also presents opportunities for traders to stay informed. Instead of reacting to fear-driven market moves, traders should focus on liquidity, capital flows, and institutional order flow. They must understand where smart money is going!

Some strategies they can use in current times are sector rotations, defensive investing strategies, and market volatility. Also, sentiment is changing quickly, but history shows that panic often creates opportunities. Those who stay disciplined and avoid emotional decisions will be in the best position to succeed.

To gain a competitive advantage, they can also use our real-time market analysis tool, Bookmap, and find ways to profit in uncertain times. Use Bookmap’s heatmap and absorption indicators to pinpoint real support and resistance levels in volatile conditions.